Bitcoin miners face revenue crisis: Exploring BTC’s August drop

- Bitcoin miners face a dilemma as they incurred their lowest mining rewards in the month of August, squeezing their profits.

- However, a strategic approach could help them navigate these challenges.

Bitcoin [BTC] faced a volatile end to August, with its price fluctuating within a specific range between $64,000 and $57,000. At the time of writing, Bitcoin was valued at $58,385.

As bulls strive to breach the $64K barrier, Bitcoin miners are facing their lowest earnings of the year, marking the worst performance in 11 months.

Consequently, AMBCrypto investigated whether this sharp drop in BTC rewards might drive miners to exit the trade.

August brings Bitcoin miners’ lowest revenue

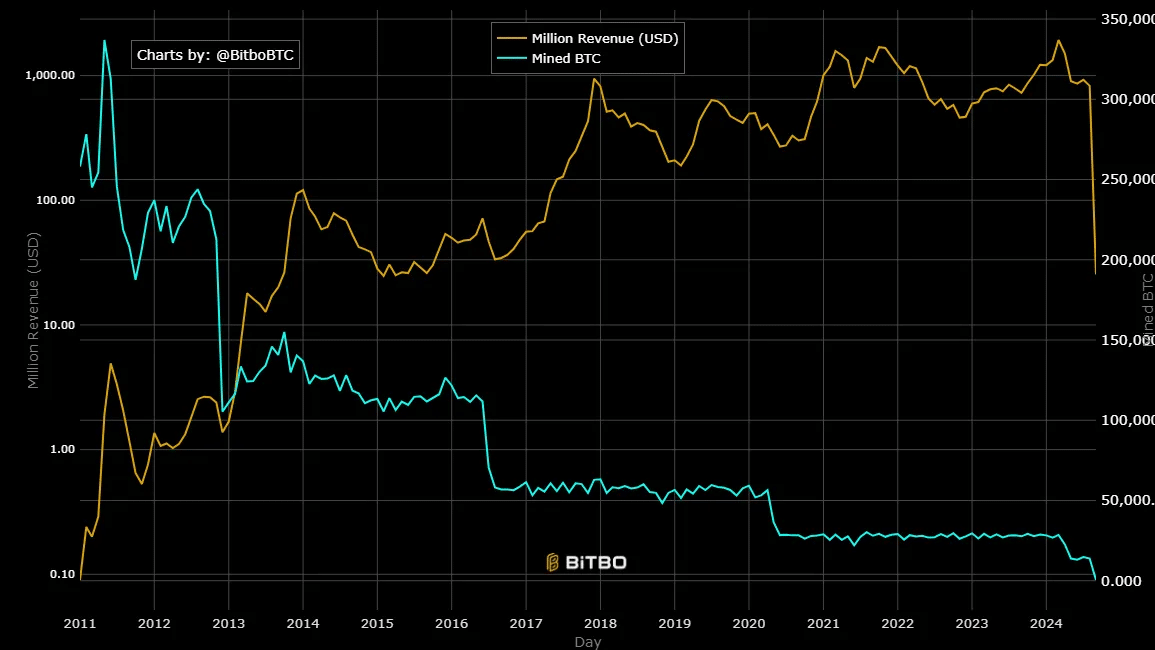

In August, Bitcoin miners recorded their lowest revenue-generating month since September 2023, with the number of mined coins dropping significantly.

Additionally, mining incurs high operational costs for Bitcoin miners. If the rewards fail to cover these expenses, miners may face capitulation.

According to AMBCrypto’ analysis of the chart below, miner revenue fell to $820 million in August, marking a decline of over 10% from July’s $927 million.

Interestingly, this August figure represents a 57% decrease from the peak of nearly $1.93 billion in March, the same month Bitcoin reached its ATH of over $73K.

This showed a big drop in mining revenue despite Bitcoin’s high price earlier in the year – But why? AMBCrypto investigated.

