Is DOGE at risk? Analyzing the $25M Dogecoin sell-off!

- Dogecoin experienced a 1.4% decline following a large sell-off but quickly bounced back with a 4% rise, trading around $0.148.

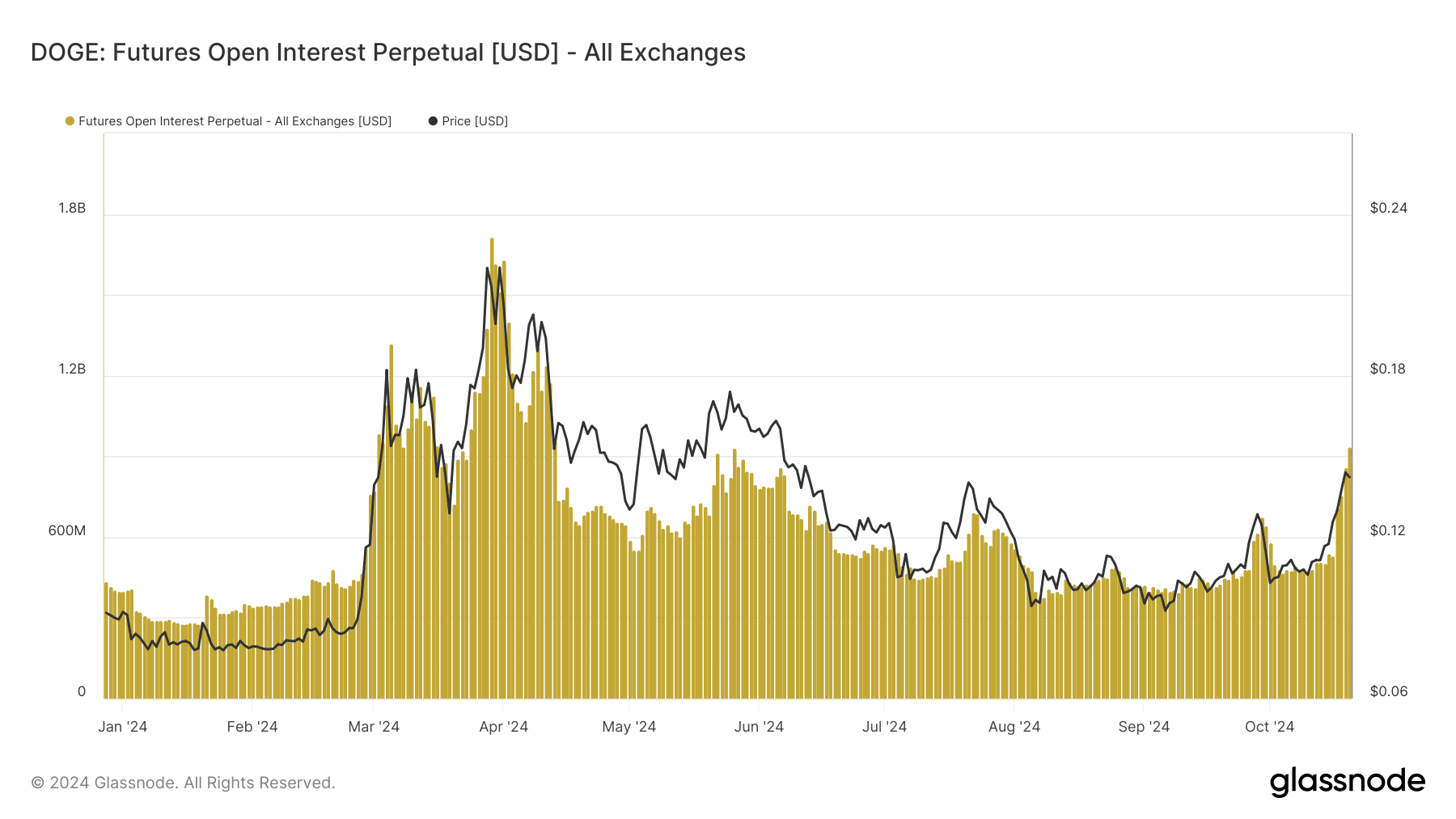

- DOGE’s open interest surged to $940 million, indicating strong trader interest.

Dogecoin [DOGE] experienced a positive trend in the past week, breaking through key price points. However, as the price climbed to a notable high, a significant volume of DOGE was transferred to an exchange, indicating a potential sell-off.

Dogecoin sees sell-off

Data from Whale Alert revealed a large transfer of Dogecoin to the Binance exchange on 20th October. Over 176 million DOGE, valued at more than $25 million, was moved in what appeared to be a substantial sell-off.

The wallet involved in the transaction still holds over 10 million DOGE, valued at nearly $1.6 million. This transfer came after Dogecoin’s price saw an upward surge, leading to speculation that holders were cashing out after the price increase.

