XRP’s next move – Will its upcoming golden cross trigger another hike?

- Investors seemed to be buying XRP as its exchange outflows spiked

- Altcoin will face resistance at $0.55 if it heads north

XRP has been consolidating somewhat over the past week, with its price chart seeing minimal volatility lately. However, there are chances its market trend might change in the coming days.

Now, does this mean XRP bulls are preparing for a rally?

XRP awaits a golden cross!

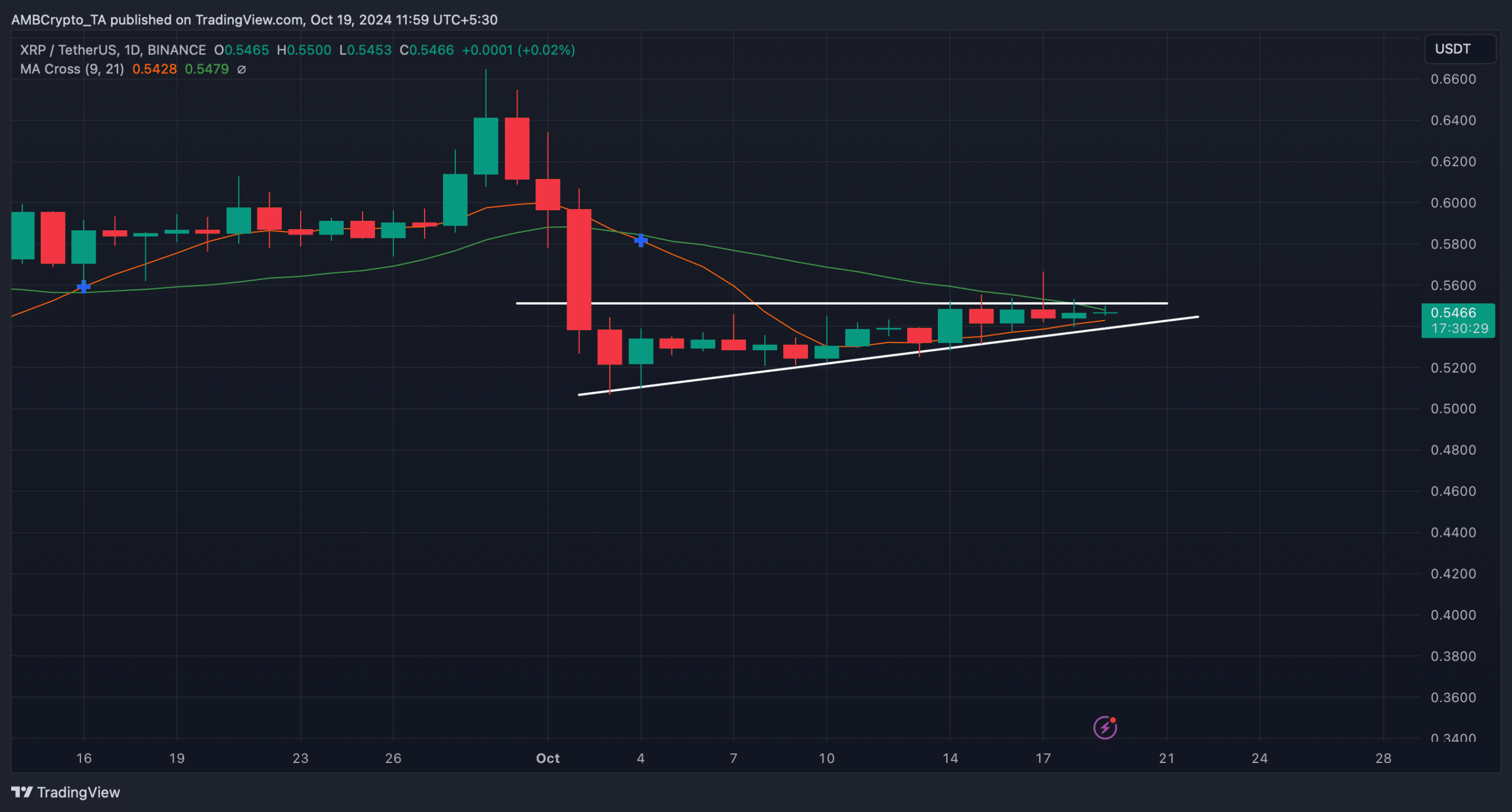

XRP, the world’s seventh largest crypto at press time, only managed to move marginally in the last 24 hours. The altcoin was trading at $0.5474 on the charts. However, things can soon turn bullish for the crypto. This seemed to be the case as according to AMBCrypto’s analysis, XRP seemed to be awaiting a golden crossover, as suggested by the MA cross technical indicator.

