Chainlink price prediction – Will LINK’s 4-year-wait finally pay off?

- At the time of writing, Chainlink was up 3% in the last 24 hours

- LINK’s long-term potential remains strong, despite some bearish signals

Chainlink (LINK), one of the industry’s prominent cryptocurrencies, has market cap 0f $6.86 billion with a fully diluted valuation (FDV) of $10.95 billion.

After recovering from a recent dip that sent its price below $10, LINK has tested and rejected this crucial level three times – Indicating a potential move higher.

At press time, LINK was trading at around $11 following a 24-hour hike of 3%, according to CoinMarketCap. However, while LINK’s short-term price action projected some challenges, its historical performance and long-term potential remain strong.

LINK’s journey

Looking back at LINK’s journey, it once surged from $0.6 to an impressive $55, after breaking above a two-year base. Currently, LINK is in a four-year accumulation phase, one which could lead to another significant rally, similar to its previous performance.

If Chainlink breaks out from this phase and reclaims its all-time high (ATH), it could deliver massive 420% gains from its press time price.

This potential breakout will be supported by recent blockchain developments, such as Ronin integrating Chainlink’s Cross-Chain Interoperability Protocol (CCIP).

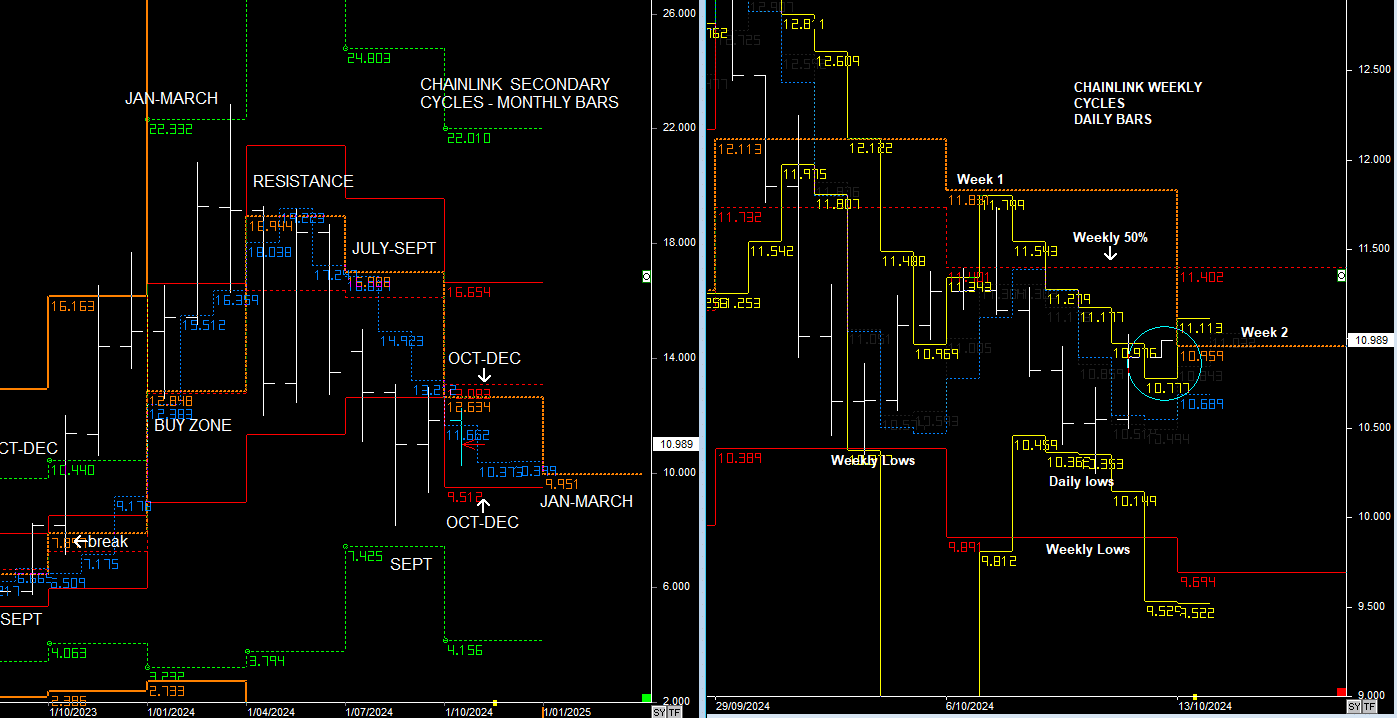

Now, while there are promising signals, the timing of LINK’s next major rally remains uncertain. Recent cycle analysis suggests that LINK’s price may not see substantial upward movement until early next year, between January and March.

For short-term traders, bullish patterns may emerge, but those hoping for major price moves may need to be patient.

