Solana’s 20% bullish sentiment: What it tells you about SOL’s next move

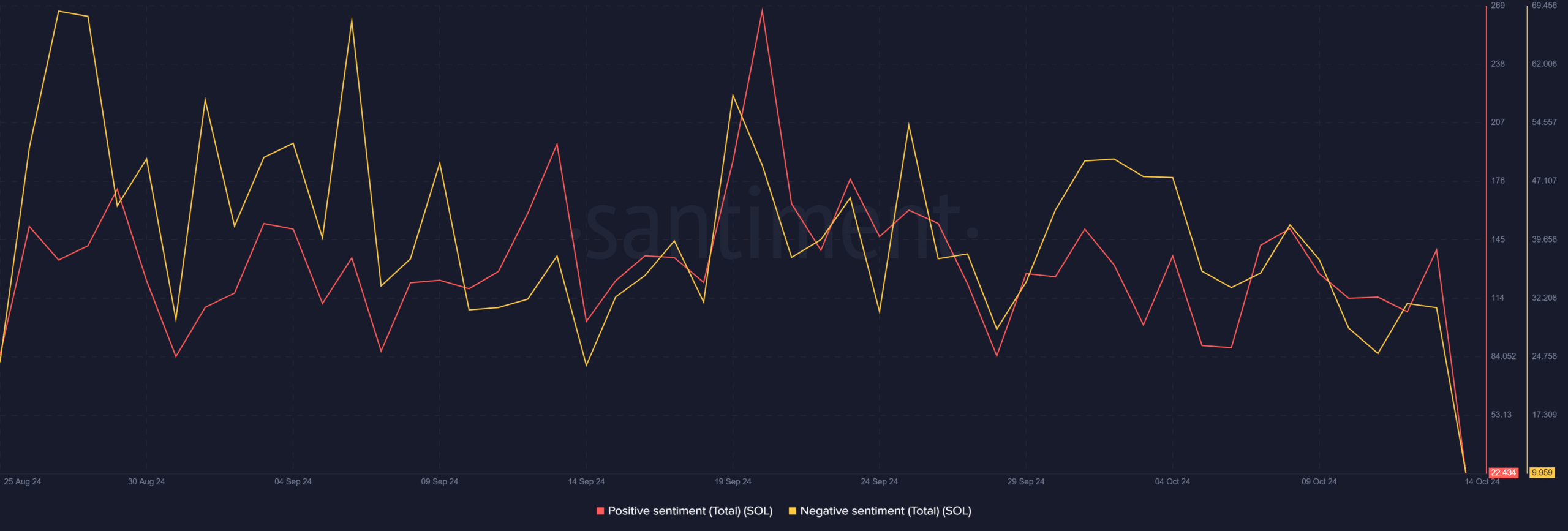

- Solana’s bullish sentiment has reached a nine-month high, with positive sentiment at 20% versus 9% bearish sentiment.

- Solana’s price was nearing key resistance at $151, with trading volume spiking to $1.7 billion in the last 24 hours.

In recent days, Solana’s [SOL] social volume and sentiment charts have shown significant movement, reflecting growing optimism around the asset. These shifts in sentiment have coincided with the rising price of SOL, pushing it closer to breaking a key resistance point.

Solana’s bullish momentum gains strength

According to data from Santiment, Solana traders have been particularly active this week, driving a notable surge in positive sentiment.

The data reveals that bullish sentiment for Solana has reached a nine-month high, with traders posting an average of over five bullish posts for every bearish post across various social platforms.

Further analysis shows that Solana has seen the highest spike in positive sentiment among major cryptocurrencies. While sentiment has cooled slightly, the overall outlook remains strong, with positive sentiment at 20% compared to just 9% for bearish sentiment.

This continued positive outlook suggests growing confidence among investors, fueling the current price trends.

