Bittensor’s open interest nears ATH — Is a TAO bullish rally ahead?

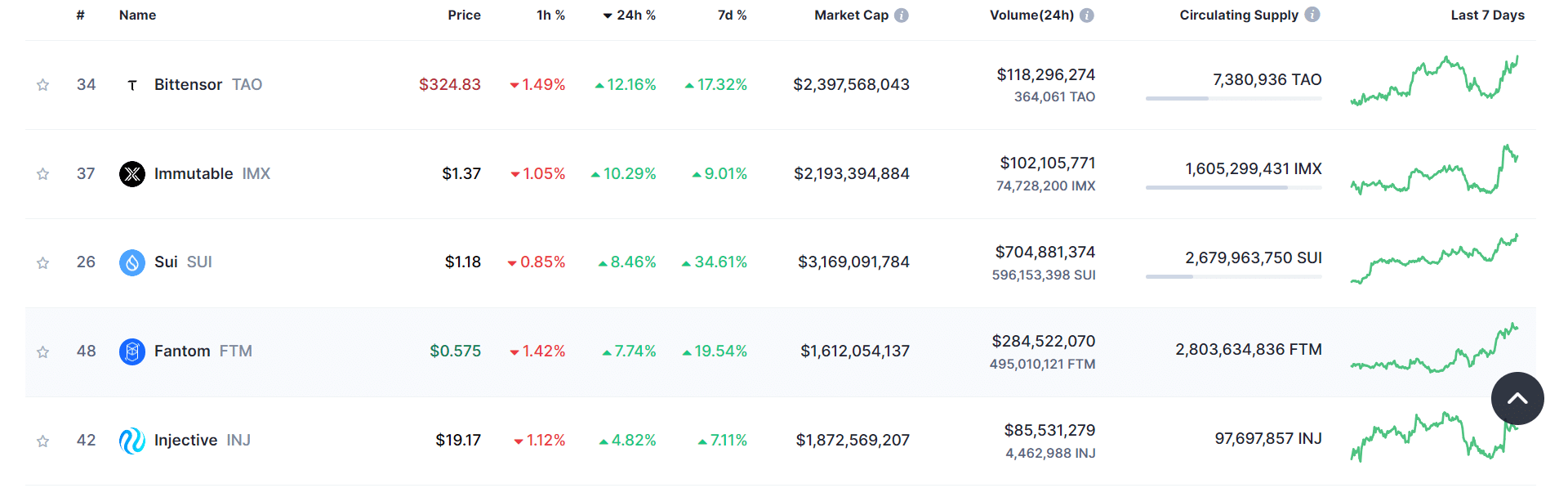

- BitTensor leading by gains for top 50 coins by market cap.

- Open interests approaching the all-time high.

BitTensor [TAO], a leading AI coin, is gaining significant traction in the cryptocurrency market as web3 continues to evolve on blockchain technology.

In the last 24 hours, TAO has recorded over 12% gains, making it the top-performing coin among the top 50 by market cap at press time, according to CoinMarketCap.

TAO is well-positioned to surpass Fetch.AI (FET) as the top AI coin, depending on broader market conditions.

Major companies like Nvidia (NVDA) recently posted better-than-expected earnings, influencing the market with their collective views.

This has sparked a bullish sentiment toward AI coins, as Nvidia plays a significant role in the AI industry.

