Solana’s supply surge – Can the market absorb $340M in unlocks?

- SOL will see about $340M in token unlocks in August

- How will the unlocks affect SOL’s price with the current weak sentiment?

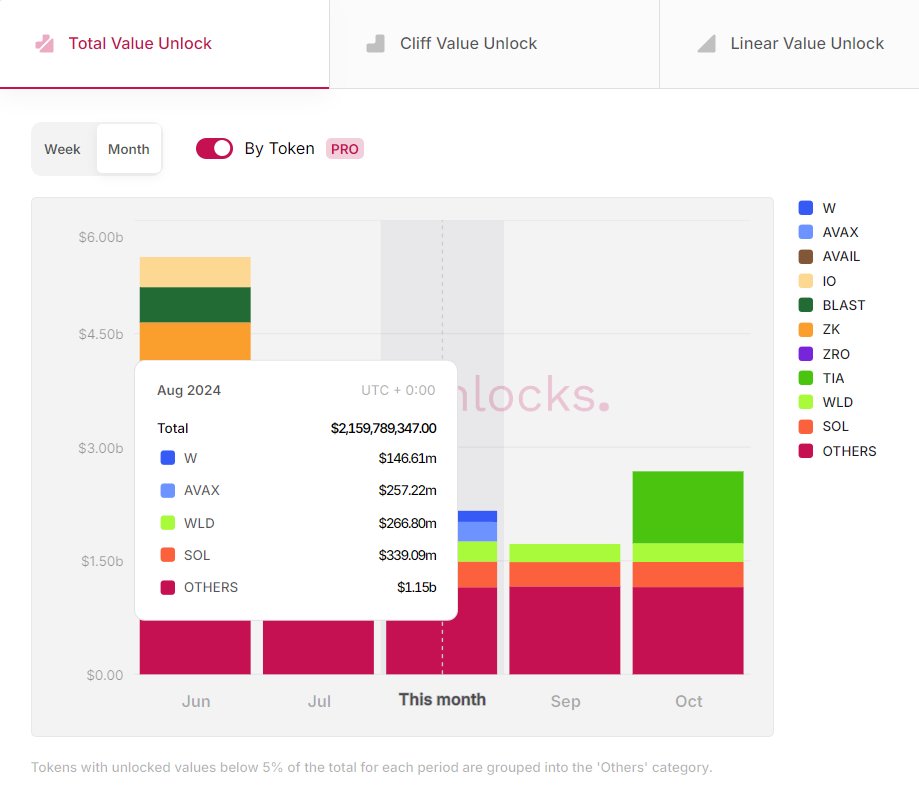

Solana [SOL] will lead August’s +$2 billion worth of token unlocks. Nearly $340 million of SOL tokens will hit its supply circulation. In fact, according to Token Unlocks data, SOL will see the highest issuance in August, which could further impact prices amidst markets that have largely been choppy.

Will SOL’s price hold the supply pressure?

Reacting to the massive token unlocks, Wazz Crypto, a market analyst and commentator, claimed that the trend could get more predatory and accelerate token ‘dumps.’

“In my opinion, token unlocks will only get more predatory as time goes on. investors/team racing to dump as they realise that there’s really no demand for the infinite tokens being minted.”

