How Bitcoin’s slight 3% rise caused an Open Interest surge

- Bitcoin’s Open Interest surged to over $19 billion after a $2.5 billion Futures liquidation.

- BTC faces strong resistance at $63,400, with recent price hovering around $62,700 after a 3% rise.

Bitcoin’s [BTC] Open Interest experienced significant volatility following a recent price surge, with several positions being closed.

Despite this, Open Interest in Bitcoin Futures has maintained high levels, and a notable spike has even been seen in recent days, signaling continued trader interest.

Bitcoin Futures experience a shake-up

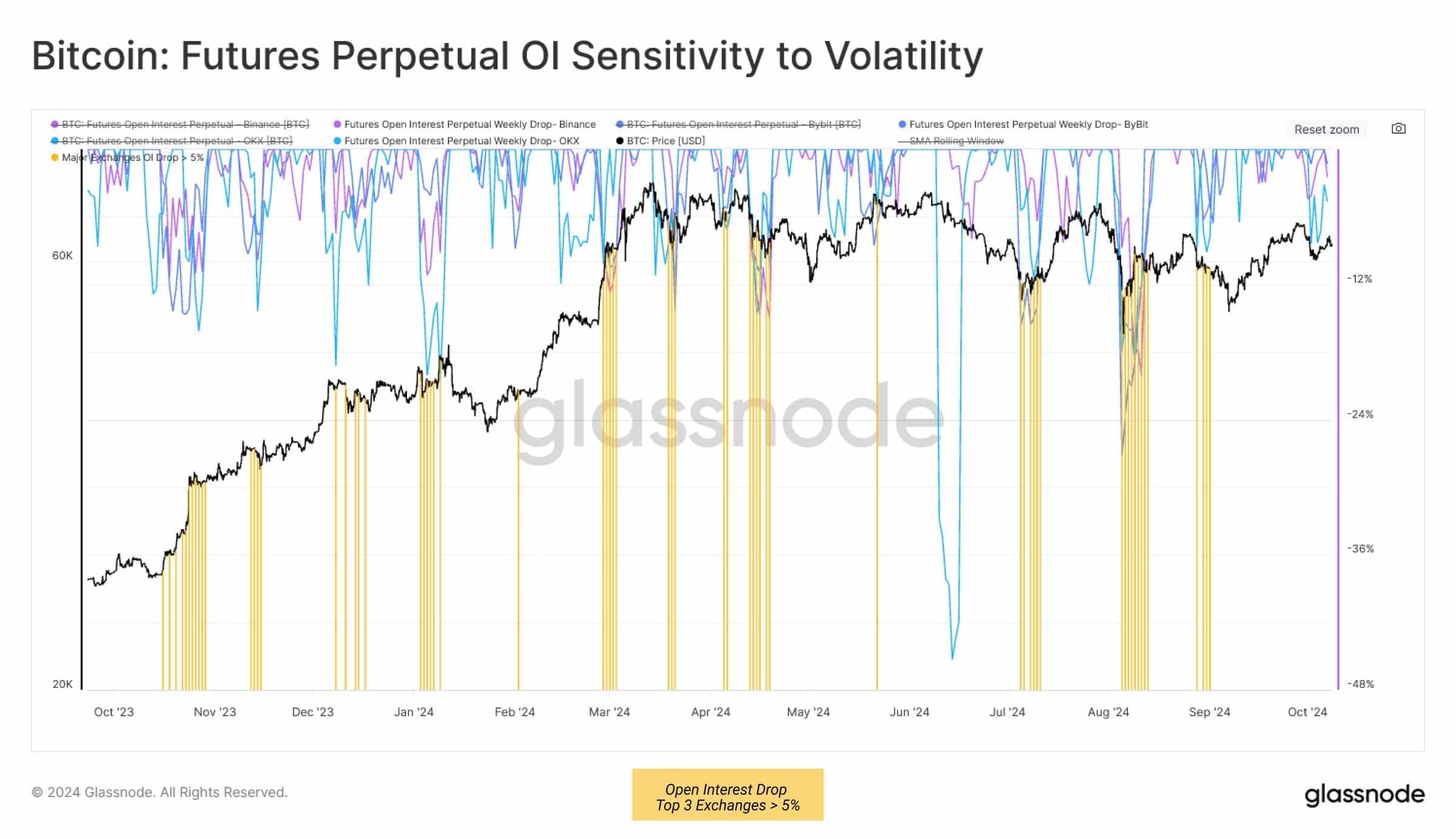

Data from Glassnode revealed that during Bitcoin’s price rally, approximately $2.5 billion worth of Futures Open Interest was forcibly closed, likely flushing out many short sellers.

