Bitcoin exchange inflows hit new lows – Can China drive BTC to $77K?

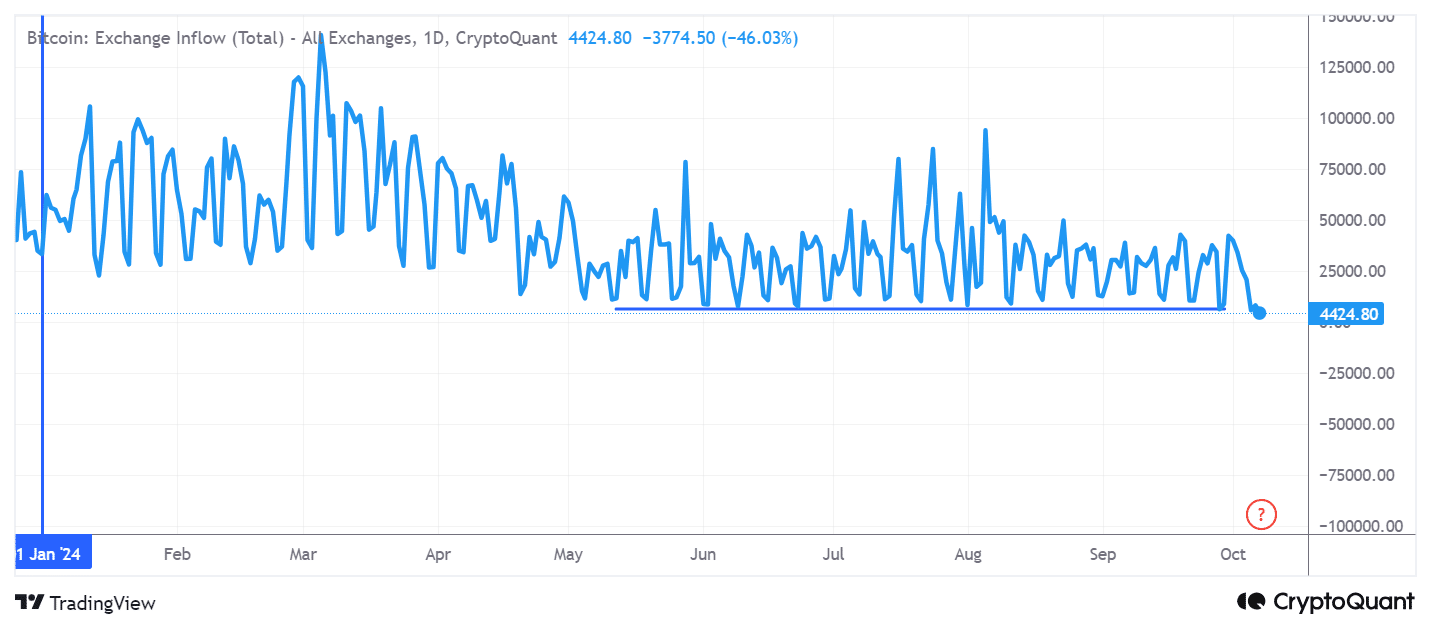

- Bitcoin exchange inflows were declining.

- China liquidity can propel BTC to $77K.

Bitcoin [BTC] continues to draw attention from investors, including traditional finance institutions, who are increasingly looking to Bitcoin as a long-term store of value.

Unlike in previous cycles where Bitcoin was frequently traded for short-term profits, much of it is now stored in cold wallets, signaling strong investor confidence.

The beginning of Q4 has seen Bitcoin exchange inflows hit their lowest levels of the year, indicating that investors and institutions are anticipating long-term gains for BTC as its market cap continues to grow with widespread adoption.

China liquidity stimulus

Chinese stocks are outperforming global markets, largely due to a government stimulus package that has injected significant liquidity.

This surge in liquidity is impacting risk-on assets like BTC, which has historically shown a strong correlation with Chinese stock performance.

Following the People’s Bank of China’s largest stimulus since the pandemic in late September, Chinese internet stocks have soared by $2 trillion.

Many traders view this surge in Chinese stocks as a potential signal for a similar upward movement in Bitcoin. This reinforces why BTC has seen reduced exchange inflows setting the stage for higher prices.

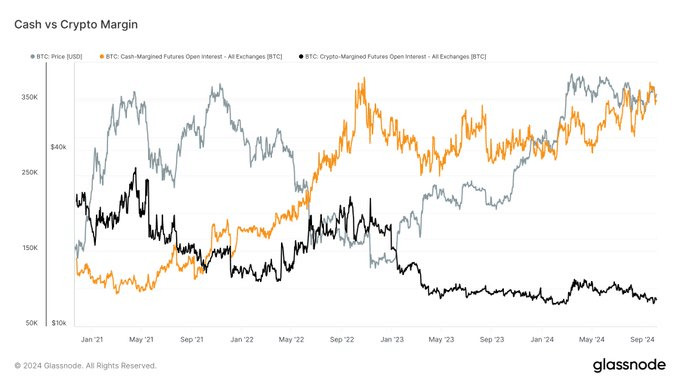

In addition to the liquidity stimulus, last week saw the largest divergence between crypto and cash-margined Bitcoin futures open interest.

