Here’s what Ethereum’s 70% orderbook imbalance means for traders

- At the time of writing, ETH’s orderbook imbalance was at 70%

- Ethereum may be set to hit new highs on the charts

Ethereum’s [ETH] price action has been a hot topic following its failure to hit a new all-time high (ATH) in 2024. This, despite the fact that Bitcoin hit its own ATH in March.

As expected, this has led to concerns that ETH may be losing momentum. Even so, recent developments in the ETH/USDT pair are providing hope for Ethereum enthusiasts.

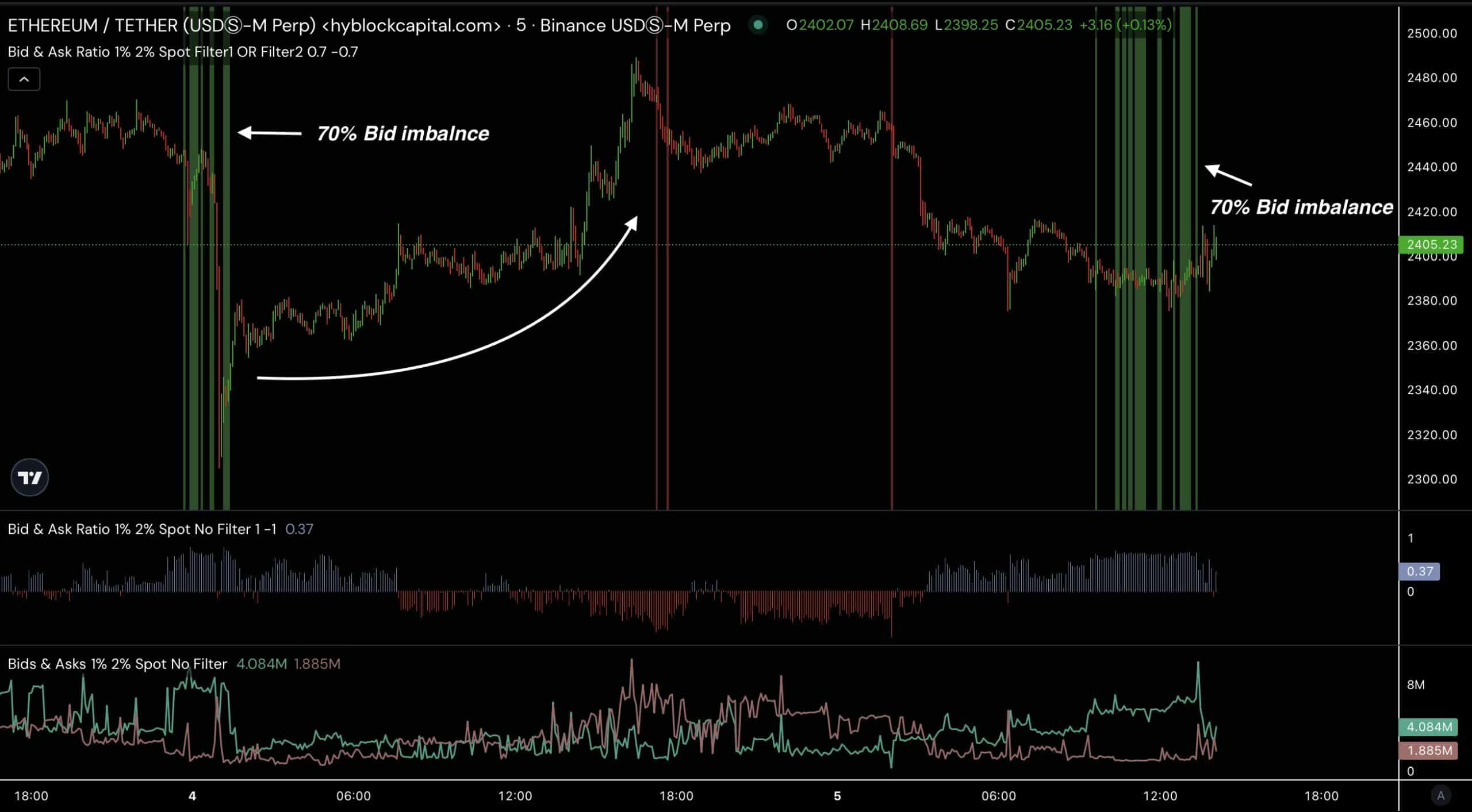

In fact, data from Hyblock Capital revealed a significant orderbook imbalance of 70% for ETH at a 1-2% depth. Historically, when ETH experiences a similar 70% bid imbalance, the price marks a bottom and began to rise.

The current bid imbalance means that ETH could see a repeat of this upward price trend.

Ethereum in an ascending triangle

Ethereum, at the time of writing, was forming an ascending triangle on the weekly timeframe, with its price respecting the 200-moving average.

This consolidation pattern supports a bullish case for ETH, as ascending triangles typically lead to price breakouts.

