The Trump – Bitcoin nexus: What his victory will mean for BTC investors

- Bitcoin surged to a three-month high as “Trump trades” gained momentum ahead of the U.S. election.

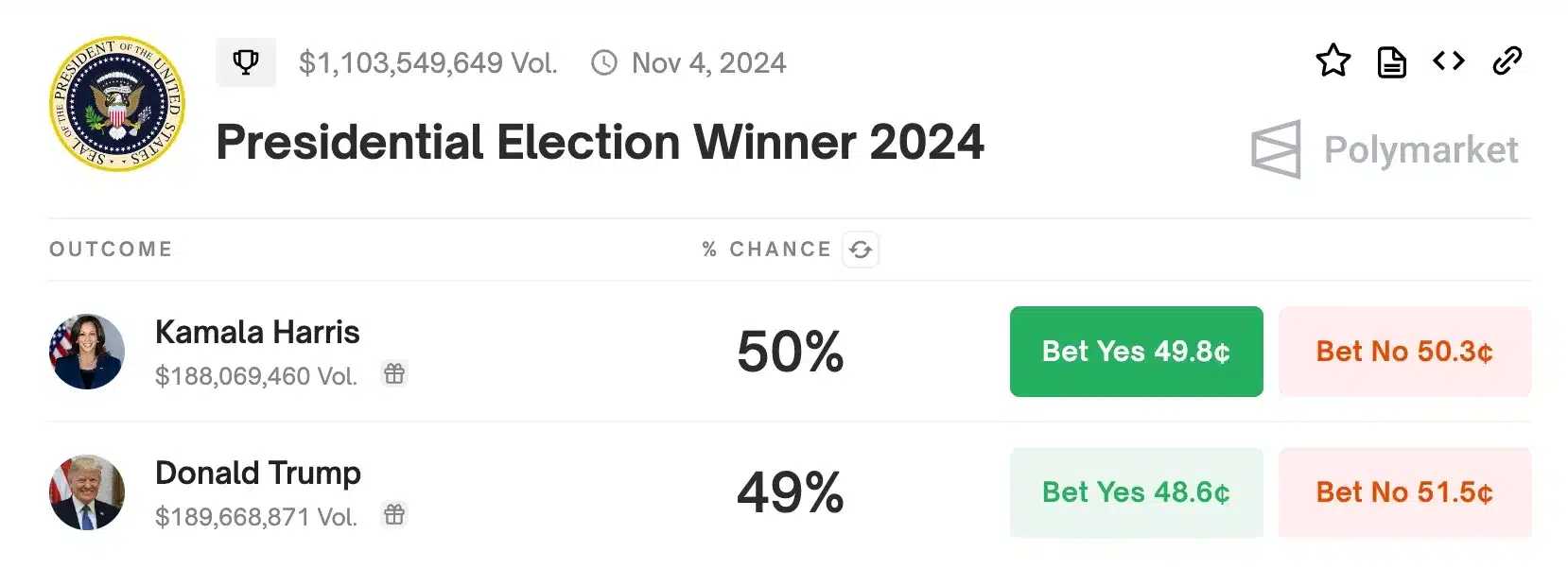

- Donald Trump leads in Polymarket data, viewed as favorable for the cryptocurrency market.

Amid fluctuating Asian markets, where shares rose and fell, the cryptocurrency landscape showed notable resilience.

Bitcoin [BTC] surged to a three-month high, reflecting a significant uptick in trading activity as the so-called “Trump trades” gained momentum.

Early trading on the 21st of October saw BTC reach $68,496.98, marking a more than 6% increase over the past week and over 8% in the last month.

This happened while investors positioned themselves ahead of the U.S. presidential election just two weeks away.

Trump’s rising odds and its impact on the crypto market

Polymarket data shows Donald Trump leading with 61.1% of projected votes, while Kamala Harris trails at 38.8%.

Hence, with no major economic events this week, markets were focused on corporate earnings and election risks.

Thus, it seems clear that Bitcoin has gained as Trump’s prospects rise, with his administration seen as more lenient on cryptocurrency regulation.

His policies on tariffs, taxes, and immigration are viewed as inflationary, potentially boosting the dollar and benefiting the crypto market.

Execs weigh in

Remarking on the same, Chris Weston, head of research at Australian broker Pepperstone, highlighted that investors might encounter rising expenses when hedging against dollar volatility and other portfolio-related risks.

Weston said,

“With just 15 days to go until the U.S. election, traders need to decide if now is the right time to start placing election trades with greater conviction.”

Adding to the fray was Brad Bechtel, global head of FX at Jefferies, who added that increasing real interest rates were providing support to the dollar, especially against three key currencies.