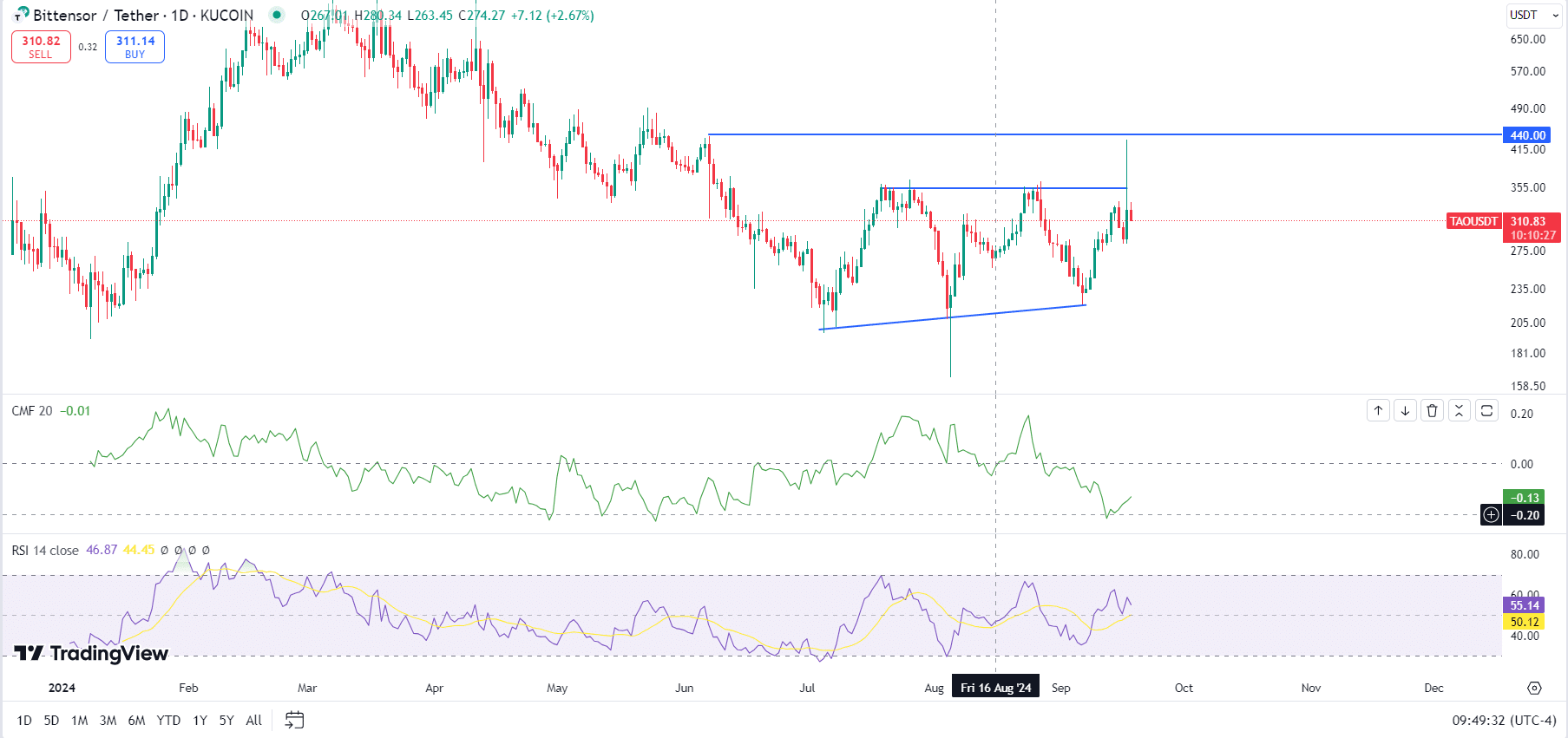

TAO price actions wicks to around $440

In the past 24 hours as at press time, TAO’s price spiked to $440 on Kucoin Exchange but faced immediate rejection, suggesting strong selling pressure at that level.

This creates a significant resistance zone moving forward. Typically, wicks are viewed as gaps that markets tend to fill, meaning BitTensor needs to climb higher to fill this gap.

Whether TAO/USDT will rally to fill this gap remains uncertain, as the price rejection could indicate that sellers still hold control. However, TAO briefly wicked above $356, where there’s liquidity due to equal highs at this level.

Additionally, the bullish close of the August 5th candle, a hammer with a long tail, suggests increasing buying pressure.

TAO/USDT’s consolidation, while in a range, is marked by higher lows, which is typically a bullish signal. The Chaikin Money Flow, currently negative, hints at a possible reversal that could drive TAO’s price higher.

The Relative Strength Index (RSI) on the 14-day moving average has also flipped bullish, further supporting the case for potential gains in the near future.

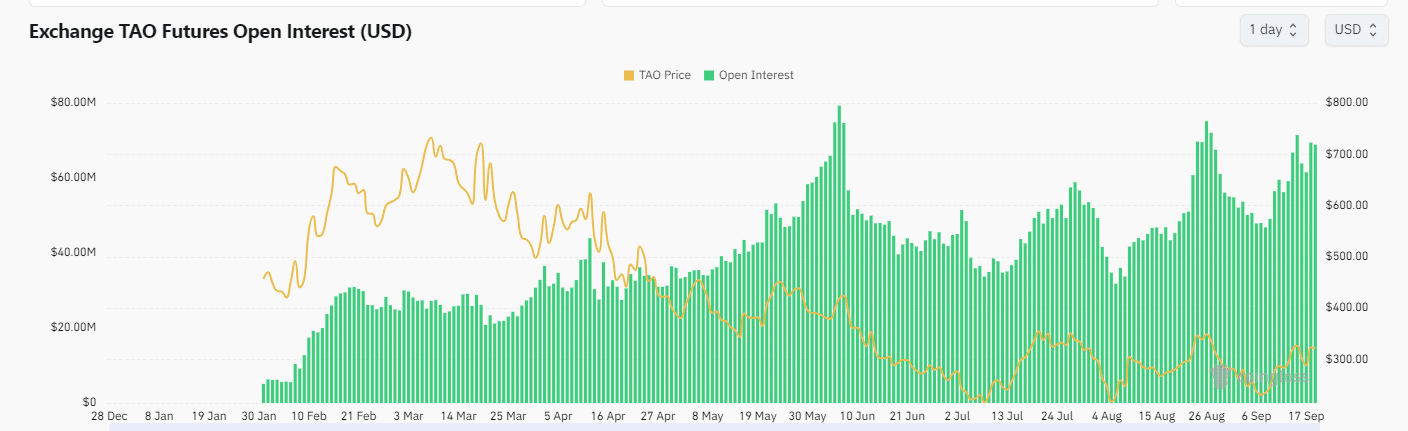

Open interest nears ATH

The open interest for BitTensor across popular exchanges is nearing its all-time high, with a current total of $68.88 million at a price of $322 as of press time.

