Toncoin’s shift to long-term HODLing – What does this mean for you?

- Toncoin’s address activity revealed that holders are moving in favor of long-term HODLing

- TON potentially on the verge of another major rally, but price yet to feel the effects of the shift

Are Toncoin bulls preparing to take over? Recent on-chain findings suggest that this could be a potential outcome, particularly based on a shift from a short-term swing trading to to a long-term HODLing preference.

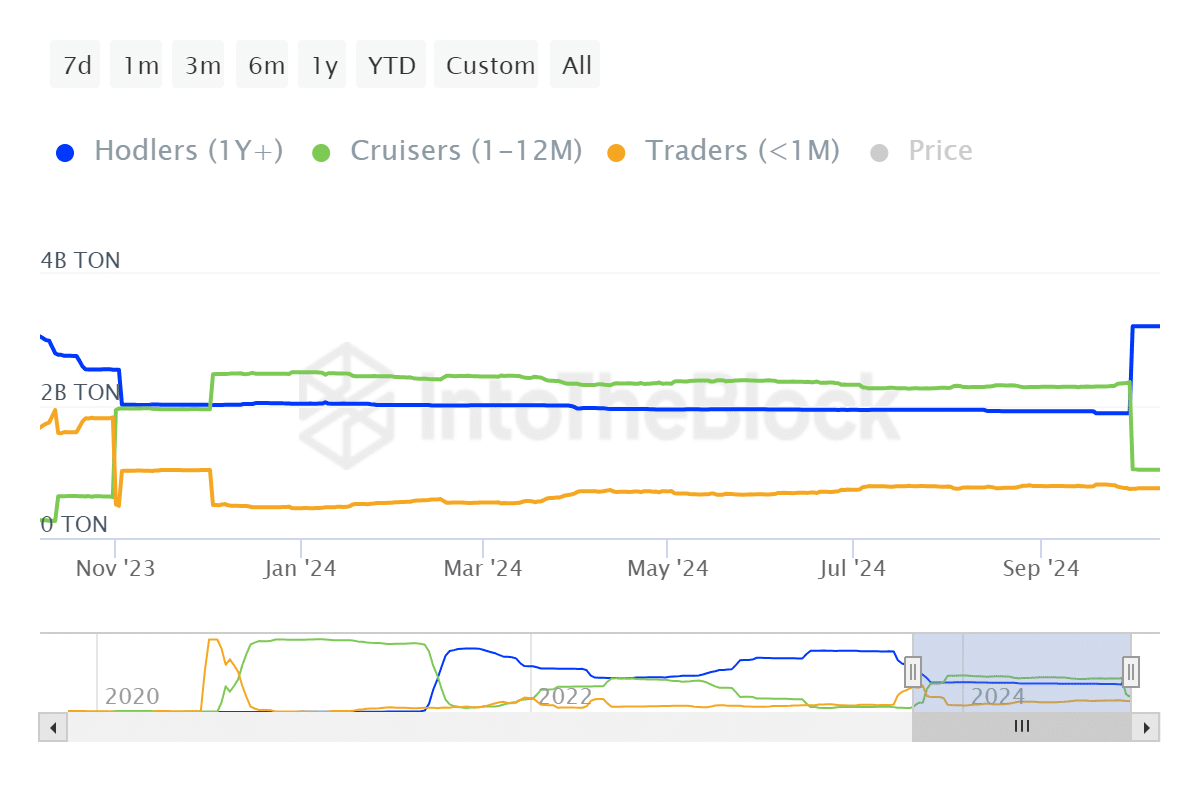

This observation is based on Toncoin balances by time held. Balances held by HODLers registered a sharp bounce from 1.89 billion TON towards the end of September to 3.21 billion TON, as per the latest data – A gain of roughly 1.32 billion coins, equivalent to $6.8 billion at press time.

Cruiser (swing traders) balances fell from 2.36 billion TON to 1.03 billion TON over the same period. This equates to roughly 1.33 billion coins, or equivalent to roughly $6.94 billion. But, what does this all mean for Toncoin?

Outflows from cruiser addresses were slightly higher than outflows from HODLer accounts. This may have contributed to the sell pressure observed since the start of October. However, it also underscores another important observation – HODLers now control over 3 times the balances held by swing traders.