Dogecoin bounces back from sell-off

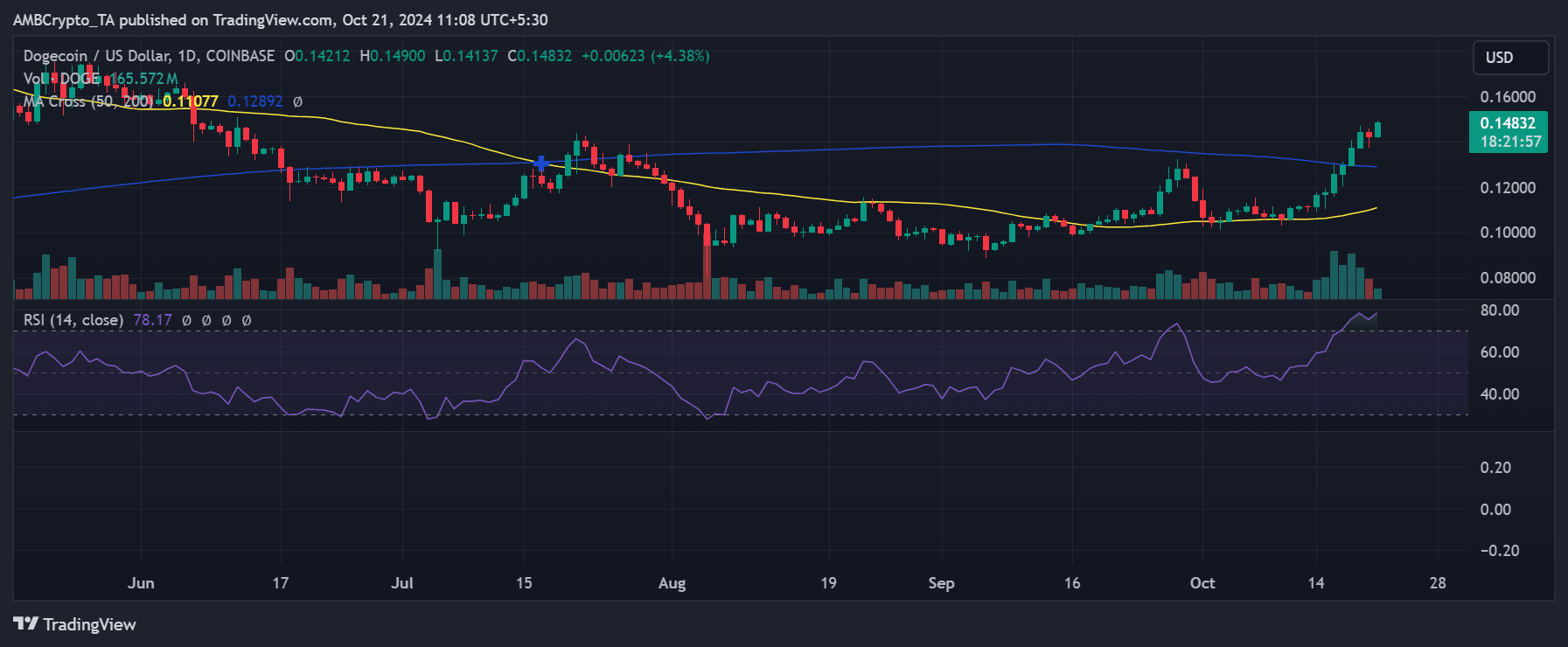

Despite the sell-off, Dogecoin has shown resilience. Price chart analysis revealed that selling pressure caused a brief dip in the last trading session. Trading volume spiked to approximately $333 million, confirming that trader sell-offs had temporarily dominated.

DOGE saw a 1.4% decline, trading at around $0.142 at one point.

However, as of this writing, Dogecoin has bounced back, regaining its momentum. The price has increased by over 4%, now trading at approximately $0.148. The Relative Strength Index (RSI) analysis shows that DOGE remains in the overbought zone, indicating that demand remains strong.

Additionally, the $0.130 price level has now become the latest support area, a level last seen in June before the token quickly dipped below it in subsequent sessions.

More open interest, but warning signs flash

According to data from Glassnode, the recent sell-off was temporary, with open interest increasing significantly over the past few days. As of this writing, Dogecoin’s open interest stands at around $940 million, up from $760 million on 18th October, reflecting an addition of nearly $200 million in just two days.

While this rise in open interest indicates renewed trader interest and a positive cash inflow, the current state of Dogecoin’s RSI suggests caution.

Is your portfolio green? Check out the Dogecoin Profit Calculator

With the RSI still indicating an overbought condition, there are signs that a price correction may be imminent.

Overall, Dogecoin remains in a strong position despite the recent sell-off, but traders should be aware of potential corrections in the coming days.