Dogecoin price prediction – DOGE’s short-term price targets will include…

- DOGE surged by 3.05% on the charts over the last 24 hours

- At the time of writing, the memecoin was stuck in a consolidation range between $0.1 and $0.13

Dogecoin [DOGE], the world’s largest memecoin by market cap, has appreciated by a significant margin over the past month. In fact, at the time of writing, DOGE was trading at $0.011, up 3.05% in the last 24 hours, with the memecoin gaining on the weekly and monthly charts too.

And yet, despite the sustained hike in Dogecoin’s value, the memecoin remains almost 85% below its 2021 ATH of $0.73. At press time, it was also 51.32% below its yearly high of $0.228.

Even so, many in Dogecoin’s community remain optimistic, especially in light of the crypto’s recent bullish action. Current market conditions have also left analysts betting on a potential memecoin-driven bull market.

One of these analysts is Kevin Capital who suggested that DOGE is currently at the perfect buying opportunity, before it surges for real.

What does market sentiment say?

In his analysis, Kevin observed that Dogecoin is still attempting to create a successful bullish retest of a macro falling wedge. This, after completing its typical bull market 60% correction.

As such, a successful retest of this level will see DOGE hike to a local high, one surpassing the $0.13 resistance level.

Historically, the last time Dogecoin broke from this channel, it went to climb to its ATH in 2021. In fact, even 2024’s breakout saw DOGE surge to a yearly high.

Therefore, based on this analogy, a successful retest and breakout will push the memecoin’s price to a new high. At least on a yearly basis.

What does DOGE’s price chart say?

While the aforementioned observation is a positive one, it’s essential to determine what market fundamentals say.

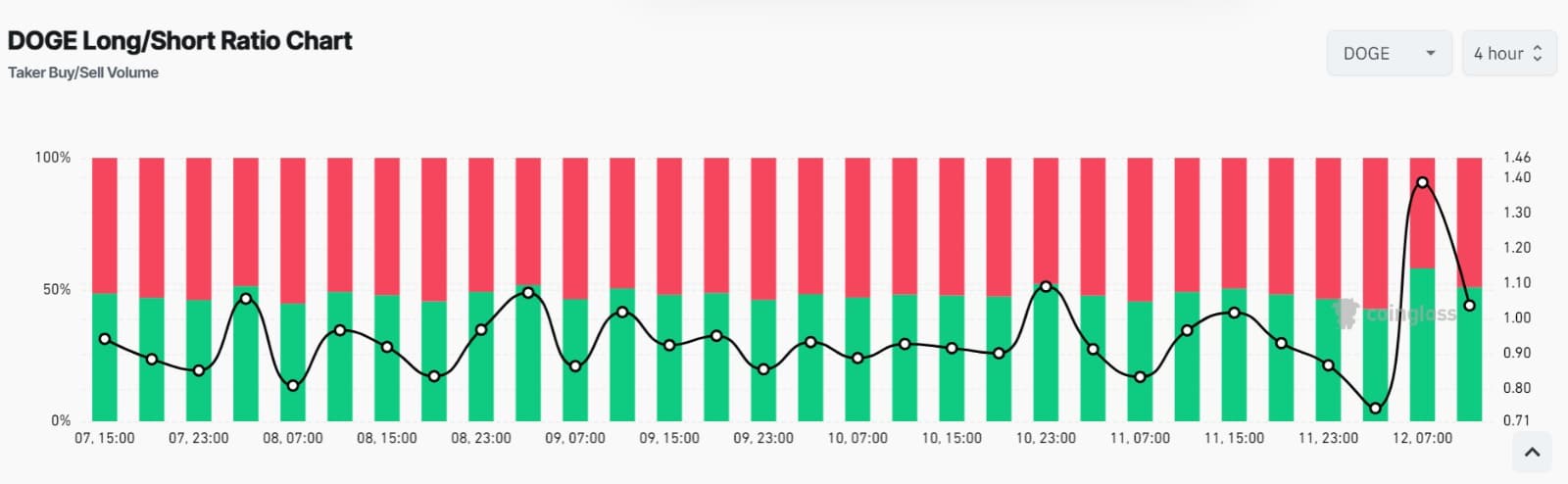

For example, Dogecoin’s long/short ratio, a metric that examines the taker buy and sell volume, remained above 1 on the 4-hour charts.

At press time, the long/short ratio was 1.07. This suggested that long-position buyers have been dominant, with many investors anticipating the price to climb.

