Shiba Inu price prediction – Assessing the possibility of SHIB hitting new local low

- The technical indicators did not show a strong trend in progress for Shiba Inu.

- The short-term sentiment was bearish, aided by the recent Bitcoin drop.

Shiba Inu [SHIB] has a bullish market structure but has had a bearish trend in the long term. The short-term momentum appeared to favor the bears. This could lead to a revisit to the local lows before another move higher.

In other news, the burn rate of Shiba Inu slowed down recently due to reduced activity. This does not impact the short-term price behavior, but if sustained over many weeks, could lead to investors losing confidence.

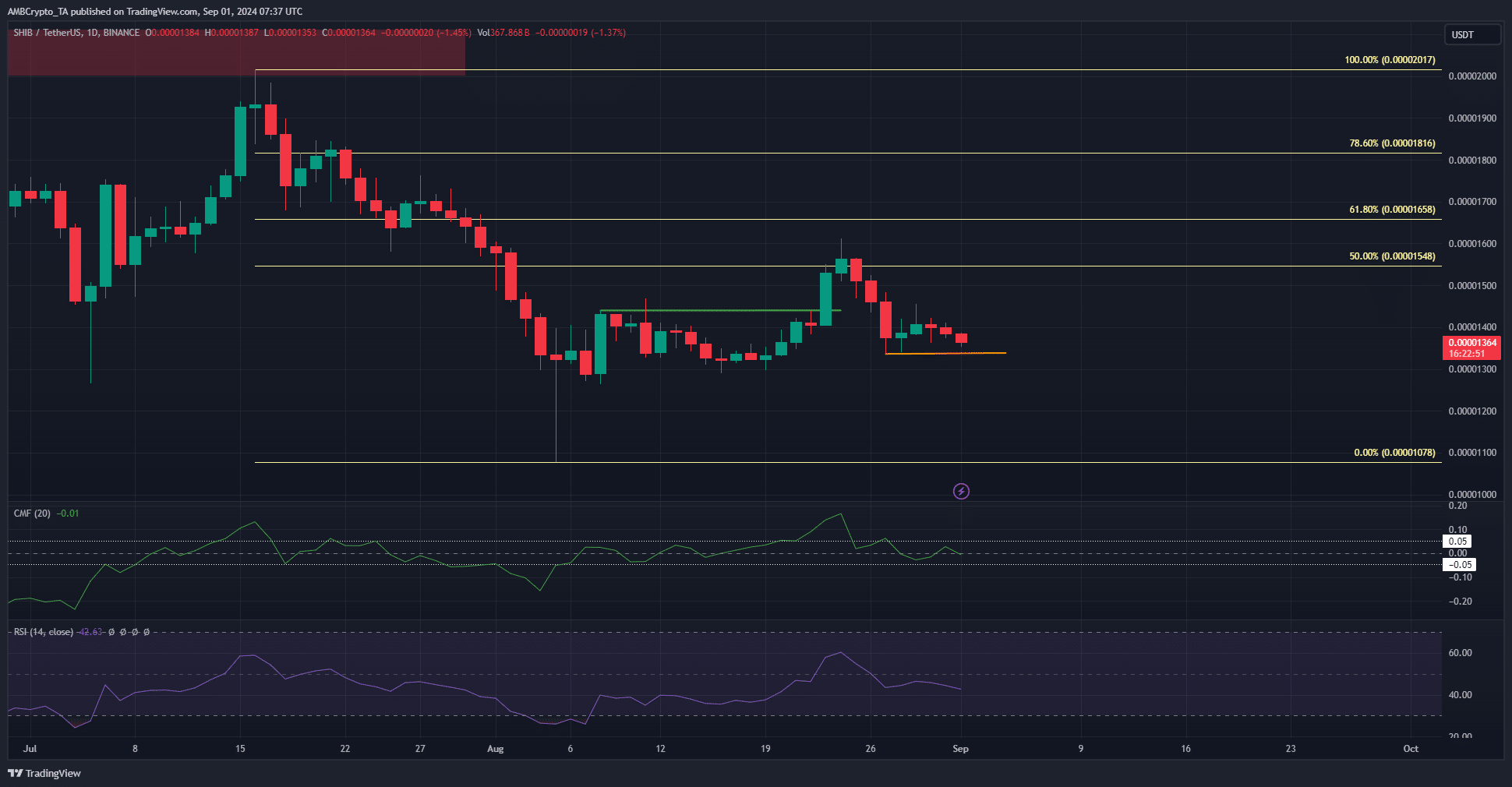

The indicators were neutral on the daily timeframe

After breaking the recent lower high at $0.0000144, SHIB saw a bullish market structure break on the 23rd of August. This structure was still in place, but a daily session close below $0.00001336 will shift the daily structure bearishly.

