Analyzing BNB as crypto markets see red across the board

- The crypto markets bleed as BNB prices take a dip.

- Stablecoin inflow and trading volume are dwindling.

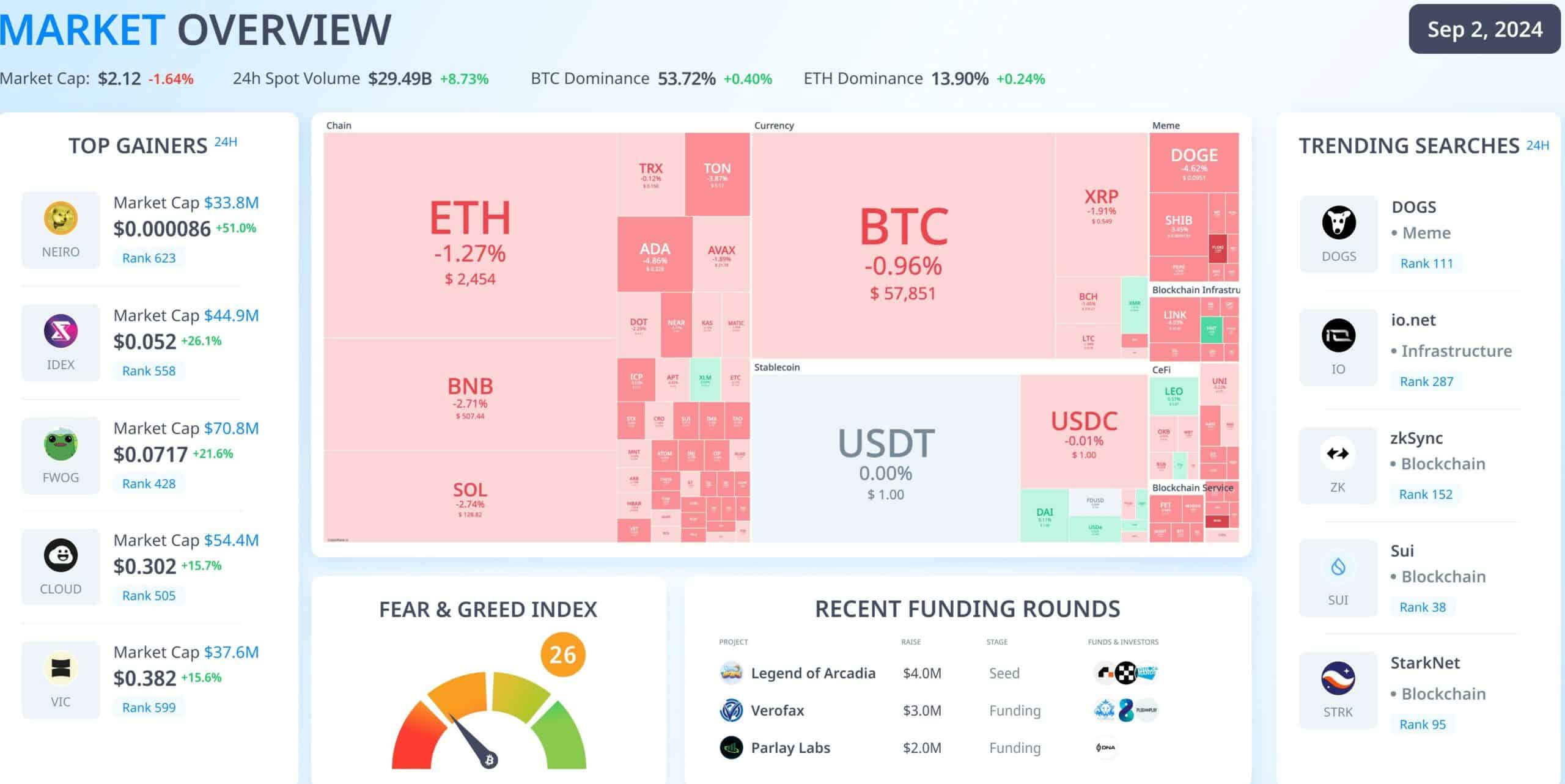

The crypto markets are experiencing significant declines, with major coins seeing substantial price drops. The overall market sentiment remains fearful, as reflected by the Fear & Greed index reading of 26.

