Bitcoin ETF inflows cross $365.7 mln – Did China help?

- Bitcoin ETFs saw a resurgence, with inflows reaching $365.7 million as of the 26th of September.

- BlackRock’s spot Bitcoin ETF recorded a $184.4 million inflow, the month’s highest single-day surge.

After facing weeks of uncertainty, Bitcoin [BTC] ETFs are once again gaining momentum.

Despite September’s bearish reputation for BTC, both the cryptocurrency and its associated ETFs have defied expectations with a trend reversal.

Bitcoin ETF, analyzed

As of the most recent data on the 26th of September, total inflows for all Bitcoin ETFs have reached an impressive $365.7 million.

Leading the charge was Ark’s ARKB with $113.8 million, followed by Blackrock’s IBT at $93.4 million.

Fidelity’s FBTC recorded $74 million, while Bitwise’s BITB sits at $50.4 million.

VanEck’s HODL, Invesco’s BTCO, and Franklin’s EZBC also contributed inflows of $22.1 million, $6.5 million, and $5.7 million, respectively.

Although two more smaller ETFs showed modest inflows below $5 million, the overall surge underscores the renewed investor confidence in BTC ETFs.

Notably, on the 25th of September, BlackRock, the world’s largest asset manager, witnessed an extraordinary surge of $184.4 million in inflows for its spot Bitcoin ETF, making it the highest single-day inflow of the month for any fund.

What’s behind this?

This spike comes amid growing market speculation, potentially influenced by developments in Asia.

For those unaware, Chinese stocks rallied following reports that the Chinese government may inject up to ¥1 trillion($142 billion) into its major state banks, aimed at boosting an economy that has faced challenges recently.

Earlier in the week, the People’s Bank of China (PBOC) took easing measures by cutting the reserve requirement ratio for mainland banks by 50 basis points and lowering the seven-day reverse repo rate by 20 basis points to 1.5%.

These actions have seemingly fueled optimism, which may be playing a role in the inflows seen in global markets, including Bitcoin ETFs.

