Assessing if Wormhole’s 13.93% hike is the start of a new bull rally

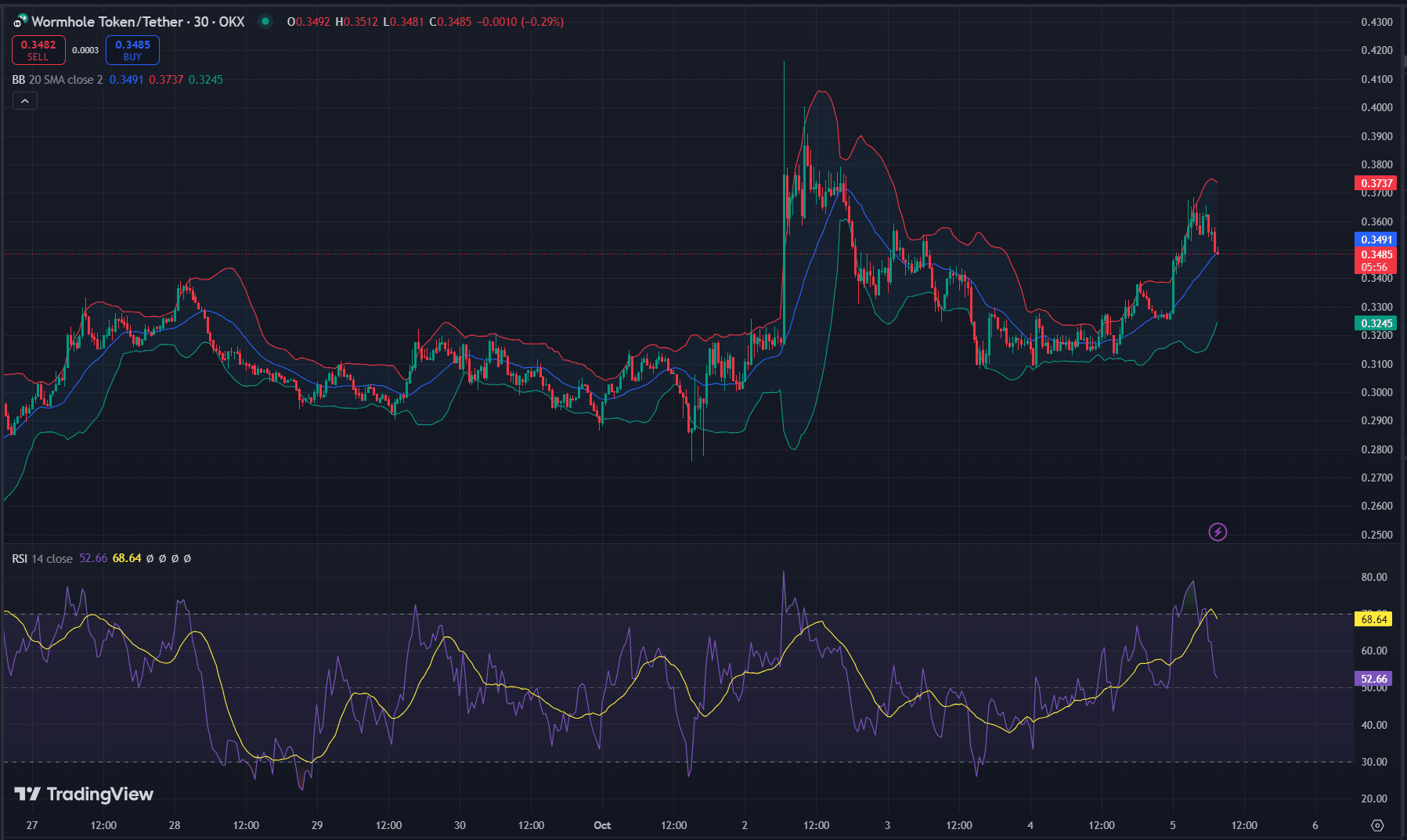

- Wormhole, at press time, faced key resistance at $0.3737, with strong support at $0.3245

- Open Interest climbed by 10.57%, suggesting strong trader interest despite mixed on-chain data

Wormhole [W] recorded a significant surge of 13.93% over the past 24 hours, propelling its price to $0.3626 at press time. This sharp hike, along with a 37% jump in trading volume, has raised questions about whether the token is nearing a breakout or not.

