Kraken’s update, soaring burn rates, et al. – How high can SHIB really go now?

- Accumulation of SHIB has been on since the market crash early in August

- A few price levels might be key to predicting where the memecoin goes next

Can Shiba Inu still pull off a strong comeback in the next major bullish phase? The memecoin segment has been rapidly becoming saturated over the past few months as more memecoins enter the fold.

To its credit, however, Shiba Inu is still seeing some healthy activity, despite the ballooning competition. This includes fresh developments that may impact its position and competitive edge in the segment. For example, Kraken recently announced the addition of SHIB as collateral for over 200 perpetual futures.

Shiba Inu’s burn rate also reportedly registered a massive spike of over 28,005% recently. Over 96 million tokens were burned as part of its deflationary burn mechanism – A small amount, compared to the memecoin’s large circulating supply.

Nevertheless, it highlights Shiba Inu’s deflationary characteristic which may considerably lower the supply in the long term.

Shiba Inu’s August demand levels

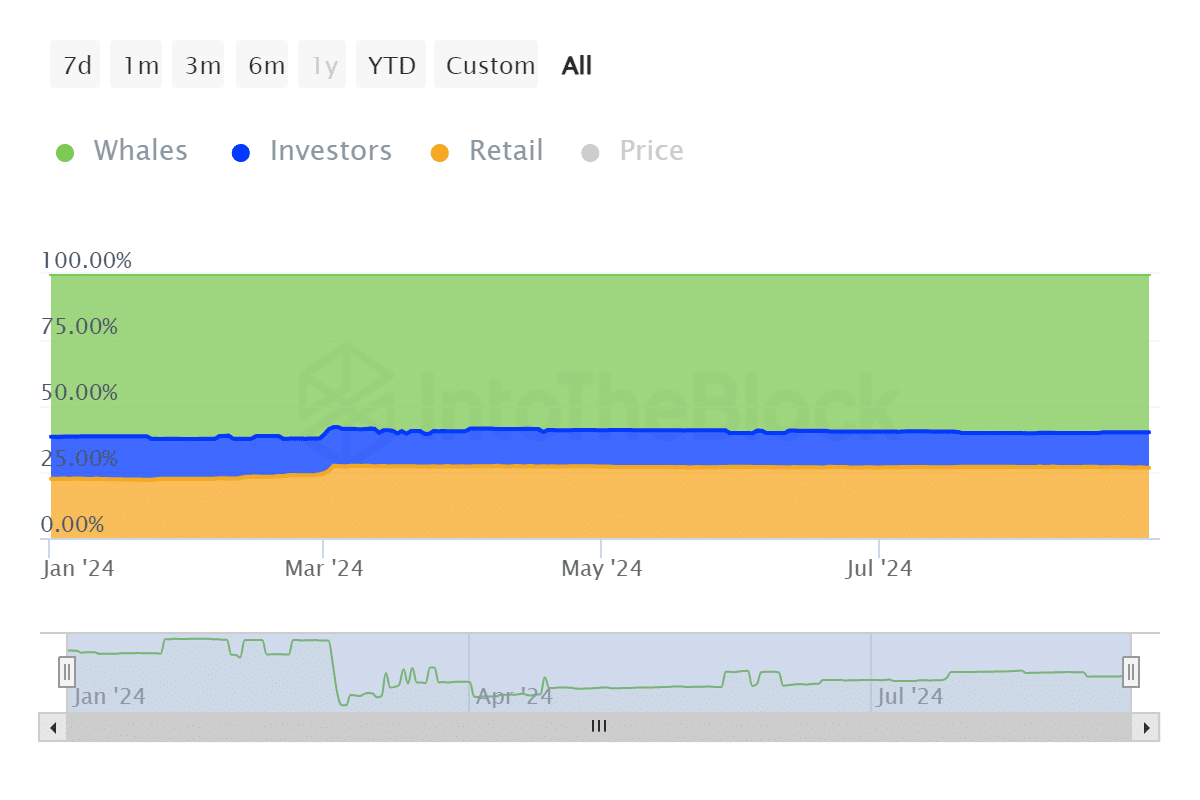

As far as Shiba Inu’s demand is concerned, AMBCrypto observed a significant surge in holdings since 5 August. In fact, by 29 August, whale holdings were up from 588.73 trillion to 589.61 trillion SHIB.

Despite these recent gains, whale addresses were down by 15.86 trillion SHIB on a YTD basis though.

The investor segment gained more significantly from 125.44 trillion on 5 August to 131.83 trillion over the same period. This means investors are set to close August higher than their 155.89 trillion SHIB holdings at the start of 2024.

Similarly, retail holdings rose from 220.75 trillion tokens in January to 264.75 trillion SHIB on 5 August. Alas, they have since reduced their holdings to 262.14 trillion as of 29 August, signaling that most of the recent demand came from whales and investors.

SHIB prime for a breakout?

Shiba Inu has been trading in a triangle/wedge pattern from its peak in March to its current press time levels. The price seems to be ready to enter September with a pattern break, one which could potentially result in another sharp long-term uptrend.

A rally of more than 100% could be on the cards if Shiba Inu rallies to the next major resistance level near the $0.00002951-level. In addition, a rally from its press time price to its current YTD high would mean an upside of 224%.

A retest of Shiba Inu’s previous ATH would equate to more than 500% upside. This will depend on whether SHIB can secure enough demand to trigger another major rally.