FET: Will whale activity fuel bullish momentum?

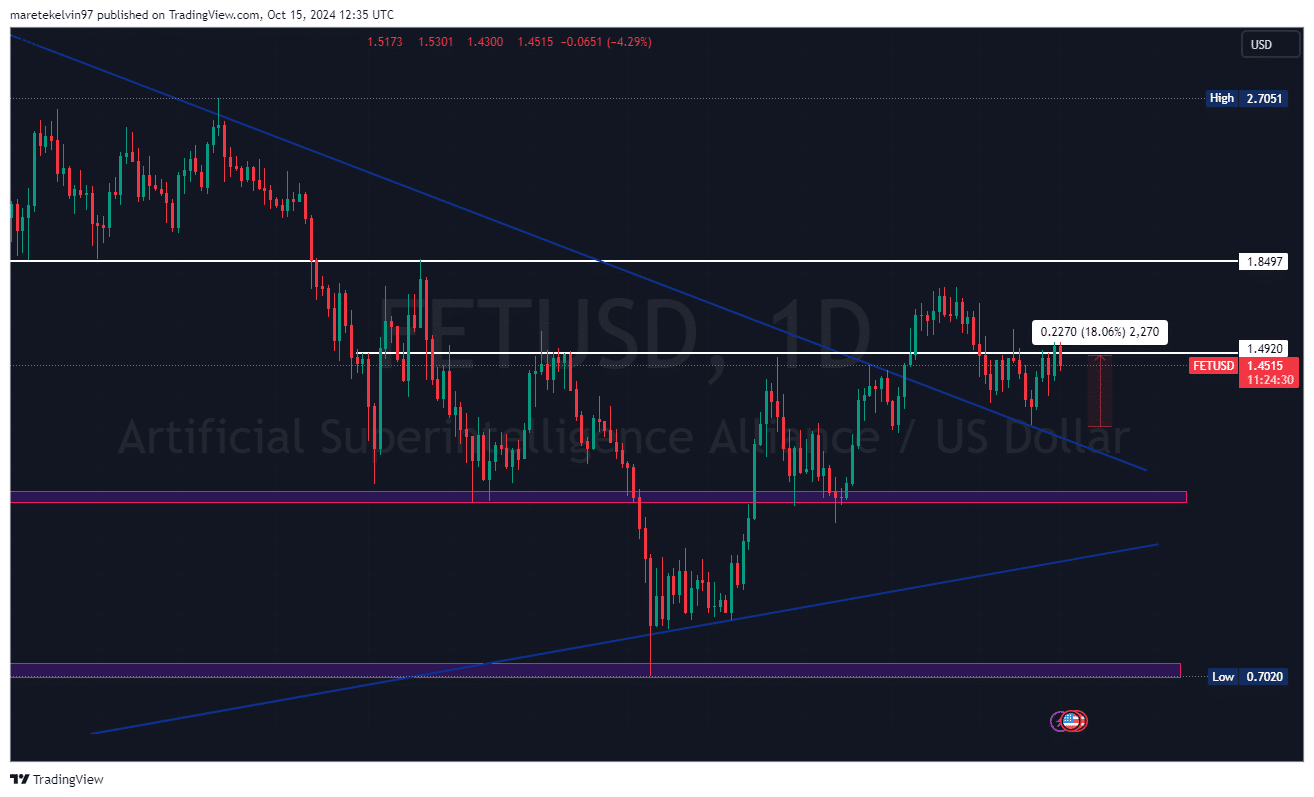

- FET surged 18% after breaking out of a symmetrical triangle at $1.2572.

- Large transactions have spiked by 135%, pointing to increasing whale activity on the network.

Artificial Superintelligence Alliance Price Prediction [FET] has had an incredible uptick recently. After breaking out from a symmetrical triangle resistance level at 1.2572, FET surged by 18%.

This also managed to break the key resistance level at $1.492, underscoring the market’s strong bullish sentiment.

AT press time, the token was hovering around another critical resistance level at $1.4954. This movement makes the market participants wonder whether the token has enough momentum to be able to push higher.

