Worldcoin bulls lack faith: Is it due to THESE factors?

- Worldcoin token price and network activity were trending downward.

- The NVT showed the token could be overvalued despite the heavy losses.

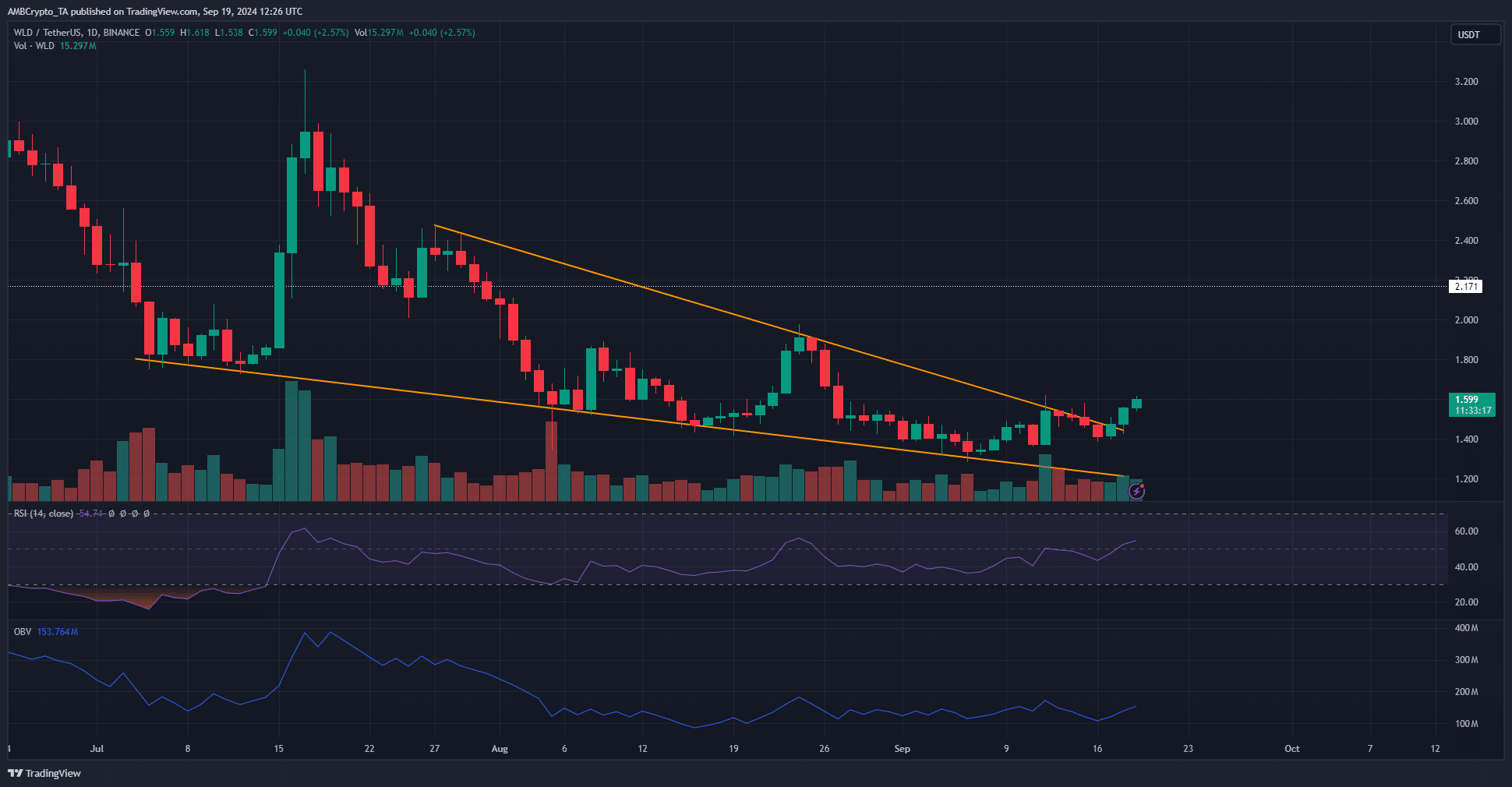

Worldcoin [WLD] is up 14.32% in the past two days of trading, but was still within a long-term downtrend. Bitcoin [BTC] has also been in a slow downtrend in recent months, but is only down by 13.5% compared to early April.

By contrast, WLD is down by 80.51% since the 1st of April. The $2.17 level, which had marked the lows in 2024 before the February rally, was soundly beaten in July.

A falling wedge pattern appeared to be forming, but its bullish promise was not high since the pattern was not filled out.