At press time, LINK’s weekly cycles were showing strength after hitting daily lows. And, if it can break out by the end of this week, it could continue its uptrend into the following week for short-term traders.

However, secondary cycles seemed to indicate that this strength may not last long. Hence, traders should remain cautious.

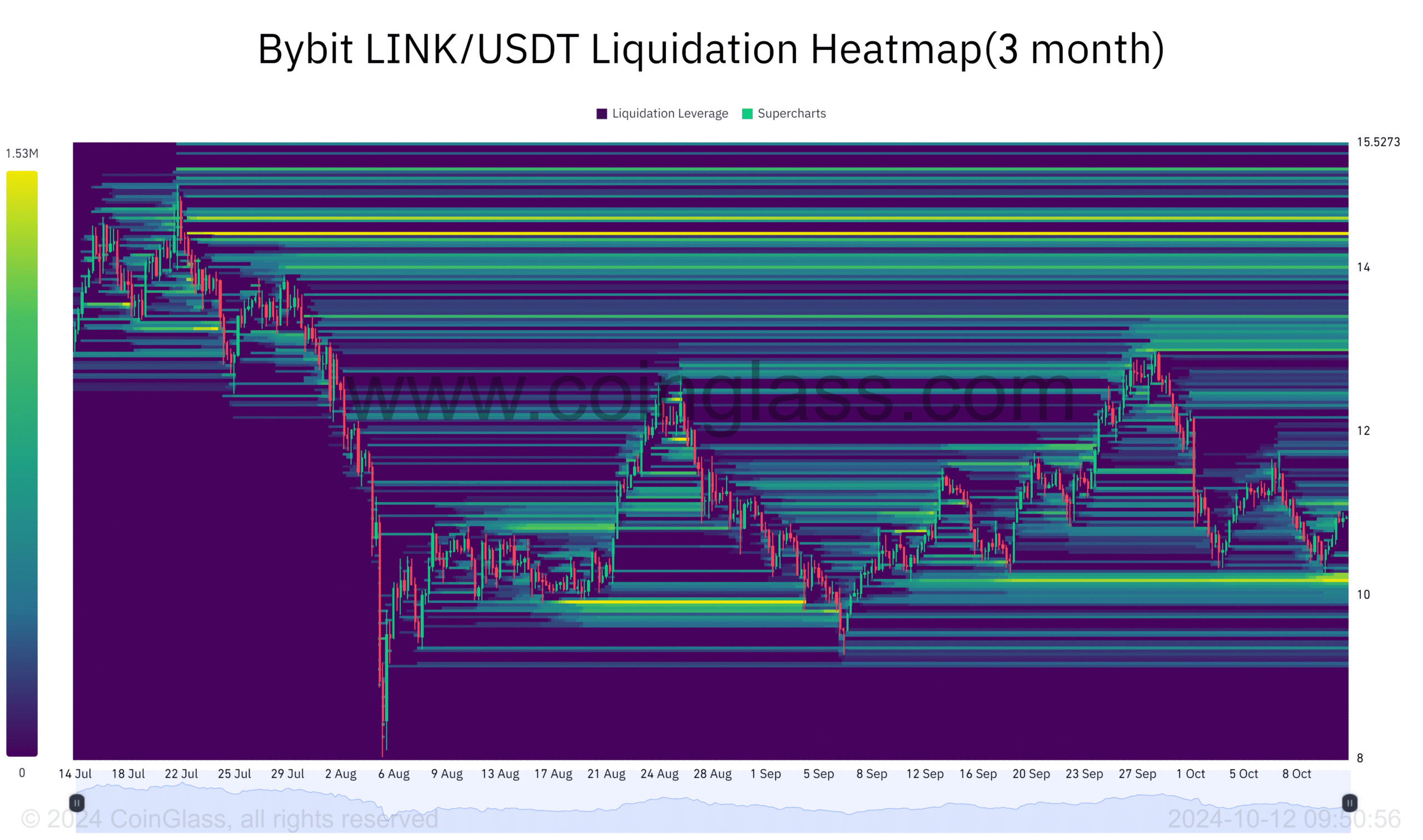

LINK’s liquidation heatmap

Another factor to consider is LINK’s liquidation levels, which offer insight into possible price movements.

Markets tend to move towards zones with high liquidity. And, Chainlink’s liquidation heatmap on Bybit, based on a three-month lookback period, revealed that $14 is a critical level.

At this price point, $1.5 million worth of leveraged orders are set to be liquidated, making it a key target for LINK’s next potential rally.

If LINK reaches this level, it could ignite the long-awaited breakout from its four-year accumulation phase.

Chainlink’s current price action alludes to potential for higher gains in the future, especially if it breaks out of its lengthy consolidation phase.

While the exact timing of this rally remains uncertain, investors should stay vigilant. Especially as Chainlink continues to show signs of strength and the possibility of another massive rally.