Cardano: What ADA needs to break out of the ‘neutral’ zone

- ADA was nearing a breakout from a symmetrical triangle, with technical indicators showing indecision.

- On-chain signals show mixed sentiment, but social dominance could play a pivotal role in ADA’s breakout.

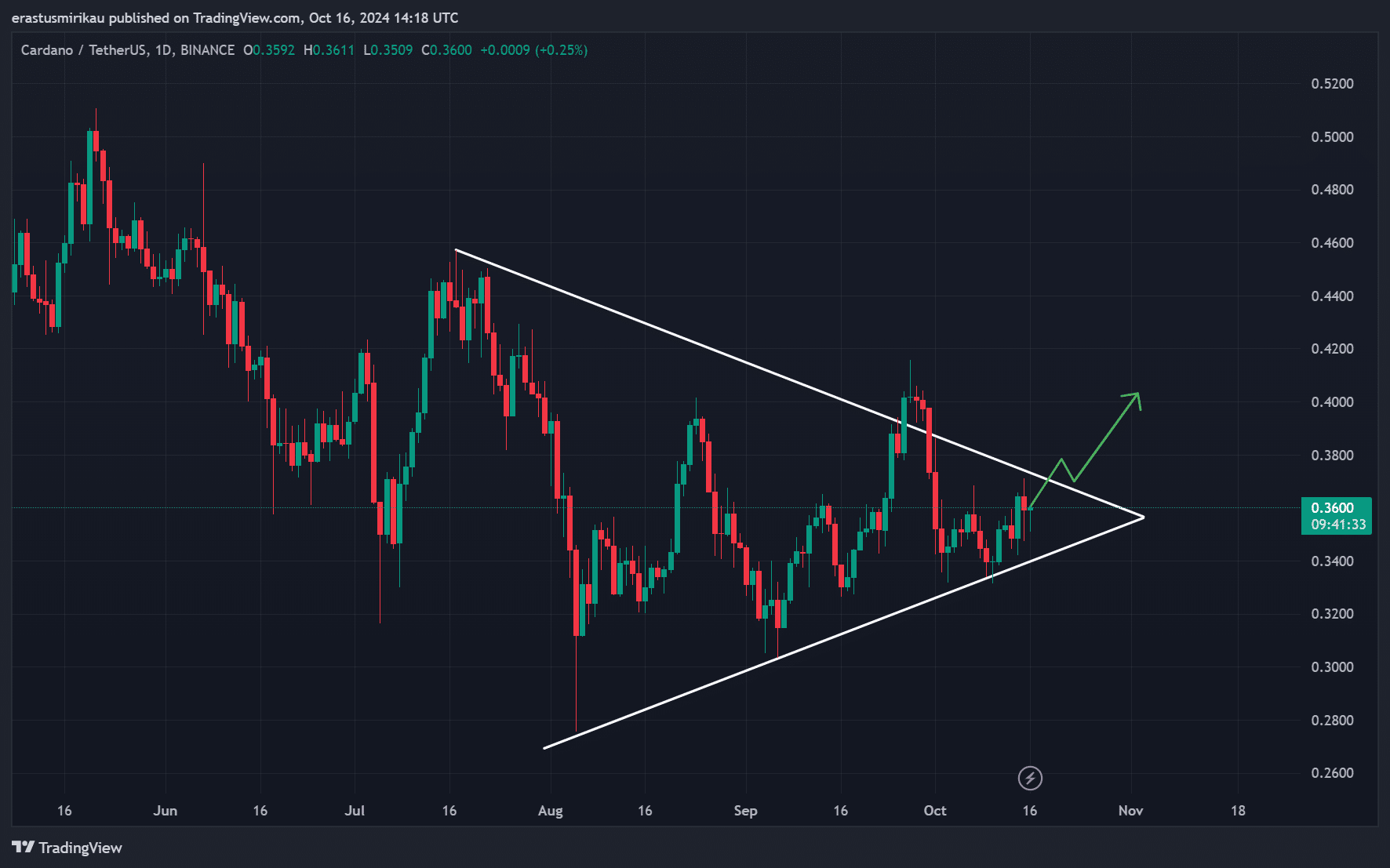

Cardano [ADA] is nearing a crucial point as it hovers just below a symmetrical triangle pattern on its 1-day chart. This technical formation indicates that a sharp price move is imminent, as ADA trades at $0.3585, down 0.80% at press time.

The key question remains: can ADA generate enough bullish momentum to break out to the upside and rally?

Cardano’s symmetrical triangle formation suggests a major price shift is on the horizon. The price is consolidating within the triangle, signaling indecision in the market. ADA is trading near the $0.3600 mark, which is critical.

A breakout above the resistance line could propel ADA higher. However, the coin needs significant volume to confirm this bullish breakout and overcome potential selling pressure.

