VELO’s next rally depends on breaching THIS price level!

- Velo’s price surge is driving high trading volumes, with RSI and Bollinger Bands signaling room for growth

- Liquidation data revealed strong long positions, but skepticism remains with a high short ratio

Velo [VELO] is gaining serious attention in the crypto market after an impressive 10.35% price surge over the last 24 hours. With the altcoin approaching its critical resistance level of $0.019, the key question is whether the token can maintain its upward momentum and break through or face a pullback.

At press time, Velo was trading at $0.01417, underlining growing interest from market participants. Its trading volume surged by 39.44% in just 24 hours to $10.48 million – A sign of heightened activity.

This spike in volume, coupled with a market cap hike to $104.74 million, signaled that traders have been bullish on VELO.

RSI and Bollinger Bands – What are they indicating?

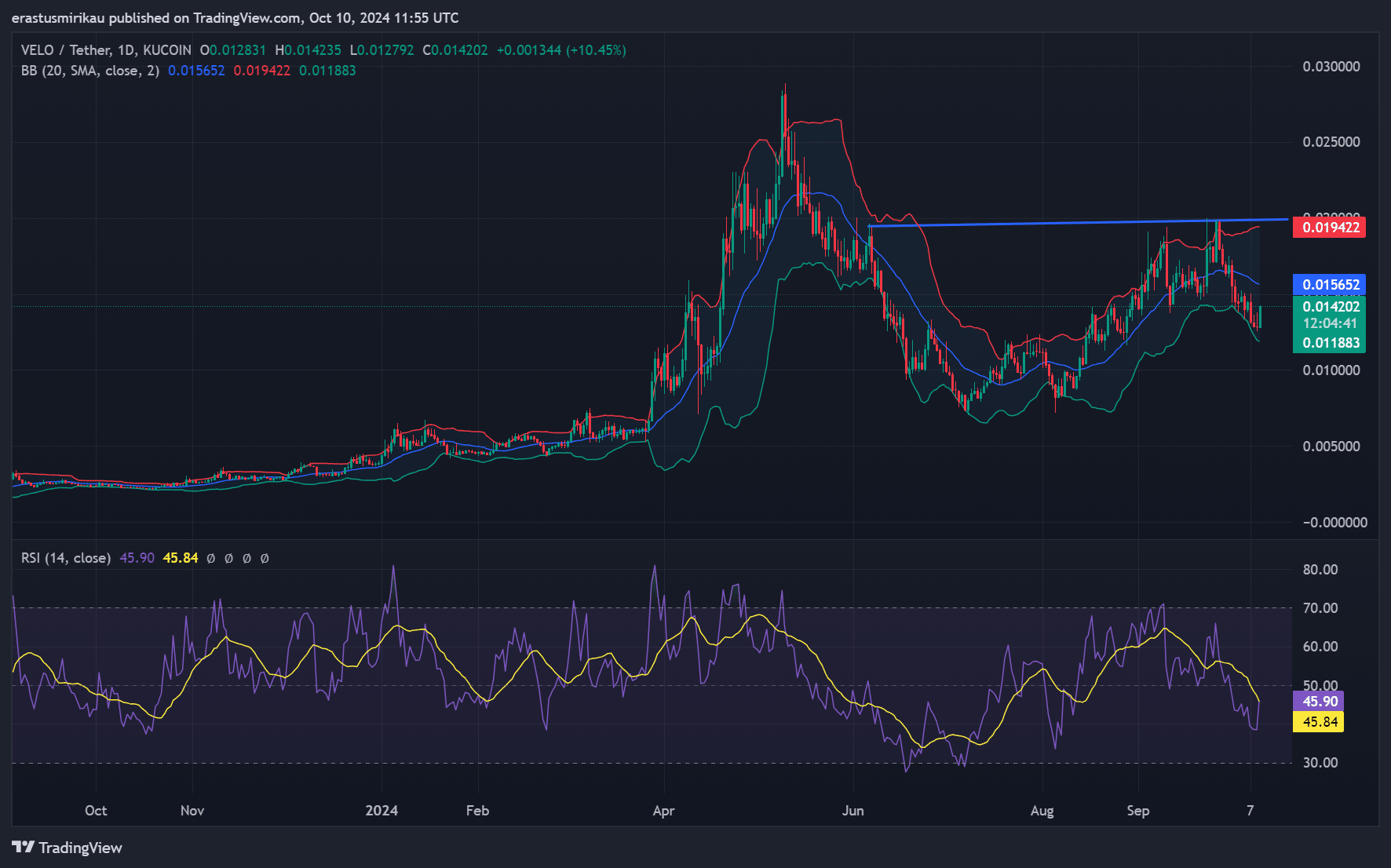

From a technical standpoint, VELO’s Relative Strength Index (RSI) stood at 45.9, indicating that the token still has room to rally before reaching overbought levels. Simply put, the market is not yet overheating, leaving the door open for further gains.

Additionally, the Bollinger Bands (BB) showed a range between $0.01188 and $0.01942, with the crypto’s price testing the upper band. As a result, this could mean that a breakout may be imminent, especially if market momentum continues to build.

VELO liquidation data – Are traders betting on a bullish move?

