Why Bitcoin’s new ATH ‘is not in the cards,’ per Peter Brandt

- BTC might have topped in this cycle, per Peter Brandt.

- However, other market analysts disagreed.

Bitcoin [BTC] saw some relief bounce on the 21st of August after July’s FOMC Minutes indicated that some policymakers advocated for rate cuts.

The largest digital asset briefly retested $61K, but the overall sentiment has remained weak.

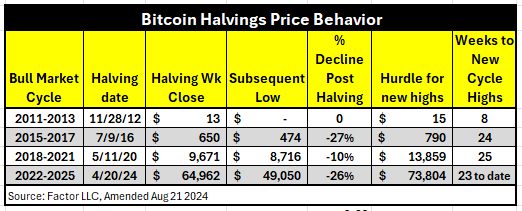

In fact, August is BTC’s fifth month of price consolidation, raising doubts about whether the asset will hit a new ATH (all-time high).

According to Peter Brandt, the current cycle was taking too long to hit a new ATH, which might signal that a BTC cycle top was already in.

“Current bull market cycle in $BTC will soon become the longest time post halving in history for a new ATH or, could indicate that new ATH is not in the cards.”

BTC is on track; Other analysts disagree

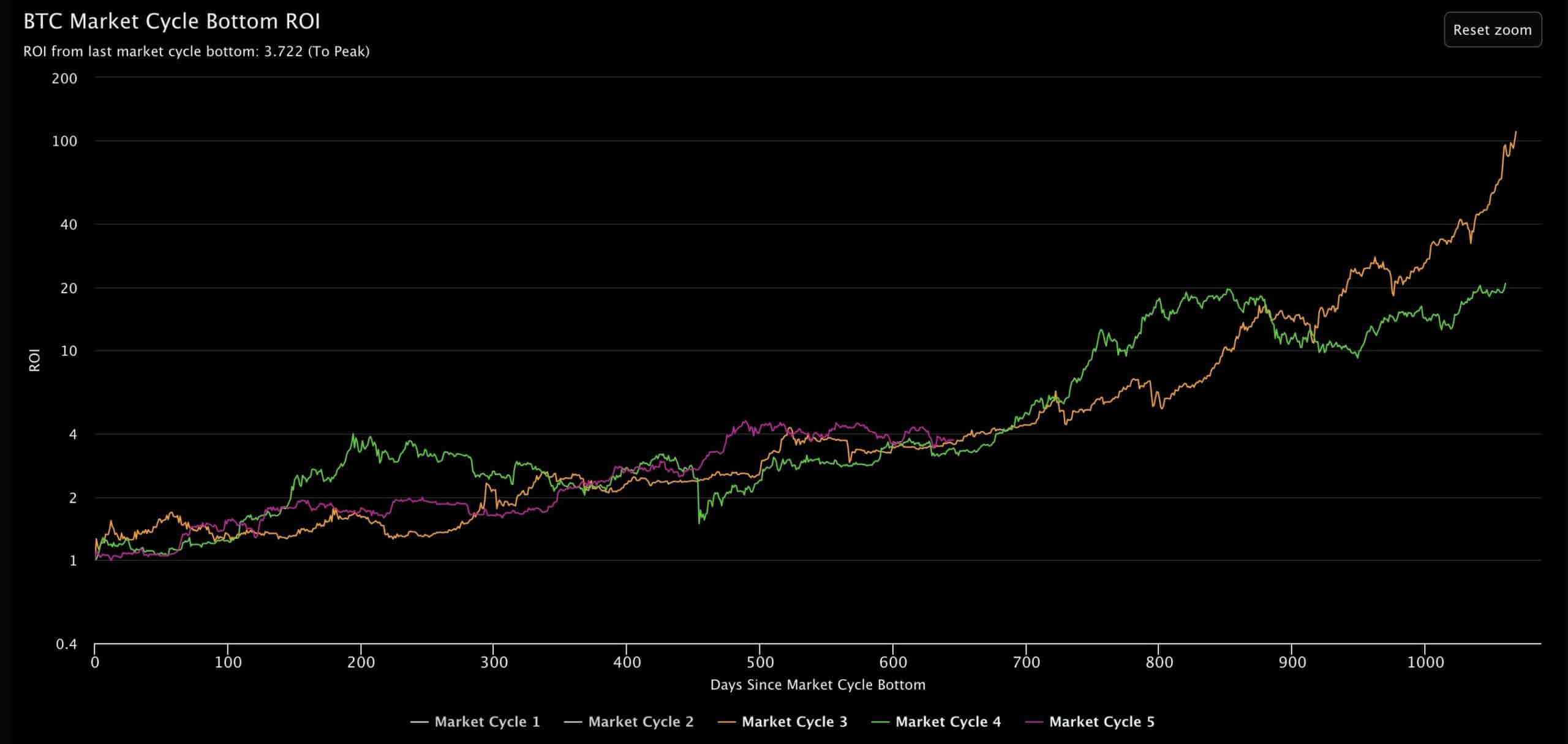

However, other crypto analysts have disagreed with Brandt’s bearish outlook. According to Benjamin Cowen, BTC was on track and in sync with other historical market cycle movements.

“Despite everything, #BTC is right around where it always is at this point in the market cycle.”

