Bitcoin’s rough day: Over 44K BTC pulled amid controversy – What now?

- Binance faces massive Bitcoin withdrawal amid backlash.

- Liquidations intensify as Bitcoin EFTs face negative net flow.

Bitcoin [BTC] experienced a subdued day yesterday, the 28th of August, with the leading cryptocurrency facing declines across various markets, including spot trading and Bitcoin ETFs popular in the U.S. Markets.

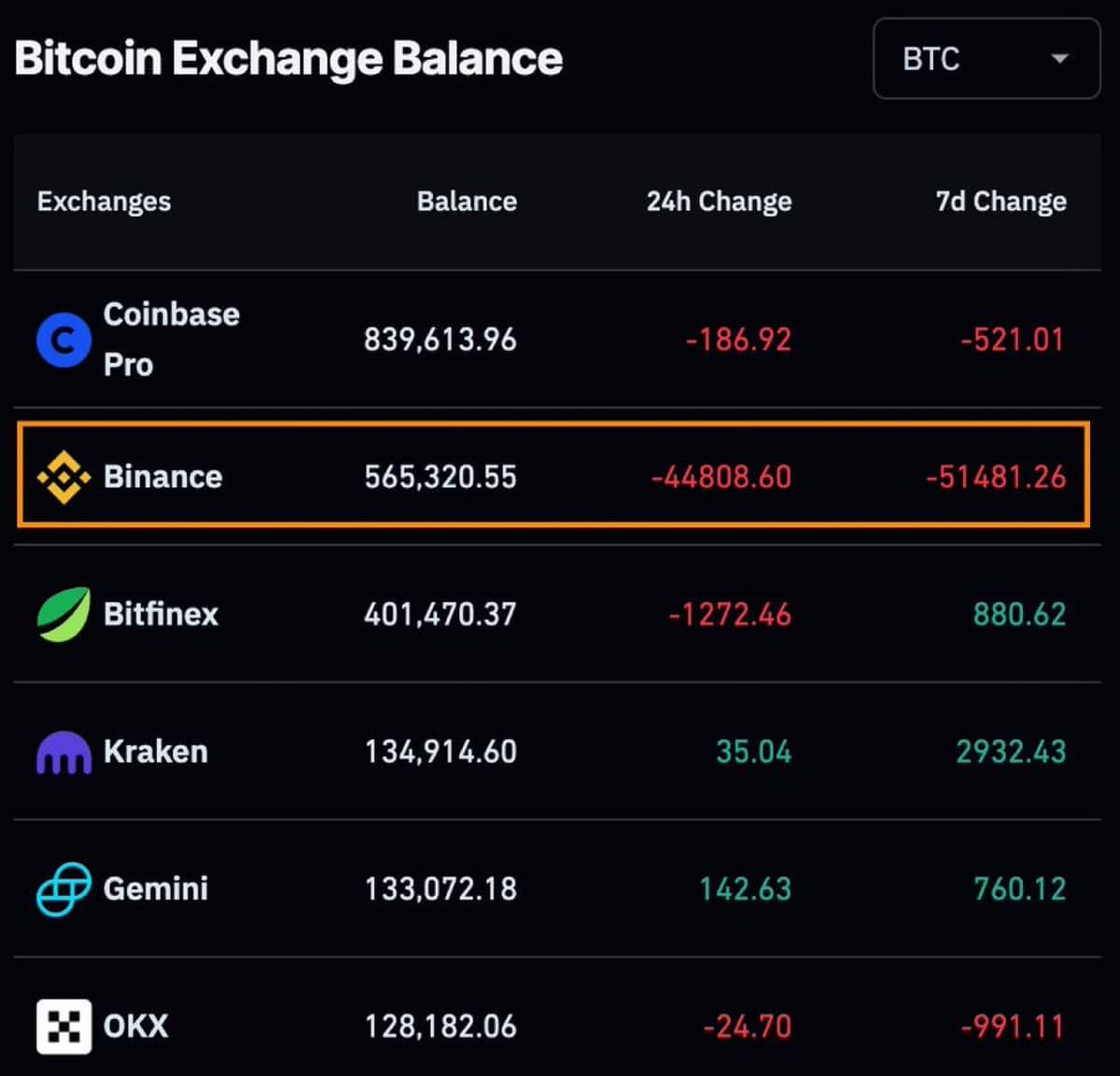

The market downturn coincided with a massive outflow of 44,808 BTC, worth over $2.6 billion, withdrawn from Binance in the last 24 hours.

This significant Bitcoin withdrawal followed allegations that Binance seized Palestinian assets at the request of Israeli authorities. Amid backlash, Binance quickly unfroze the accounts.

This massive outflow of Bitcoin is likely to impact the price of BTC, with potential effects in both directions.

First, the Bitcoin may be held for long-term gains, possibly driving the price higher. On the other hand, a large sell-off could lead to a price decline, given the substantial amount involved the Bitcoin market could be shaken,

Massive liquidations

Additionally to the Binance withdrawal, past 24 hours have seen 66,423 traders liquidated, amounting to $161.12M.

The largest single liquidation occurred on Bybit’s BTC/USD pair for $3.52 million, followed by a $12.67 million liquidation on Binance’s ETH/BTC pair the day before.

