NEIRO’s +50% hike – Is its bull run here to stay?

- NEIRO’s price surge broke a key resistance, but the overbought RSI pointed to a potential pullback

- Rising Open Interest and liquidation data highlighted hike in volatility

Neiro Ethereum [NEIRO] recorded a dramatic surge of 50.64% today, hitting a price of $0.09058 at press time. With its market cap rising to $90.58M and trading volume increasing by a massive 309.73%, all eyes are on whether NEIRO can maintain this momentum. However, is this rally sustainable, or could a correction be looming?

The impressive 309.73% spike in trading volume is a sign of heightened interest in NEIRO. Consequently, this volume hike can also be interpreted as a bullish trend, especially as more buyers flood the market.

However, traders should be cautious. Such sharp hikes can sometimes precede volatility, leading to quick market corrections. Therefore, while the volume spike is promising, it’s important to monitor price movements closely.

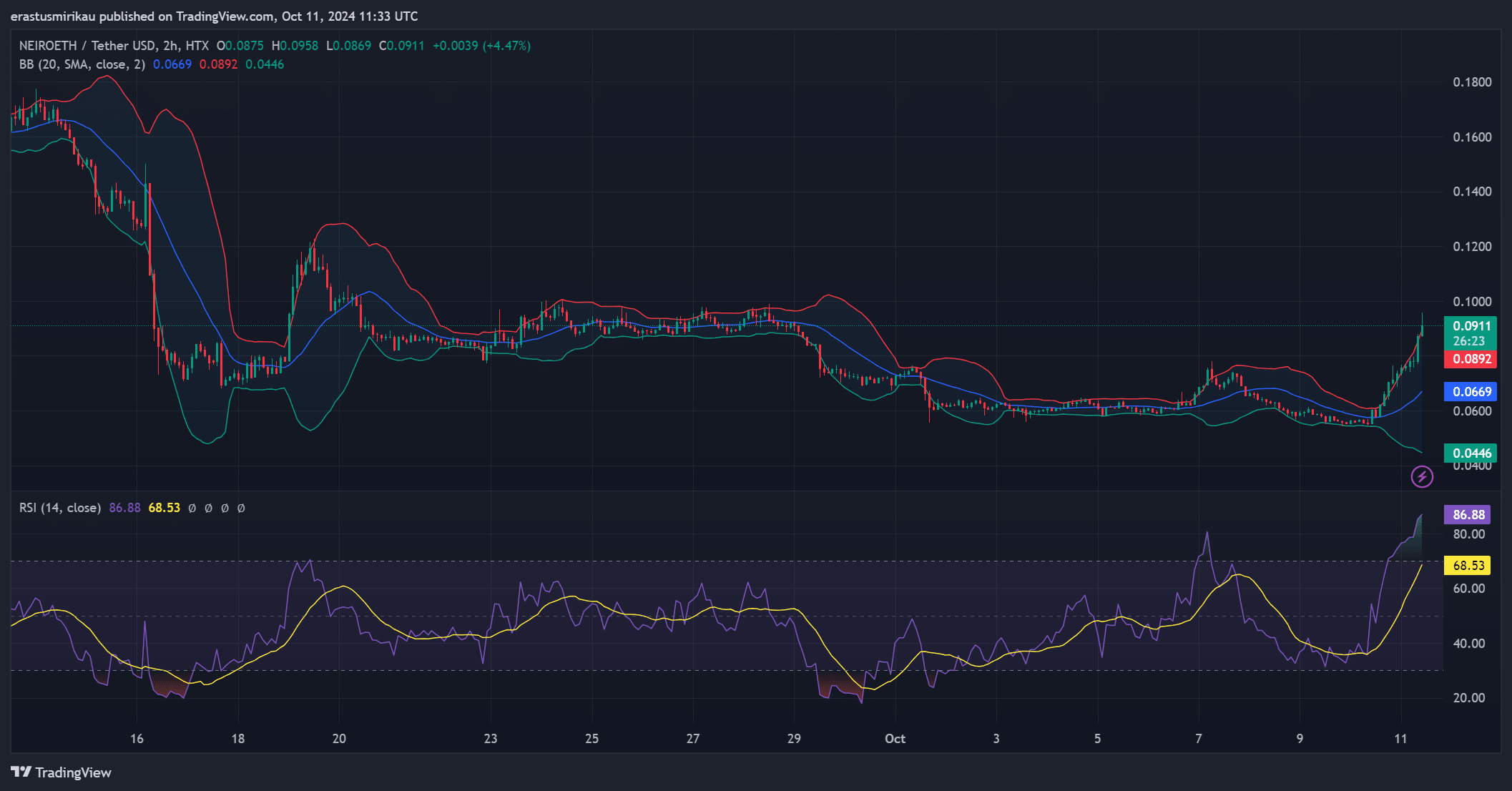

Bollinger Bands and RSI – Is a reversal likely?