Increased whale activity

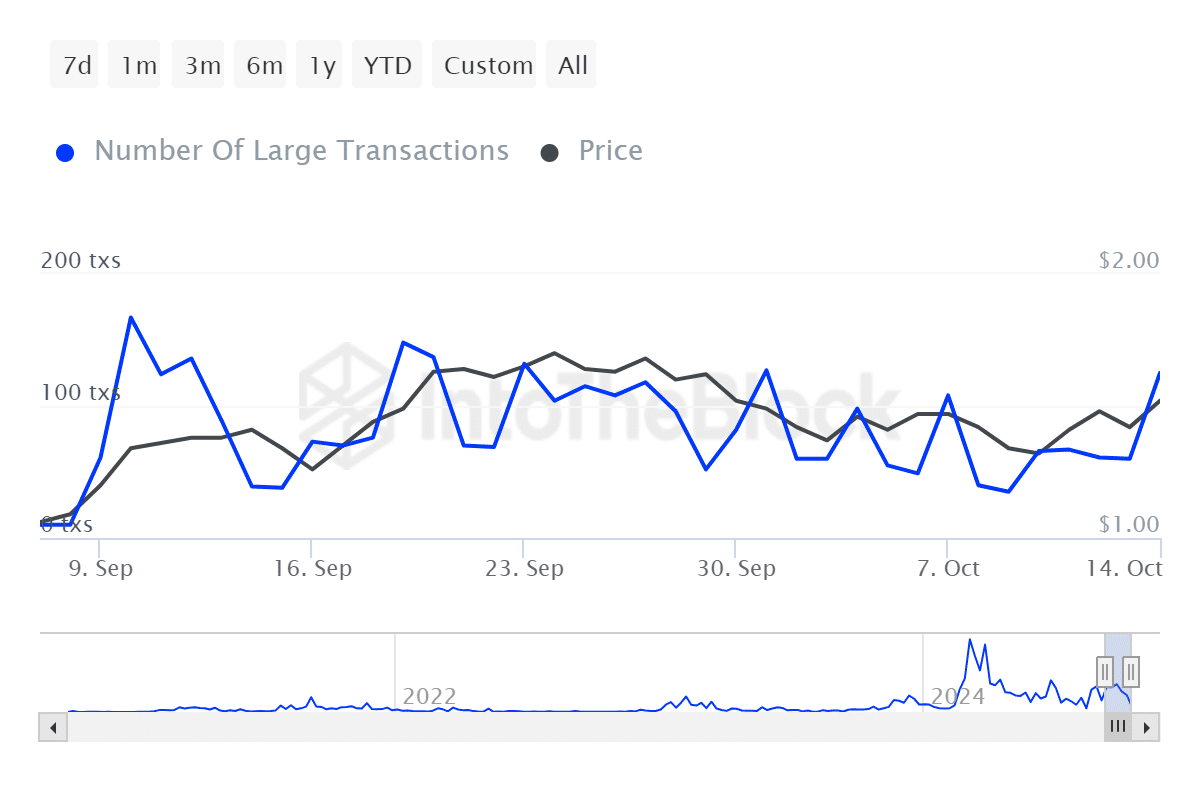

Backing FET’s price surge are encouraging on-chain metrics. Large transactions on the FET network are up 135%, indicating heightened whale activity.

Spikes in high-value transactions indeed signal that some big players are accumulating or circulating tokens, which could lead to price momentum.

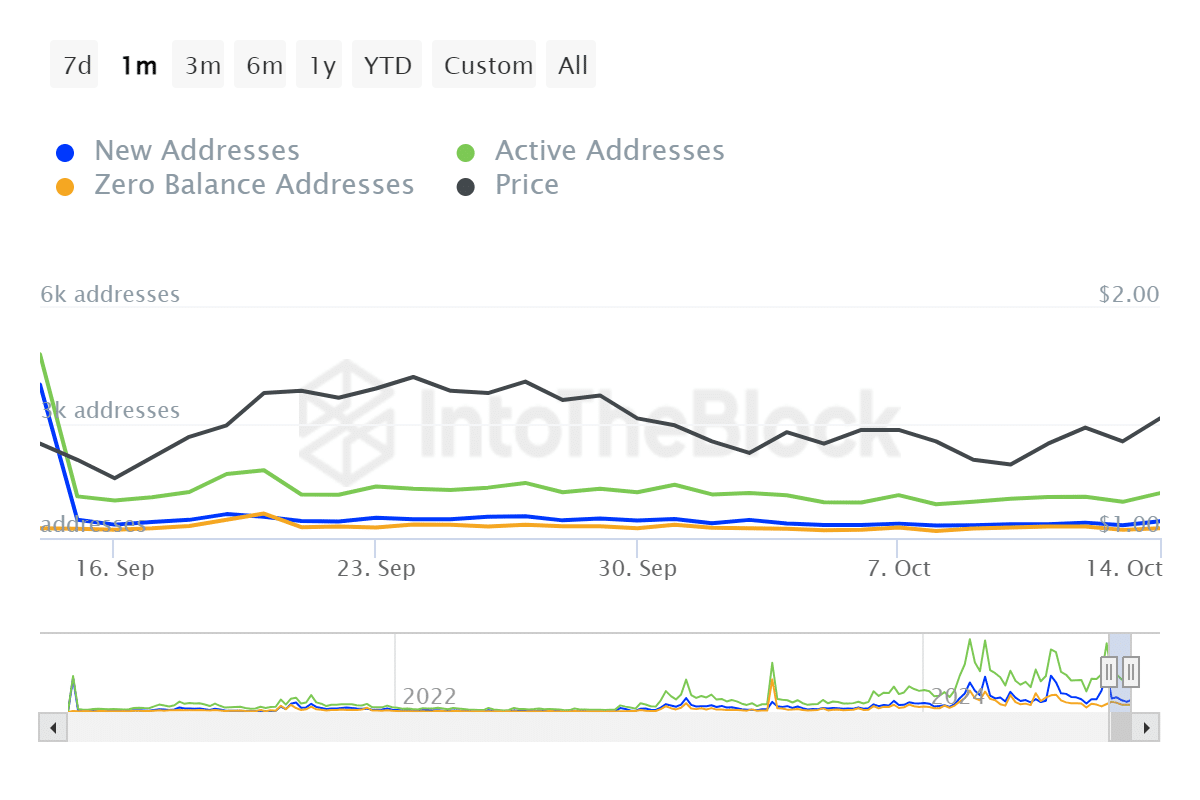

Adding to the aforementioned increase in whale activity, the number of active addresses spiked 24% too. This indicates heightened interest and participation of addresses on the network.

Although this portrays a good indication of the market strength for FET, the rise in whale activity and network engagement has come with it.

FET tests key resistance level

While this price movement was accompanied by increased trading activity, at press time, FET was testing a key resistance level at $1.4954.

A break above that might be the key going forward that keeps the token’s uptrend intact.

Increased whale activity and a growing number of active addresses indicate that FET might have the momentum to break above this resistance, thus signaling further gains in its price.

Read Artificial Superintelligence Alliance’s [FET] Price Prediction 2024–2025

If the asset manages to close above $1.4954, it could pave the way for continued upward momentum towards a new all-time high, driven by strong on-chain metrics.

However, a failure to break higher may result in a consolidation phase.