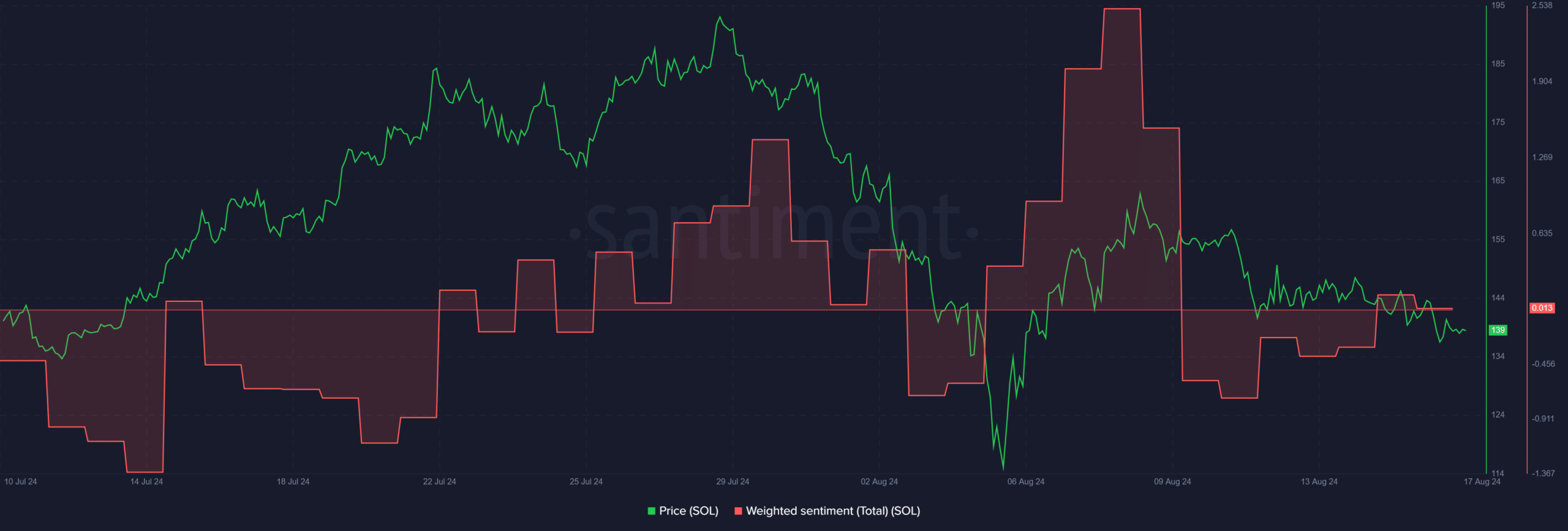

At the time of writing, speculators’ sentiment on SOL was neutral, as shown by the neutral reading of the weighted sentiment on Santiment.

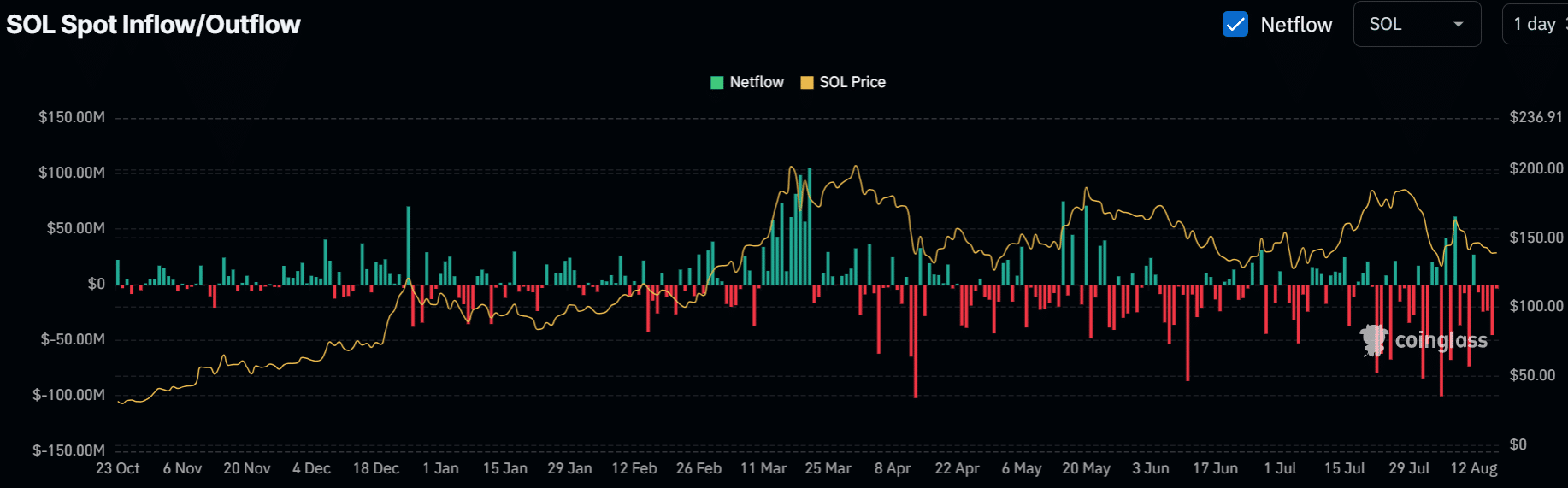

Nevertheless, this week, investors and traders have de-risked themselves from the altcoin, as shown by massive spot outflows.

For example – Since 12 August, SOL has recorded $77 million in net outflows, as per Coinglass data. In the previous week, the altcoin saw $182 million in outflows, reinforcing an overall risk-off approach from investors in August.

