Is BONK at risk of a major dip? Assessing key fundamentals

- Bonk declined by 17.7% in 24 hours.

- The memecoin’s fundamentals suggested a further decline below $0.0000200 before another uptrend.

Over the past month, memecoins have experienced an exponential surge. Over this period, Bonk [BONK] saw a sustained upswing, hiking by 19. 21%.

The memecoin has recorded moderate gains over the past week, surging by 5.05%.

However, the last 24 hours have seen a significant market correction. In fact, at press time, BONK was trading at $0.00002082.

This marked a 17.70% decline on the daily charts. Also, the memecoin saw a decline in trading activities, dropping by 27.89% to $460.6 million while the market cap dipped by 17.55% to $1.48 billion.

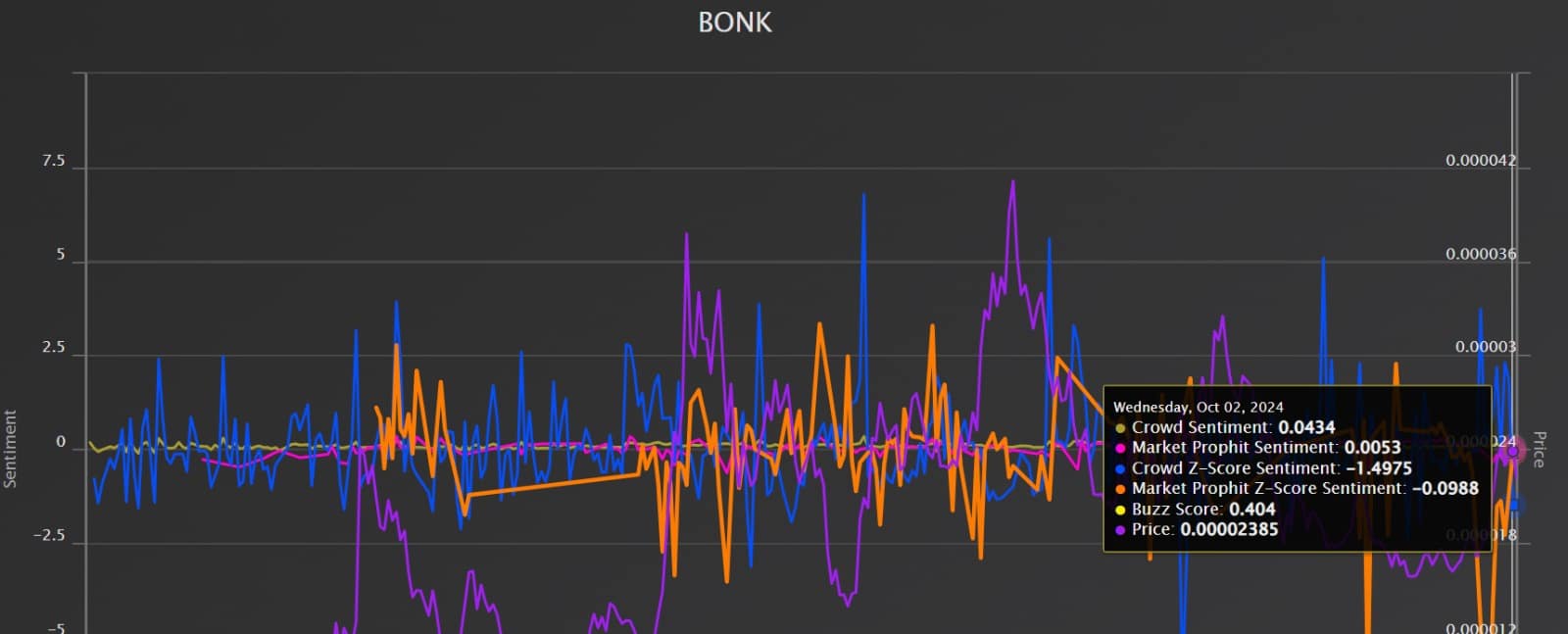

Prevailing market sentiment

According to AMBCrypto’s analysis, BONK attempted a breakout above $0.00002750 but faced a rejection, causing the price to retrace.

