‘Quick to look past Ethereum,’ Bitwise CIO rues – Here’s why

- ETH’s underperformance has dropped to a multi-year low.

- Bitwise’s executive remains confident about ETH’s price reversal.

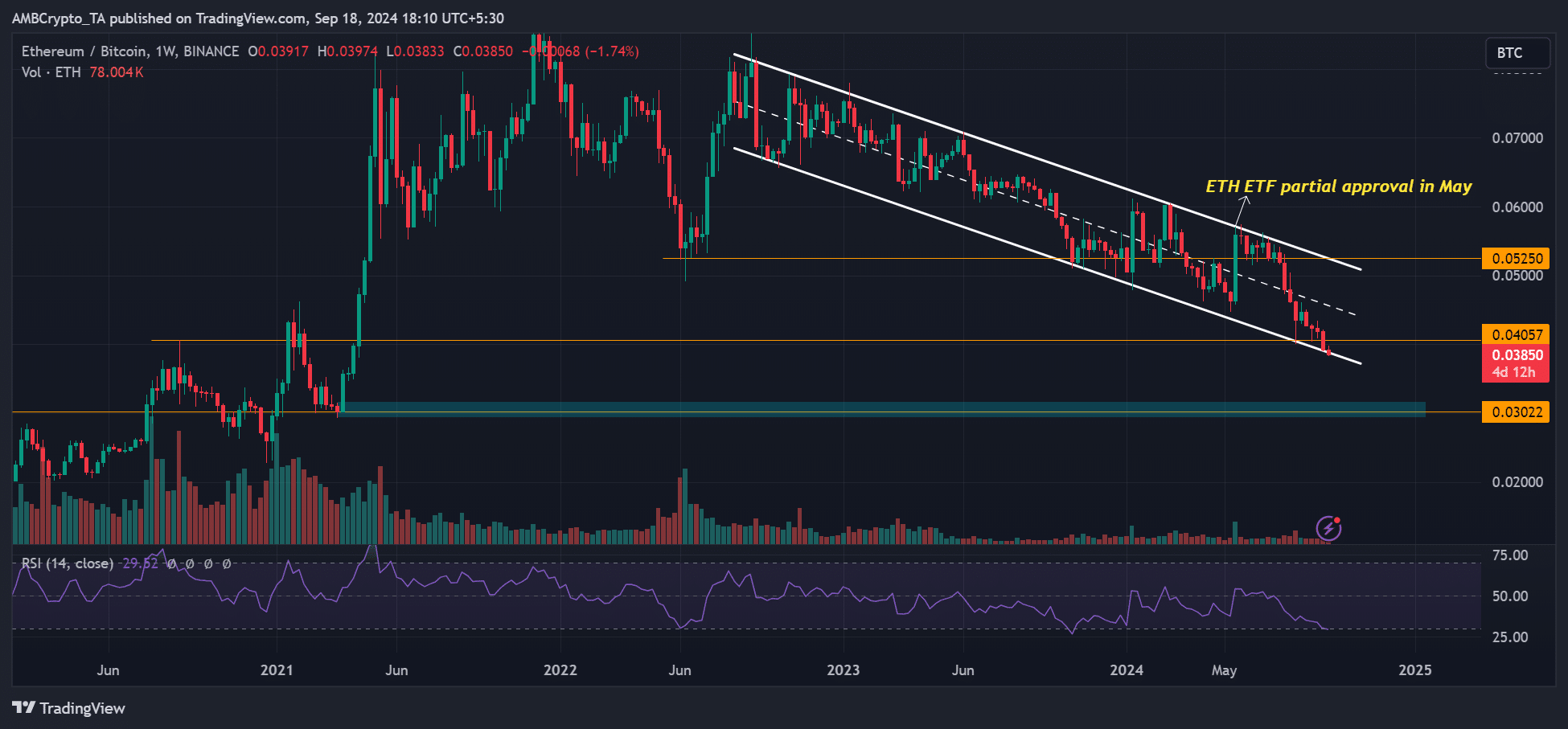

Ethereum’s [ETH] relative valuation to Bitcoin [BTC] elicited market concerns earlier this week, as the ETH/BTC pair broke below 0.04 for the first time in nearly four years.

The pair tracks ETH’s valuation relative to BTC, and its multi-year downtrend marked the altcoins’ worrying underperformance.

In fact, ETH has erased its yearly gains. But BTC was up 40%, and Solana [SOL], ETH’s main competitor, was up 18% year-to-date.

ETH’s moment will come…

However, the digital asset manager Bitwise was confident of ETH’s bullish price reversal in the long run. Bitwise CIO Matt Hougan made a contrarian bet on ETH, highlighting potential recovery after the U.S. elections.

Part of his recent note to investors read,

“I think people are too quick to look past Ethereum and the real-world success we’re already seeing in its ecosystem.”

Hougan cited the prediction site Polymarket, massive stablecoin, and DeFi space as top bullish cues for the altcoin. Besides, the increasing institutional interest from BlackRock and the rest was also great for ETH’s value.

He added that extra regulatory clarity on DeFi space could boost the altcoin, especially after the U.S. elections. He noted,

“I suspect the market may reevaluate Ethereum as we get closer to the November elections and any regulatory clarity that emerges. For now, it looks like a potential contrarian bet through the end of the year.”

ETH’s current woes

Market pundits have cited several reasons for ETH’s relative poor performance to BTC.

Coinbase’s Head of Institutional Research, David Duong, linked most of the current muted price to the market structure typically marked by slow market activity due to summer.

However, the poor performance of U.S. spot ETH ETFs has also been cited as a catalyst for weak ETH sentiment.

Unlike its U.S. BTC ETFs, the ETH products have seen net negative flows of $606 million since launched in July.

According to Hougan, regulatory uncertainty has also weighed on ETH, especially ahead of the U.S. elections with no potential clear presidential winner.

He added that the community’s concern over ETH’s tokenomics also contributed to its current woes.

For context, ETH revenue has fallen to a four-year low after scaling allowed L2s to attract most of the volume from the L1 base layer. This has caused concerns amongst users, noted Hougan.

“Many wonder if Ethereum has shot itself in the foot by scaling away from the foundational Layer 1 blockchain.”

In the meantime, ETH/BTC was on the verge of breaking below its multi-year descending channel.

That said, market analyst Benjamin Cowen projected that ETH/BTC could bottom by the end of the year. At the time of writing, ETH was valued at $2.3K, down 43% from its March highs of $4K.