Based on the attached chart, BTC was on the brink of the next leg of a rally if the historical trend continued.

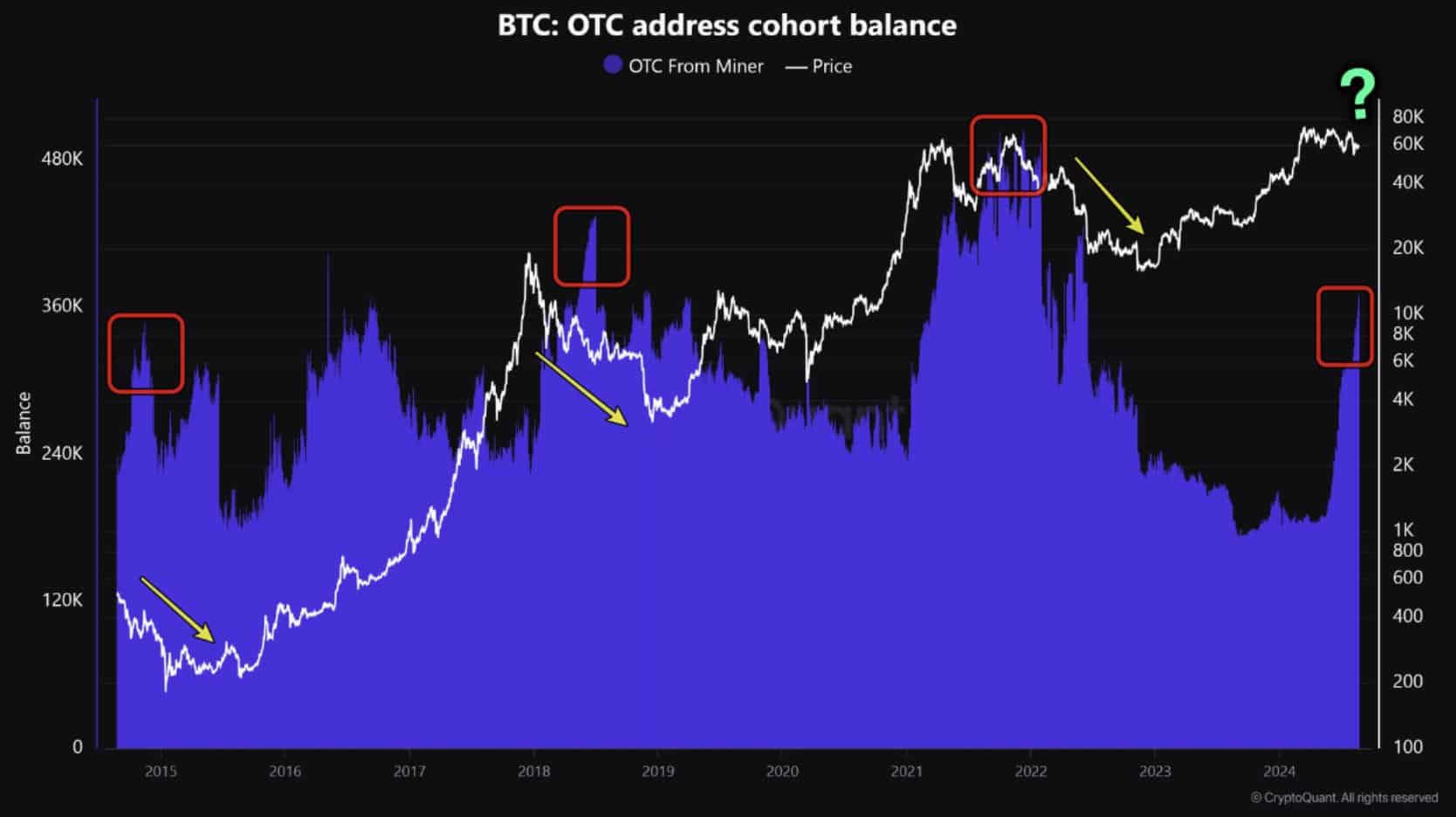

The next phase of the BTC rally could begin in Q4, according to CryptoQuant founder Ki Young Ju, who cited likely whale actions.

“In the last #Bitcoin halving cycle, the bull rally began in Q4. Whales won’t let Q4 be boring with a flat YoY performance.”

Another data point that suggested a likely BTC upswing was the recent drop in Funding Rates alongside an uptick in Open Interest rates. According to K33 Research, this market set-up was ‘ripe’ for a short squeeze.

“Market conditions are looking ripe for a short squeeze. BTC perps notional open interest has jumped by 30k BTC since August 13, with consistent negative funding rates.”

Additionally, Glassnode revealed that BTC’s Long-Term Holders (LTH) have reduced profit-taking, which historically tends to usher in a new price uptrend.

However, according to CryptoQuant, BTC inventory on OTC (over-the-counter) markets increased to a record two-year high, which could suppress BTC recovery in the short term.

“Bitcoin OTC Desk Balances Soar to Two-Year Peak. Historically, increases in #Bitcoin OTC desk balances have been associated with declines in Bitcoin prices.”

In conclusion, BTC had more upside potential if the historical trend seen in post-halving repeats. However, the expected rally could face risks from the rising BTC balance on OTC markets.