Bitcoin closes above a key level: Is now the time to grab BTC?

- Bitcoin price action flips bullish.

- Bitcoin pulling institutions due to its yearly gains.

Bitcoin [BTC] has closed above the Bull Market Support band, a critical level on the higher timeframe, after three consecutive weeks of staying below it.

This recovery signals potential for BTC’s price to move higher. Despite brief deviations, the price action now suggests a bullish trend, with the current level around $67k acting as a key liquidity zone.

Bitcoin breaking through the liquidity zone with strong volume and staying above it, makes traders and investors feel confident to go long, while others might add to their positions.

Bitcoin’s pull is unstoppable

The institutional interest in Bitcoin continues to grow, strengthening its upward momentum. Semler Scientific recently purchased 83 additional Bitcoin, worth $5 million, bringing their total holdings to 1,012 BTC.

This acquisition positions them as the fourth-largest Bitcoin-holding company in the US, excluding miners.

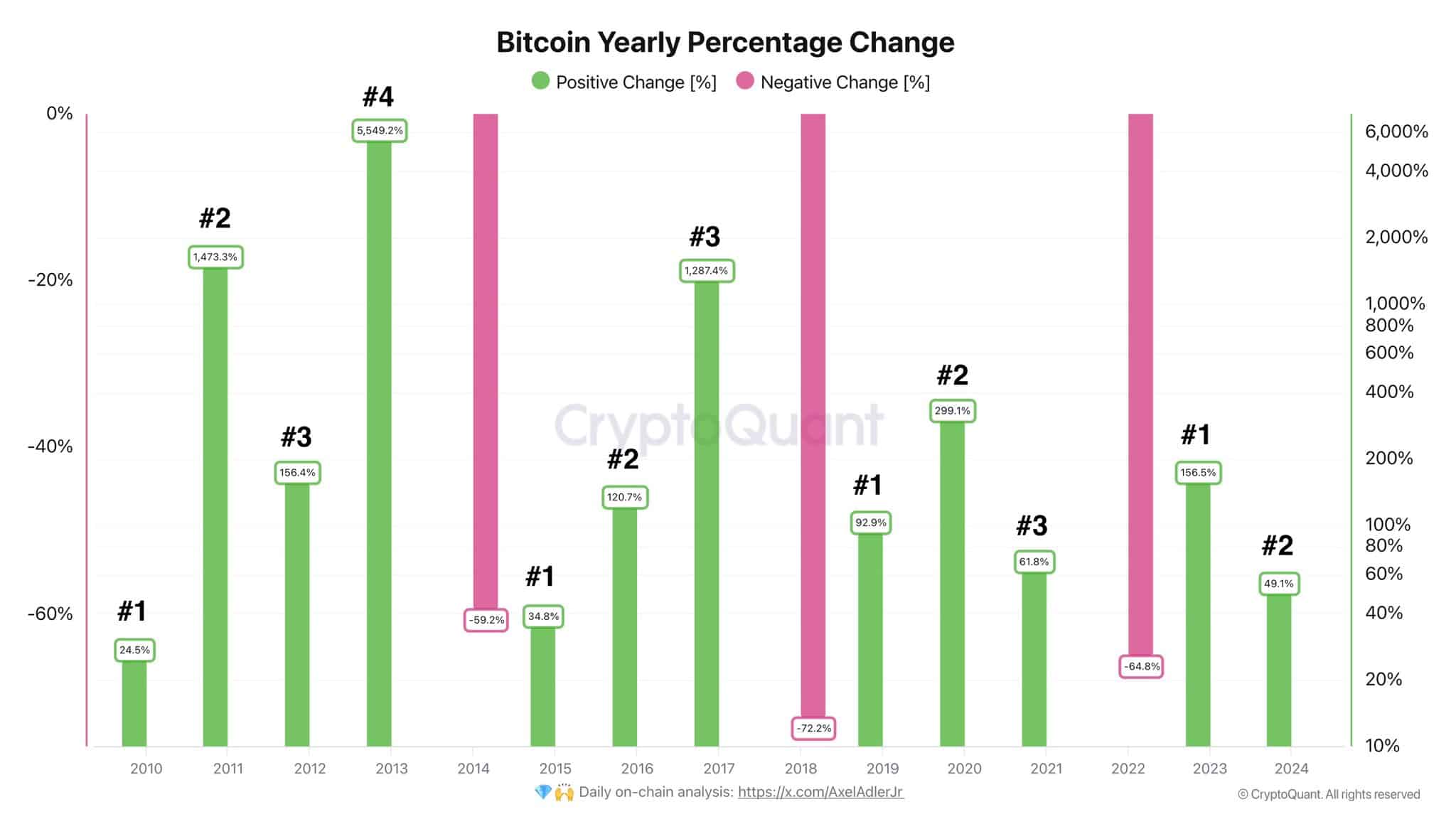

Historically, BTC has shown resilience, with only three years of negative percentage change since its inception, while the other 12 years have been positive.