The CMF was at -0.01 and has not noted sizeable capital flows into or out of the market in the past week. This neutrality from market participants meant traders must be cautious.

The daily RSI was below neutral 50 to signal bearishness, but the momentum was not robust. Overall, it appeared likely that the $0.00001336 low will be revisited before prices bounce higher.

A move toward the 61.8% or 78.6% retracement levels overhead could be followed by a swift rejection, and the meme coin short sellers can look for trading opportunities once this happens.

Muted sentiment in the Shiba Inu futures market

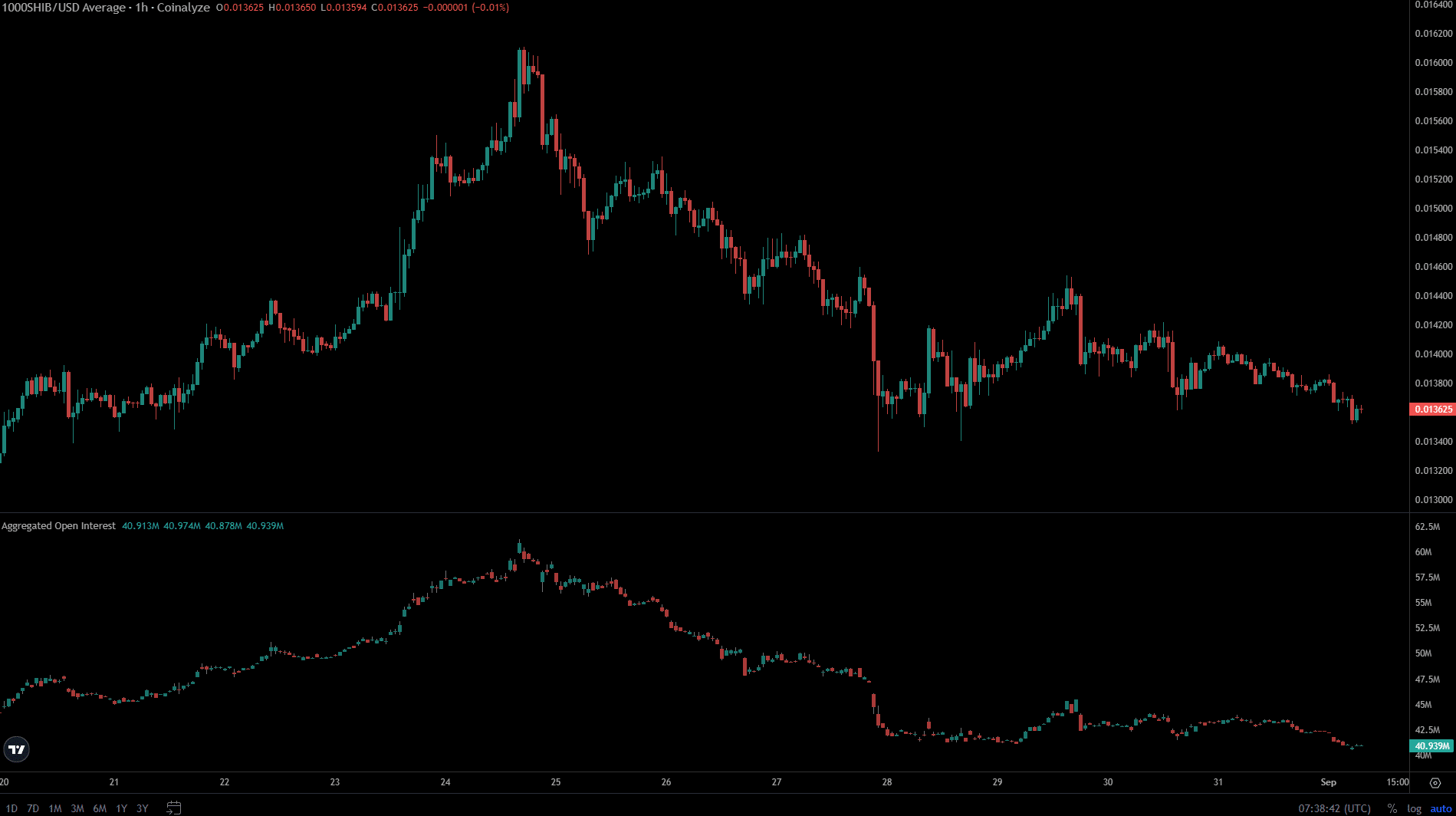

Source: Coinalyze

SHIB has been dipping lower over the past week and the Open Interest has followed its trend. This showed bearish sentiment and speculators increasingly opting to remain sidelines.

