Bitcoin: THIS key level hints at BTC’s next bull run

- Bitcoin stabilizes above $64,000, with metrics suggesting potential bullish momentum and ETF demand driving support.

- Analysts predict possible breakout targets between $88,000 and $100,000 if key resistance levels are reclaimed.

Bitcoin [BTC] has recently shown signs of stabilization above the $64,000 mark, although it initially surged to $66,000 in the early hours of the 30th of September.

Since then, a correction has brought the asset down to $64,633, marking a slight 1.4% decline.

Despite this short-term dip, a broader view reveals Bitcoin’s growth, with the asset up by 10.2% over the past two weeks.

However, the question remains: when will Bitcoin start the bull run that many experts predict could push its price into six figures?

To provide clarity for investors, CryptoQuant, an on-chain data provider, has shared critical metrics for tracking Bitcoin’s bullish momentum.

The platform published a series of posts on X (formerly Twitter) aimed at helping investors understand where Bitcoin might be headed.

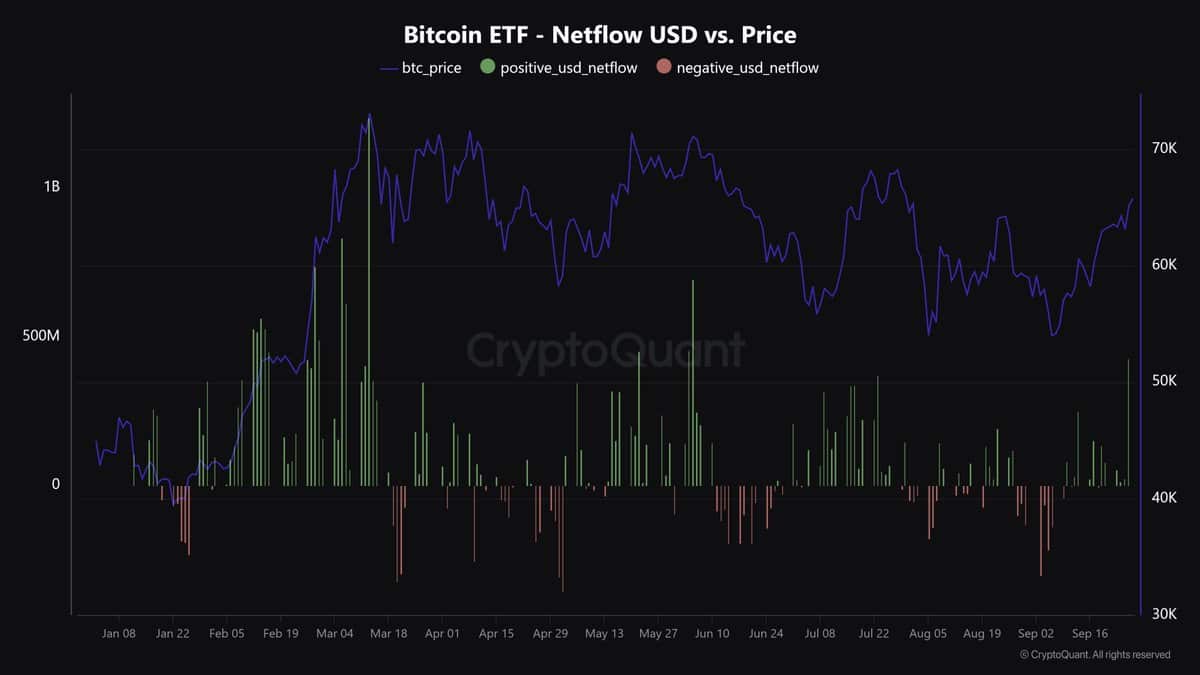

They noted that Bitcoin’s strong momentum over the past three weeks—rising over 23% from $52,500 to above $65,000—has been partly fueled by increased demand for spot Bitcoin Exchange-Traded Funds (ETFs).

Notably, combined inflows from BlackRock, Fidelity, and Ark totaled $324 million on the 26th of September, signaling heightened interest from U.S. investors.