“We expect this trend to continue straight into the election and if Trump wins, likely well after the election as well.”

Is Trump likely to win?

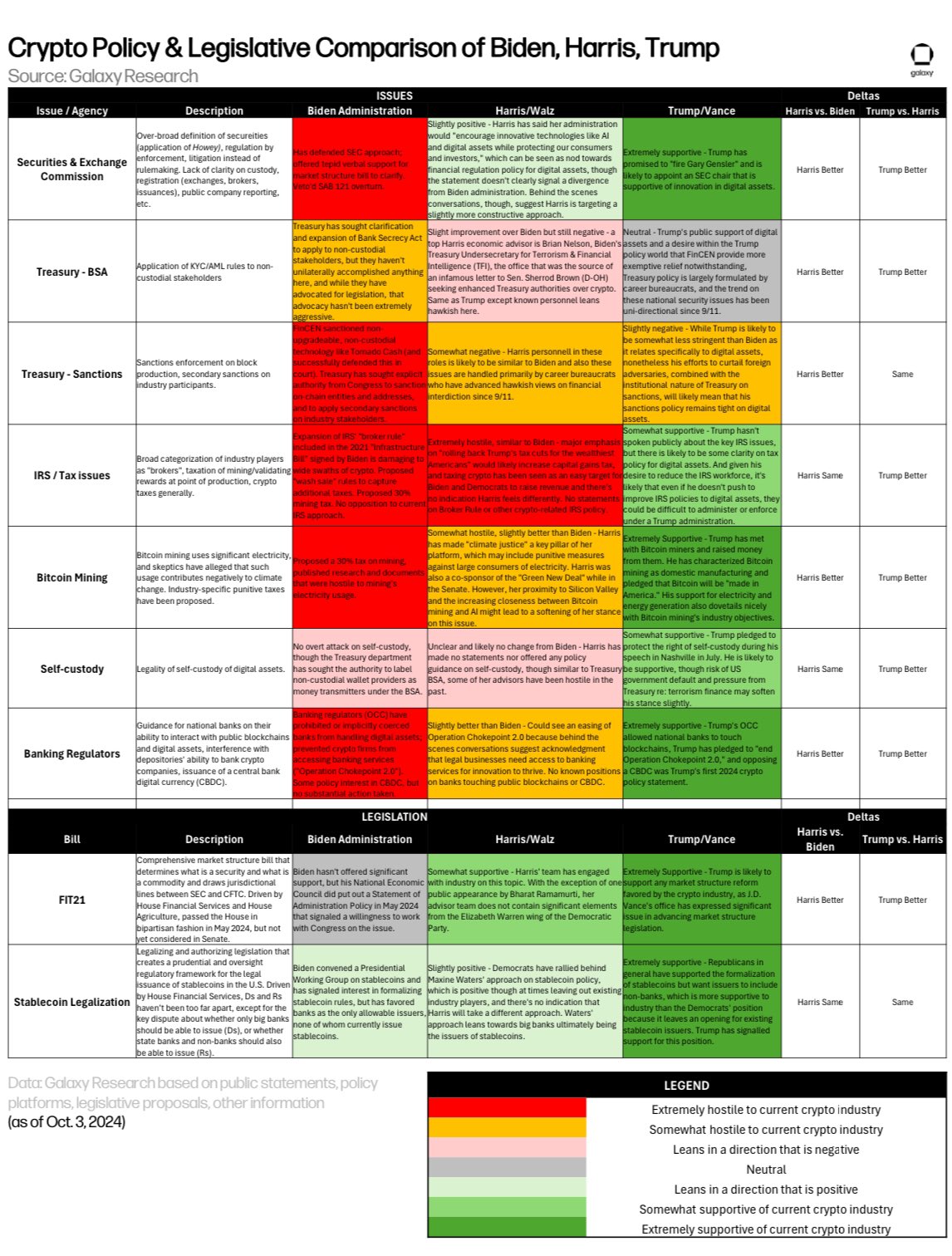

In fact, in a recent post on X, Alex Thorn, Head of Firmwide Research at Galaxy Digital, unveiled a policy scorecard assessing the cryptocurrency stances of presidential candidates Kamala Harris and Donald Trump.

He said,

“Downside risk of a Harris victory as limited, with explosive upside possible in the case of a Trump victory.”

As expected, a detailed examination of the scorecard revealed that among the nine core points assessed, Donald Trump outperformed Kamala Harris in seven areas.

Therefore, with only a few days remaining until the U.S. presidential election, it will be intriguing to observe how the crypto market responds both during and after the election.

![Kusama [KSM] explodes 119% in one day - How DOT helped](https://ambcrypto.com/wp-content/uploads/2024/11/Michael-KSM-400x240.webp)