A spike in OI alongside a large price drop would imply heavy short selling, which hasn’t happened recently.

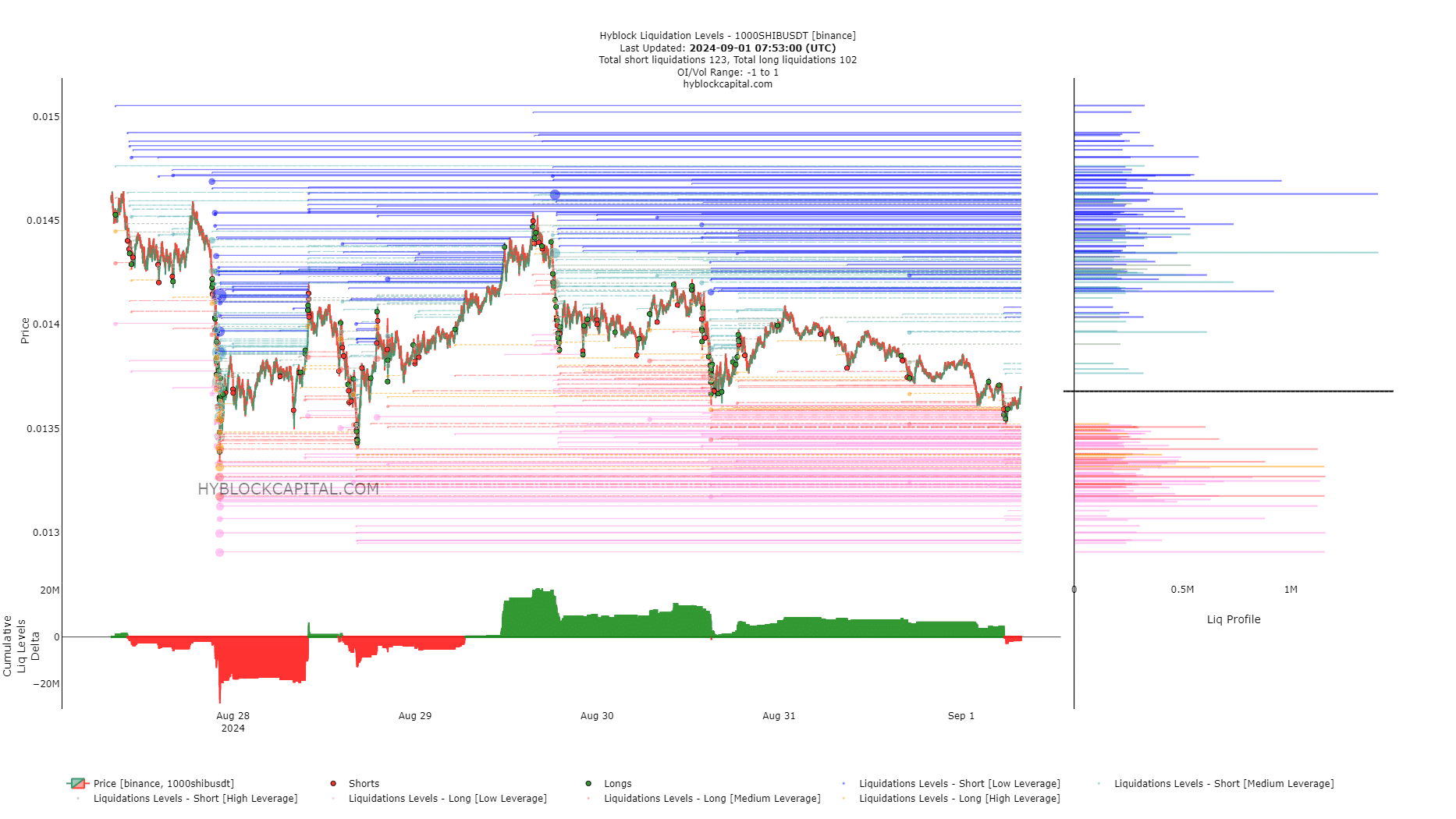

Source: Hyblock

The cumulative liquidation levels were also muted. The futures market was fairly balanced in the near term and neither side was overextended. Therefore, a choppy and indeterminate trend is anticipated over the next few days.

Read Shiba Inu’s [SHIB] Price Prediction 2024-25

Once speculators get impatient enough en masse, which would be evidenced by a large build-up of liquidity, Shiba Inu prices could move toward that liquidity pool.

Until then traders needed to bide their time as a short-term trading opportunity was not apparent.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

![Kusama [KSM] explodes 119% in one day - How DOT helped](https://ambcrypto.com/wp-content/uploads/2024/11/Michael-KSM-400x240.webp)