This price movement indicated buyers were not strong enough to push the prices above this level, as sellers were defending it.

Such market conditions showed a shift in market sentiment from positive to negative.

As such, AMBCrypto’s look at Market Prophit suggested that the current crowd sentiment was negative at press time.

This was supported by the fact that crowd Z score sentiment was -1.49, while the Market Prophit Z score sentiment is -0.0988. Also, the crowd sentiment and BUZZ scores have seen a sharp decline over the past 24 hours.

The question is, could this pullback see BONK drop below $0.00002000 or the retrace is a mere correction before a strong upswing?

What BONK charts indicate

AMBcrypto’s analysis showed that the press time market conditions could set BONK for further declines before attempting another uptrend.

For example, BONK’s Relative Strength Index (RSI) declined over the past five days from a high of 74 to 51 at press time.

This showed a decline in buying activities as sellers started to dominate the market. Usually, higher selling pressure results in price dips.

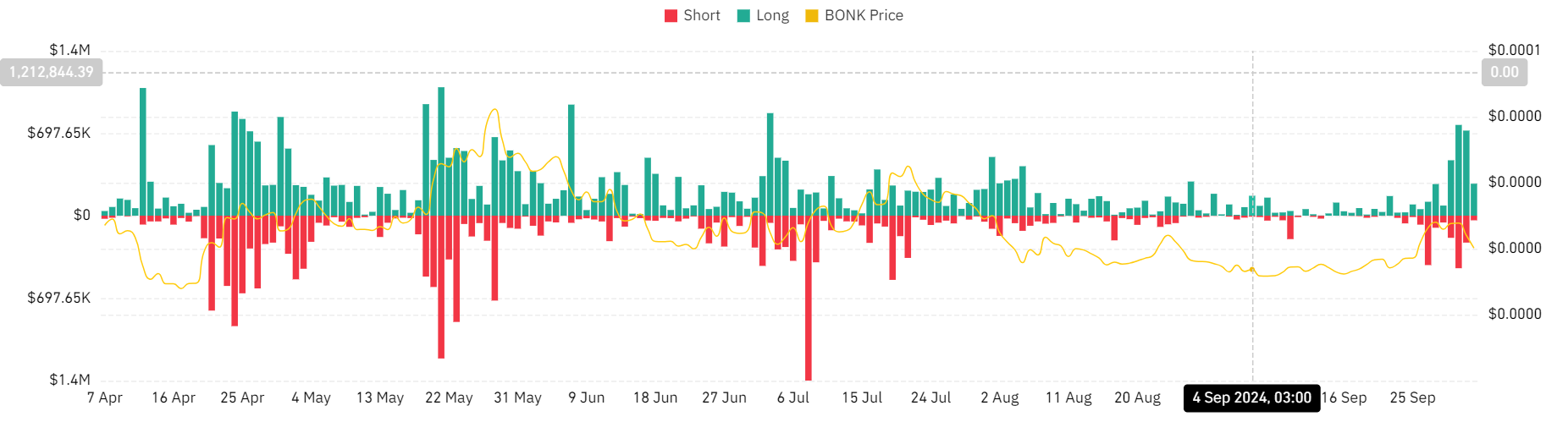

Additionally, BONK has seen liquidations skyrocket to $2.2 million over the past four days. This showed a strong shift in market sentiment. So, investors seemed to lack confidence in memecoin’s prospects.

