Bitcoin Golden Cross appears – Will BTC break $65K?

- The Bitcoin Golden Cross could signal an opportunity for a breakout to $65K.

- However, several conditions need to align for this cross to materialize in the long term.

Bitcoin [BTC] bulls have edged past bearish pressure after a week of solid attempts to break above $64K, reaching a daily high of $64,825.

This level has been tested multiple times since BTC hit its ATH of $73K in March. In August, bears reasserted their dominance, thwarting a potential breakout to $68K.

Now, with BTC trading at $63,687 after another failed attempt to hold the support, what will it take to break the cycle?

Bitcoin Golden Cross needs long term assurance

On the daily price chart, Bitcoin’s 50-DMA has crossed above the 200-DMA, signaling a Golden Cross.

Historically, this pattern has been a reliable signal for tracking Bitcoin’s directional trends. When the short-term moving average crosses above the long-term one, it often indicates a strong upward swing.

Interestingly, during the last week of the August cycle, the short MA nearly closed in on the long MA, hinting at a potential bull rally.

However, a resurgence of short positions stopped the crossover from materializing, leading to a sharp rejection and a retracement to the $55K support.

If a similar scenario unfolds, the trend could reverse into a Death Cross, foreshadowing a bearish market – What needs to change?

Turning down BTC short control is crucial

Typically, traders interpret a Golden Cross as a signal to enter long positions, expecting future price gains.

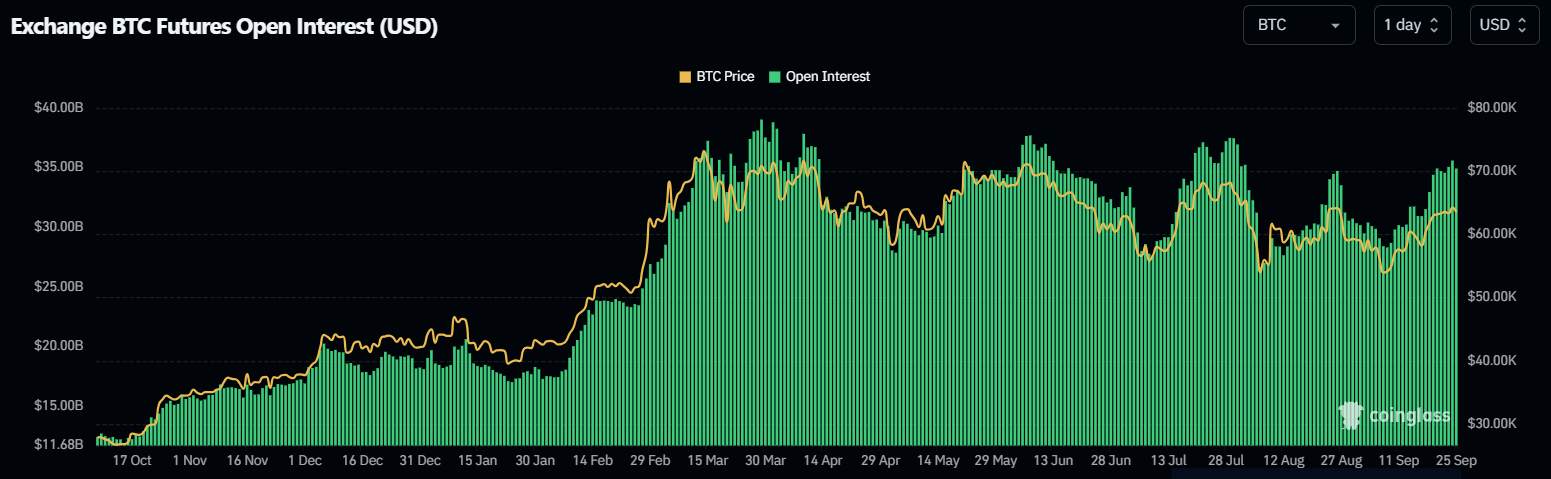

With this in mind, AMBCrypto analyzed the speculative market to assess whether traders were positioning themselves to capitalize on the cross.

Normally, whenever Open Interest (OI) surges, it typically coincides with Bitcoin testing critical resistance levels.

Put simply, each peak has been characterized by a notable rise in futures traders going long, but this surge typically ends with them closing their positions, resulting in a sharp decline for BTC.

Surprisingly, while OI mirrors these market tops, BTC’s price hasn’t followed suit, potentially indicating a resurgence of short control.

As Bitcoin bulls entered their fifth day of attempting to push BTC above $65K, a significant influx of long positions has emerged.

However, if short control persists, long liquidation could trigger another downturn, potentially sending BTC back below $60K before a breakout attempt can materialize.