Binance leads the pack with $29M in TAO open interest, followed by Bybit with $18.6M. Bitget and BingX follow with $13.19 million and $5.54 million, respectively.

Other exchanges like Coinbase, Kraken, HTX, and CoinEx show notable, but lower, open interest.

Source: Coinglass

This strong open interest is a bullish sign for TAO. Now could be a good time to accumulate TAO tokens.

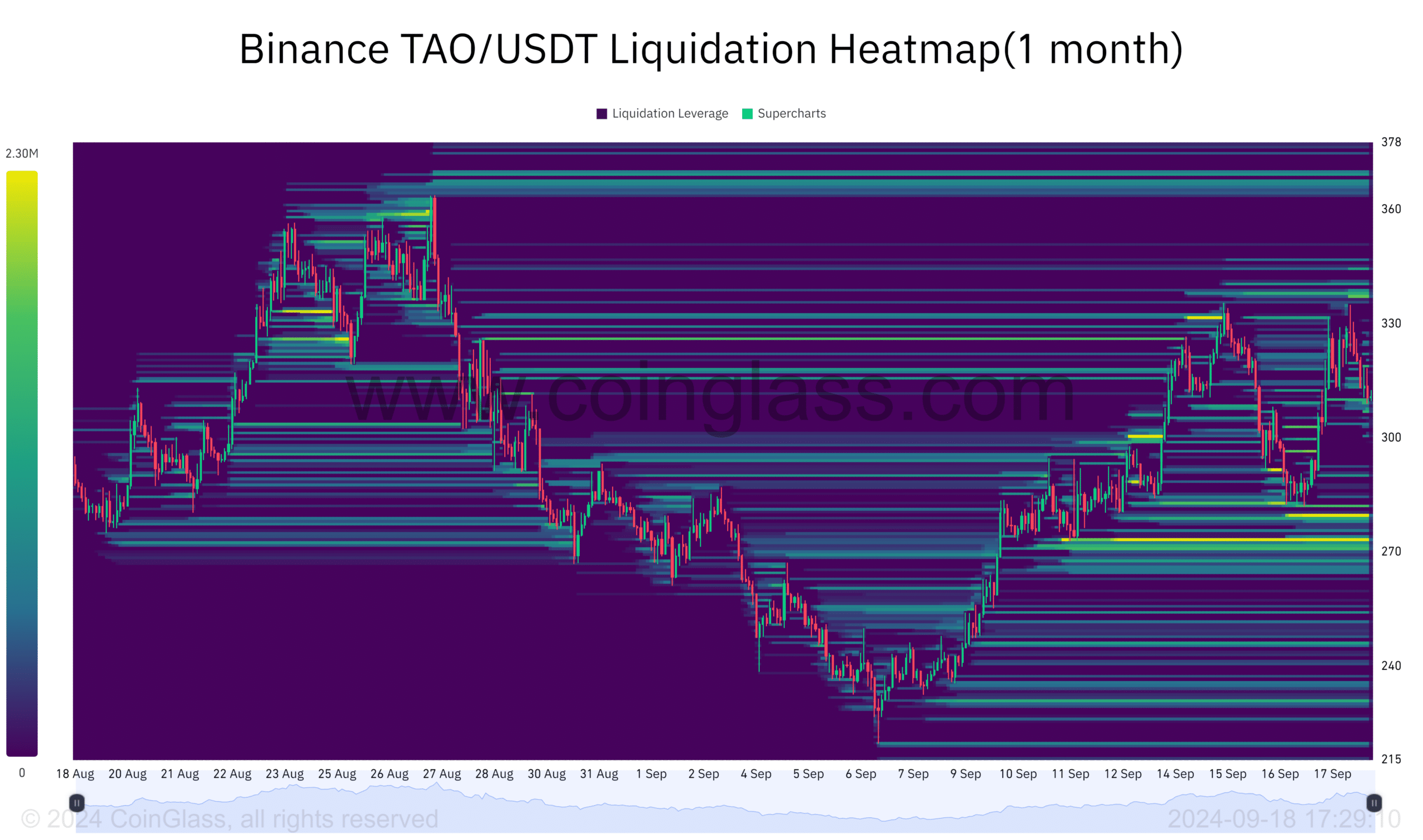

Liquidation heatmap

Lastly, examining the liquidation heatmap, several liquidation levels suggest potential price movements.

There’s a significant cluster of $482.17K in liquidation leverage above the $366 price level, likely held by traders who are bearish on BitTensor following its rejection.

Is your portfolio green? Check the TAO Profit Calculator

Below $280, there’s $1.11 million in liquidation leverage, and another $1.92M is resting below $275.

Source: Coinglass

If TAO’s price captures liquidity above its current level, it could boost bullish activity and push TAO/USDT higher.