Breaking down the technical indicators

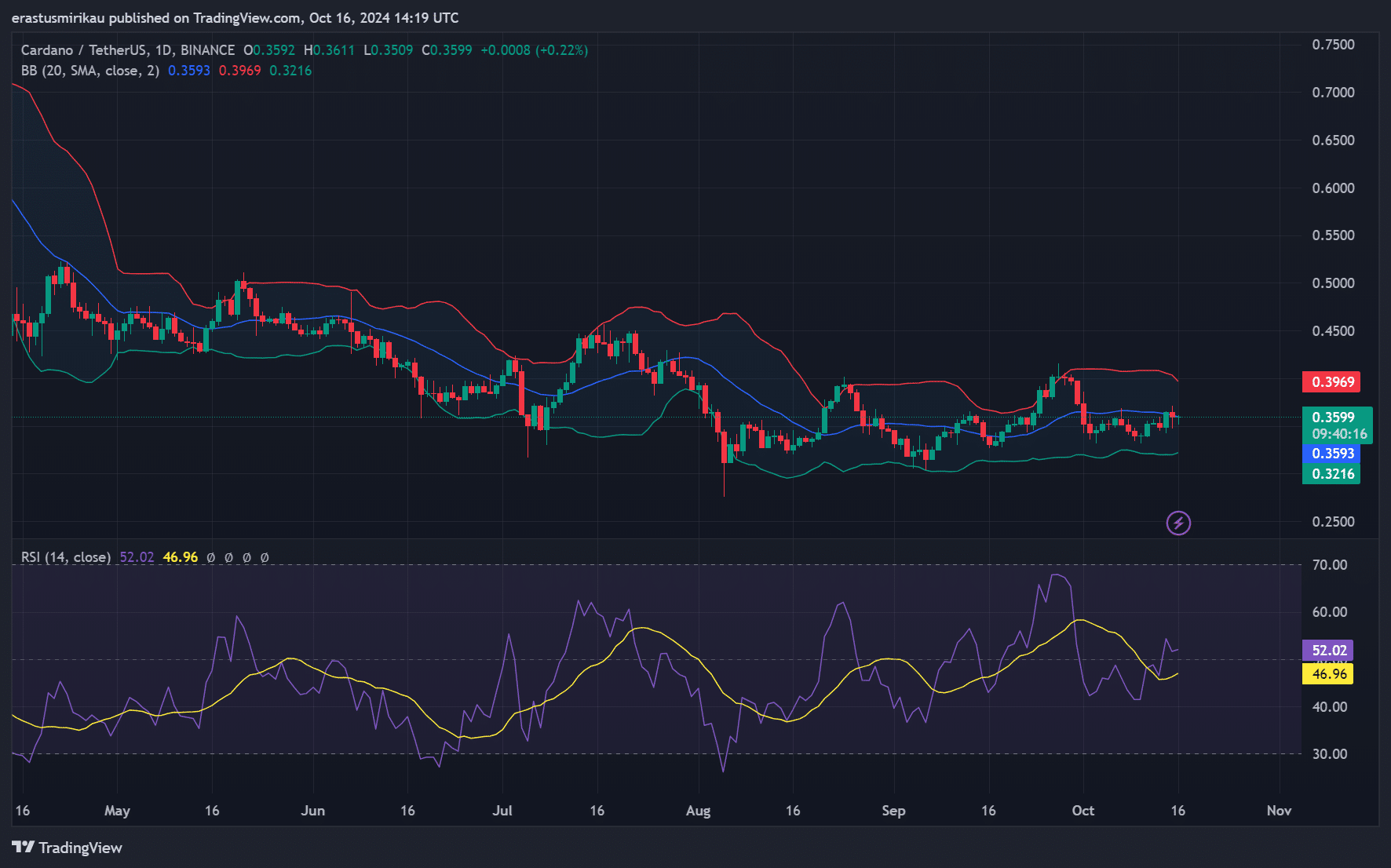

Several key technical indicators show the market’s indecision. The Relative Strength Index (RSI) is at 46.96, placing ADA in neutral territory. This suggests that the market lacks strong directional bias.

Additionally, the Bollinger Bands are narrowing, signaling decreasing volatility.

ADA currently trades near the middle of the bands, with the upper band at $0.3969 acting as resistance. For a bullish breakout to be confirmed, the RSI must climb above 50 and buying momentum should increase, consequently pushing the price past key resistance levels.

On-chain signals: Mixed or clear direction?

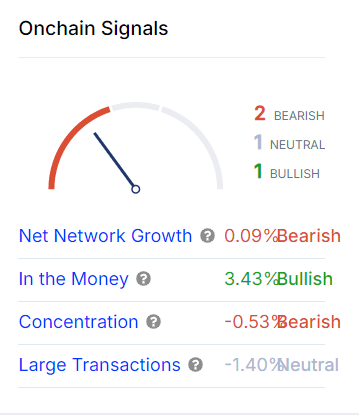

On-chain data paints a mixed picture. Net network growth is slightly positive at 0.09%, but this slow expansion is a bearish signal. Additionally, concentration levels are down -0.53%, indicating large holders are decreasing their positions.