More traders are now using cash to back their leveraged positions, rather than Bitcoin itself. This shift is a positive, as cash margins reduce volatility and the risk of forced liquidations, creating a more stable trading environment.

Meanwhile, retail traders continue to chase high-leverage gains, contributing to the market’s volatility.

This divergence between institutional caution and retail enthusiasm highlights a maturing Bitcoin market. Now, long-term sustainable growth is increasingly driven by institutional activity.

Can BTC reach $77K?

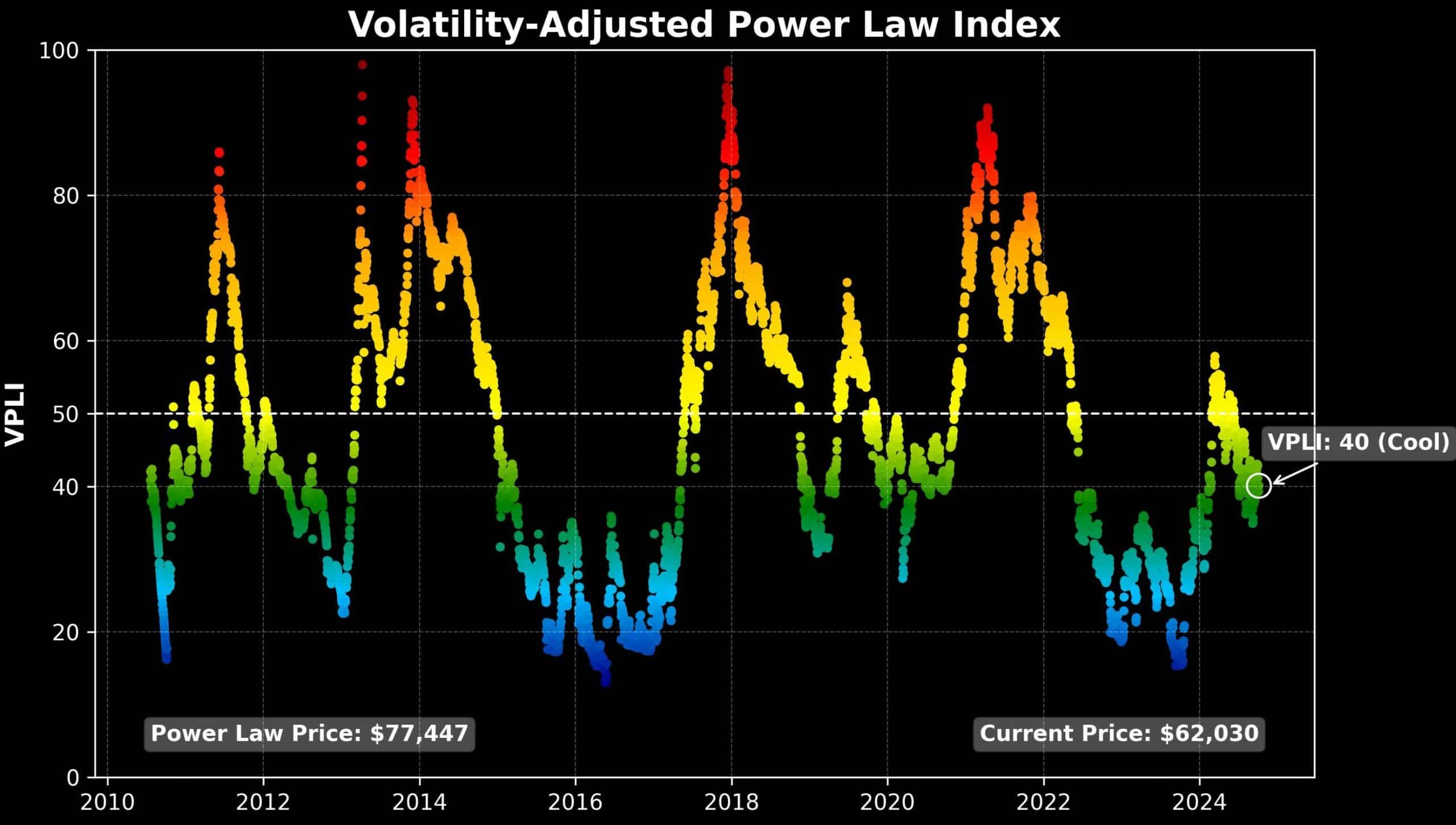

The Volatility Adjusted Power Law Index projects BTC’s fair price at $77K, considering long-term growth and volatility. Despite price consolidation around $60K, the fair price has risen from $70K to $77K in the past month.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Increasing liquidity from China’s stimulus and reduced futures market volatility suggest Bitcoin is gaining momentum for a breakout. Bitcoin appears ready to break higher, with potential to reach $77K as Q4 progresses.

Source: Sina/X

With global liquidity surging, BTC reaching $77K seems more realistic. This is especially true if economic conditions and institutional support drive growth.