Injective’s INJ pumps by 16% after Upbit listing – Here’s what’s next!

- INJ pumped by double-digits following its Upbit listing

- Will the update help INJ to break its downtrend?

On 17 October, Injective [INJ] saw a wild 16% pump immediately after Korea’s largest crypto exchange, Upbit, announced its listing on the platform. The token surged from $20 to $23, partly boosted by a massive 112% uptick in daily trading volume.

Although the pump had slightly waned as of press time, the listing is crucial given the impact the Upbit listing had on cats in a dogs world (MEW).

For perspective, MEW was launched in March and was listed in several exchanges, including Bybit and OKX. However, Upbit’s listing in September triggered a wild run for the cat-themed memecoin.

The explosive pump happened because the exchange is Korea’s largest crypto trading platform. Hence, the question – Will INJ follow MEW’s steps?

Will the uptrend continue?

Whether INJ’s uptrend will extend after the listing remains to be seen. However, the price move after the update was triggered by Futures market speculators, rather than the spot market.

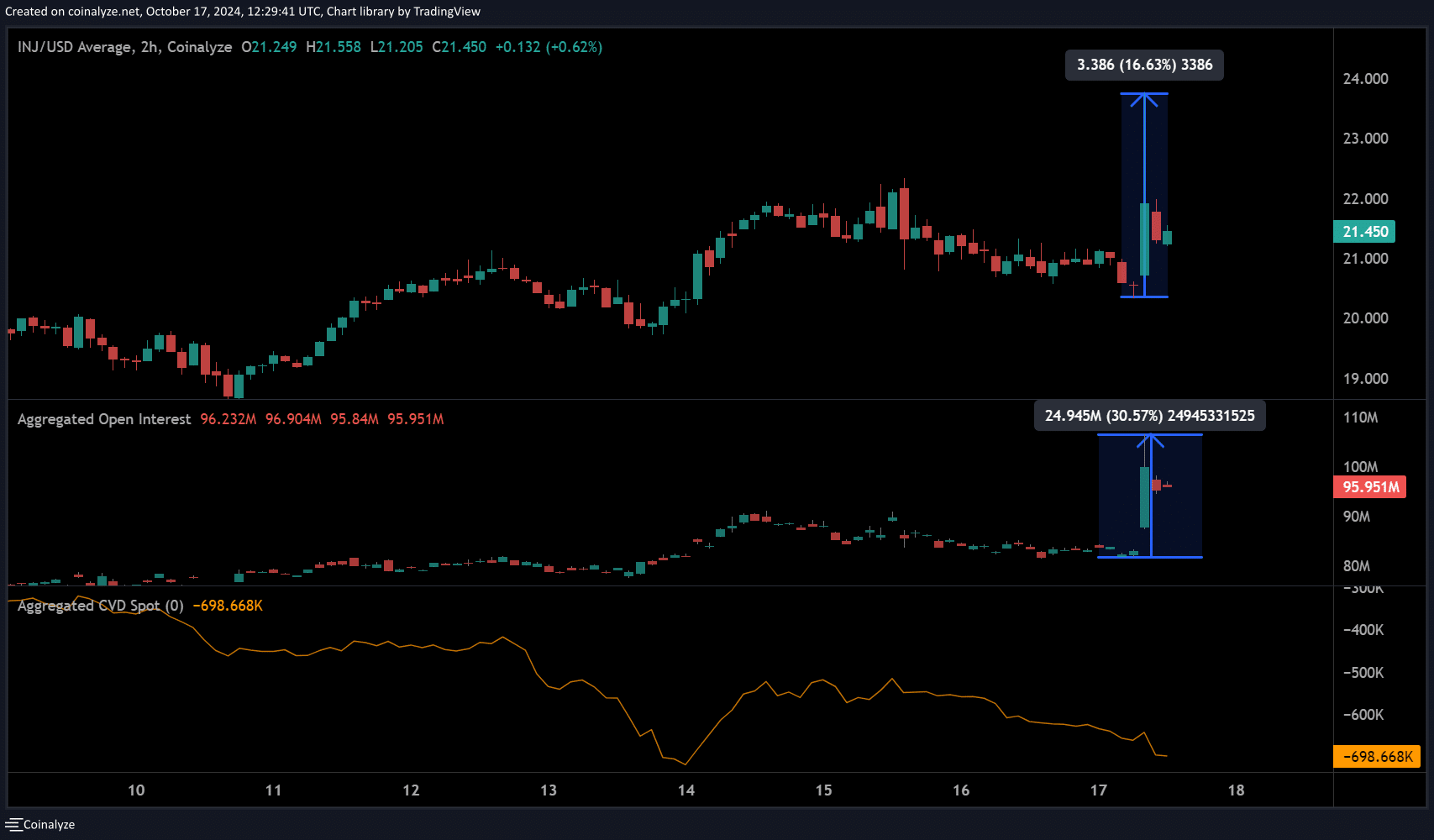

According to Coinalyze data, the upswing saw over 15 million INJ Open Interest added on the Binance exchange.

This meant that the explosive rally was led by leveraged traders as spot demand remained muted, as shown by the low spot CVD (cumulative volume delta).

For context, CVD gauges the buying and selling volumes across exchanges, and the decline indicated that selling volume (sellers) was dominant.

