Bitcoin reclaims $65K – What BTC needs to hit $74K next

- Bitcoin has reclaimed a key resistance of $65K, generating enthusiasm in the market.

- However, this may not yet confirm a bull market.

At present, Bitcoin [BTC] has indeed reclaimed the $65K resistance, which is a positive sign, but it’s not yet a full confirmation of a bull market.

In past bull markets, levels like this often represent psychological barriers. Breaking $65K is significant, as it marks the reclaiming of a key historical resistance.

However, simply breaking it isn’t enough. Further steps are required to confirm a bull run to $74K.

Why is $65K a psychological barrier for Bitcoin

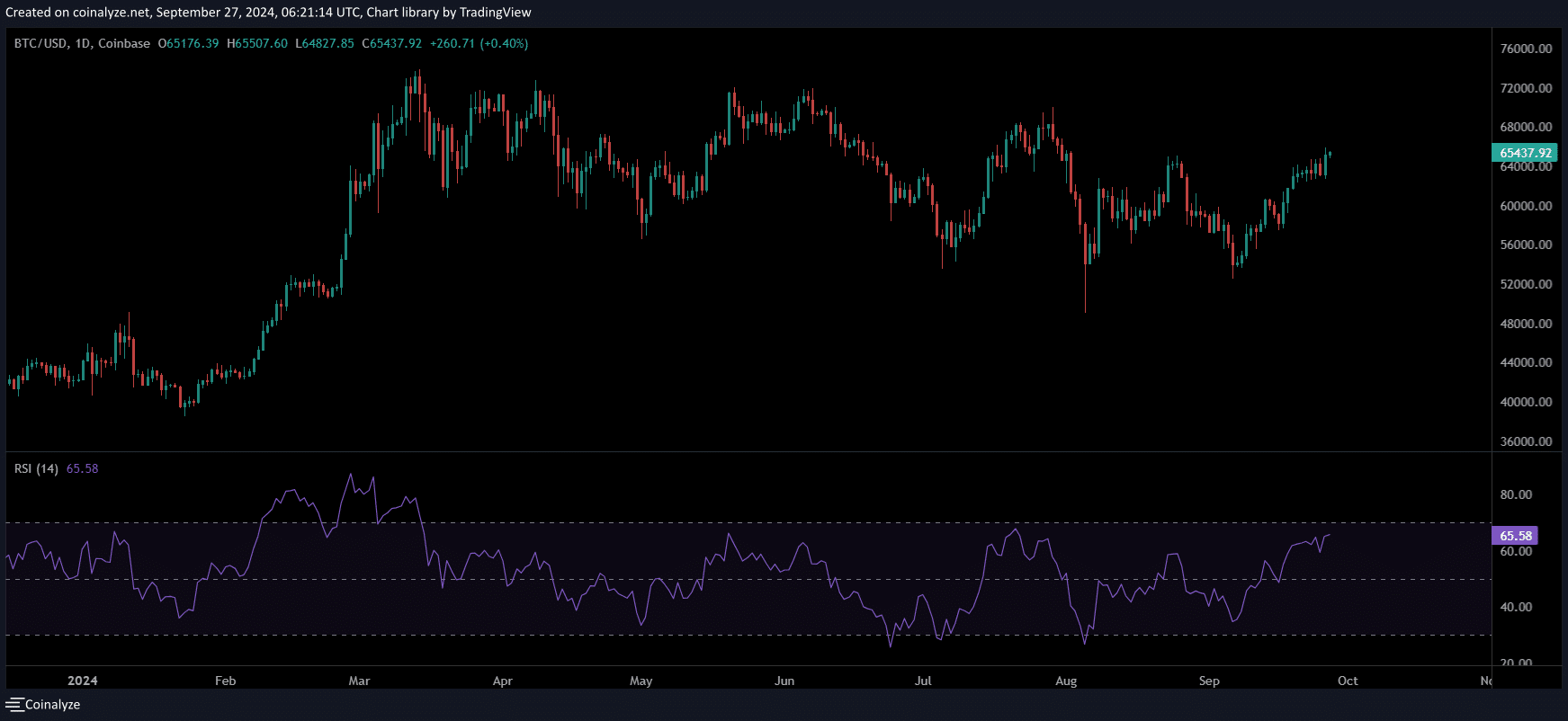

Historically, whenever a key resistance is tested, it indicates strong buying pressure, often represented by the RSI reaching overbought conditions.

Psychologically, this can make traders cautious. A rapid move to $66K could raise concerns about overextension, increasing the risk of a sharper correction later.

For instance, when BTC hit its ATH of $73K in March, the RSI remained above 70 for over a month, signaling an impending pullback, which eventually caused BTC to retrace back to $61K.

According to AMBCrypto, to maintain a consistent bull run, Bitcoin must hold above $66K and ideally continue upward or pull back to $61K for a healthy retest.