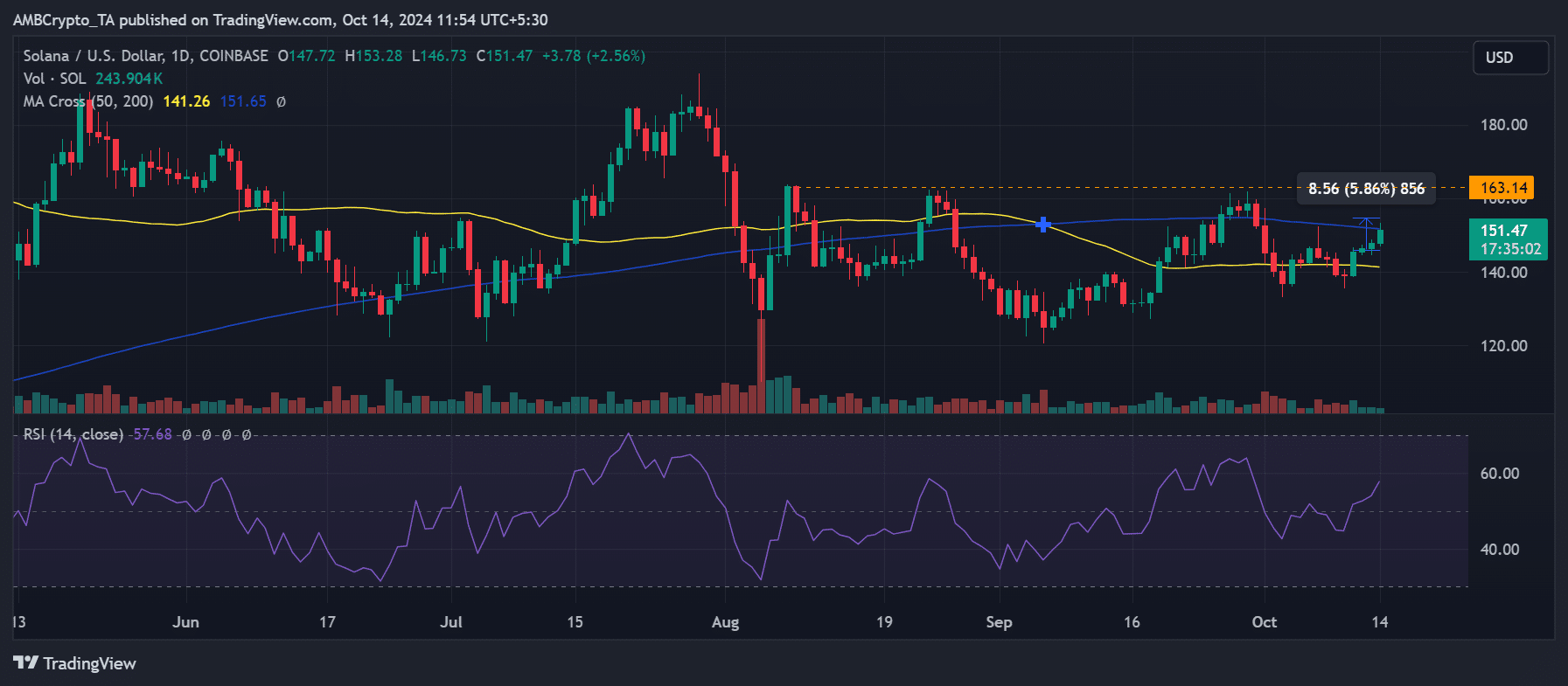

Solana prepares to break resistance

Solana’s recent price performance has been a major driver of its bullish sentiment. Over the past four days, SOL has consistently posted positive gains, with its price moving closer to breaking an immediate resistance level.

If it manages to break this resistance, it will have successfully crossed two key barriers in just a matter of days.

As of this writing, Solana is trading at approximately $151.2, reflecting an over 2% increase in the last 24 hours. Over the past four days, SOL’s value has increased by more than 5%.

The 200-day moving average (blue line) is currently acting as resistance, but Solana is already beginning to breach this level. Should it break through, the next major resistance level is at $160.

For months, the $160 level has proven to be a tough barrier, with SOL’s price repeatedly bouncing off it. However, if the current momentum continues, it may finally break through this long-standing resistance.

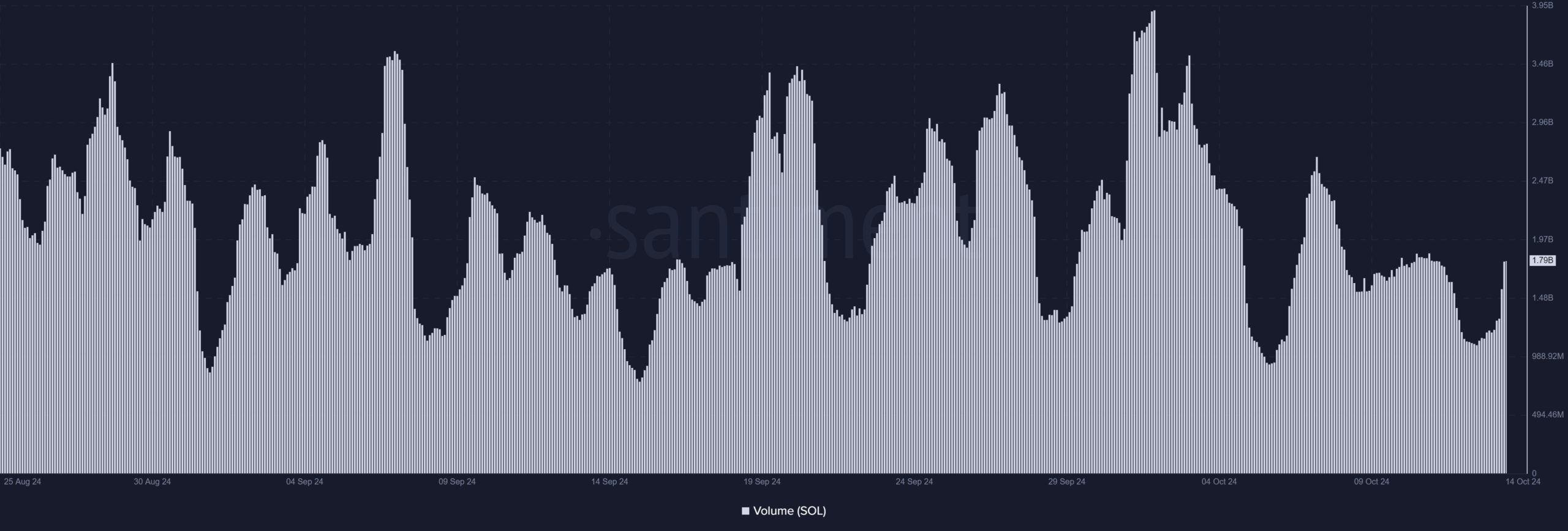

Trading volume spikes alongside bullish sentiment

In addition to rising sentiment, Solana’s trading volume has surged in the past 24 hours. Current data shows that trading volume is now around $1.7 billion, up from $1.3 billion in the previous session.

Is your portfolio green? Check out the Solana Profit Calculator

This increase in trading volume coincides with the spike in bullish sentiment, indicating that more investors are entering the market.

Increased trading activity often signals the potential for larger price movements, suggesting that Solana could be poised for further gains shortly.