The risk-off approach saw SOL drop from $185 in early August to below $150, at the time of writing.

So, the $340 million supply overhang from token unlocks could further dent an already weak investor sentiment. Unless Bitcoin [BTC] leads the market recovery and boosts SOL in the remaining two weeks, the altcoin’s price could be dragged lower on the charts.

What are the key levels to consider?

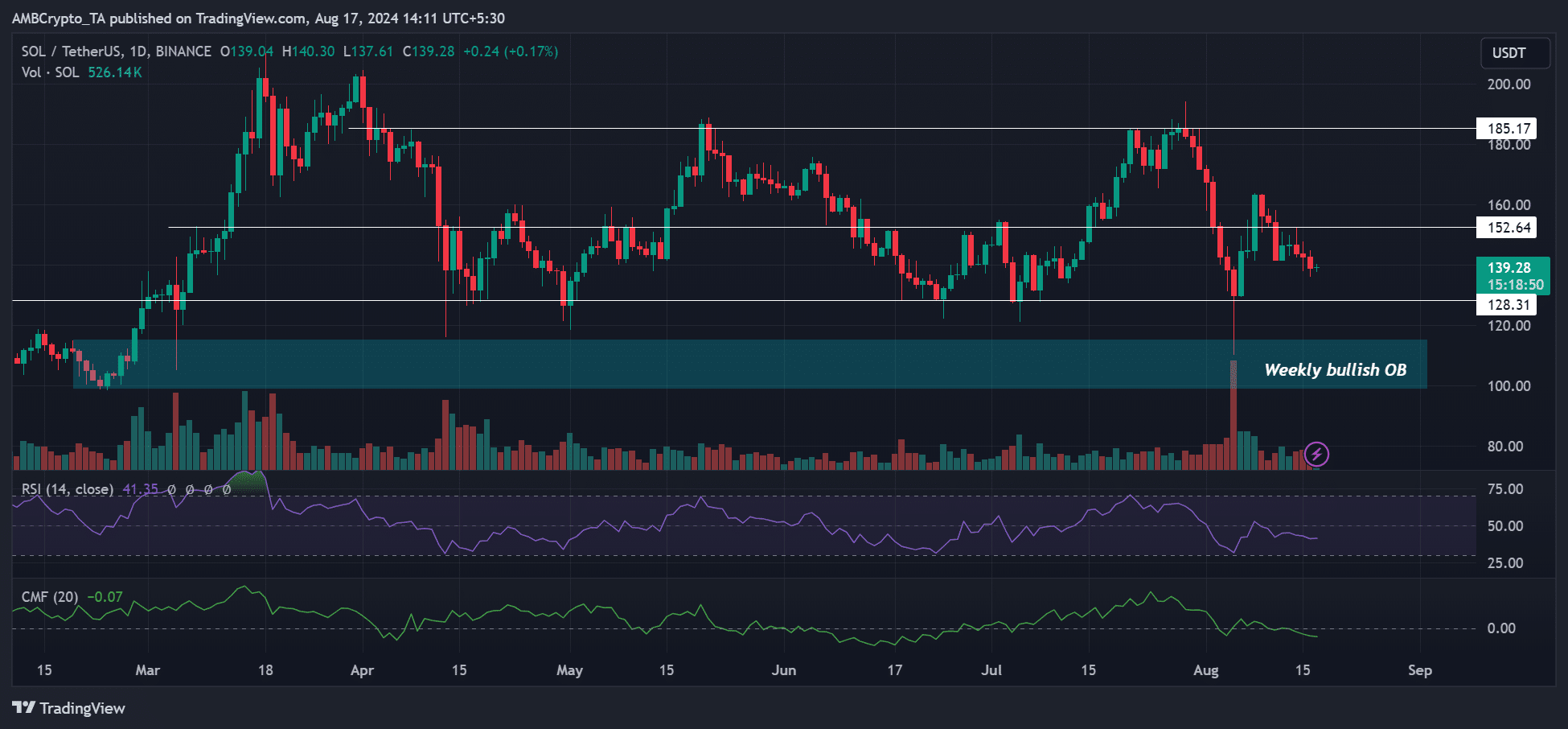

The buying pressure and overall demand were muted on the daily charts, as shown by the downsloping CMF (Chaikin Money Flow) and RSI (Relative Strength Index).

Meanwhile, the weekly bullish order block (OB), the higher timeframe support, and above $100 and $128 were key levels to assess for a better discount on SOL.