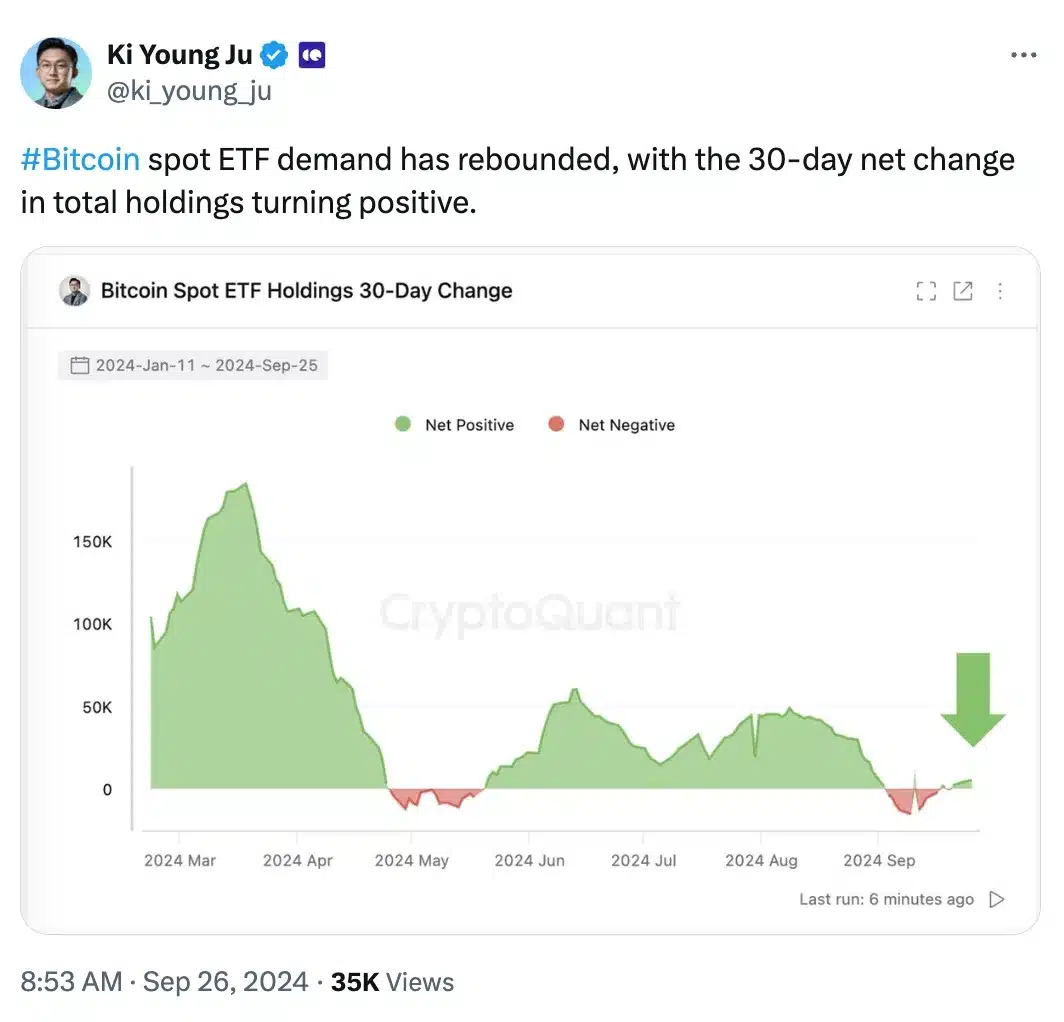

Remarking on the matter, Ki Young Ju, Founder and CEO of CryptoQuant, said,

He further added,

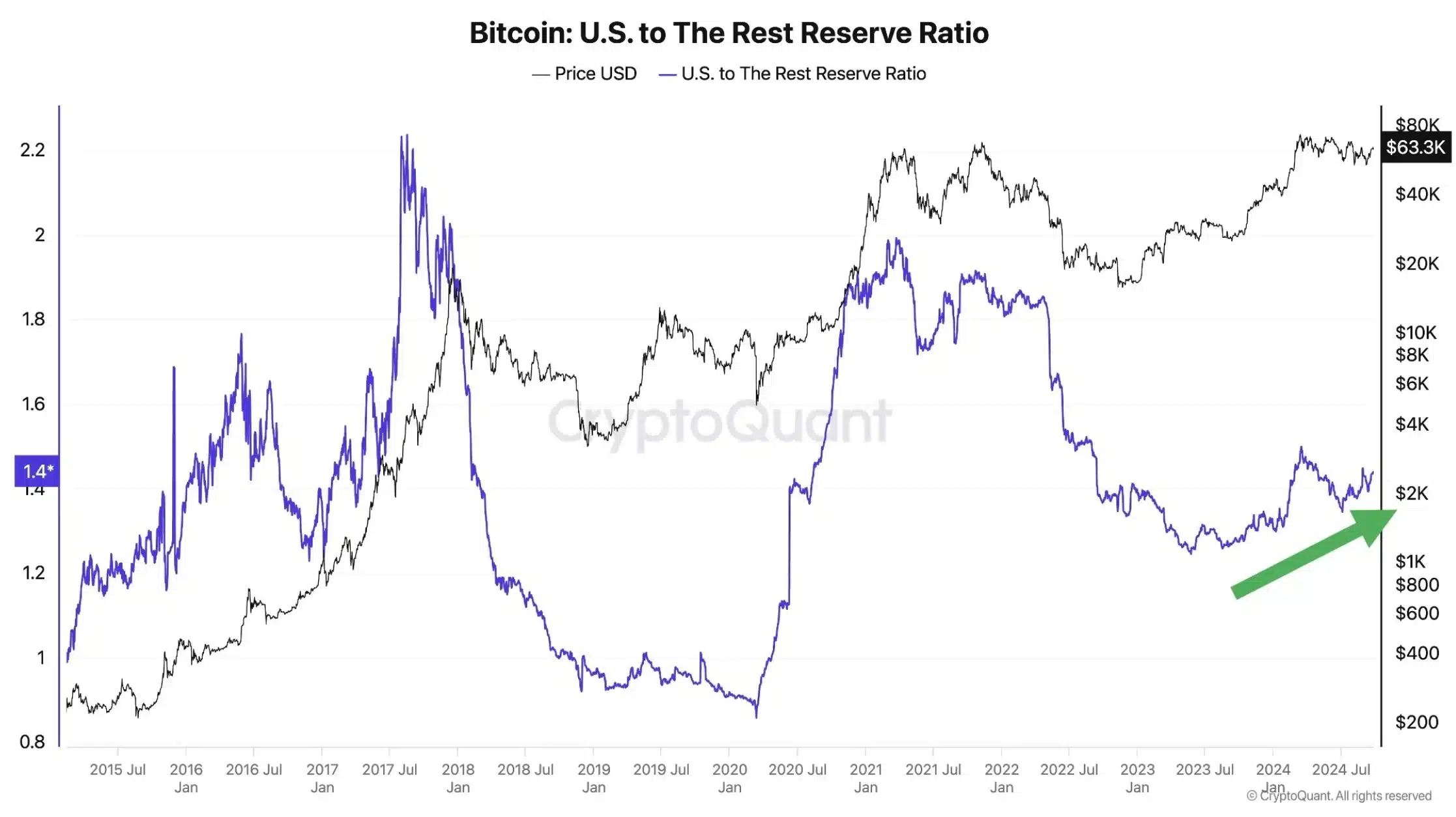

“The U.S. is regaining dominance in #Bitcoin holdings. Its ratio compared to other countries is rising, driven by spot ETF demand. Only known entities are included.”

A look at the price front

Meanwhile, on the price front, BTC’s price action has shown remarkable resilience.

After struggling to break past the $60,000 barrier for days, the leading cryptocurrency surged, reaching $65,642. This marked a 2.89% gain in the last 24 hours.

As the month draws to a close, Bitcoin has exhibited a strong bullish trend with an impressive monthly rise of 10.98%, signaling sustained upward momentum in the market.

![Shiba Inu [SHIB] price prediction - A 70% rally next after 300%+ burn rate hike?](https://ambcrypto.com/wp-content/uploads/2025/04/Erastus-2025-04-12T132907.604-min-400x240.png)