Semler’s commitment to buy more BTC, backed by a $150M fundraising effort, reflects the increasing institutional adoption of Bitcoin, which is driving the market higher.

Despite challenges, Bitcoin consistently demonstrates its potential to reach new highs. With this year already showing positive growth, expectations are for a strong finish, reinforcing the bullish sentiment.

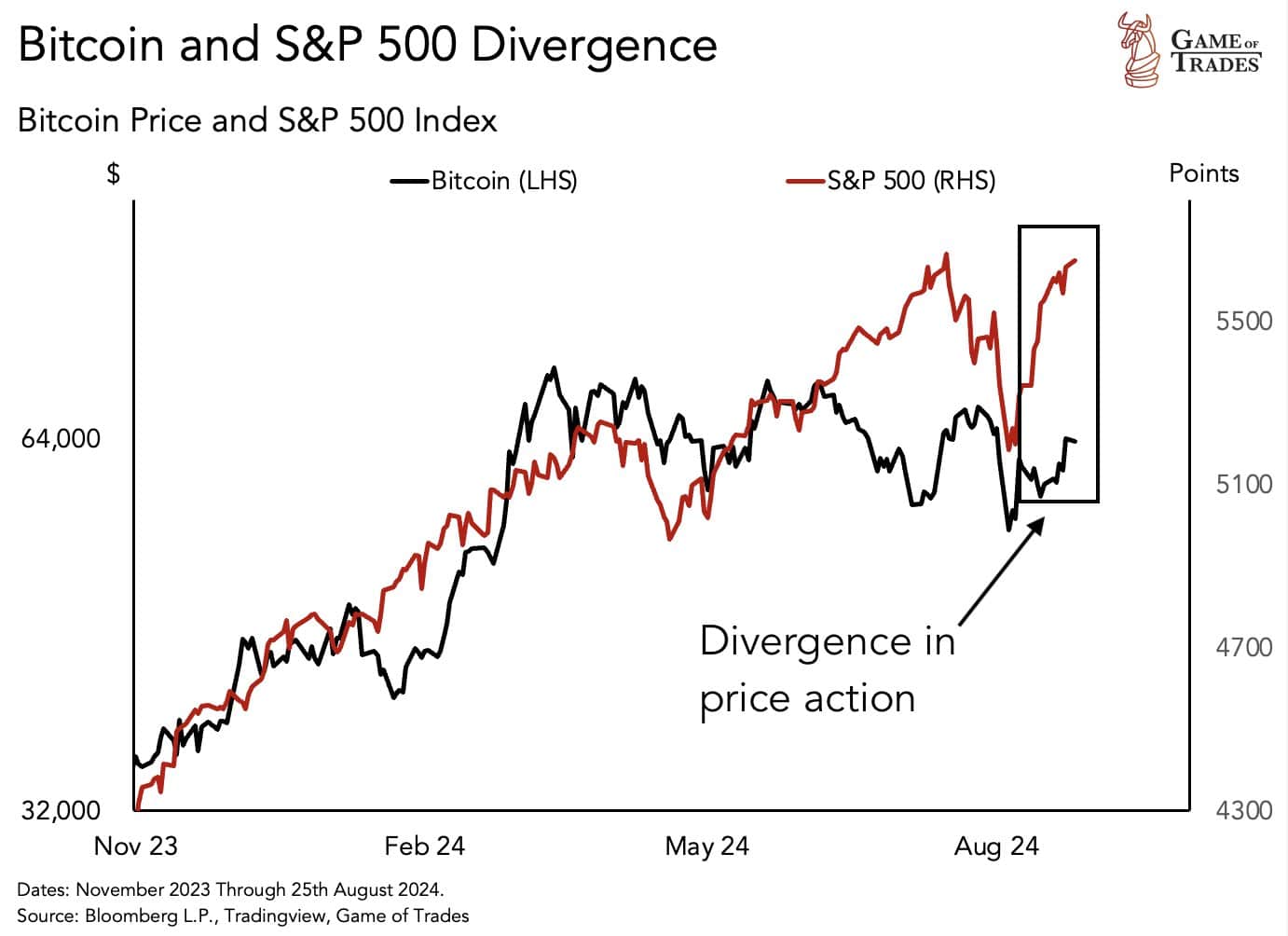

BTC and S&P 500 divergence

Bitcoin price movements often mirror those of the U.S. stock market, particularly the S&P 500. When the S&P 500 rises, BTC tends to follow, and vice versa.

In August, when the market dropped by 6% due to recession fears, Bitcoin price also saw a sharp decline of 30%.

