BlackRock BTC ETF faces zero flows – Are North Korean hackers to blame?

- Bitcoin ETFs faced $804.8 million in outflows from 27th August to 4th September.

- North Korean hackers target crypto firms, impacting ETF stability and investor confidence.

September has been a difficult month for the leading cryptocurrency, Bitcoin [BTC].

Not only has Bitcoin struggled to break past the $60K mark, but Bitcoin exchange-traded funds (ETFs) have also faced significant challenges.

Over the past few days, Bitcoin ETFs saw outflows of $804.8 million, sending shockwaves through investors and enthusiasts.

Of particular concern was BlackRock’s iShares Bitcoin Trust ETF (IBIT), which has failed to attract any inflows since 27th August.

The fund had zero inflows on many days, including the 27th, 28th, 30th of August and 3rd of September, adding to market concerns.

North Korean hackers to be blamed?

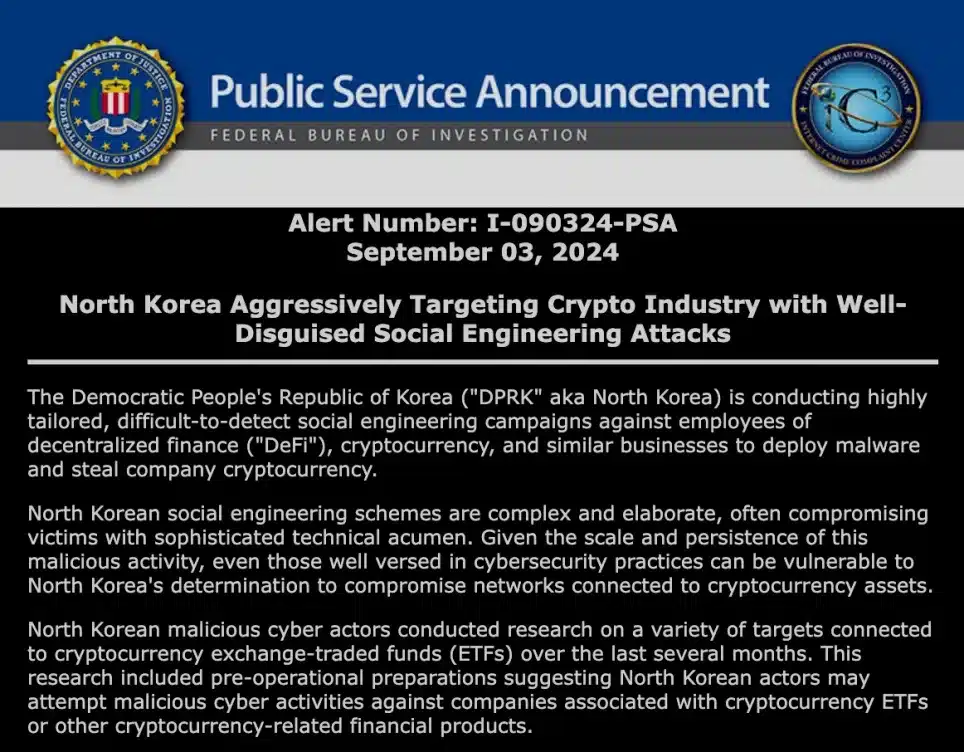

Amid these events, U.S. authorities have issued a warning about an imminent threat posed by North Korean hackers, specifically targeting crypto firms involved in the growing Bitcoin ETF market.

For context, North Korean hackers, notably the Lazarus Group, have a well-established pattern of targeting cryptocurrency firms and platforms.

The FBI has revealed that North Korean cybercriminals are focusing their efforts on employees at decentralized finance (DeFi) and cryptocurrency firms.

According to the announcement, these criminals are employing highly “difficult-to-detect social engineering campaigns.”

The warning has raised concerns about the long-term viability of the Bitcoin ETF space as it navigates both financial and cybersecurity challenges.

IBIT investors’ shift

However, it’s important to note that, IBIT’s cumulative net inflows since its launch on 11th January were approaching $21 billion.

In fact, on 22nd July, IBIT experienced a significant inflow of half a billion dollars, the largest since 13th March, according to SpotOnChain data.

This shift highlights the ETF’s fluctuating appeal to investors over time, reflecting changing market dynamics and sentiment.