THIS is key for bullish momentum

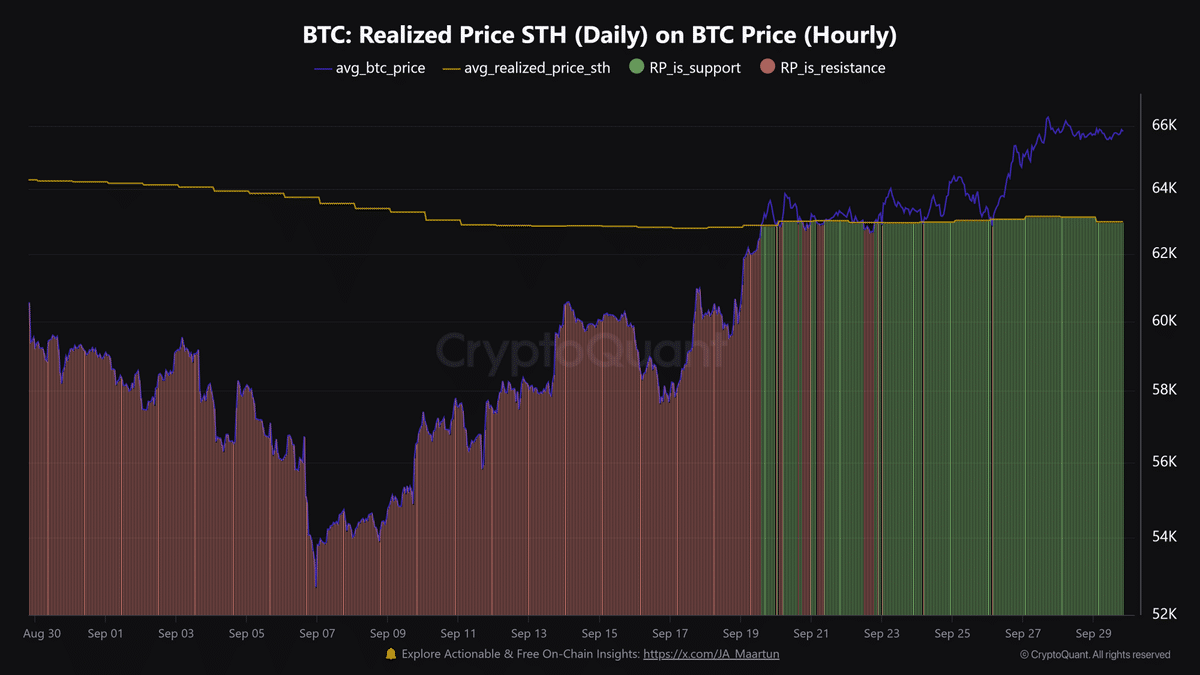

According to CryptoQuant, one of the key drivers for Bitcoin’s recent rally is the resurgence of short-term holders back into profit territory.

These holders, defined as investors who have moved their Bitcoin within the last 155 days, have an average purchase price of around $63,000.

As Bitcoin’s price hovers above this level, it could act as a strong support level, reinforcing bullish sentiment.

The futures market also offers significant insights into Bitcoin’s price trends. CryptoQuant revealed that Bitcoin’s Open Interest was $19.1 billion at press time.

Historically, surges past $18.0 billion have led to price corrections.

This marks the seventh time such a threshold has been crossed since March 2024, prompting caution around the possibility of a short-term dip.

Despite this, the overall trend of increasing futures activity reflects growing investor confidence.

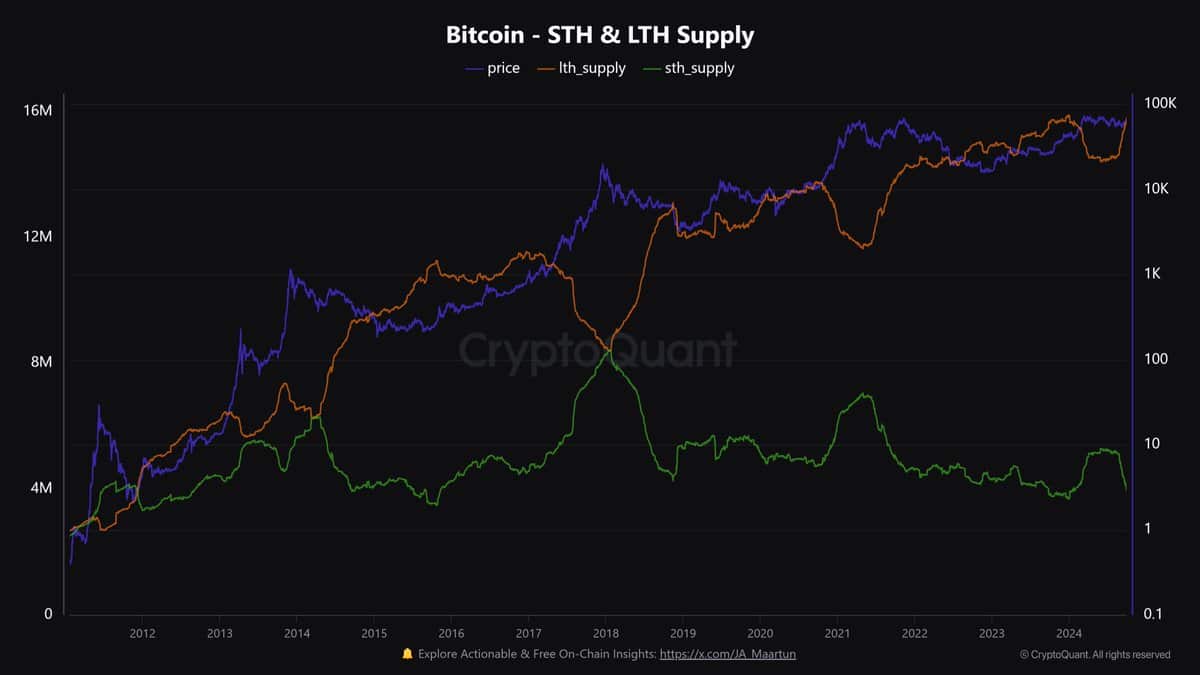

Another notable development is the transformation of spot Bitcoin ETF holdings into long-term holder supply.