Investors are watching key technical levels closely to see if the momentum can continue or if a correction is around the corner.

Key support and resistance levels to watch

At the time of writing, the token was approaching a resistance level of $0.3737, according to Bollinger Bands analysis. If the price fails to break through, a retracement could follow. However, strong support at $0.3245 might allow the bullish trend to persist.

Additionally, the RSI had a reading of 68.64. This pointed to an overbought market condition, signaling that caution may be necessary as the asset nears these thresholds.

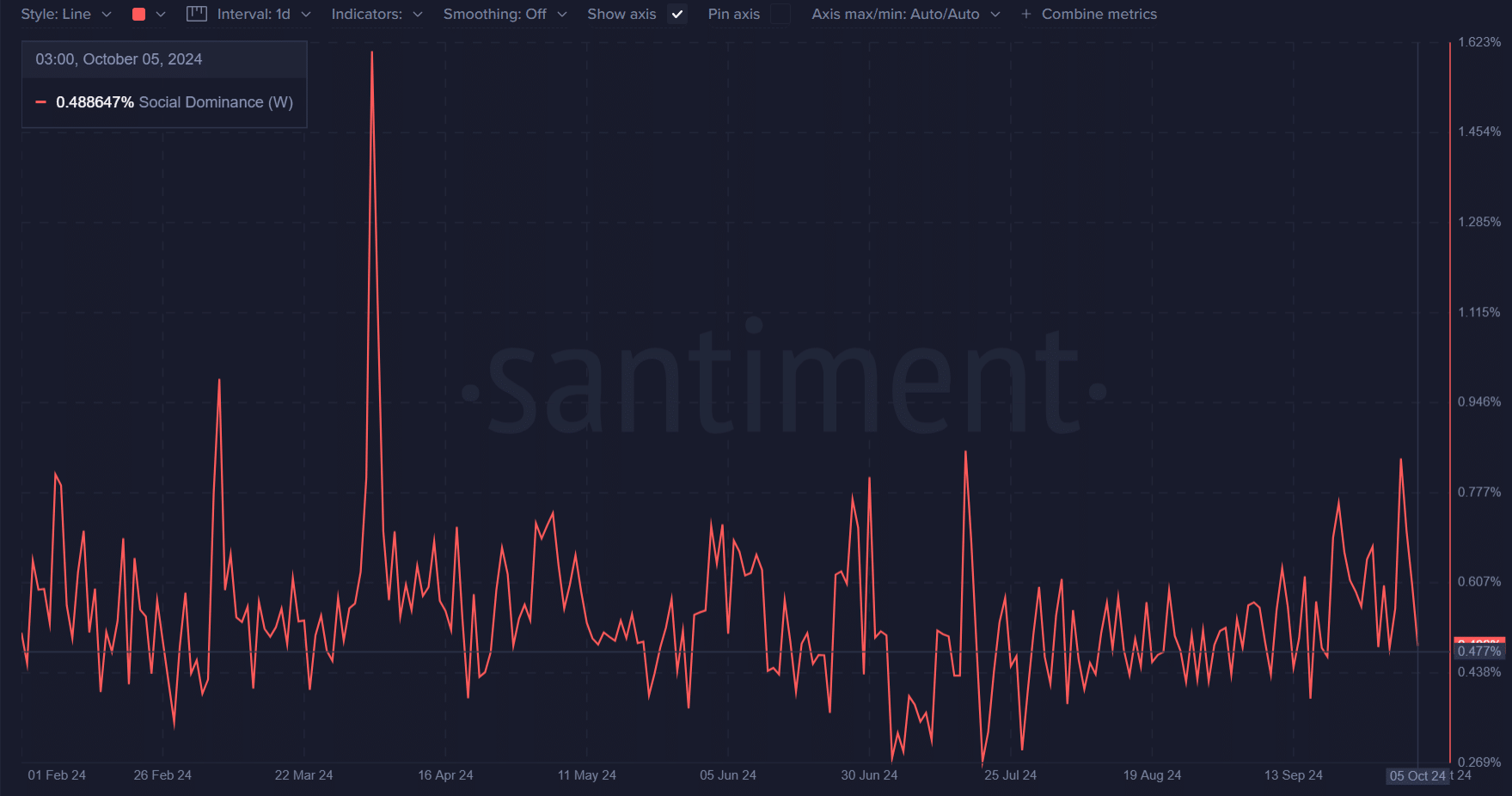

Wormhole social dominance – Still modest

The social dominance had a reading of 0.488%, indicating that it has not yet captured enough attention for a massive rally.