Currently, the RSI is mirroring historical retracement points when BTC reclaimed key resistance levels. Traders may become wary and start taking profits, anticipating a potential correction.

In short, without a pullback, Bitcoin’s price could quickly become overextended. Therefore,

Retracement might be needed next

Per AMBCrypto, a retracement to $61K would help confirm that the previous resistance at $65K has successfully flipped to support.

In simple terms, this would give bulls a chance to demonstrate their strength by defending this support level.

If this trend holds, it might attract more buyers looking to enter the market at a lower price, making it easier for Bitcoin to push past $70K.

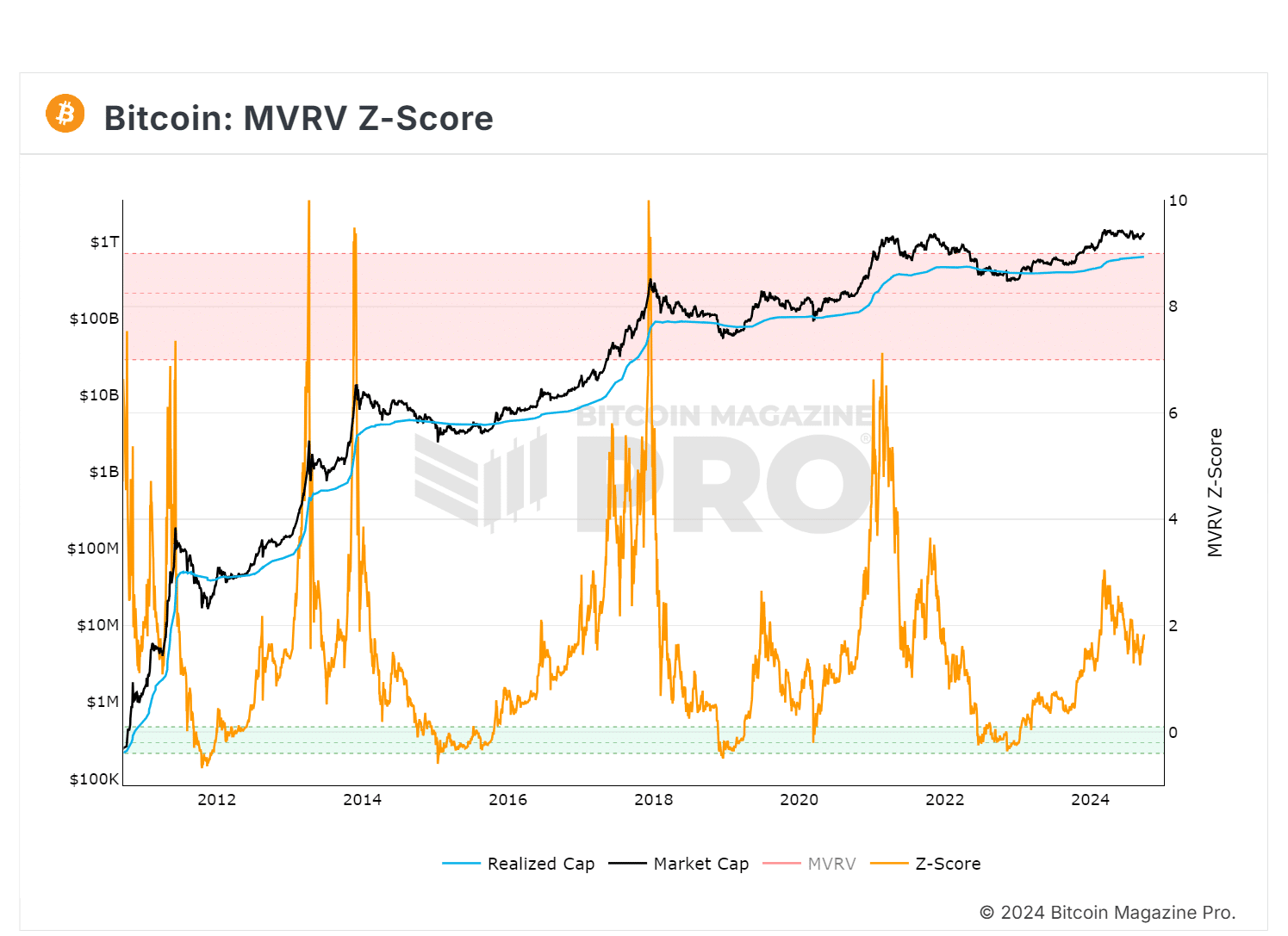

Typically, the Z-score entering the green box has led to a bull rally afterward, indicated by the peak testing the red band, which highlights an overheated market.

Therefore, a healthy retracement to $61K can set the stage for more aggressive buying, paving the way for BTC to retest its original ATH.

