Dormant Bitcoin wallets activated after 10 years – Sell pressure incoming?

- Together, these wallets had 407 BTC worth $24.25 million

- BTC seemed bearish, at press time, and could fall to the $53,000 level soon

Over the past few days, the larger cryptocurrency market has been very volatile, with the same fueling some selling pressure across the board. Amid this market volatility, however, four Bitcoin (BTC) wallet addresses that had been dormant for more than 10 years activated themselves within the last 7 days.

Dormant Bitcoin holdings activated

According to blockchain transaction tracker Whale Alert, all these dormant Bitcoin holders reappeared as the market volatility reached its peak. At the time of writing, collectively, these wallets held 407 BTC worth $24.25 million.

Based on historical data and analysis, the activation of dormant wallets has consistently created selling pressure. However, this time, in addition to the activation of dormant wallets, both Mt. Gox and the U.S Government have recently transferred a significant amount of BTC to Bitso and Coinbase Prime.

Together, these factors spur a bearish outlook for Bitcoin, which might be the reason for significant price fluctuation in recent days.

Bitcoin technical analysis and upcoming levels

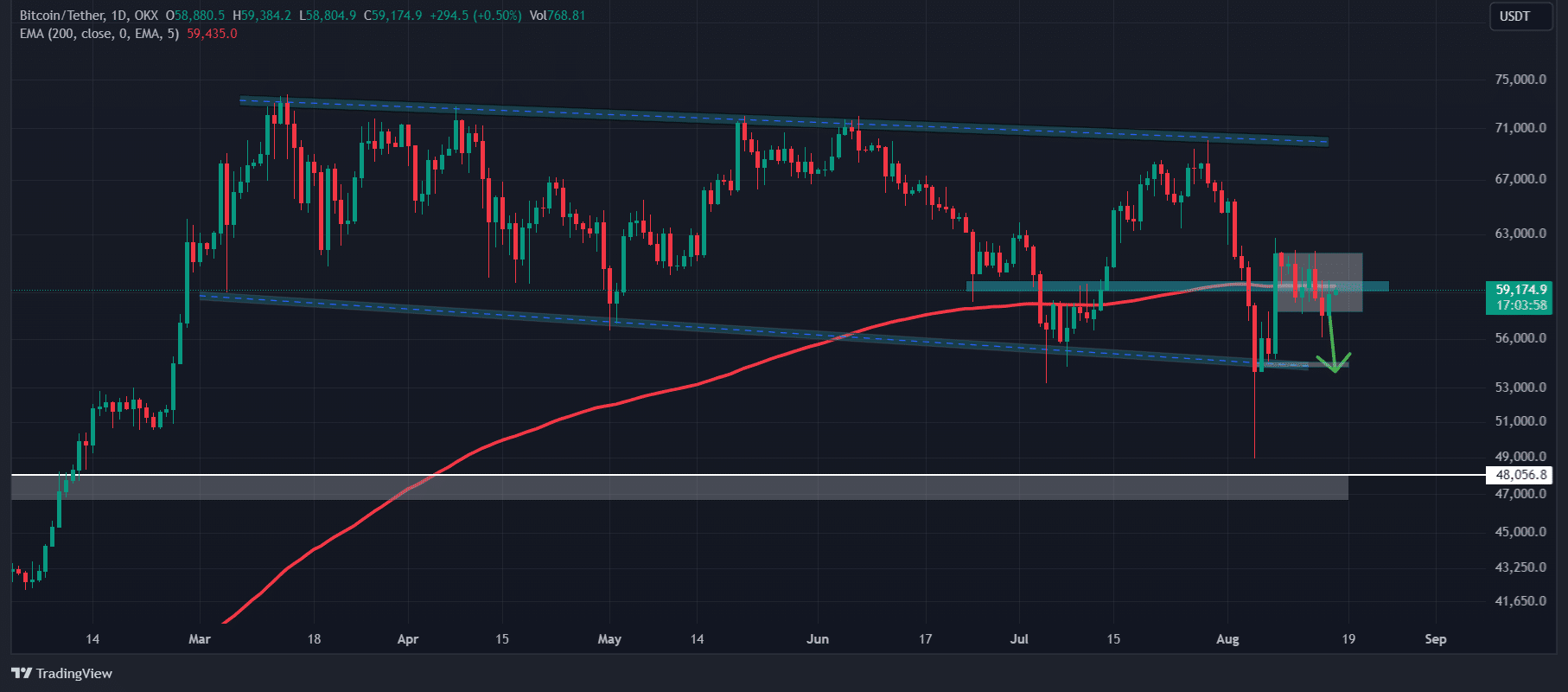

According to AMBCrypto’s analysis of the cryptocurrency’s charts, BTC was consolidating within a tight range between $57,700 and $61,700 at press time.

