Chainlink shows bullish signs – Will LINK face a major rally soon?

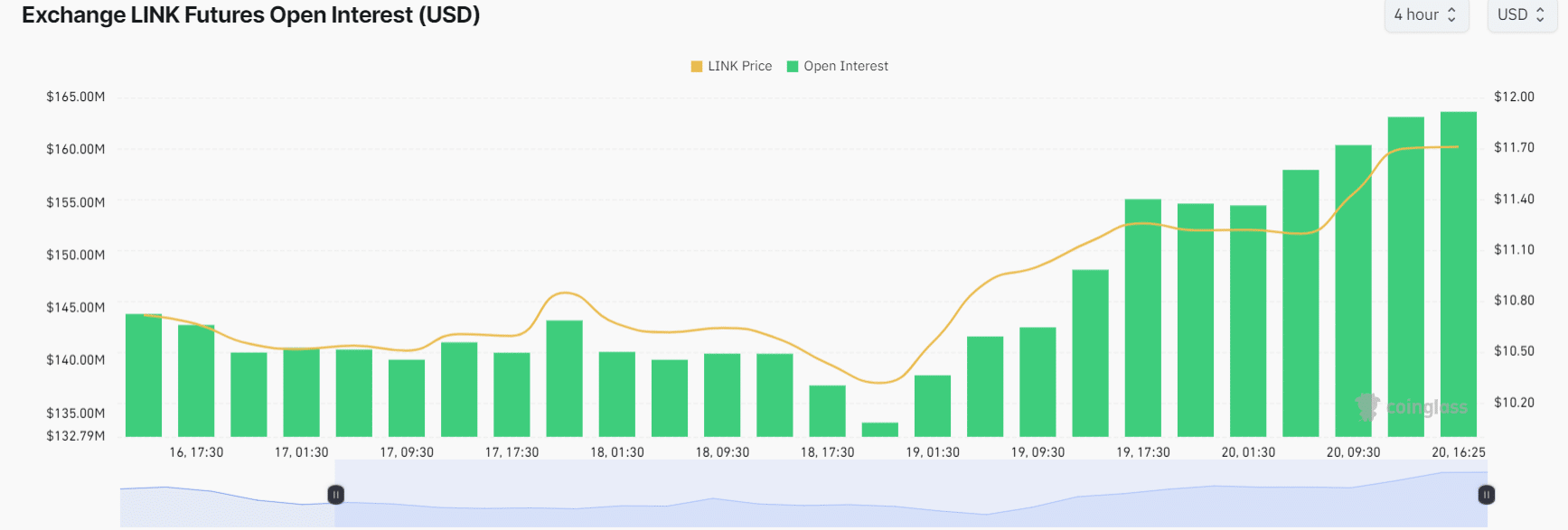

- LINK’s Futures Open Interest increased by 8.5% in the last 24 hours and has been steadily rising.

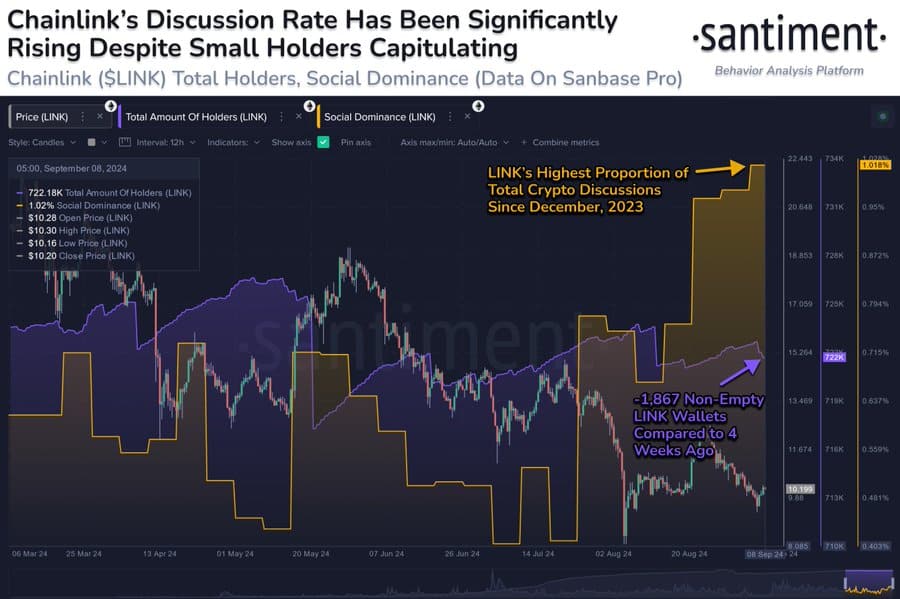

- Chainlink is one of the top cryptocurrencies being discussed on social media in 2024.