However, the percentage reduction in Open Interest across the top three perpetual exchanges remained below 5%, indicating that the substantial impact did not lead to a dramatic market collapse.

This highlighted the market’s resilience, which, even amidst heightened volatility, could continue to affect leveraged traders.

Historically, the total cost of leverage during Bitcoin’s March all-time high (ATH) reached as high as $120 million weekly.

This figure has dropped to $15.3 million per week in recent weeks, reflecting a significant reduction in speculative, long-biased trades as the market entered a range-bound phase.

Increased funds flow into Bitcoin’s Open Interest

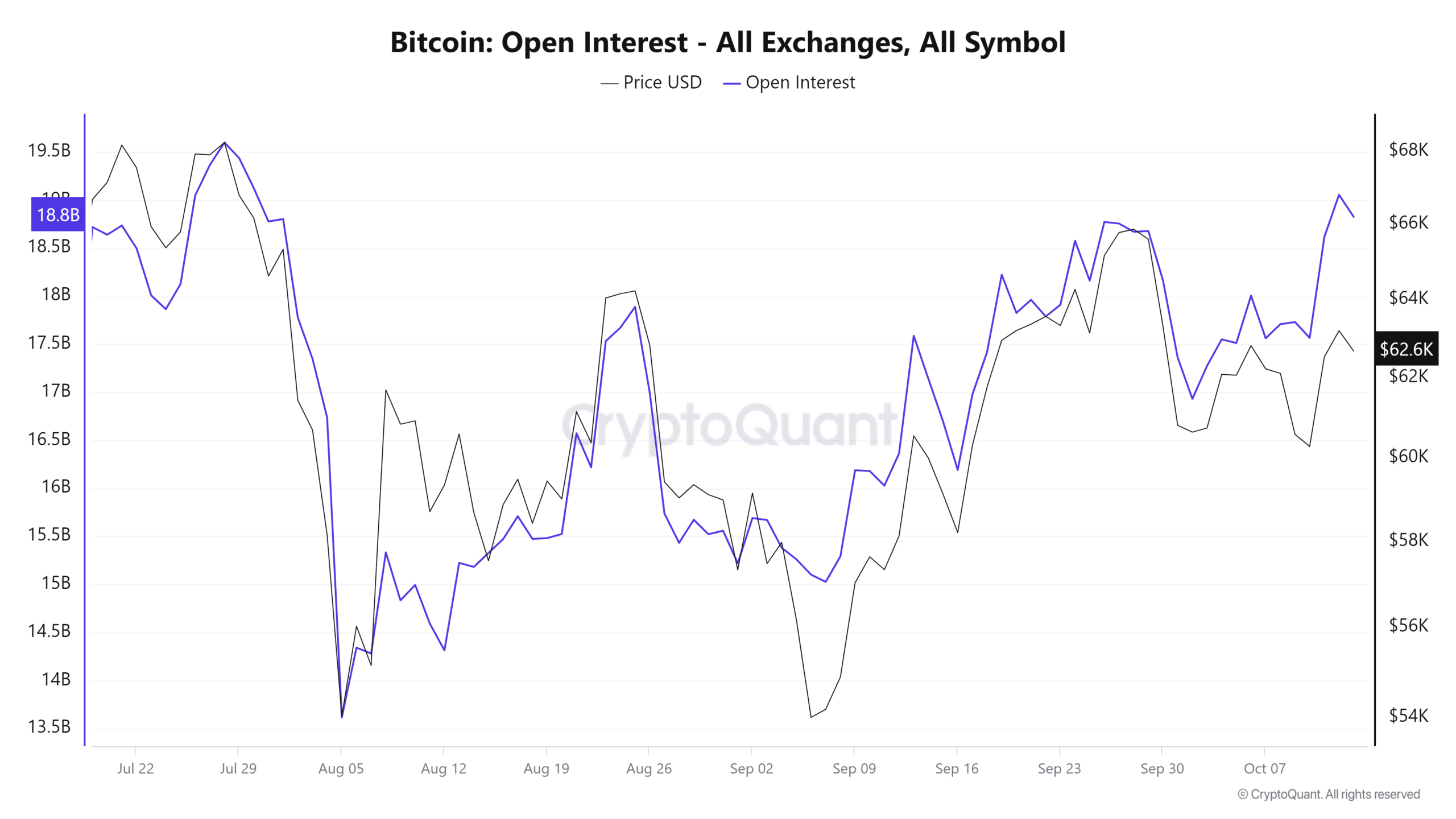

Despite the earlier closures of large positions, traders continue to open new ones.

According to CryptoQuant, Bitcoin’s Open Interest, which was around $17.5 billion on the 10th of October, surged to over $19 billion by the 12th of October.

