Chainlink on the rise: Can LINK break $19 after latest milestone?

- LINK showed the potential for upward momentum with growing market interest and strong trading volumes.

- Network activity increasing, while declining exchange reserves suggested a bullish outlook.

Chainlink [LINK] has consistently strengthened its position within the crypto market, largely thanks to innovations like its Cross-Chain Interoperability Protocol (CCIP).

This cutting-edge technology enhances cross-chain security, particularly benefiting NFTs, and supports an impressive $16 trillion transaction infrastructure.

Recently, LINK has caught the eye of traders due to its upward price movement, potentially hinting at a larger breakout.

Can LINK maintain its market momentum?

At press time, LINK was trading at $11.96, reflecting a 5.47% surge in the last 24 hours. Consequently, its market cap has risen to $7.50 billion, with a 5.46% increase.

Trading volume soared by 86.08%, reaching $222.24 million over the same period.

These numbers suggested growing interest and confidence from traders, which could fuel even more upward momentum in the near future.

LINK: Is a breakout imminent?

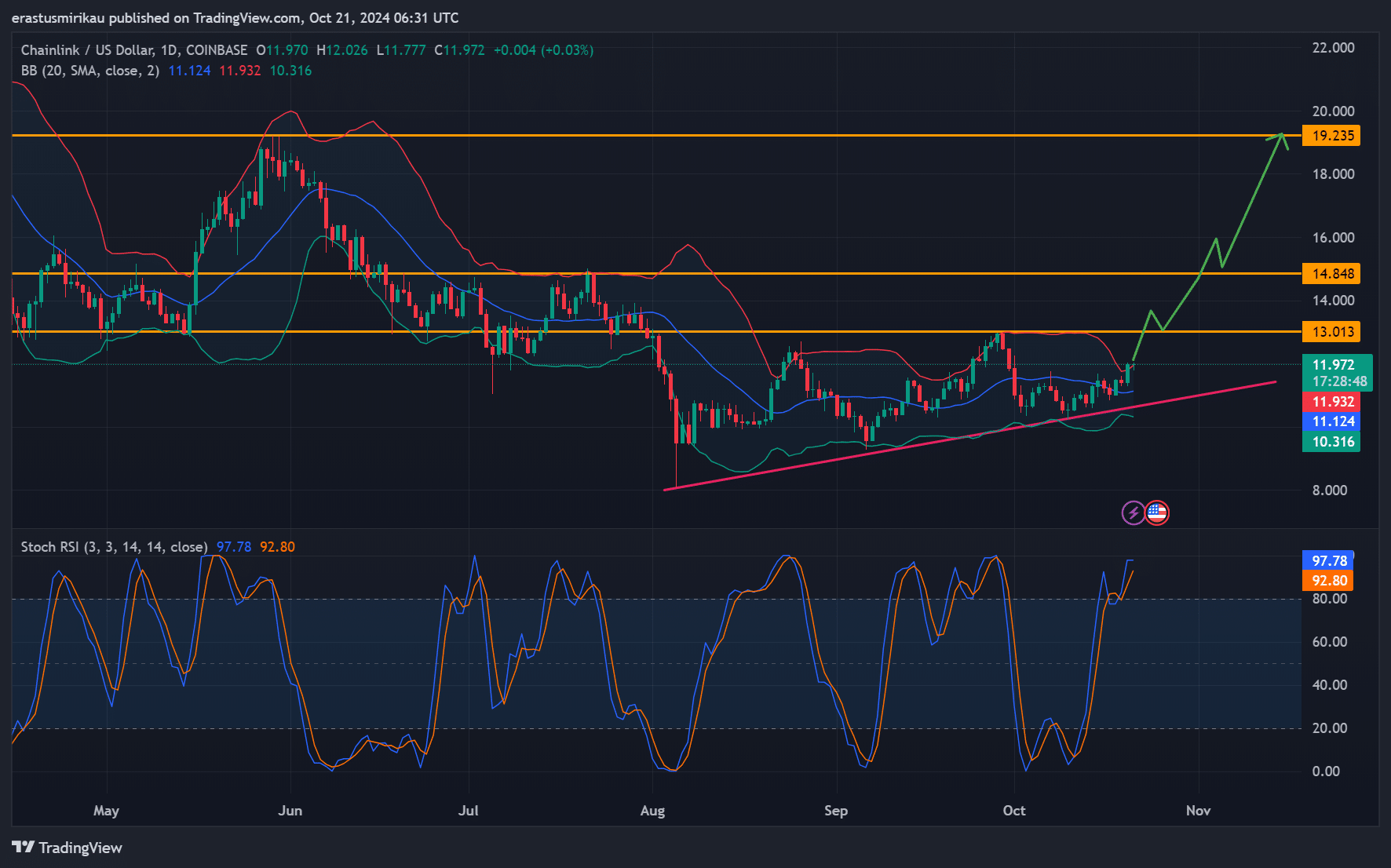

LINK has been trading within a defined range, with support at $10.31 and resistance at $13.01. The Stochastic RSI indicated overbought conditions, with values exceeding 97 at press time.