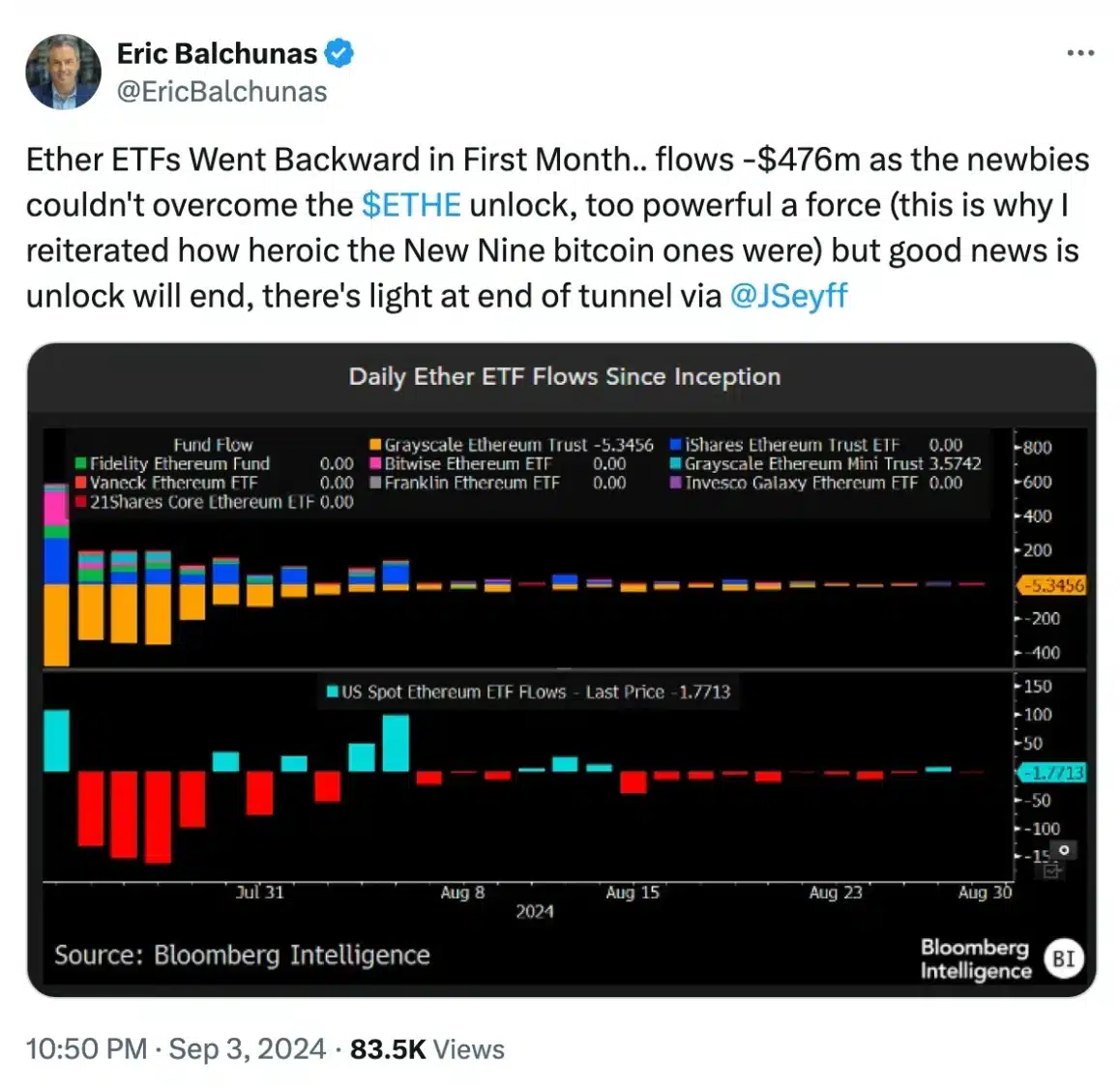

Ethereum ETF continues to outflow

In contrast, Ethereum [ETH] ETFs have been on a consistent outflow streak, with only brief periods of inflows.

Comparing the same time frame used for Bitcoin ETFs—from 27th August to 4th September—ETH ETFs recorded outflows on 27th, and 29th August and again on 3rd and 4th September.

On 30th August and 2nd September, the ETFs saw zero inflows.

The only notable inflow occurred on 28th August, when ETH ETFs registered a modest net inflow of $5.9 million, according to Farside Investors.

Similarly, BlackRock’s Ethereum ETF experienced predominantly zero flows over the past few weeks, mirroring the trend seen with BlackRock’s Bitcoin ETF.

However, despite the recent turmoil, ETF analyst Eric Balchunas maintains a positive outlook, believing that brighter days are ahead.

![Kusama [KSM] explodes 119% in one day - How DOT helped](https://ambcrypto.com/wp-content/uploads/2024/11/Michael-KSM-400x240.webp)