Bitcoin [BTC] was trading below $58K, and the top 10 cryptocurrencies were all in the red, led by Dogecoin [DOGE] at -4.00%, followed by Binance Coin [BNB] at -2.22%, and Solana [SOL] at -2.11%.

The total market capitalization has dropped to $2.12 trillion, marking a decrease of -1.64%.

Notably, developments surrounding Binance Smart Chain (BSC) could have a significant impact on the broader crypto market, as BNB remains one of the top three cryptocurrencies by market cap, currently standing at $73.95 billion.

Binance price analysis shows…

Examining the price action of Binance (BNB), particularly in the BNB/USDT pair, reveals a concerning trend. The broader crypto market’s downturn has not spared BNB, with its rate of decline raising alarms.

Although there are early signs of recovery with the daily candle showing a tail, Binance’s projections for the coming months suggest further potential declines.

Having recently touched the $500 level, BNB appears to be on the verge of breaking down further.

A fall below the $500 mark could signal a critical correction period, while a sustained move above $550 might indicate a shift in market sentiment and potentially resume the bull market.

However, the entire crypto market currently remains in a correction phase.

A key indicator, the regular bullish divergence in the relative strength index (RSI) detected by the Divergent indicator on BNB/USDT, offers a glimmer of hope but is not yet conclusive.

BNB trading volume and market impact

In terms of trading volume, BNB ranks fourth among cryptocurrencies with the largest market caps, controlling a substantial portion of the entire crypto market’s volume.

This dominance means that any negative news related to Binance or BNB could have far-reaching effects on the broader market. Despite its significant trading volume, BNB’s growth appears stagnant, which is concerning.

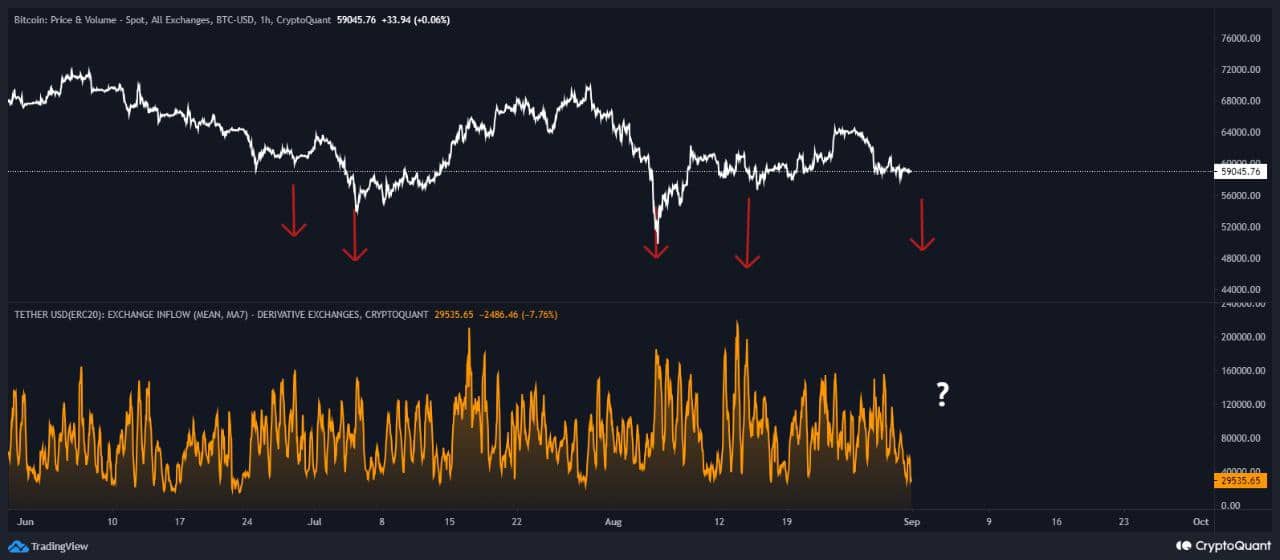

Moreover, when considering stablecoin inflows to exchanges, the situation looks bleak for BNB. The inflows are plummeting, signaling that the volume is either stagnant or declining.

Read Binance (BNB) Price Prediction 2024-25

Even as Bitcoin falls to $59,000, stablecoin exchange inflows continue to dwindle, suggesting that investors are not convinced that the market slump is over.

This hesitation to deploy stablecoins to purchase BNB at its current price level further exacerbates concerns about the coin’s future.