These events have contributed to over $4.8 billion in liquidations for August 2024, the highest since 2021, with two days still remaining.

As the market matures and grows heavier, participants are taking on larger leverage, leading to increased losses during strong market movements.

Source: Coinglass

Bitcoin ETFs face negative NetFlow

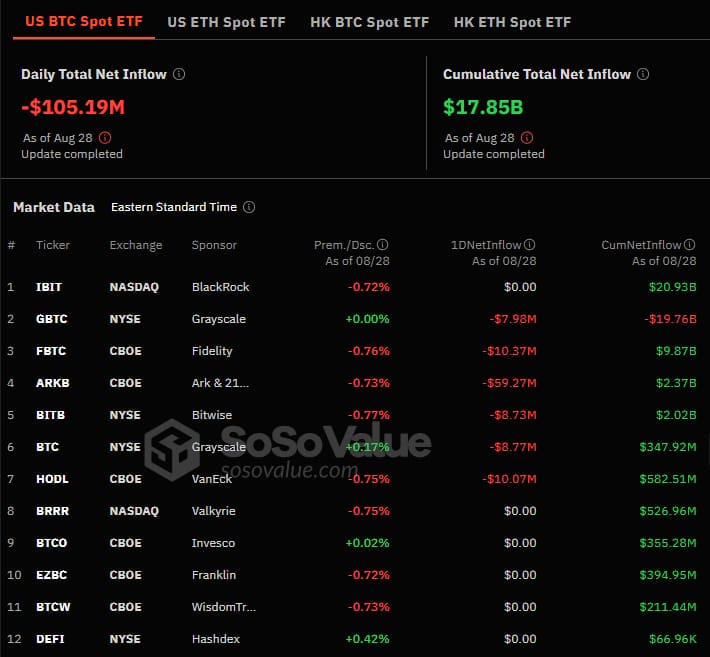

The massive BTC withdrawal from Binance also affected ETFs, which saw a net outflow of $105.19 million on August 28th, the same day as the Binance BTC withdrawal.

Ark & 21Shares’ $ARKB led the outflows with $59.27 million, followed by Fidelity’s $FBTC, VanEck’s $HODL, and Grayscale’s $GBTC with $10.37 million, $10.07 million, and $7.98 million outflows, respectively.

Source: Soso Value

These continued negative events raise concerns about BTC’s ability to recover, as its price action hovers around the $60K mark.

Will stablecoin supply help Bitcoin recover?

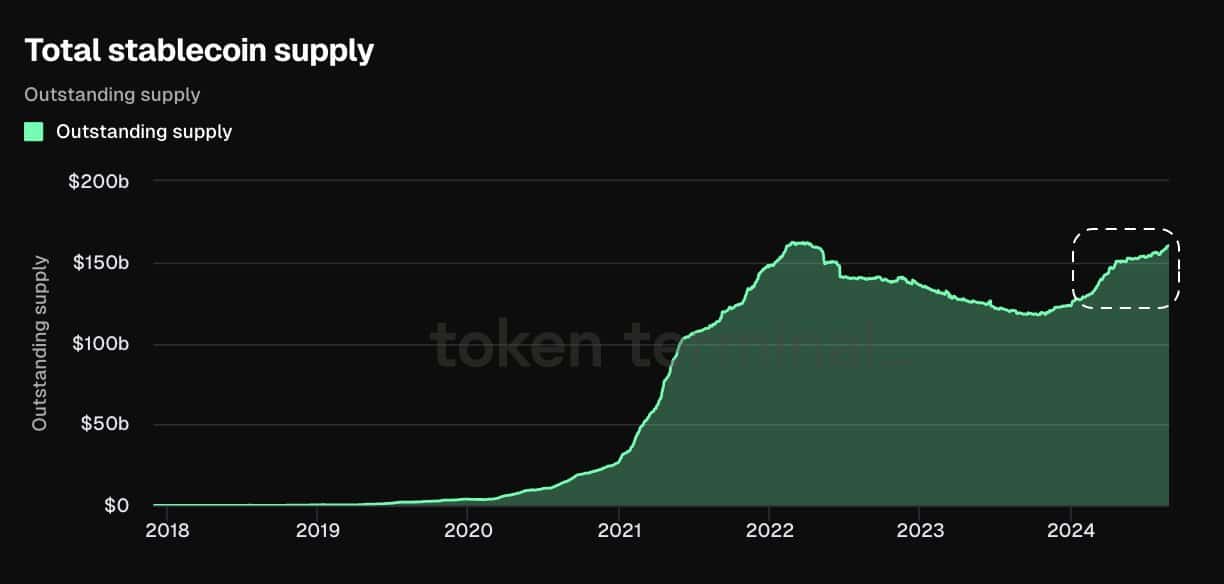

Despite the massive BTC withdrawal from Binance, widespread liquidations, and negative ETF outflows, there is hope that Bitcoin’s negative correlation with stablecoins could lead to a turnaround.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The last 24 hours have seen over $67 million in USDC minted, $70M in USDC transferred to unknown wallet and another $100 million USDT being transferred to Bitfinex.

Source: Token Terminal

This influx of stablecoins into the market could inflate prices and potentially drive Bitcoin higher. With stablecoin graphs near all-time highs, a reversal for Bitcoin and other cryptocurrencies could be on the horizon.