However, if social dominance rises, it could act as a catalyst for further price gains. Investors are closely monitoring online discussions to anticipate any shifts in market sentiment.

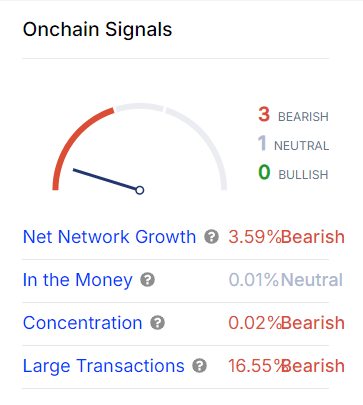

On-chain data provides mixed signals

On-chain indicators offer a more complex picture though. Net network growth fell by 3.59%, indicating slower user adoption. Large transactions also fell by 16.55%, pointing to a drop in whale activity.

However, the “In the Money” indicator flashed neutral, reflecting that most holders may be at break-even levels. These factors suggested potential volatility in the near term.

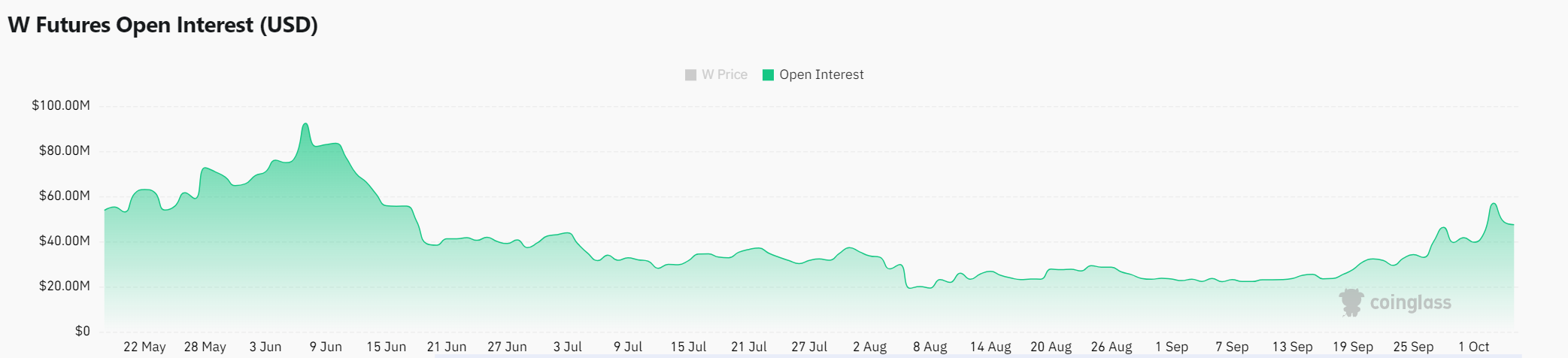

Wormhole’s Open Interest on the rise

An optimistic sign for bulls is the 10.57% hike in Open Interest, with the same recording figures of $52.46 million at press time. This means more traders have been betting on sustained price action.

A hike in Open Interest could propel the token beyond its current resistance levels in the short term.

Is your portfolio green? Check the Wormhole Profit Calculator

Breakout likely, but caution is warranted

Given the current bullish momentum, rising Open Interest, and solid support levels, Wormhole may be poised for a potential breakout. However, the mixed signals from social dominance and on-chain data suggested that traders should remain cautious.

The key resistance at $0.3737 must be broken for a sustained rally. Therefore, while a breakout seems likely, close monitoring these metrics is crucial for navigating the market’s next move effectively.