This suggested a potential short-term pullback; however, this might only be temporary before further gains.

If LINK can break above the $13.01 resistance level, there’s a strong possibility it could test the next resistance at $14.85, and ultimately aim for $19.23.

Additionally, the Bollinger Bands suggested increased volatility, which further hinted at the likelihood of LINK testing new highs soon.

THIS supports bullish sentiment

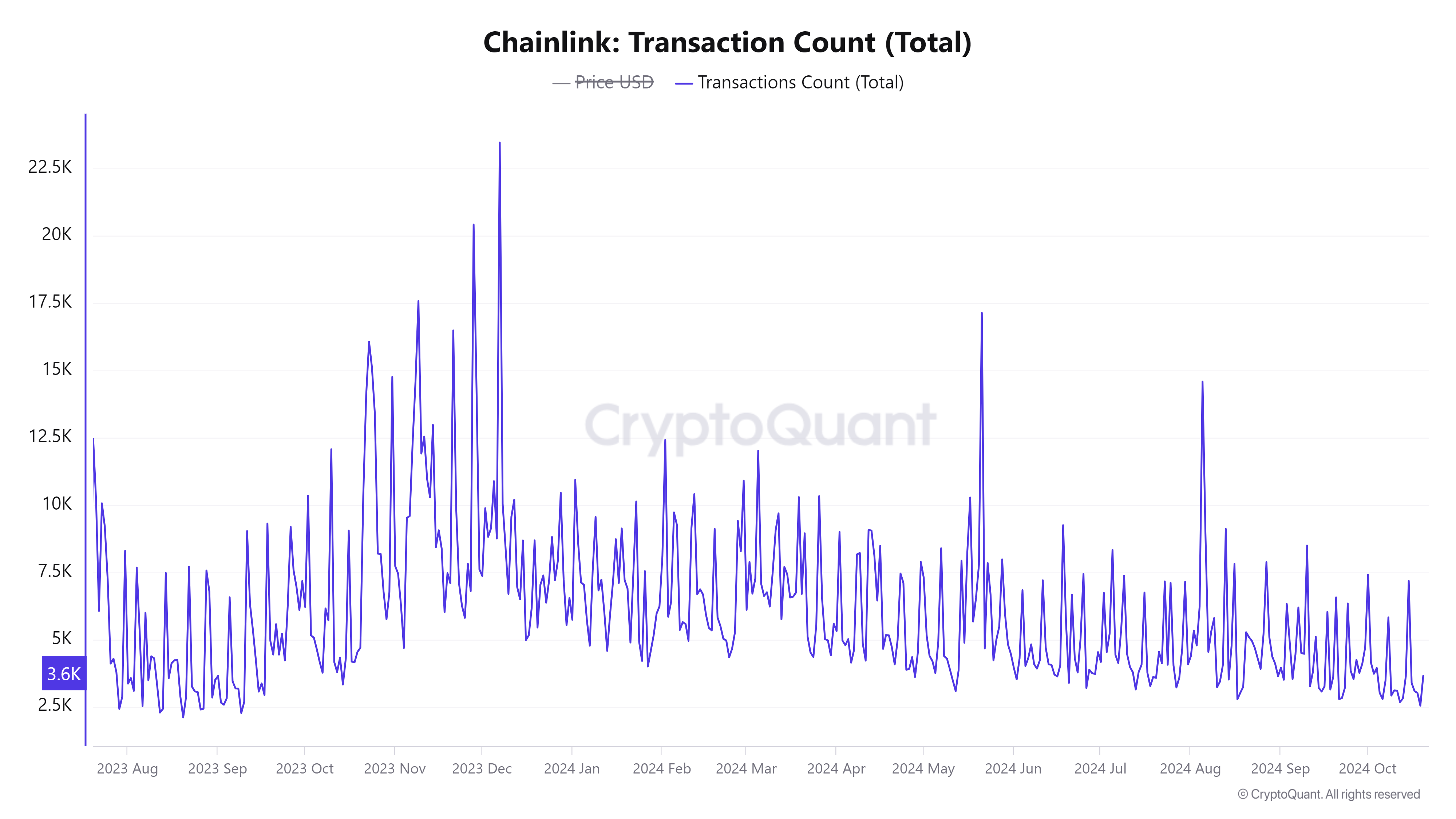

Network activity continues to rise. LINK’s active addresses climbed by 1.34% in the last 24 hours according to CryptoQuant. Furthermore, transaction counts have grown by 1.51%, now totaling 3.82k.