After being in a downtrend for almost three months, Chainlink [LINK] is once again gaining significant attention from the crypto community.

Following the FED rate cut announcement, the overall sentiment has shifted, and LINK has broken out of the crucial resistance that it has been facing from a descending trendline for the last three months.

Chainlink dominates social media

This breakout has not only created hope for a massive upside rally but has also turned on LINK’s bullish on-chain data.

Additionally, LINK is one of the top cryptocurrencies being discussed on social media in 2024 despite the decline in its token. This is a bullish signal, per crypto intelligence tracker Santiment.

LINK looks bullish, on-chain

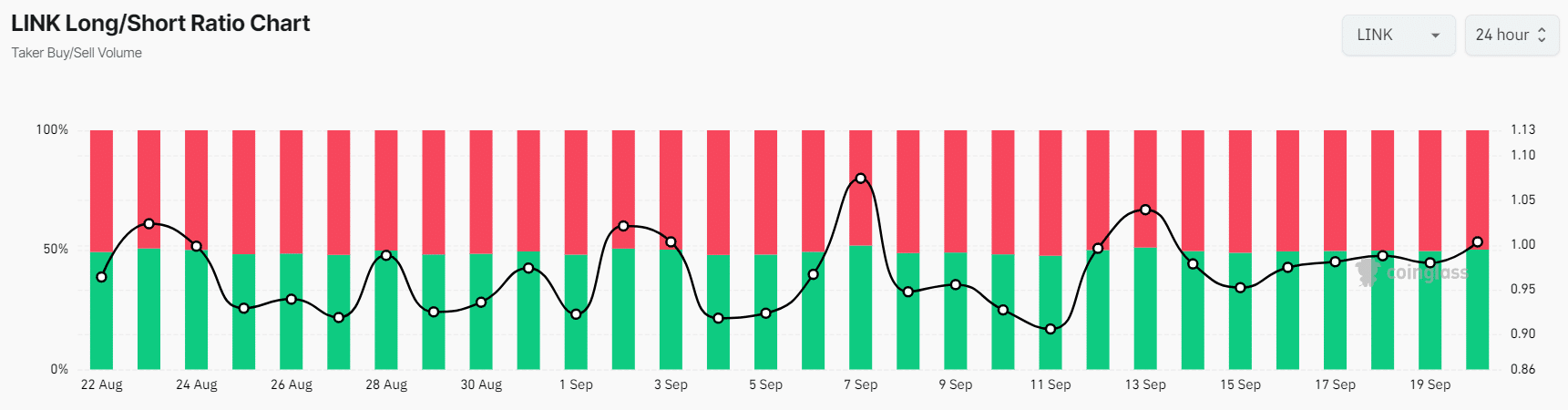

According to the on-chain analytics firm Coinglass, LINK’s Long/Short Ratio, Futures Open Interest, and OI-Weighted Funding Rate have started signaling potential buying opportunities.

Coinglass’s LINK Long/Short Ratio was 1.022 at press time (a value of ratio above 1 indicates bullish market sentiment among traders).

Additionally, its Futures Open Interest increased by 8.5% in the last 24 hours and has been steadily rising since the beginning of September 2024.

This rising Open Interest indicates that bulls are potentially betting more on long positions. At press time, 50.53% of top LINK traders held long positions, while 49.47 held short positions.

Furthermore, LINK’s OI-Weighted Funding Rate was at +0.0075%, indicating bullish sentiment.

Traders and investors often use the combination of rising Open Interest and a long/short ratio above 1 when building long positions, while they look for rising Open Interest and a long/short ratio below 1 when building short positions.

Current price momentum

At press time, LINK is trading near $11.70 and has experienced a price surge of over 5% in the last 24 hours.

Read Chainlink’s [LINK] Price Prediction 2024–2025

During the same period, its trading volume increased by 5%, indicating higher participation from investors and traders amid a bullish outlook.

However, LINK’s bullish outlook is further supported by recent accumulation by whales and the significant price surges in top cryptocurrencies, including Bitcoin (BTC) and Ethereum (ETH), in recent days.