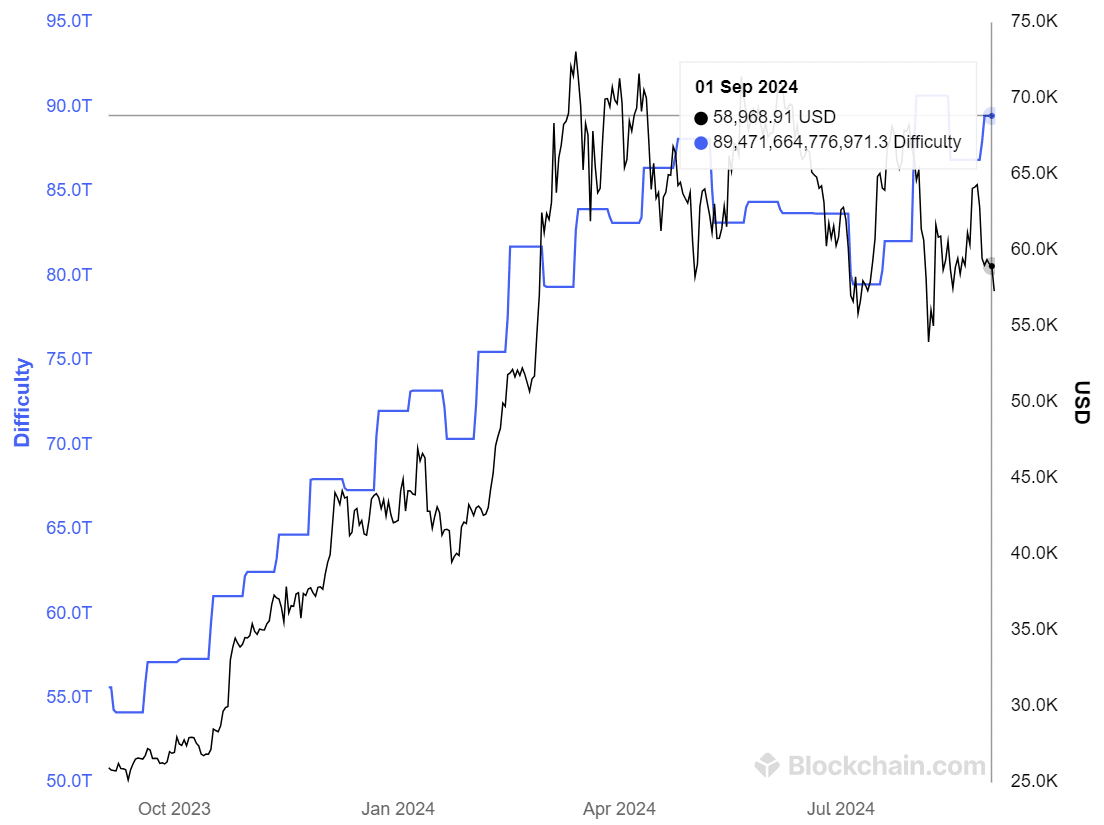

Following the last BTC halving in April, which reduced block rewards to 3.125 BTC per block, mining difficulty increased sharply.

As a result, mining difficulty surged to an all-time high of 89.47 trillion in August, up 3% from 86.87 trillion in July.

With more Bitcoin miners joining the network, validating transactions became harder, reducing the number of coins mined and the revenue earned.

In short, this indicated that rising mining difficulty, driven by the Bitcoin halving, has significantly squeezed miners’ profitability. So, are Bitcoin miners exiting the trade?