WLD is overvalued

Source: Santiment

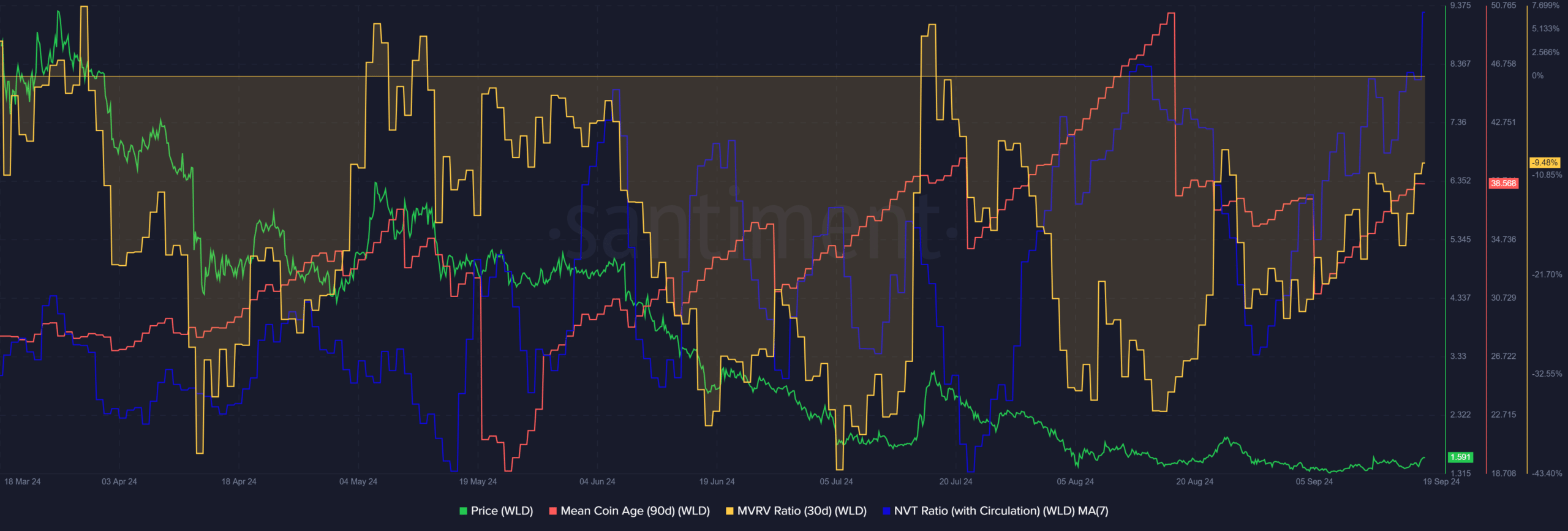

To understand if Worldcoin investors can be hopeful of recovery, AMBCrypto took a closer look at the on-chain metrics. The combination of the mean coin age and the MVRV ratio gave a short-term buy signal.

The uptrend of the mean coin age signaled accumulation, while the 30-day MVRV in negative territory showed short-term holders were at a loss. Yet, this signal should be treated with caution.

Such a buy signal came up during early July and early August, but the downtrend on the higher timeframe remained in play. The bulls were too weak to drive a sizeable rally higher.

The Network Value to Transactions (NVT) ratio using the circulation showed the metric was at a six-month high.

Such high values indicate that the network’s market value is high compared to the amount transacted, meaning the WLD token is overvalued.

Network activity is also in decline

Source: Santiment

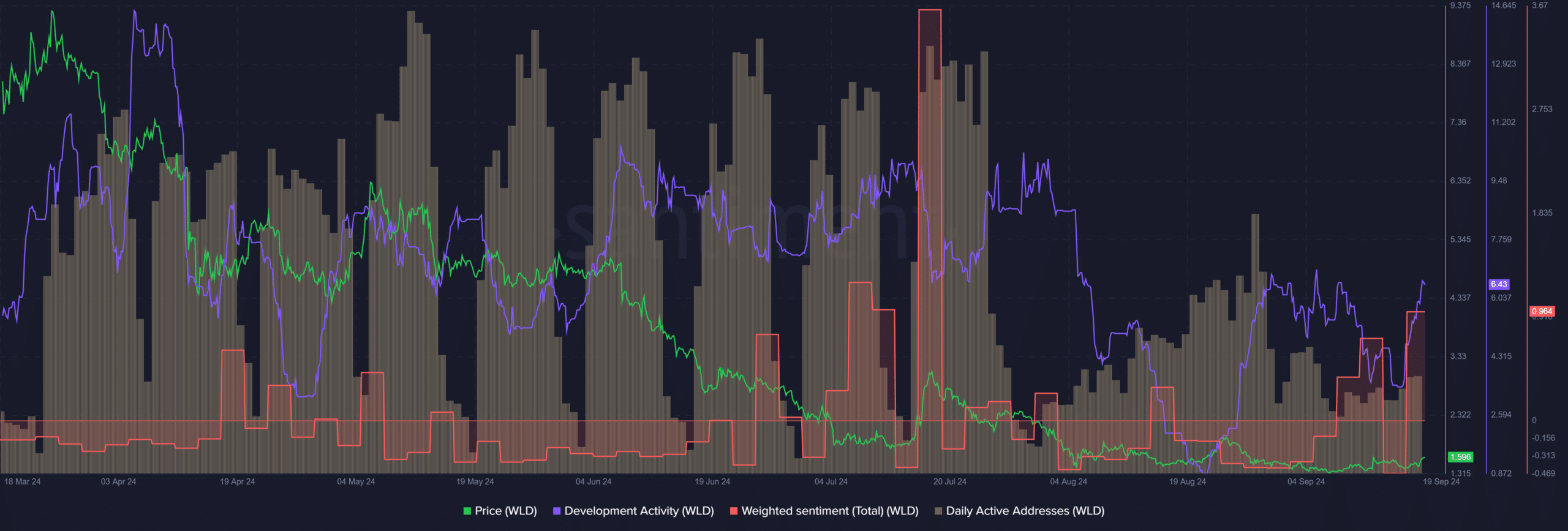

From April to July, the daily active addresses metric saw similar peaks during weekdays that invariably declined during the weekends.

Read Worldcoin’s [WLD] Price Prediction 2024-25

The steady activity seen back then fell dramatically in early August and struggled to recover.

During that time the development activity also took a hit but was back near the July highs again. However, the drop in activity should be a concern for long-term investors.