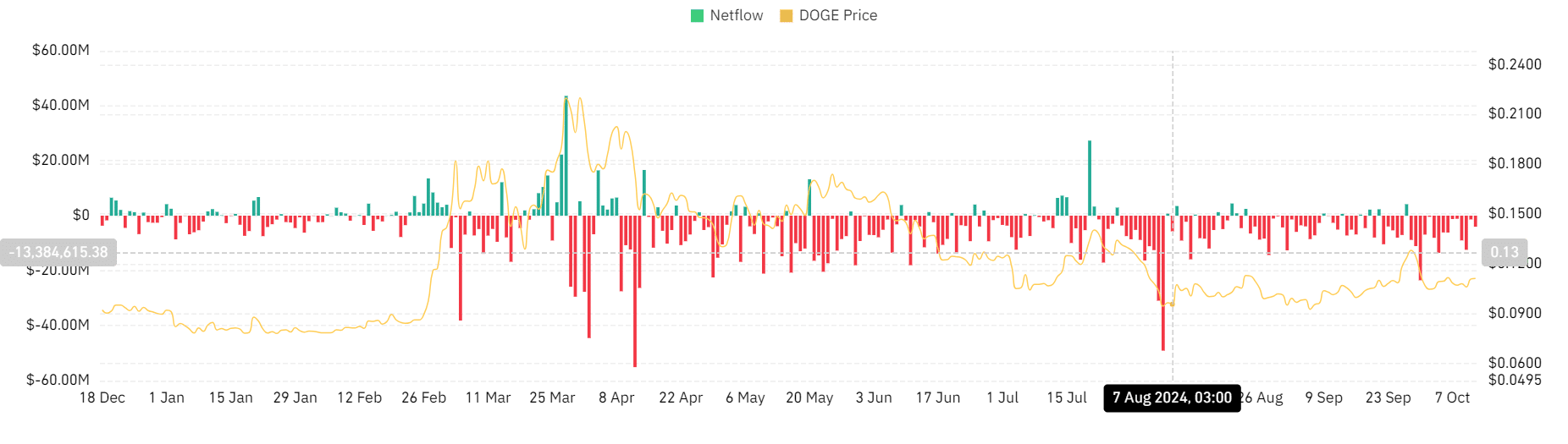

Additionally, Dogecoin’s Spot Netflow has remained negative over the past 2 weeks. This meant that investors are withdrawing their DOGE tokens from exchanges to private wallets.

A sustained stay at this level will result in a supply squeeze, one which results in high demand with less supply – Driving prices up.

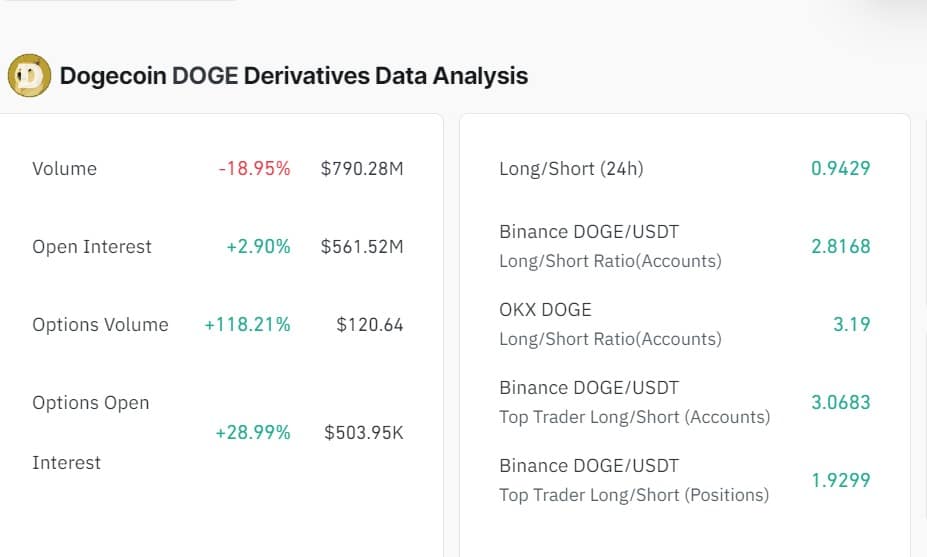

Finally, DOGE’s Options volume surged by 118.21% to $120.64 million. Such a surge usually entails that many traders are entering the market – A sign of rising market activity.

Thus, an uptick in call Options volume implies that many investors are bullish and expect the price to rise even further.

Can Dogecoin finally rally?

According to AMBCrypto’s analysis, DOGE has faced multiple rejections at the $0.130 resistance level. Since the memecoin is experiencing positive market sentiment now, it may be well positioned for more gains on price charts.

Right now, its price is stuck in the consolidation range between $0.1 and $0.13. A break above $0.13 will see DOGE hit a 3-month-high of $0.14. A breakdown will see the memecoin dip below $0.1.