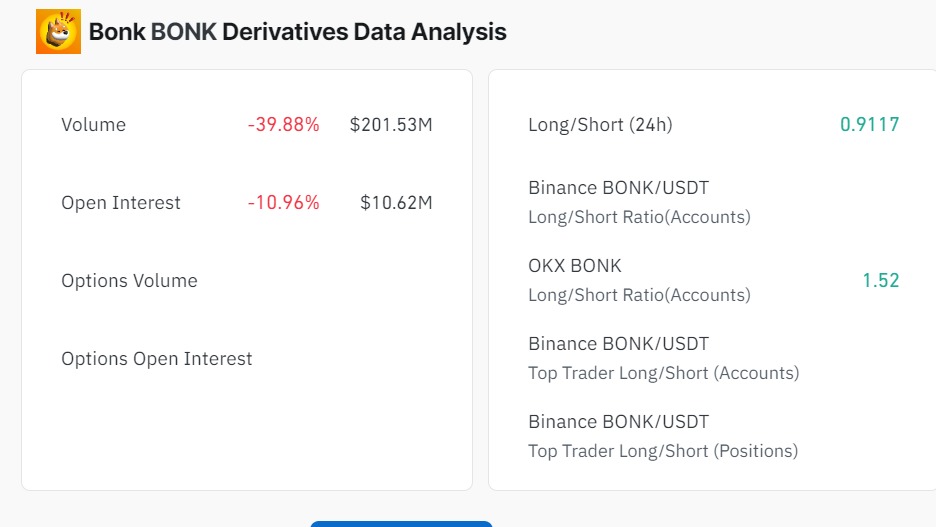

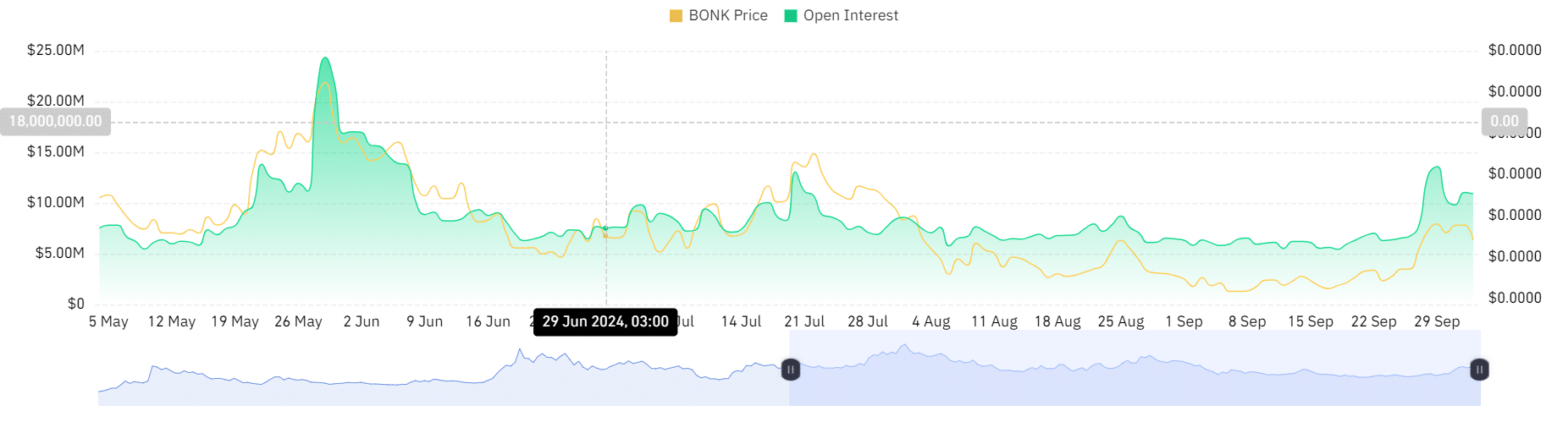

Finally, the memecoin’s Open Interest has declined by 10.96% to $10.62 million over the past day.

This decline suggested that investors were closing their positions while there were no new investors entering the market. This indicated investors’ lack of confidence in the current direction.

This phenomenon is further supported by a sustained decline in Futures open interest over the past 5 days. BONK’s Futures Open Interest has declined from $13.59 million to $10.91 million.

Read Bonk’s [BONK] Price Prediction 2024–2025

Therefore, BONK was seeing a significant change in market sentiment, with sellers starting to dominate at press time.

If the current trend persists and BONK closes below $0.0000200 on a daily candle stick, the memecoin will find its next support around $0.00001862 and $0.00001706.