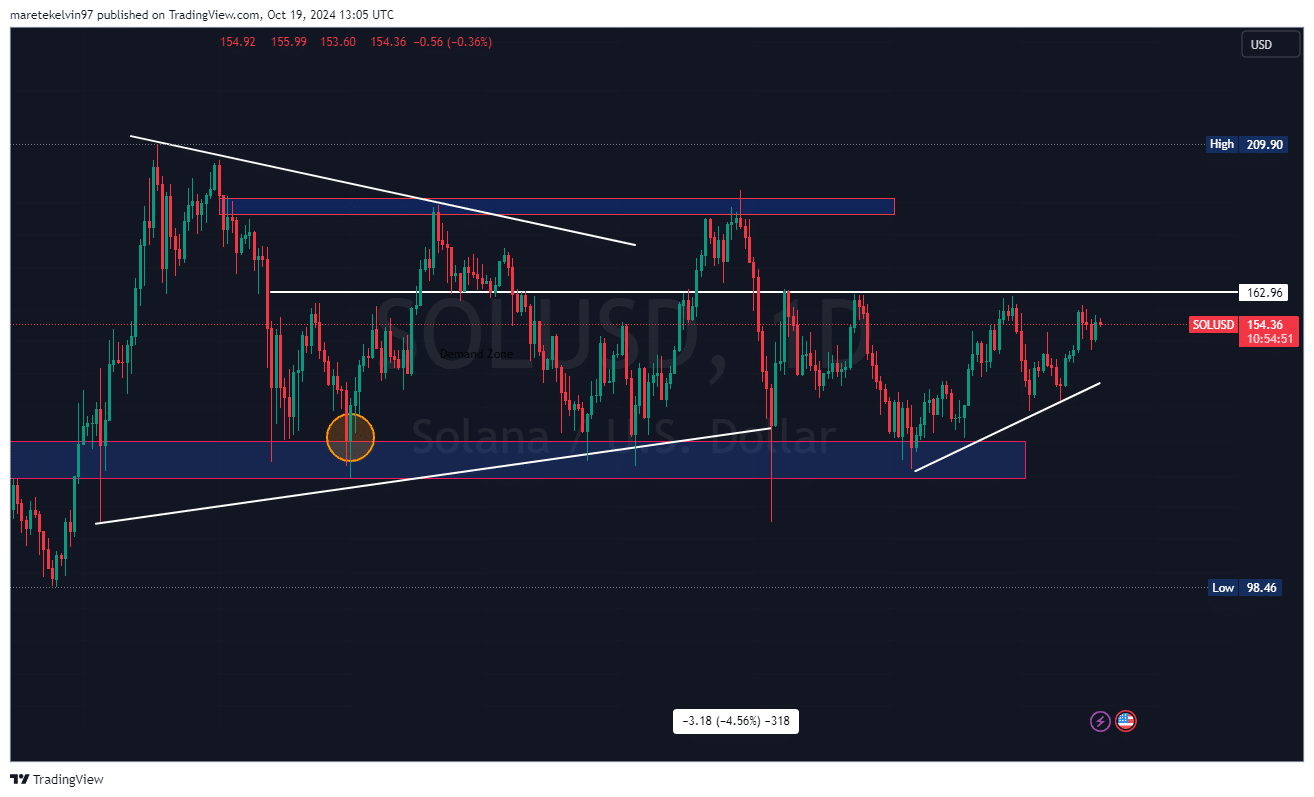

Solana: Assessing if SOL can successfully cross the $160 level

- Solana was consolidating at $154 after a 6% rise.

- Whale activity and social dominance rose, but a 51.96% short position ratio suggested market caution.

Solana [SOL] has witnessed an impressive bullish run, gaining over 6% this week. The altcoin even closed above its previous weekly high, driving optimism among market participants.

As of writing, the altcoin was consolidating at $154, building bullish momentum. Many analysts believe that this is the calm before the storm, as SOL inches ever closer to testing the key $160 resistance level.

