Dogecoin: Why $0.11 is key for DOGE to avoid mass sell-offs

- Dogecoin declined by 11.42% over the past week.

- Indicators suggested that DOGE must reclaim $0.11 to avoid further decline.

Over the past month, Dogecoin [DOGE] saw significant gains on price charts, hiking by 13.66%. As such, the memecoin surged from a low of $0.088 to a high of $0.132.

However, over the past 24 hours, DOGE has seen a moderate recovery, surging by 2.8%. In fact, at the time of writing, Dogecoin was trading at $0.108. This marked an 11.422% decline in weekly charts.

The recent price movement raises questions about whether Dogecoin will recover and continue with the monthly uptrend, or whether bears will take over the market.

Inasmuch, popular crypto analysts Ali Martinez and Kevin have noted conditions that must be met to get another sustained uptrend.

What market sentiment says…

In his analysis, Kevin posited that the current market conditions mean the bearish sentiments are dominating.

According to the analyst, DOGE faked out of the macro falling wedge, which is a bearish signal.

Also, the memecoin lost out on all the key 1-day and 4-hour Moving Averages(MA), which is another bearish signal.

Therefore, the analyst argued that Dogecoin has to retrace to $0.08 and find another support before attempting an uptrend.

On the other hand, Martinez cited the example of 60210 addresses that hold 36.40 billion DOGE at $0.11.

Source: X

According to this analysis, DOGE must reclaim the $0.11 resistance level to sustain a bullish outlook. If the memecoin fails to do so, it will result in a massive sell-off with investors seeking to reduce their losses.

Usually, such a massive sell-off would result in further price dips and extend the bearish trend, as witnessed over the past week.

What DOGE charts suggest?

Undoubtedly, the analysis provided by Martinez and Kelvin provides a bearish outlook. The question is what do other metrics suggest?

Source: Santiment

For starters, Dogecoin’s Open Interest per exchange has declined over the past week from $224 million to $129.6 million.

This decline pointed out that investors are closing their positions with no new entrants, thus signaling a bearish market sentiment.

Source: Santiment

Additionally, Dogecoin’s price DAA divergence turned negative three days ago. A negative DAA divergence highlighted that fewer users are interacting with the DOGE ecosystem.

Thus, the recent rally is not fully backed by fundamentals but instead by speculation.

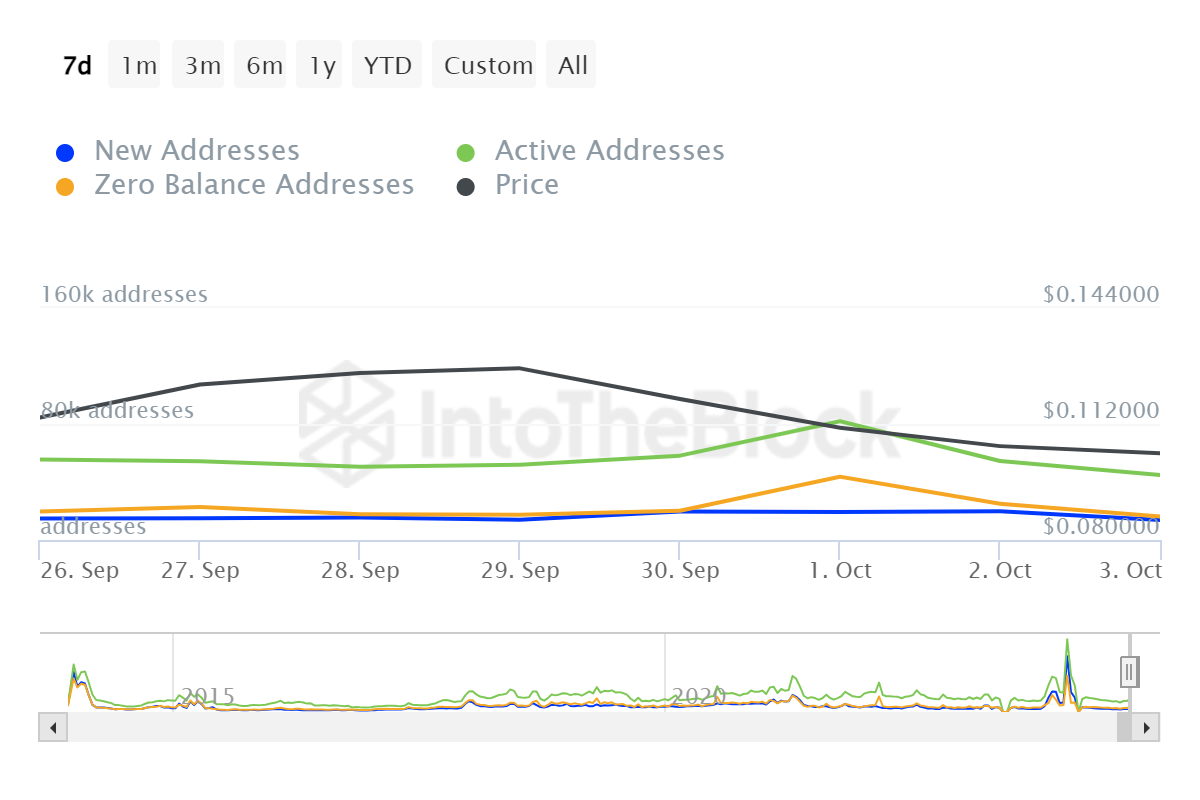

Source: IntoTheBlock

Finally, Dogecoin’s daily active addresses over the past four days have declined from 144.8k to 74.7k. A decline in active users suggests a reduction in demand or interest in the memecoin.

Read Dogecoin [DOGE] Price Prediction 2024-2025

Simply put, although DOGE has made a modest recovery on daily charts, weekly losses outweigh these recent gains.

Therefore, if the current sentiment persists, can DOGE hold its next support at $0.098? However, a reversal will see Dogecoin reclaim $0.011105.