As coins surpass the 155-day holding period, they are increasingly categorized as part of the long-term supply.

While this shift might suggest a bullish outlook, CryptoQuant warns that such movements are often observed in the later stages of a bull market, indicating potential market maturity or a transition phase in Bitcoin’s trajectory.

Analysts weigh in on Bitcoin’s potential rally

Beyond the fundamental metrics, several analysts have shared their perspectives on where Bitcoin could head next.

Javon Marks, a prominent crypto analyst, suggested that Bitcoin was nearing a critical resistance level defined by a “descending broadening wedge” pattern.

According to Marks, a bullish breakout past this resistance could propel Bitcoin to a target range of $99,000 to $100,000, an increase of over 51% from its current price.

His outlook emphasized that Bitcoin may be gearing up for a significant move in the coming weeks.

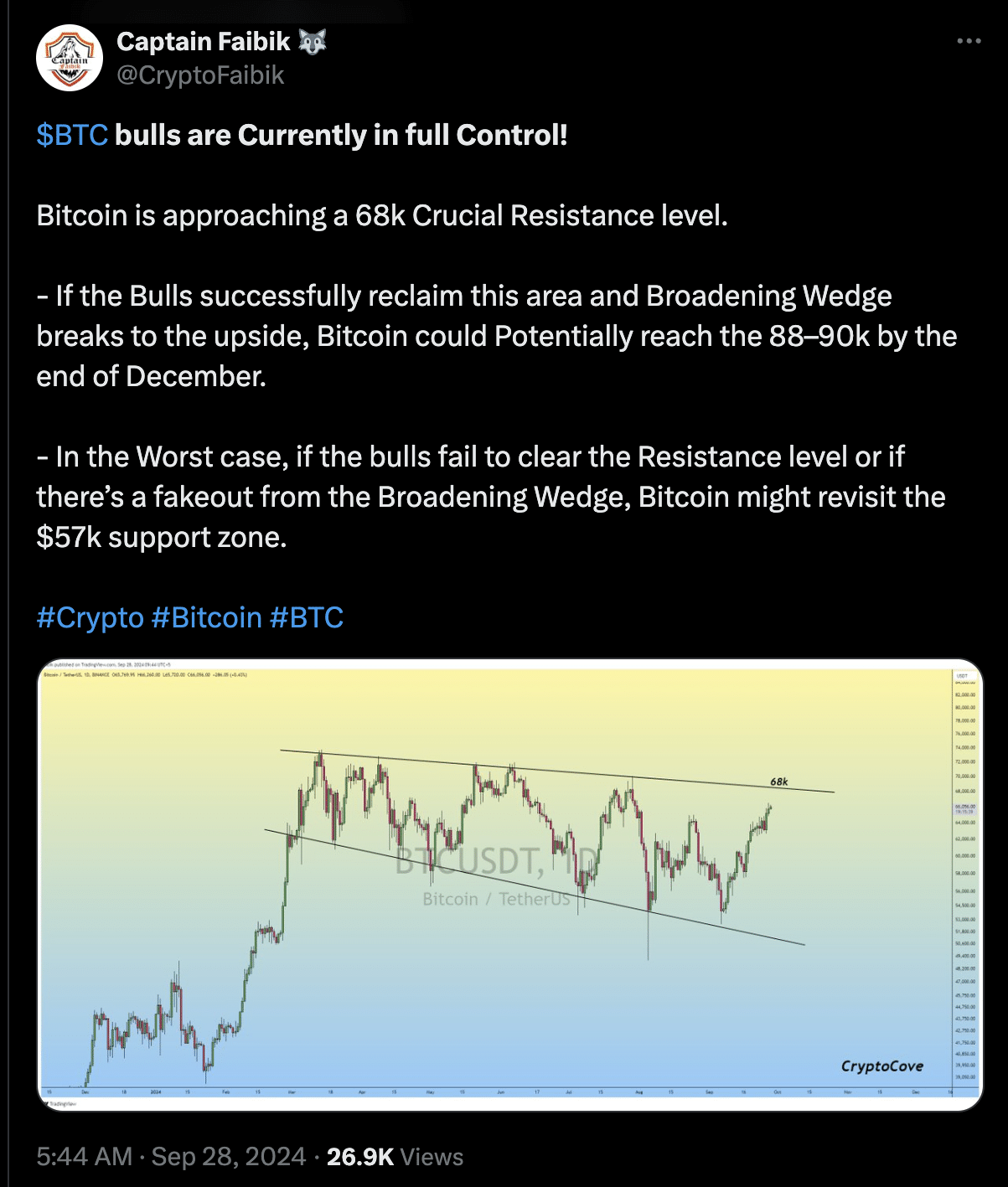

Similarly, another analyst, Captain Faibik, noted that Bitcoin bulls currently hold a strong position in the market.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

With Bitcoin approaching a crucial resistance level of $68,000, Faibik speculated that a successful breakout from the broadening wedge could see the cryptocurrency reach $88,000 to $90,000 by the end of December.

However, he also cautions that failure to break through this resistance, or a potential fake-out, could see Bitcoin retest support zones around $57,000.