The 70% bid imbalance further reinforces the possibility of an upward move on the charts.

Consolidation phases usually precede significant price movements. In this case, a breakout could push ETH to much higher levels.

Weekly RSI heatmap

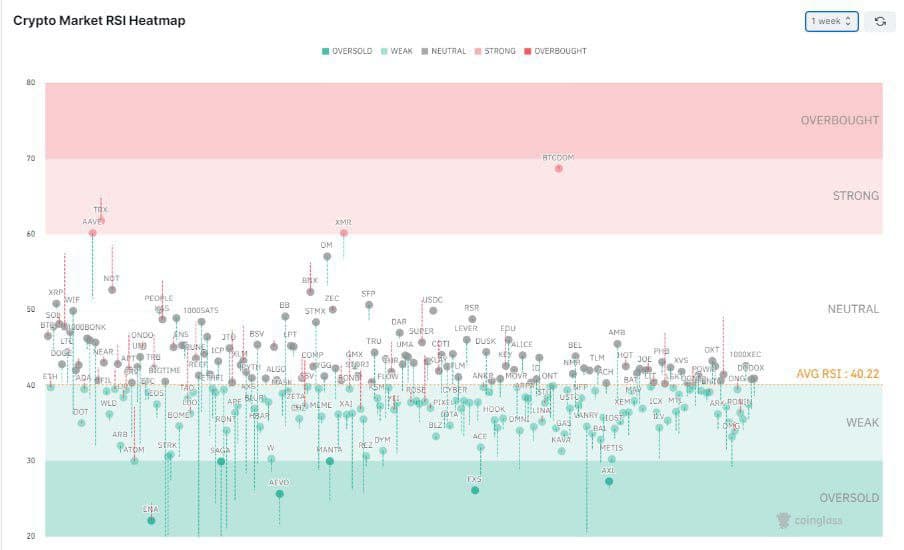

The weekly Relative Strength Index (RSI) heatmap indicated that at press time, many cryptocurrencies were in the weak or neutral zone, with an average RSI of 40.22%.

This means that the market is transitioning from an oversold condition right now.

As the RSI approaches more neutral levels, it might point to a potential upward movement for ETH. Especially with the 70% bid imbalance indicating a possible bottom. This would align with expectations of a price surge on the charts.

ETH-based protocols booming…

Vitalik Buterin, Ethereum’s co-founder, recently announced his intention to donate his Layer 2 (L2) and project tokens to support public goods within the ETH ecosystem and charitable causes.

This move strengthens Ethereum’s long-term outlook too.