Miners strategic positioning counters short-term volatility

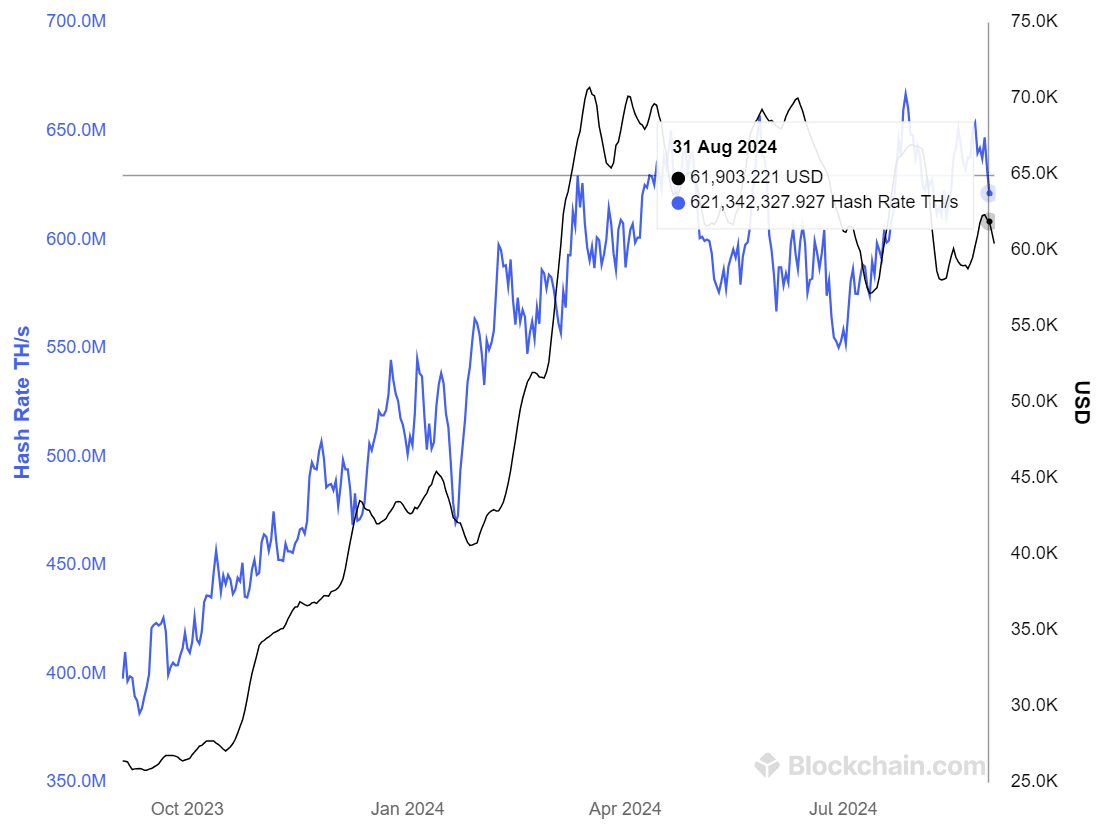

Put simply, the hash rate measures the total computational power being used to mine and process transactions on the Bitcoin network.

If this figure drops significantly, it can be an indicator that miners are leaving the network.

The chart above revealed a striking trend. Interestingly, whenever BTC tested a crucial resistance level, the hash rate also jumped.

According to AMBCrypto, this suggested that miners were more engaged or optimistic about potential price movements.

However, the hash rate has absorbed a notable decline since the last week of July, falling from 667 million to 620 million, a drop of 7%.

While not extreme, it suggested that miners are reacting to changing conditions, potentially due to lower rewards.