Whenever a golden cross happens, it means that the chances of a price hike are high. Apart from the crossover, we also found an ascending triangle pattern on the token’s daily chart.

A breakout above that mark could kickstart a major bull rally.

Hence, it’s worth checking XRP’s on-chain data to properly assess the likelihood of a bullish breakout or a golden cross.

What to expect from XRP?

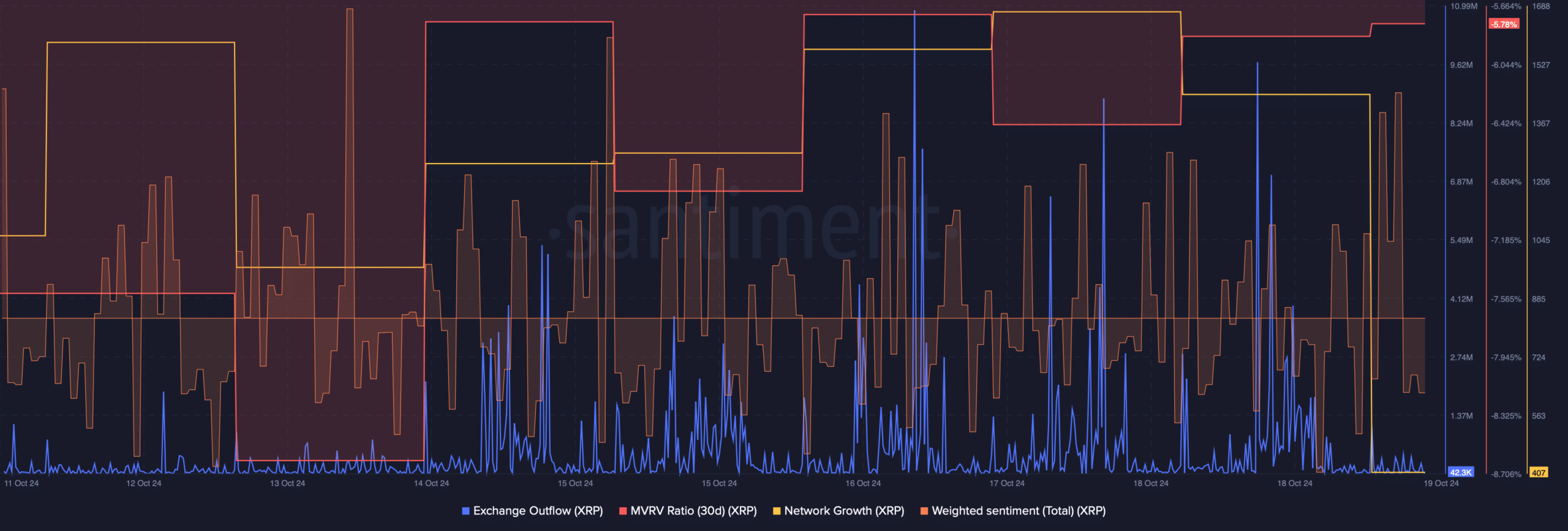

Our assessment of Santiment’s data revealed that XRP’s weighted sentiment remained primarily in the positive zone. This meant that bullish sentiment around the token was dominant across the market.

Other metrics also looked bullish as they hinted at a price hike. For instance, the MVRV ratio improved considerably.

XRP’s network growth was high, meaning that more addresses were created to transfer the token. On top of that, XRP’s exchange outflows rose. A hike in this metric means that buying pressure is climbing too. This often results in price upticks on the charts.

Another optimistic metric was revealed when we checked Coinglass data. We found that the token’s long/short ratio rose over the past few hours. This indicated that there were more long positions in the market than short positions – A bullish development.

A few other technical indicators on the price chart also alluded to a successful bullish breakout in the coming days.

For instance – The MAC displayed a clear bullish advantage in the market. However, the bears might as well take control of the market as the token’s Money Flow Index (MFI) registered a downtick.

