Ripple whales accumulate as XRP struggles with key resistance

- Ripple whales have accumulated close to 50 million XRP, worth approximately $26.5 million.

- XRP is struggling to break key resistance levels, with its 50-day and 200-day moving averages at $0.56 and $0.54, respectively.

Ripple [XRP] has been trading sideways for the past few days, with the token unable to break through key resistance levels despite some positive price trends.

However, whale investors have shown renewed interest, increasing their holdings, although this has not stopped more XRP from flowing into exchanges.

Ripple whales continue accumulating

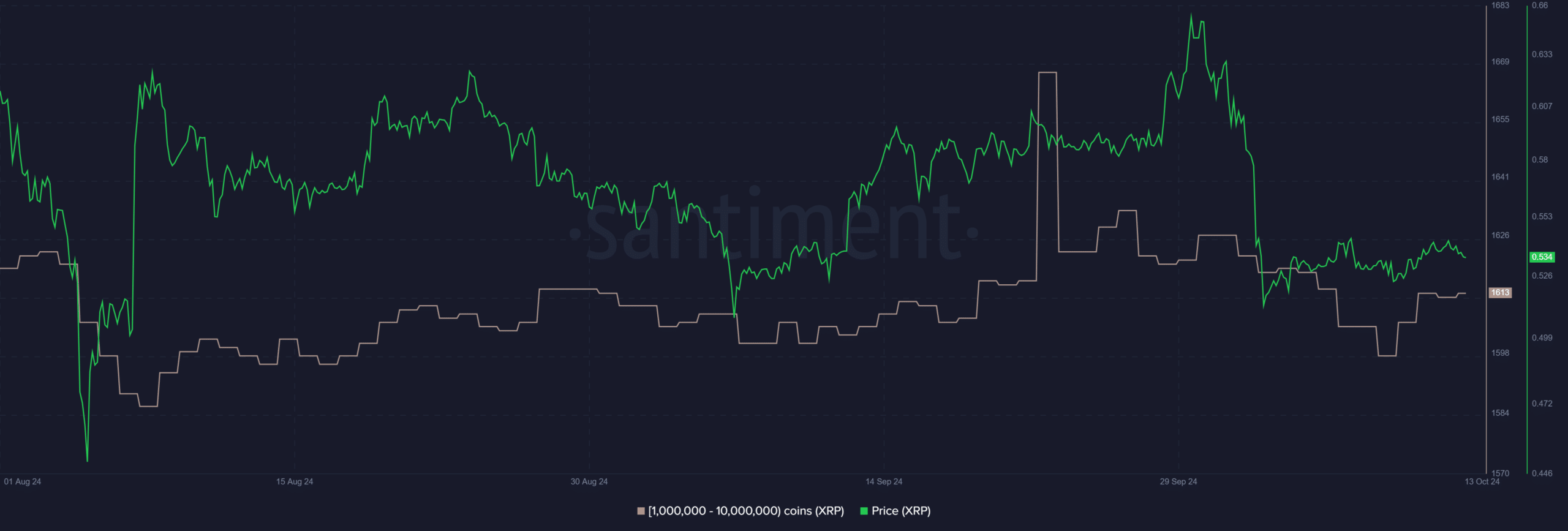

According to data from Santiment, the number of Ripple whale addresses holding 1 to 10 million XRP has risen over the past three days. The total number of these addresses increased from 1,606 to 1,614.

During this period, these whales collectively acquired close to 50 million XRP, valued at approximately $26.5 million.

This accumulation is noteworthy, especially given that XRP has been moving sideways without significant price movements. Despite the stagnant price action, whales are betting on a potential breakout or long-term growth.