Additionally, it remained in a downtrend as it was trading below the 200 Exponential Moving Average (EMA) on a daily timeframe.

However, a breakout or breakdown from this consolidation will determine where the price moves in the coming days. Looking at the prevailing market sentiment, there is a high chance BTC may see a breakdown of the consolidation zone and could fall to $53,000 soon.

Price Analysis

At press time, the cryptocurrency was trading near the $59,20-level following a hike of over 1.6% in the last 24 hours. Meanwhile, due to the high volatility and price fluctuation, BTC’s trading volume dropped by 25% during the same period.

This fall in trading volume pointed to declining participation from traders.

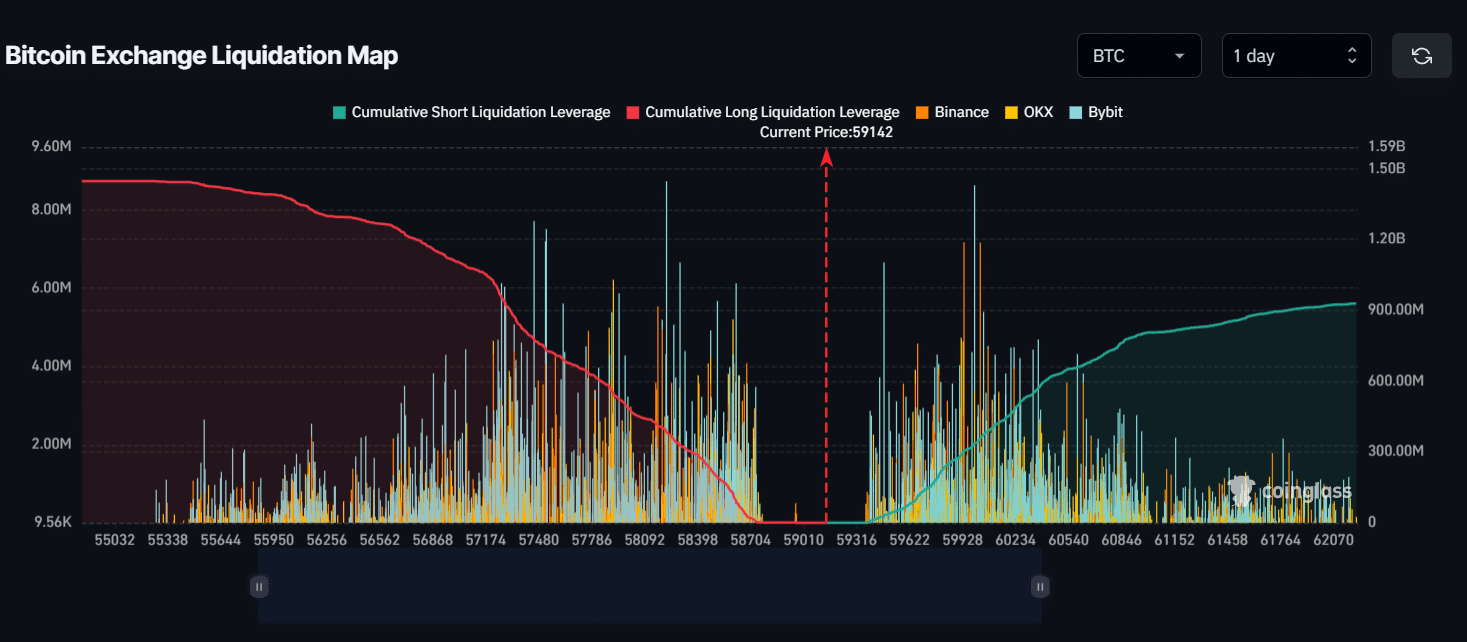

Major liquidation levels

At the time of writing, BTC’s major liquidation level was near the $58,200 level on the lower side and $60,000 on the upper side. At both these levels, traders seemed to be highly leveraged, according to the on-chain analytics firm CoinGlass.

If the market sentiment remains unchanged and BTC’s price falls to $58,200, nearly $400 million worth of long positions will be liquidated.

Conversely, if sentiment changes and the price rises to $60,000, nearly $330 million worth of long positions will be liquidated.