The potential implication is that a shift has occurred in favor of a long-term outlook. The lower balances held by swing traders may have a lesser impact on short term price action.

Toncoin’s address activity points towards growing accumulation

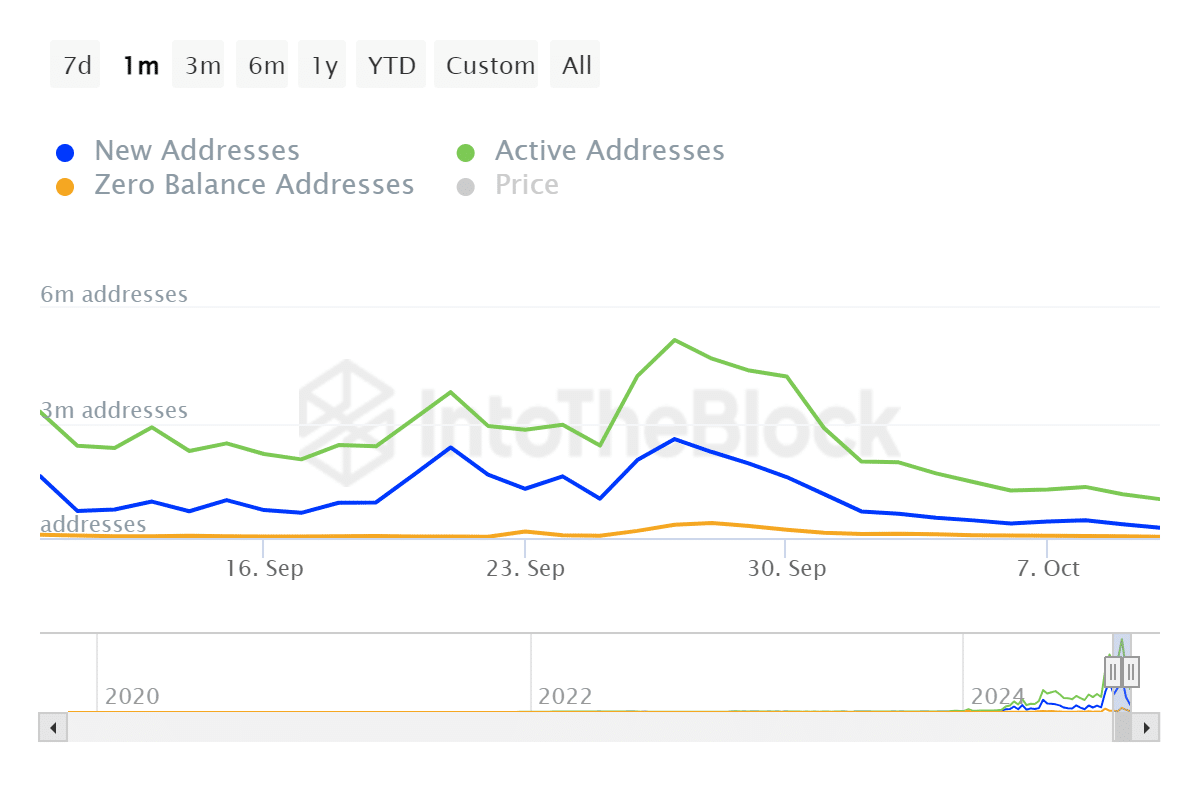

Daily active addresses also aligned with the shift towards a long-term preference. For example, the number of active addresses declined from 5.16 million addresses on 27 September to 1.01 million active addresses.

More importantly, zero balance addresses dropped from just over 392,000 addresses on 28 September to just over 35,000 addresses by 10 October.

The lower zero-balance addresses suggested that accumulation has been gaining traction. Finally, new addresses also fell from 2.58 million towards the end of September to 265,000 addresses on 10 October. This highlighted the absence of fresh demand that can potentially contribute to Toncoin.

Nevertheless, it’s worth reporting that TON recently announced that it now has over 100 million holders.

Now, although these findings paint a bullish picture, TON’s price action has been bearish for the last 2 weeks. It was down by 15% from its September highs. Despite this discount though, TON’s press time price was still at a 16% premium, compared to its lowest price level in September.

To sum things up, Toncoin might be preparing for a major recovery based on recent on-chain observations. However, its price action suggested that it may be yet to reach enough volumes to trigger its next major bullish bounce.