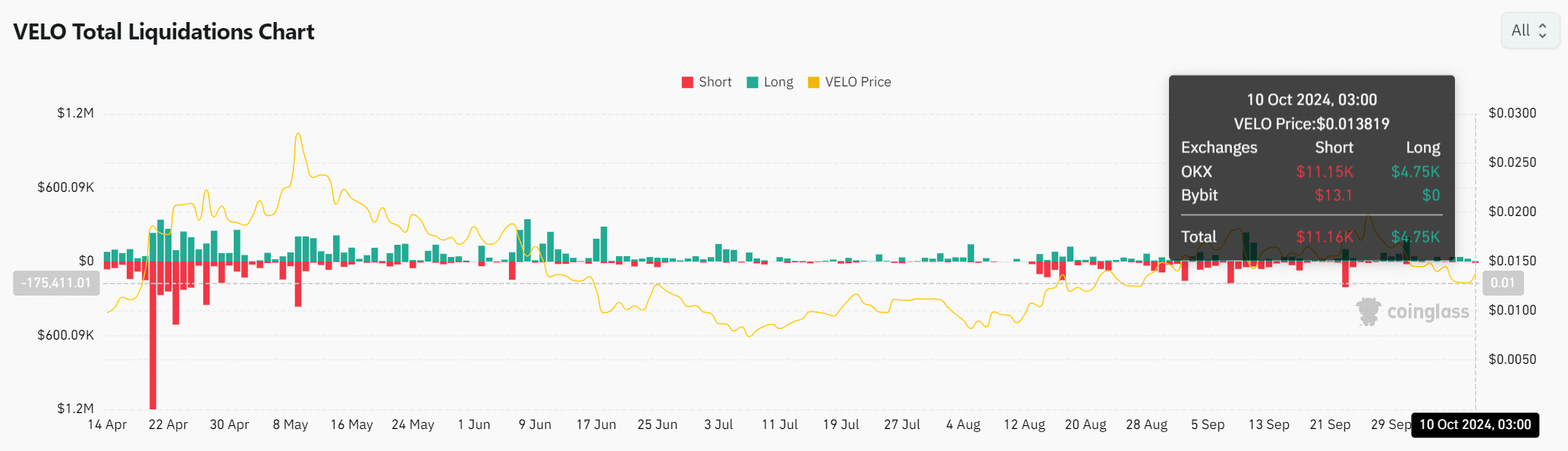

Looking at the liquidation data, long positions dominated the market. Over the past 24 hours, $4.75k in long positions were liquidated compared to $11.16k in shorts, showing that traders remain cautious. However, the overall confidence in the altcoin’s potential remains strong, as underlined by the significant number of long positions.

However, this confidence will need to be matched with sustained buying pressure for the token to break through the $0.019 resistance.

VELO long/short ratio – Skepticism or short squeeze setup?

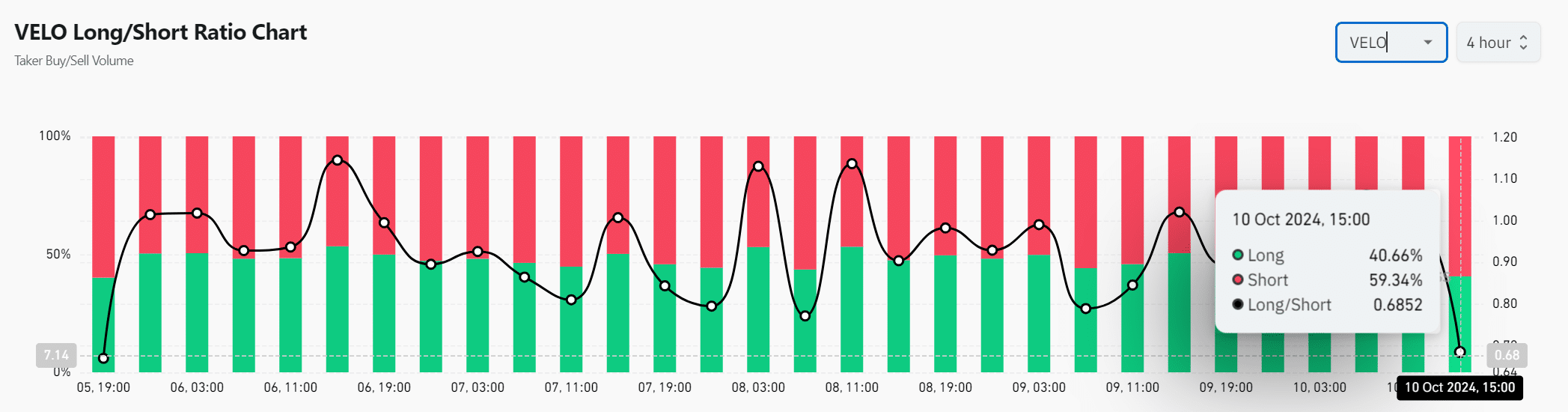

Interestingly, the long/short ratio revealed that 59.34% of traders have been shorting VELO, while only 40.66% have been holding long positions. This short dominance suggested that some traders remain skeptical of the token’s ability to sustain its recent gains.

However, if the crypto continues its upward move, it could lead to a short squeeze. This might force shorts to cover their positions, driving the price even higher.

Read Velo’s [VELO] Price Prediction 2024–2025

VELO may be well-positioned for a bullish breakout, with rising trading volumes, neutral RSI, and strong liquidations data favoring long positions. Therefore, if the token breaks the $0.019 resistance, it could continue to rally.

However, skepticism from short traders may pose a temporary hurdle. All eyes are on VELO as it nears this crucial price level.