NEIRO has surged past the upper Bollinger Band, signaling strong bullish momentum but also indicating that the price may be overextended. Additionally, the RSI at 86.88 suggested that the asset is deep into overbought territory, raising concerns of a potential short-term pullback.

While the prevailing momentum could push prices higher, traders should remain cautious of a reversal or consolidation as both indicators pointed to an overheated market.

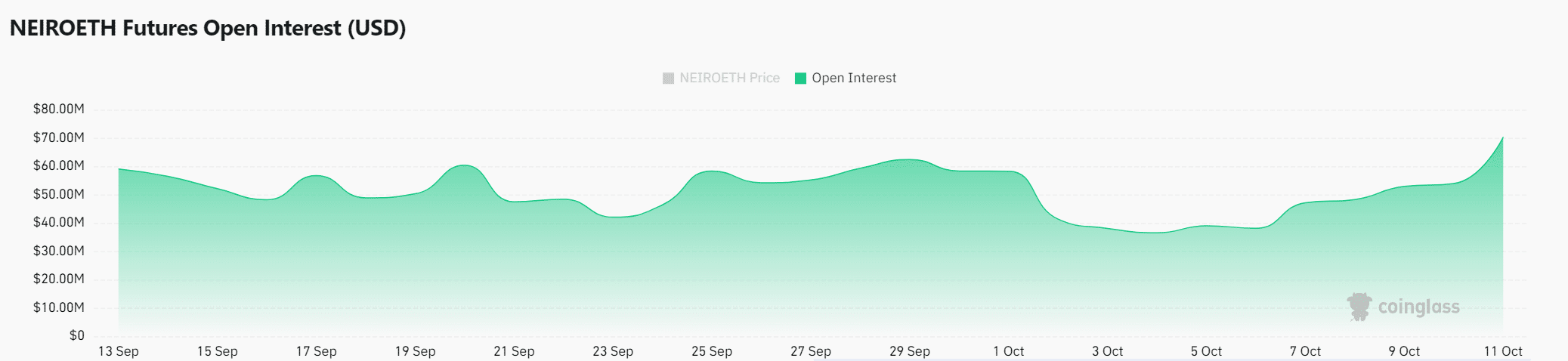

NEIRO’s rising Open interest: Increased volatility ahead?

Open interest jumped by 101.22%, reaching $119.49M. This surge is a signal that more traders are entering the market, anticipating continued volatility. However, a hike in Open Interest often leads to greater market fluctuations.

Consequently, investors should be prepared for potentially sharp price movements as the market reacts to new positions.