Although there has been a slight decline since then, Open Interest remained strong at over $18 billion.

This renewed interest from traders is largely attributed to Bitcoin’s recent price increase, which pushed the cryptocurrency above the $63,000 mark.

The rise in Open Interest signals that traders are actively positioning themselves in anticipation of further price movement.

BTC faces resistance at key price levels

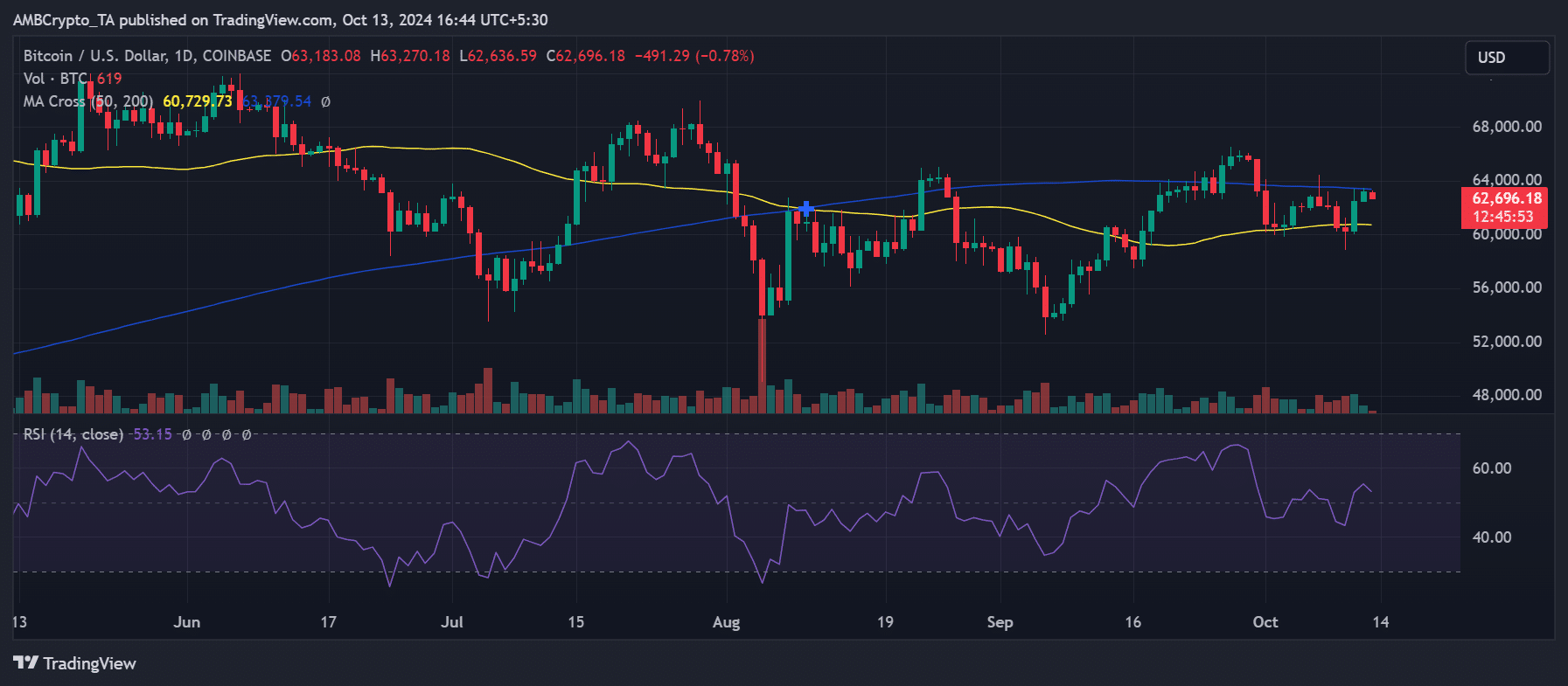

An analysis of Bitcoin’s daily price chart showed that BTC experienced a 3% price increase on the 11th of October, reaching $62,500.

This rally also pushed the price above the 50-day moving average (yellow line), which had previously served as a significant resistance level.

However, Bitcoin was now facing tougher resistance at its 200-day moving average (blue line), positioned around $63,400.

While the recent price surge pushed BTC to around $63,100, the cryptocurrency failed to break through this crucial level.

As of this writing, Bitcoin has slightly declined to $62,700, marking a 1% drop and moving it farther from the resistance.

Despite a period of volatility and the forced closure of billions in Futures Open Interest, Bitcoin’s Open Interest remains strong.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The recent price surge to $63,000 reflects increasing optimism among traders, although it faces strong resistance around $63,400.

The coming days will determine whether Bitcoin can break through this barrier or continue to face challenges at this key price point