XRP fails to break key resistance levels

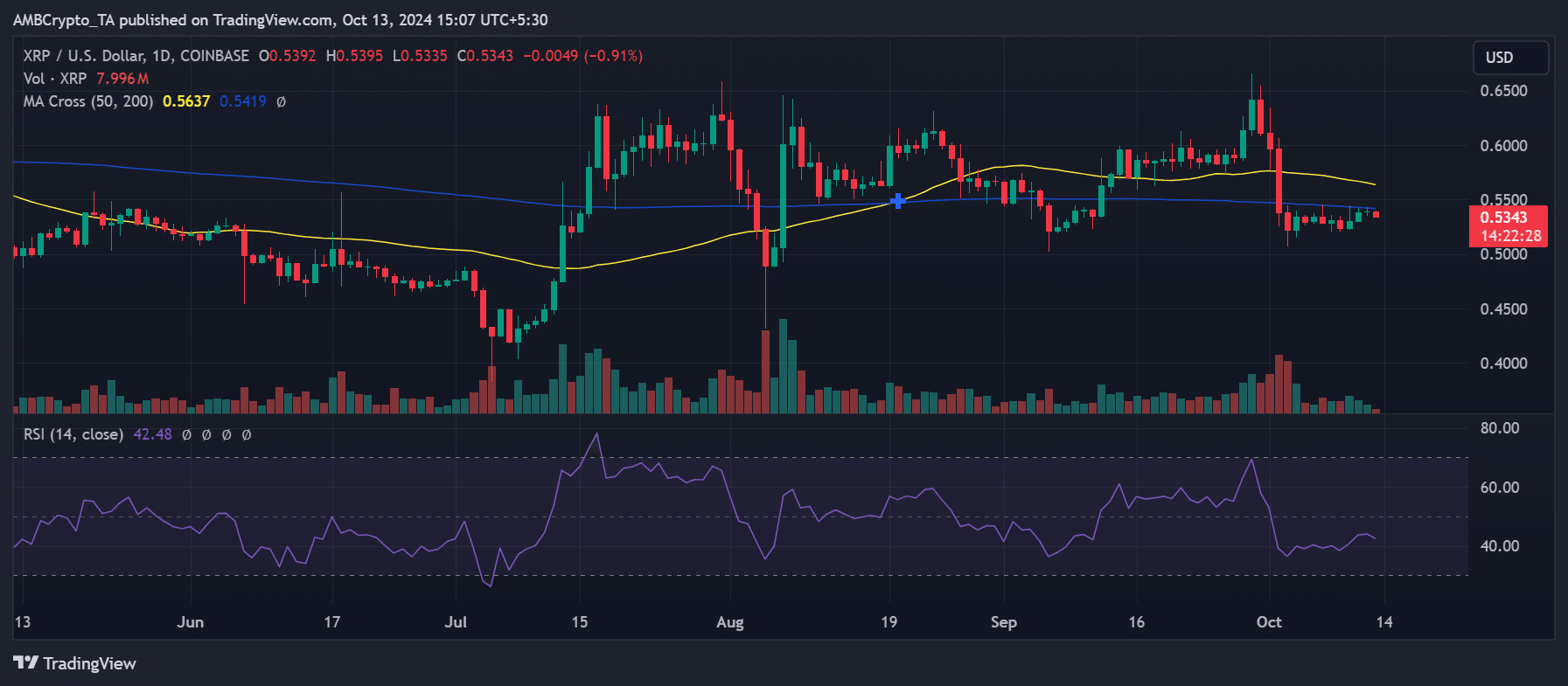

An analysis of Ripple’s daily price trend shows that XRP is struggling to break above its 50-day and 200-day moving averages.

The 50-day moving average (yellow line) acts as a longer-term resistance level, at around $0.56 at press time, while the 200-day moving average (blue line) was at $0.54.

In the last week, XRP experienced some brief uptrends, but they were not strong enough to push the price above the 200-day moving average. The most recent trading session saw XRP rise slightly to $0.53.

However, it failed to sustain this momentum, with the price still hovering around this level as of this writing.

Additionally, Ripple’s Relative Strength Index (RSI) was sitting at 42, indicating a downward trend that was getting closer to the oversold region.

Thus, if the price continues to decline, it could fall further into bearish territory.

More XRP flowing into exchanges

While whale accumulation suggests positive long-term sentiment, the overall market behavior tells a different story.

Recent data from CryptoQuant showed an increasing amount of Ripple being moved into exchanges, signaling that more traders are selling their holdings.

The analysis of inflow and outflow charts reveals that exchange inflows have been nearly double the outflows over the past few days.

Although this typically indicates bearish market behavior, the ongoing accumulation by whale investors provides a counterbalance, suggesting that some traders remain optimistic about XRP’s future potential.

XRP remains trapped below critical resistance levels, struggling to break out of its sideways trend at press time.

Realistic or not, here’s XRP’s market cap in BTC’s terms

At the same time, whales continue to accumulate large amounts of XRP, and the token faces selling pressure from smaller traders, leading to more inflows into exchanges.

As XRP’s RSI approaches the oversold region, monitoring whether whale accumulation can shift the market sentiment and drive a breakout will be crucial.