AVAX’s midweek bounce brings 50% holders into profit

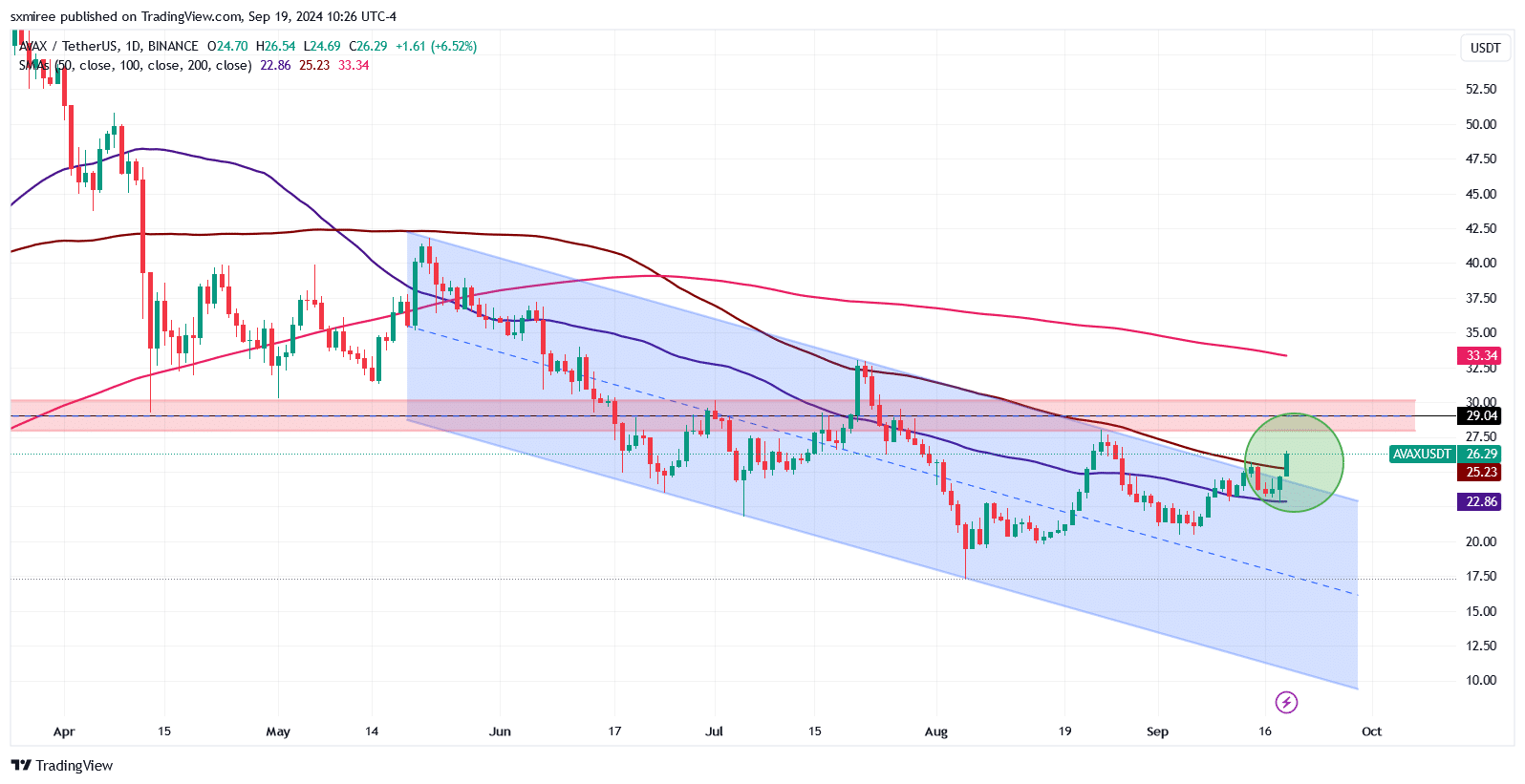

- Avalanche has broken out of a multi-month descending parallel channel.

- AVAX price faced a crucial test as it approached a key resistance zone of $29.

Avalanche [AVAX] has been a standout performer in the midweek crypto market action. AVAX’s price climbed to a three-week high of $26.52 earlier today, extending the overnight rally on the 18th of September.

The altcoin was, at press time, pictured trading 12% higher in the last 24 hours.

The uptick in AVAX’s price coincided with a broader crypto market rebound on the back of a perceived favorable macro environment.

The prevailing buoyant sentiment comes after the U.S. Federal Reserve lowered interest rates by 50 basis points to 4.75%-5% on the 18th of September.

The latest benchmark fed funds rate adjustment indicated a shift in monetary policy aimed at taming inflation and supporting economic growth.

The Fed’s decision marked the first rate cut in four years and only the third time policymakers have started a rate-cutting cycle with a 0.5% reduction.

Though largely anticipated, the outcome still sparked volatility in both stock and crypto markets. IntoTheBlock’s data showed that AVAX’s price jump has put 49% of the token holders in profit.

Observers widely expect further reductions going into the last quarter, but views on the implications of the Fed’s 50 bps cut to risk assets have been mixed.

Some analysts hold that the latest adjustment can only provide a short-term boost to the cryptocurrency market.

Avalanche’s DeFi outlook

The recent surge in AVAX price comes as Avalanche continues gaining traction in the decentralized finance niche.

Avalanche’s total value locked, denominated in AVAX, grew by 11% from 28.1 million AVAX in Q1 to 30.8 million in Q2. Data from DeFiLlama shows that Avalanche’s TVL has maintained the trend.

The TVL across all protocols on Avalanche stood at 38.63 million AVAX as of the 18th of September. The top three protocols by TVL continue to account for most TVL on Avalanche thus far in Q3.

However, Benqi has overtaken Aave as the largest protocol on the network.

TVL is widely considered a key indicator of adoption and activity within a DeFi ecosystem. Generally, a higher TVL reflects strong liquidity and user engagement, supporting a positive outlook in spot price action.

AVAX approaches key resistance

TradingView’s AVAX/USDT daily chart showed the pair was trending above the 100-day Simple Moving Average (SMA) at $25.23 and the 50-day SMA at $22.82 at press time.

The midweek price upswing has seen AVAX break out of a descending channel that has defined the price trajectory since late May 2024.

AVAX, however, faces strong resistance between $27.92 and $30.14 – a zone that has posed a significant hurdle over the last three months.

This range sticks out as a make-or-break zone, given the resistance has been tested multiple times but has yet to be successfully broken.

Read Avalanche’s [AVAX] Price Prediction 2024–2025

This zone’s successful challenge could open the door for northbound action, with bullish speculators eyeing $33 as the next target.

Failure to sustain the renewed sentiment and clear this resistance could trigger a decline below the 50-day SMA at $22.82 and potentially drag to the support area around $19.50, tested earlier this month.