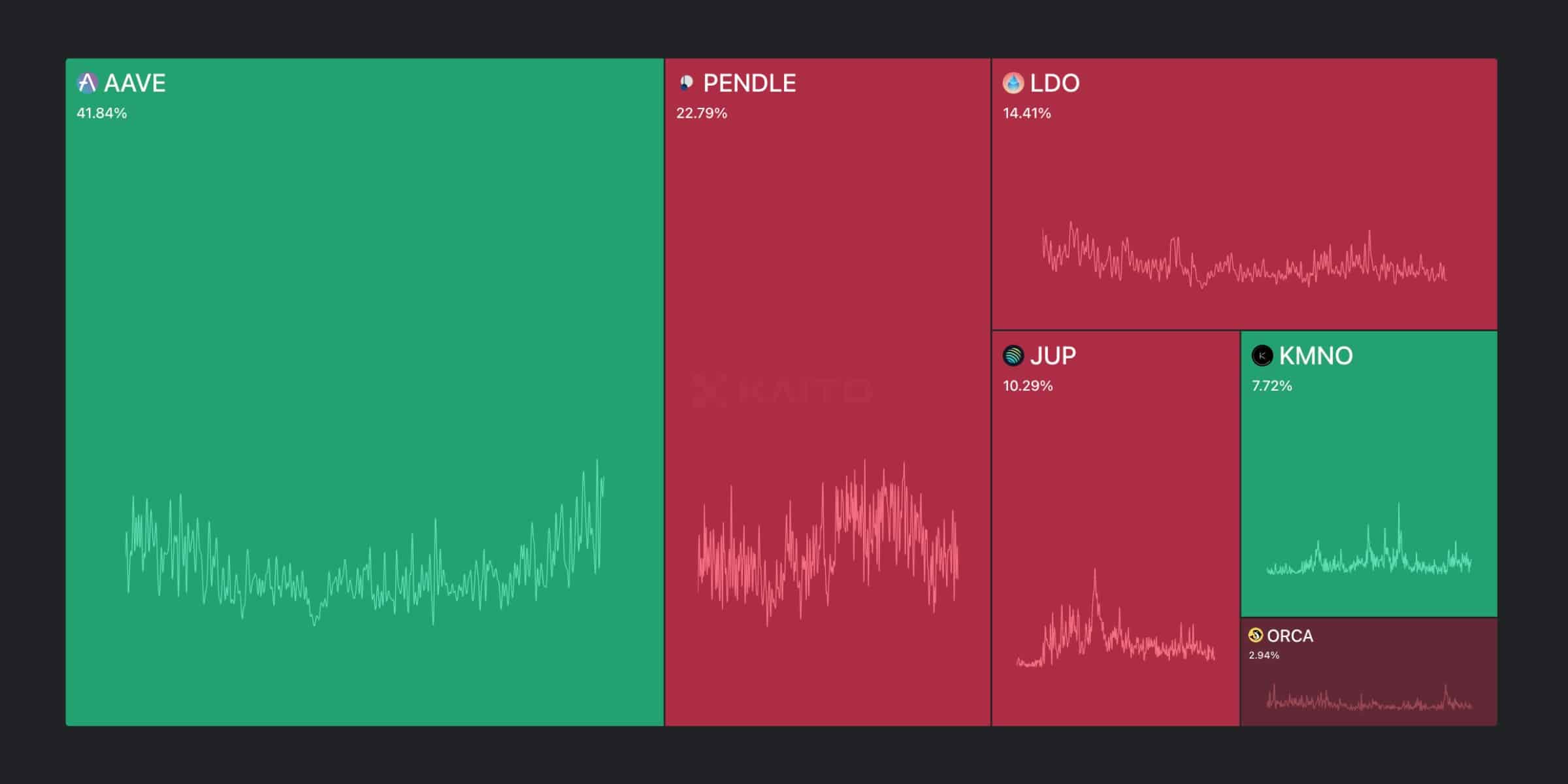

Additionally, while some traders are wondering if Solana might push ahead in the decentralized finance (DeFi) sector, Ethereum remains dominant. In fact, analysts at Kaito AI confirmed that Ethereum still holds a majority of the mindshare in DeFi.

Aave, one of the largest DeFi platforms, operates on ETH, along with other key protocols like Pendle and Lido. These platforms are likely to drive further adoption of ETH and support its price moving higher.

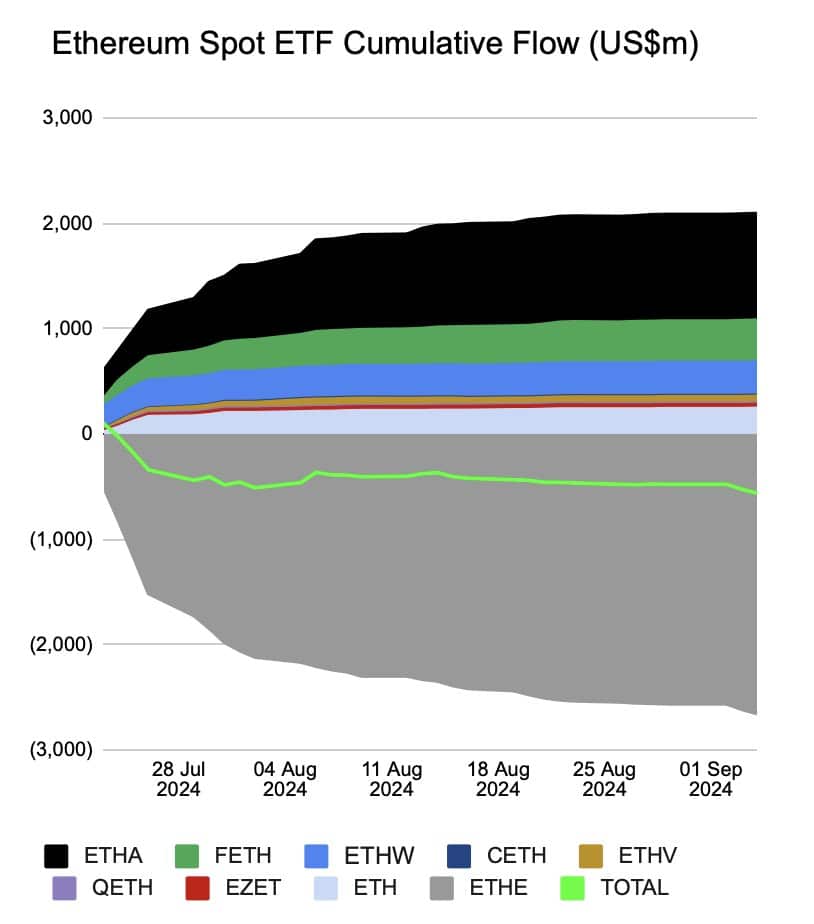

Ethereum ETF cumulative flows

However, there is one area of concern – Cumulative flows for Ethereum-based ETFs have hit an all-time low. The net flows in ETH ETFs are currently negative, with a reading of $562.3 million.

While the existence of an ETF is positive for Ethereum, the lack of demand poses a risk.

Source: X

If demand does not increase, some ETF issuers may be forced to close their products.

Nonetheless, owing to the ongoing developments in the Ethereum ecosystem, a price turnaround could be on the horizon.