However, there’s a silver lining in the “In the Money” metric, which shows 3.43% of ADA holders are profitable, offering a slightly bullish outlook. Furthermore, large transactions remain neutral at -1.40%, signaling that whale activity is neither bullish nor bearish.

Will ADA’s social dominance push it higher?

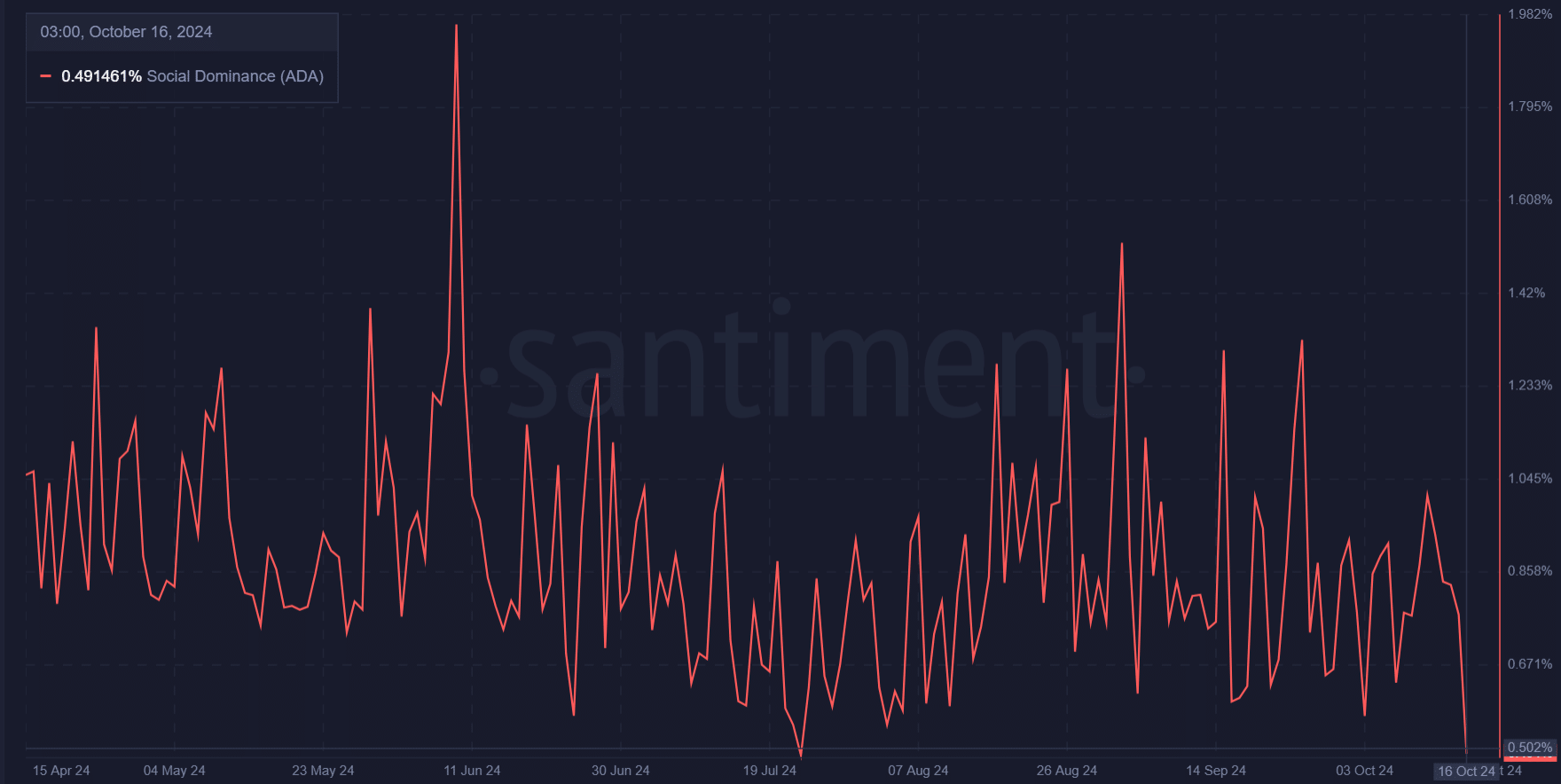

Cardano’s social dominance, currently around 0.491%, reflects moderate community interest. This level of social attention is crucial because significant price moves often correlate with increased social discussions.

Therefore, a spike in Cardano’s social dominance could drive greater market interest, helping to fuel a breakout. However, ADA will need more sustained social buzz and large-scale buying to truly capitalize on this technical setup.

Read Cardano’s [ADA] Price Prediction 2023-24

Cardano is at a critical juncture. While the technical setup suggests a breakout is near, Cardano will need significant buying momentum to overcome key resistance levels.

Mixed on-chain data adds uncertainty to the equation. However, if Cardano can rally in both social and market sentiment, a breakout could push the price higher in the coming days.