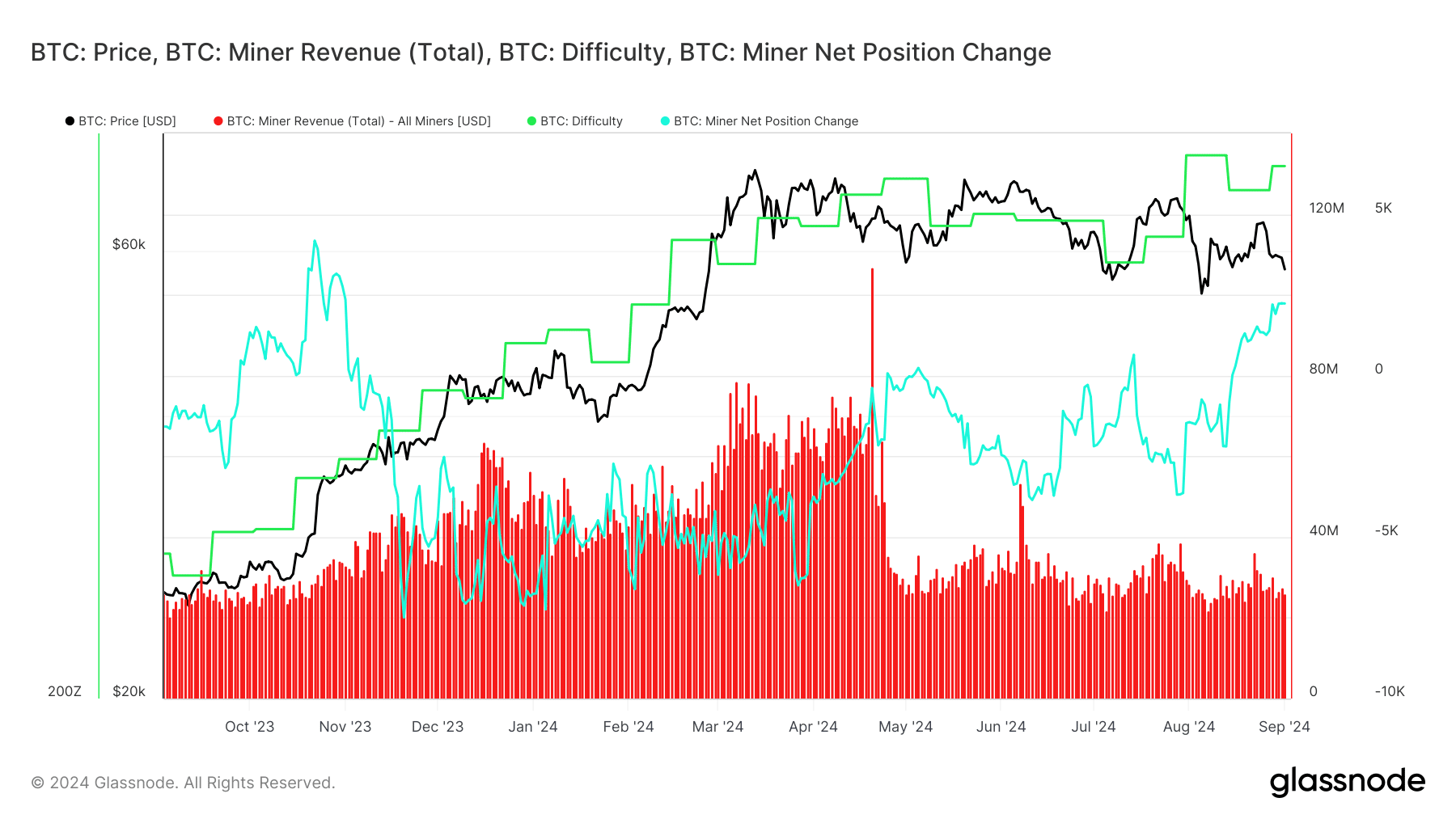

However, the BTC miner net position change has shifted to positive since mid-August, despite reduced miner rewards.

This indicated that, even though miner rewards have decreased, miners have begun accumulating more Bitcoin rather than selling it.

Additionally, AMBCrypto noted that miners might be strategically positioning themselves by accumulating BTC when prices are relatively low.

Read Bitcoin’s [BTC] Price prediction 2024-25

Overall, despite squeezed profitability, miners remain confident in Bitcoin’s long-term gains as highlighted by the positive net change.

However, this confidence could lead to increased mining difficulty in the long run, potentially causing miner rewards to plunge further.