However, as the market has since recovered, trading near all-time highs, BTC remains 20% below its July level and 30% below its March 2024 level.

This divergence presents a compelling opportunity to buy BTC, with the expectation that it will catch up to the stock market’s recovery.

Read Bitcoin’s [BTC] Price Prediction 2024-25

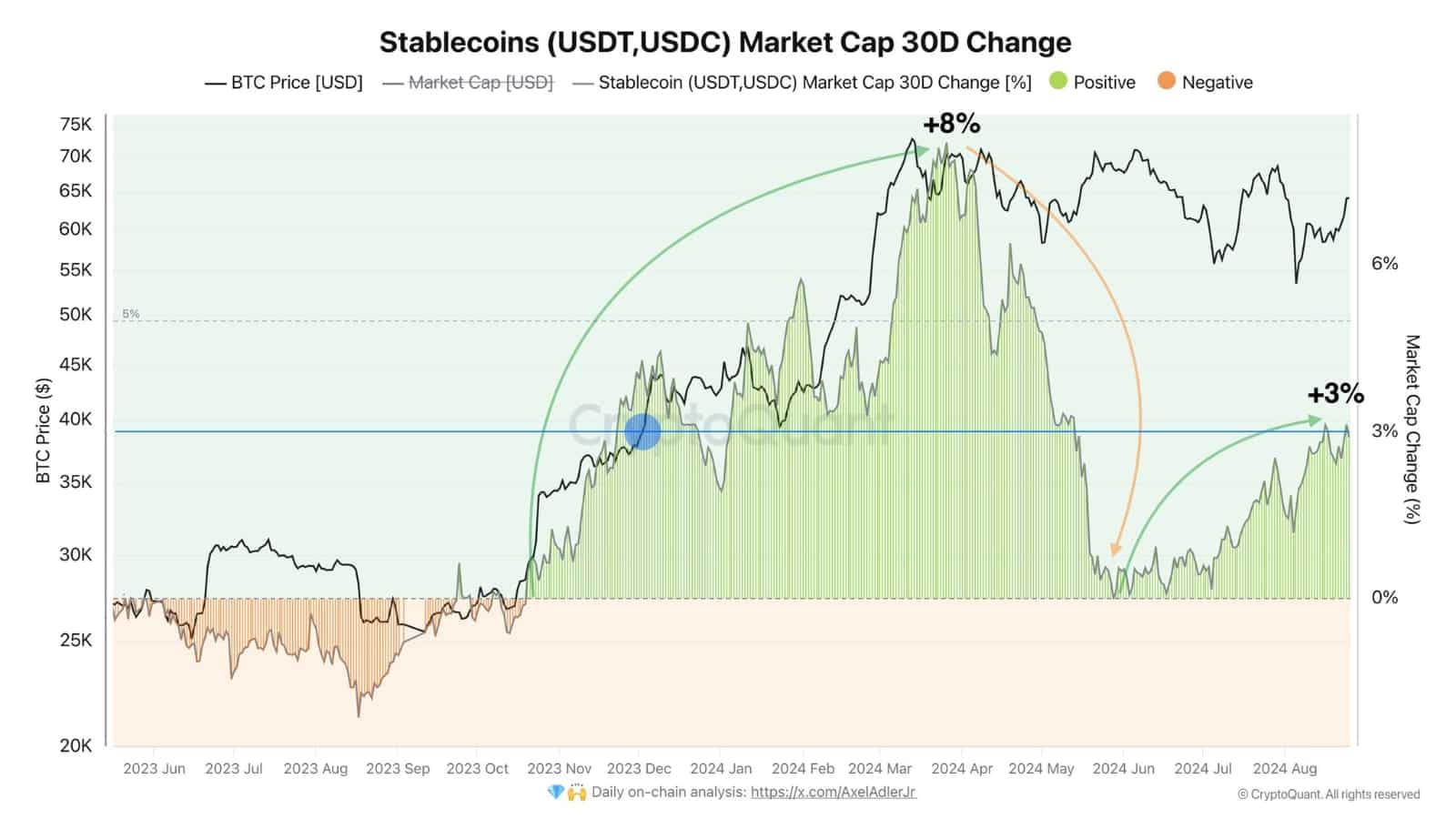

Stablecoin supply increases

Lastly, the increasing supply of stablecoins like USDT and USDC also supports a higher BTC price. Over the past three months, their market capitalization has grown by 3%, indicating rising demand.

With BTC supply growth slowing after the halving, this increasing demand suggests that price is likely to continue climbing higher.

![Kusama [KSM] explodes 119% in one day - How DOT helped](https://ambcrypto.com/wp-content/uploads/2024/11/Michael-KSM-400x240.webp)