Ethereum Foundation offloads as ETH faces pressure – What’s next?

- Ethereum Foundation liquidated 2,500 ETH amid market volatility, totaling approximately $6.06 million.

- ETH faced critical support at $2,300; failure to hold this level could lead to a significant decline.

In a significant move, the Ethereum Foundation recently transferred 2,500 Ethereum [ETH], valued at around $6.06 million, to the Bitstamp exchange.

Details of Ethereum Foundation’s recent transfer

Executed on the 8th of October at 08:14 AM and 08:19 AM UTC, these transactions are part of a broader trend of liquidation by the Foundation as it navigates fluctuating market conditions.

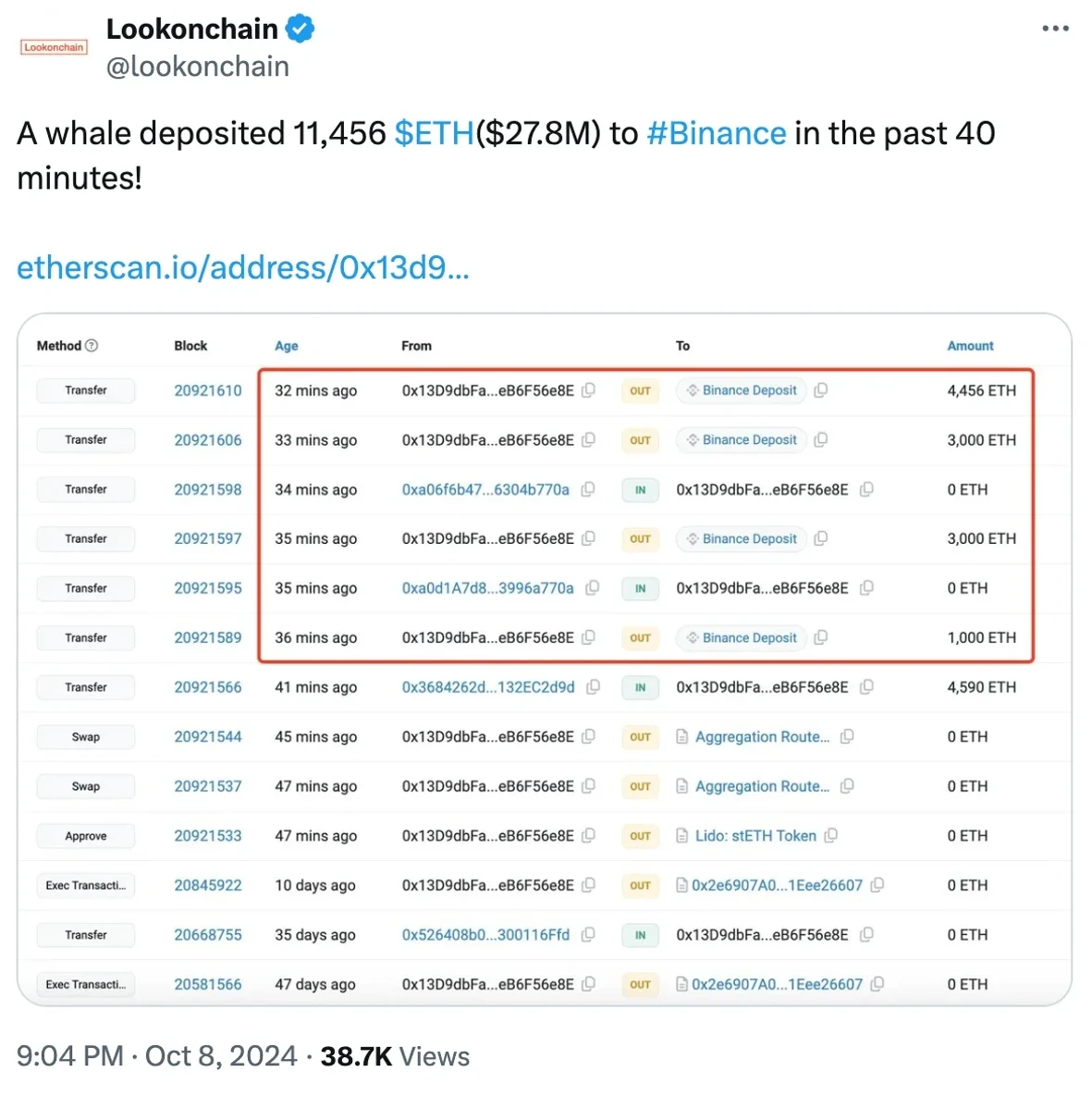

Adding to this development, a prominent whale from the 2017 ICO era has also been active, transferring 5,000 ETH—approximately $12.22 million—on the same day.

This whale has reportedly offloaded over $113 million in ETH since September, adding further selling pressure to the market.

Recent insights from Lookonchain reveal that the Ethereum Foundation has been actively managing its ETH holdings in response to a bearish market environment.

In a calculated move, the Foundation transferred 2,500 ETH to Bitstamp, executing the transaction in two equal segments of approximately $3.03 million each.

This strategy appears to be aimed at converting a portion of its digital assets into cash or stablecoins, underscoring a proactive approach to asset management amidst ongoing market challenges.

Community reaction

Reacting to the situation, various crypto communities jumped in, as highlighted by an X (formerly Twitter) user who said,

“What the heck is going on with ETH?”

Adding to the fray was another X user-Sweep who noted,

“what’s cooking, what does the whale knows.”

A recent analysis by Ali Martinez underscored that Ethereum is at a pivotal crossroads, with the $2,300 mark identified as a crucial support level.

Martinez noted that approximately 2.77 million addresses were acquired.

If bullish momentum prevails and the price remains above this threshold, there is potential for a significant upward trajectory, possibly tripling its value.

However, should the price fall below $2,300, it could trigger a substantial downturn of around 30%, bringing ETH down to $1,600.

Impact on ETH’s price

In the face of mounting bearish sentiment around ETH, CoinMarketCap‘s latest update revealed that Ethereum was trading at $2,433.51, during press time, reflecting a modest increase of 0.16% in 24 hours.

Despite this slight uptick, the Relative Strength Index (RSI) remained below the neutral level at 45. This suggested that bearish pressure is still a factor in the market.

However, the widening of the Bollinger Bands indicates heightened volatility, hinting at the potential for bullish momentum to soon outstrip bearish influences.