THIS adjustment can make a difference

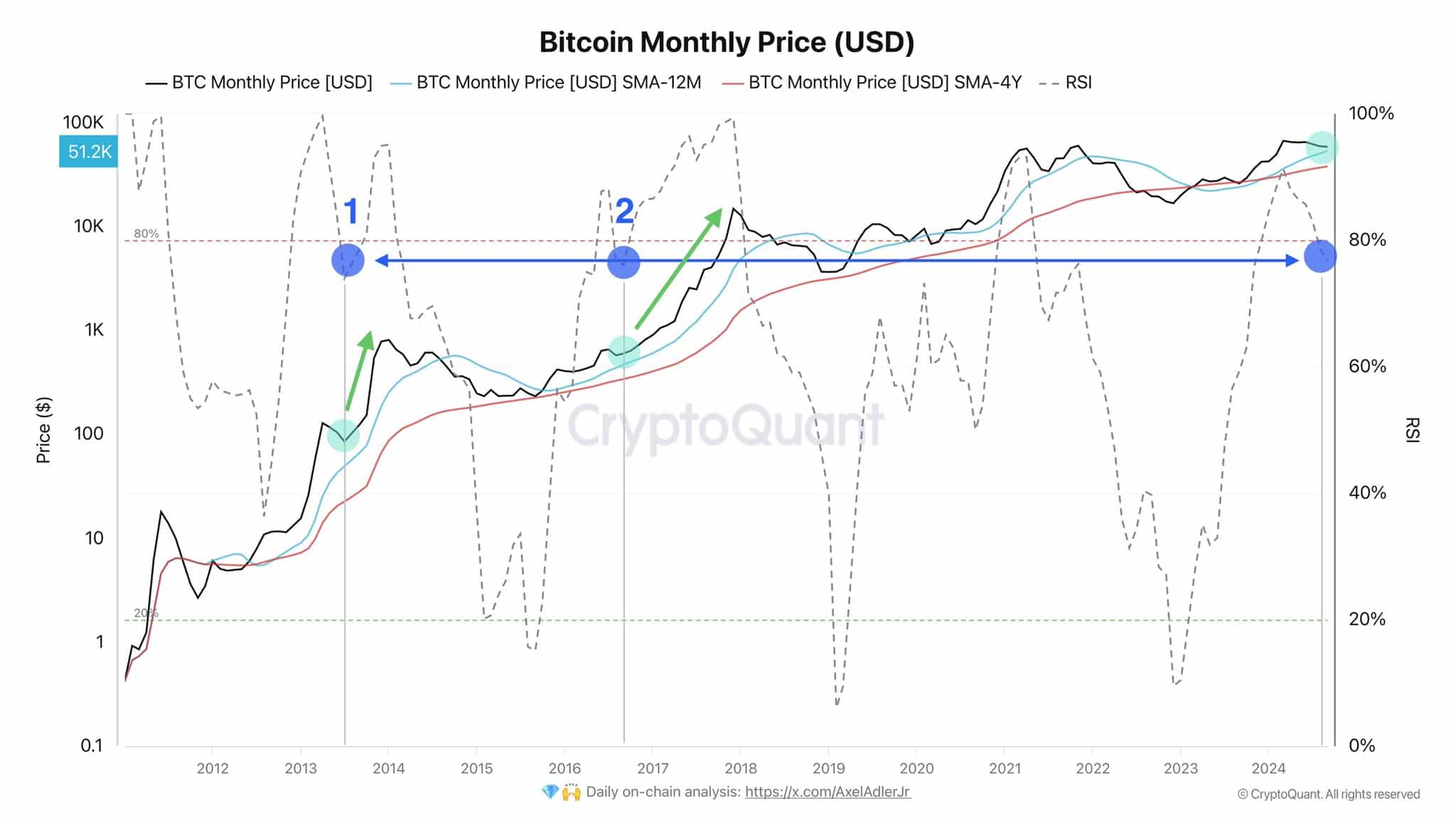

On the monthly timeframe, the RSI has dipped below 80%. AMBCrypto’s analysis suggested that Bitcoin may be gearing up for a short-term price correction, as oversold conditions often spark renewed buying interest.

Historically, such RSI drops have heralded upward price corrections during bullish cycles, prompting investors to seize perceived bargains.

Read Bitcoin’s [BTC] Price Prediction 2024-25

While this could bolster the likelihood of the Golden Cross materializing soon, for long-term stability, the market must reduce OI by at least 10%. This reduction would make Bitcoin less susceptible to short control.

Without this adjustment, while BTC may remain above $64K in the short term, it is unlikely to reach $65K imminently.