Such increases in network activity indicated a growing user base and higher engagement, which often serves as a positive signal for future price movement.

Declining exchange reserves could push prices higher

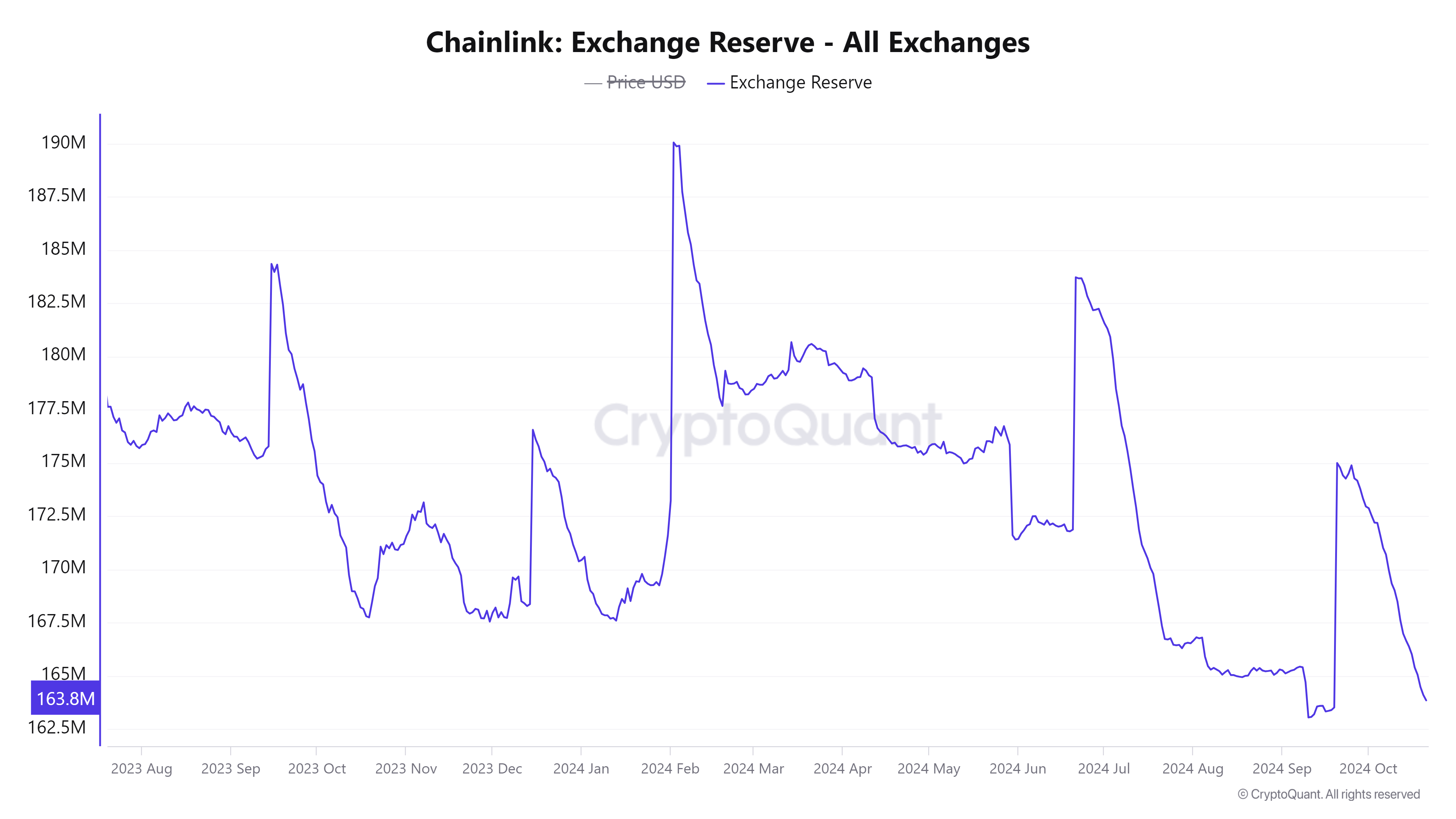

Interestingly, LINK’s exchange reserves decreased by 0.19%, standing at 163.8 million tokens at press time.

Fewer tokens on exchanges typically suggest that holders are less inclined to sell, expecting further price increases. This scarcity could drive prices higher as demand outpaces available supply.

Is your portfolio green? Check out the LINK Profit Calculator

Is LINK ready for a major price surge?

With strong technical indicators, increasing network activity, and declining exchange reserves, Chainlink seems primed for further price growth. However, short-term volatility may precede any significant gains.

If Chainlink breaks key resistance levels, it could soon be trading in the $14.85 to $19.23 range.