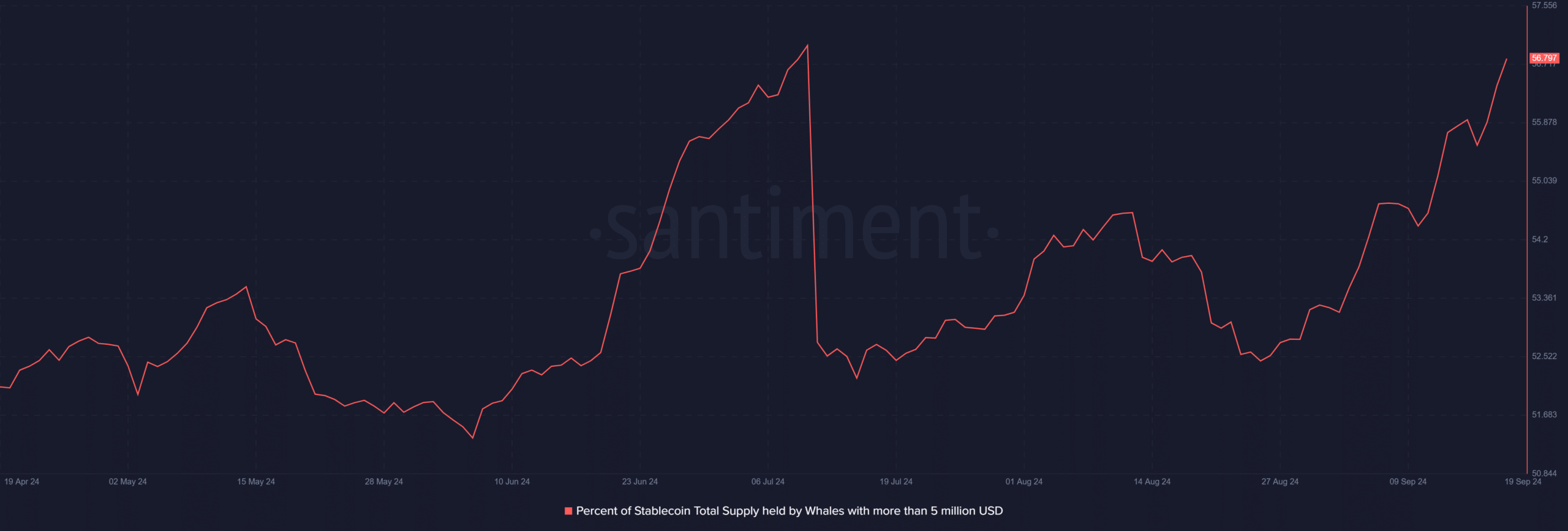

Solana whales on the move

One of the key factors driving Solana’s bullish run is whale activity. AMBCrypto analysis on the Santiment data indicated that whales holding more than 5 million SOL owned 56.80% of the supply at press time.

This increased involvement by large holders is typically seen as a positive sign for upward price movement.

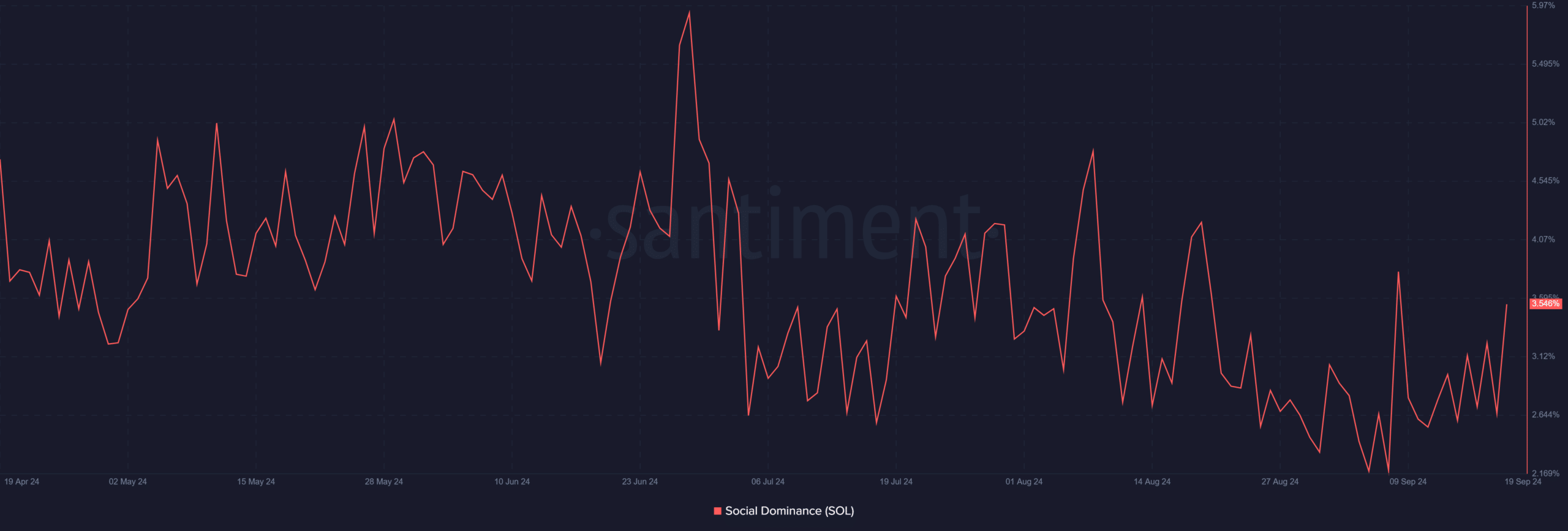

Social mentions pushes Solana to the forefront

Social media buzz added to the aforementioned market sentiment, with Solana leading the pack. The altcoin’s Social Dominance has jumped to 3.72%, indicating the immense attention the altcoin attracts.

In most cases, this rise in social chatter implies the increased interest of both retail investors and institutions alike, supporting a bullish breakout.

Bears are slightly gaining control

Despite the positive outlook, the Solana Long/Short Ratio is highly conservative. According to Coinglass, 51.96% of market participants were going short at press time, an indication of high skepticism in the market.

This could mean that while the majority are optimistic of Solana’s future, there are still concerns about its ability to break the $160 resistance.

Read Solana’s [SOL] Price Prediction 2024–2025

With whales getting more active and social dominance on the rise, Solana does look set for further uptick.

However, the fact that over half of market participants are still holding short positions shows caution is still in order.