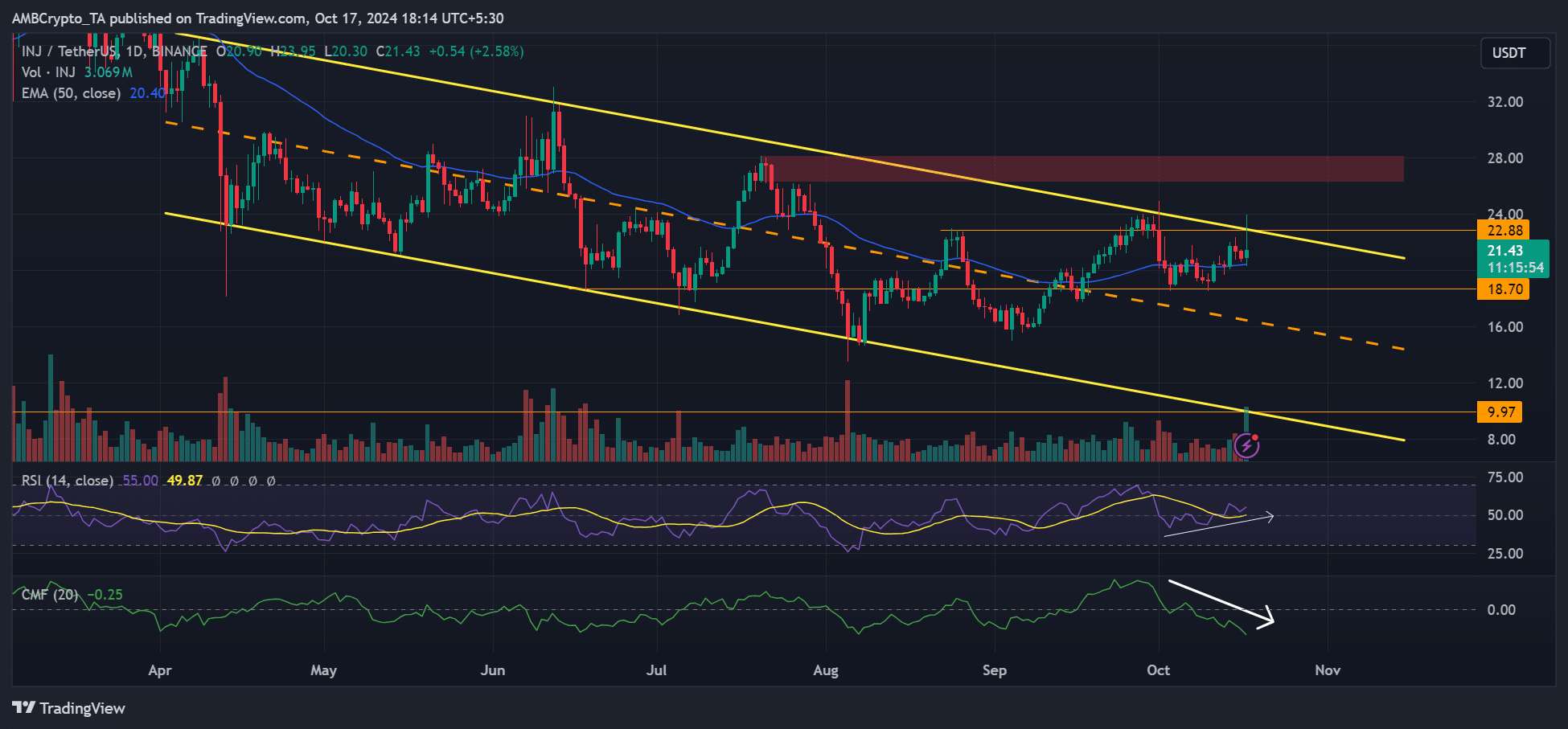

On the higher timeframe charts, Thursday’s pump reinforced INJ’s bullish market structure. Especially as it has been making higher lows and higher highs in October.

The rally tapped the range-high of the descending channel (yellow). However, the pump didn’t decisively break the downtrend structure.

Although INJ could front a breakout, it has faced massive outflows from its market since late September. This was indicated by the southbound