The key will be to hold

Conversely, instead of pulling back to $61K, Bitcoin jumps directly to $66K. This rapid rise shows strong buying pressure, as investors are eager to enter the market without waiting for a better price.

While it seems unlikely, this can be a bullish signal, showing that there is enough demand to sustain higher prices. Therefore, to maintain a bull market, Bitcoin must hold above $66K and ideally continue upwards.

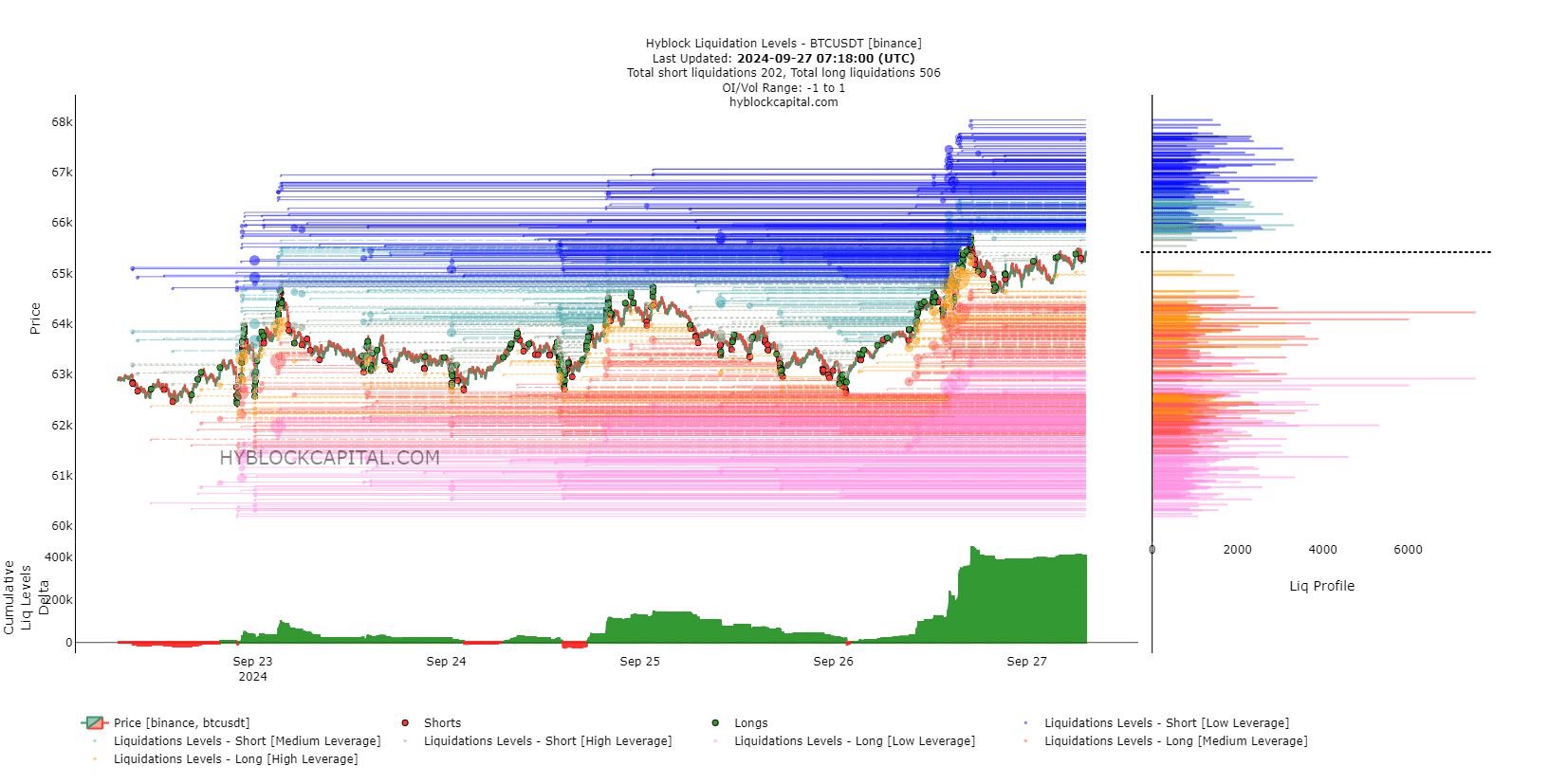

In the past three days, as Bitcoin tested the $65K resistance, many long positions entered, expecting bulls to hold the level.

Read Bitcoin’s [BTC] Price Prediction 2024-25

However, with short sellers resurfacing, long liquidation could trigger a retracement to $61K, reinforcing AMBCrypto’s hypothesis. Overall, the bull rally past $70K hinges on bulls holding the $66K resistance.

Otherwise, a retracement to $61K is essential for confirming support, reducing volatility, attracting buyers, and setting up for a sustained bull run to $74K.