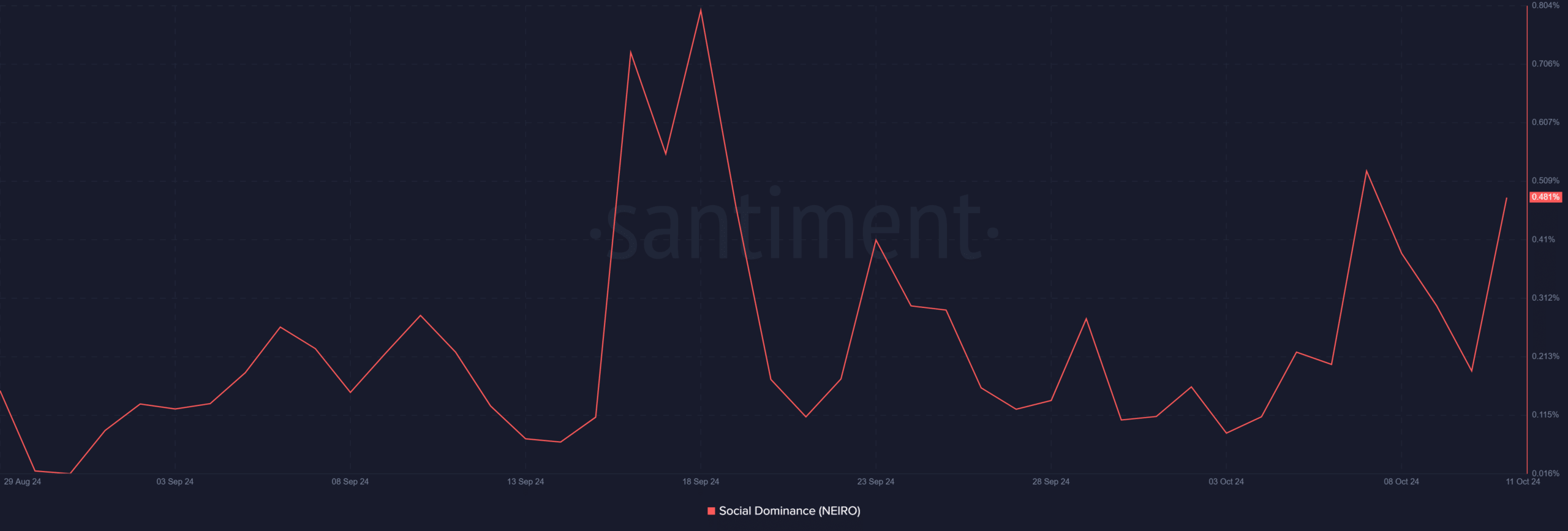

Social dominance: Is NEIRO gaining popularity?

NEIRO’s social dominance rose to 0.481%, highlighting that it’s gaining attention across social platforms. This growing social presence could further drive market interest and lead to sustained price hikes.

However, social sentiment can change quickly, so it’s essential to track how the community responds to future price movements too.

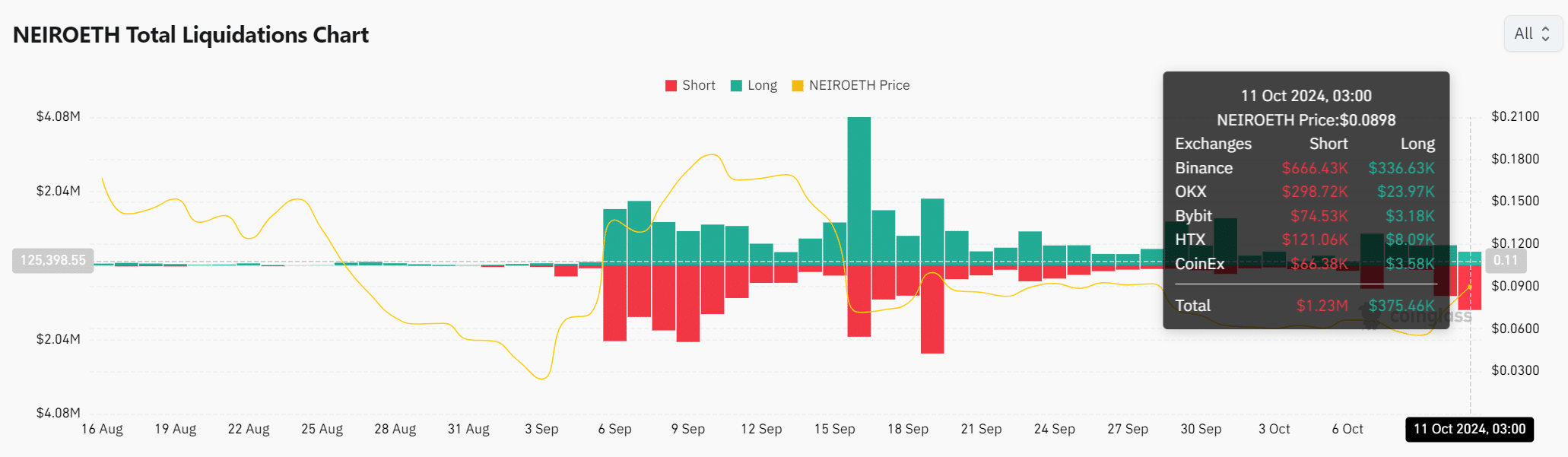

NEIRO Liquidation data: What are traders facing?

Recent liquidation data revealed $1.23M in short liquidations as traders betting against NEIRO’s rise were caught off-guard.

On the other hand, long liquidations remain at $375.46k. With market volatility on the rise, these liquidation levels may increase as traders adjust their positions.

Read Neiro Ethereum [NEIRO] Price Prediction 2024–2025

Is the rally sustainable?

NEIRO’s 50.64% hike and growing market interest are certainly bullish indicators. However, with overbought RSI levels and increasing Open Interest, the risk of a short-term pullback is high.

Investors should stay cautious and monitor key technical indicators to assess whether this rally will continue or face a correction.