Read XRP’s Price Prediction 2024–2025

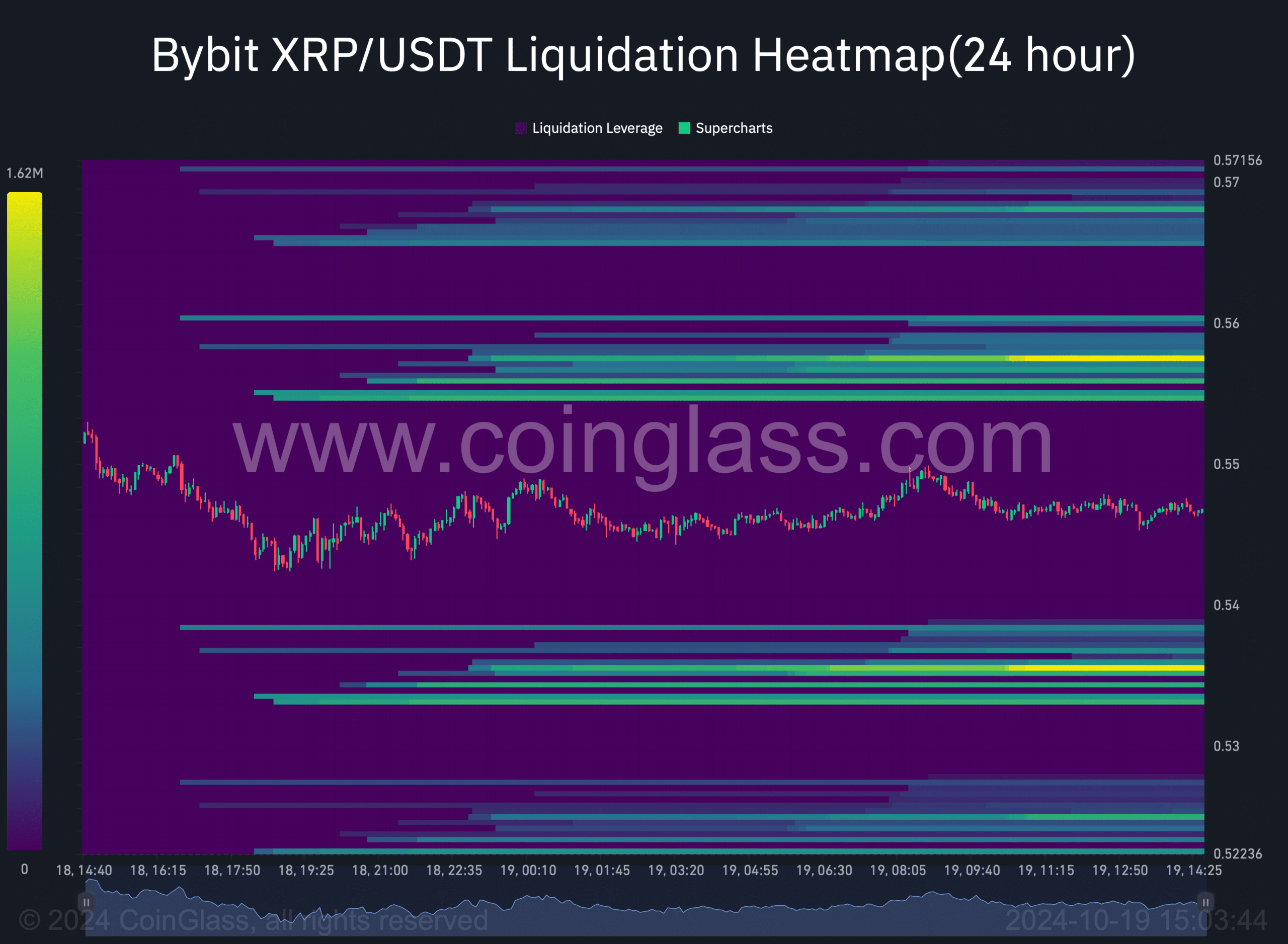

Finally, we checked XRP’s liquidation heatmap to look for any resistance levels ahead in case of a bullish breakout.

As per our analysis, if a bullish breakout happens, then it will be crucial for the token to go above $0.55. This was the case as liquidations will rise sharply at that level. However, if the bears take over, then XRP might fall to $0.53 in the short term.

![Ethereum [ETH] ETF gets a boost with $500 mln inflows in 2 days - What's next?](https://ambcrypto.com/wp-content/uploads/2024/12/News-articles-FI-Samyukhtha-23-400x240.webp)