Chaikin Money Flow (CMF). Low capital inflows could delay the breakout prospects.

However, at press time, INJ defended the 50-day EMA as support and could attempt another upswing from the level. If so, $24 or $28 could be the next target, especially if bullish momentum extends over the next few days.

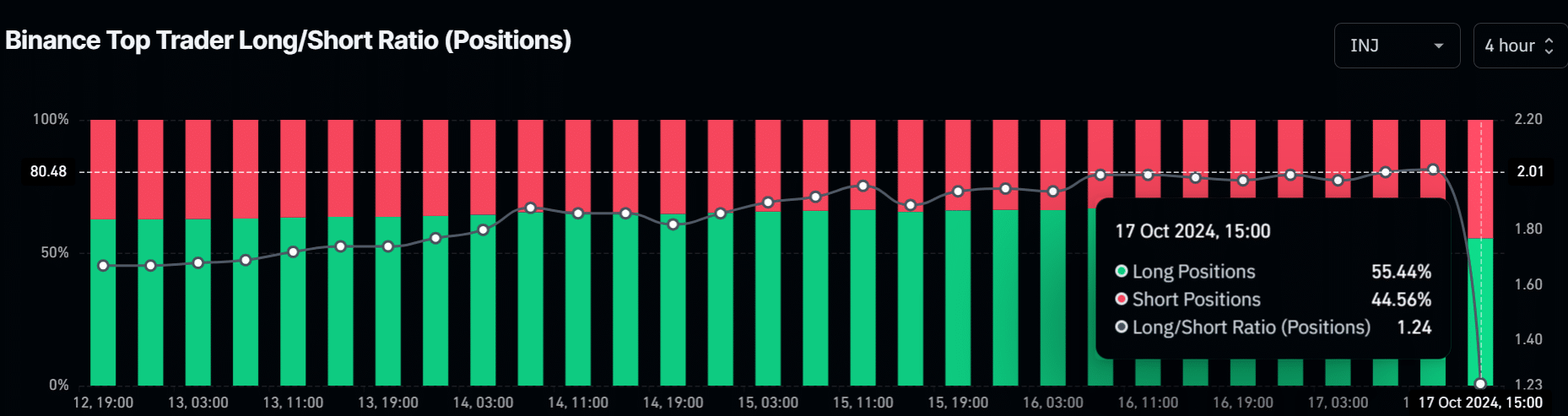

It’s worth noting, however, that the smart money on Binance was net long on the token, with 55% of positions betting on INJ’s price upside.