ARPA crypto booms 43% in 24 hours, but is a correction looming?

- ARPA crypto saw a 43% price surge in the last 24 hours, with its market capitalization now exceeding $91 million.

- Despite signs of overbought conditions, ARPA maintained a bullish momentum.

According to data, ARPA crypto has emerged as the highest gainer in the last 24 hours.

Although there have been corrections in the last 24 hours, the asset maintains the top spot among the top 500 crypto assets with the largest market capitalization.

ARPA crypto emerges as top gainer

In the past 24 hours, ARPA crypto has risen to become the top-performing asset, according to CoinMarketCap. Its value has surged by over 43%, solidifying its position as the biggest gainer.

This impressive increase has boosted its market capitalization to over $91 million. At the same time, its trading volume has skyrocketed by more than 4,000%, reaching a remarkable $378 million.

Signs of corrections

Although ARPA crypto experienced a sharp rise, analysis of its daily chart revealed signs of a price correction.

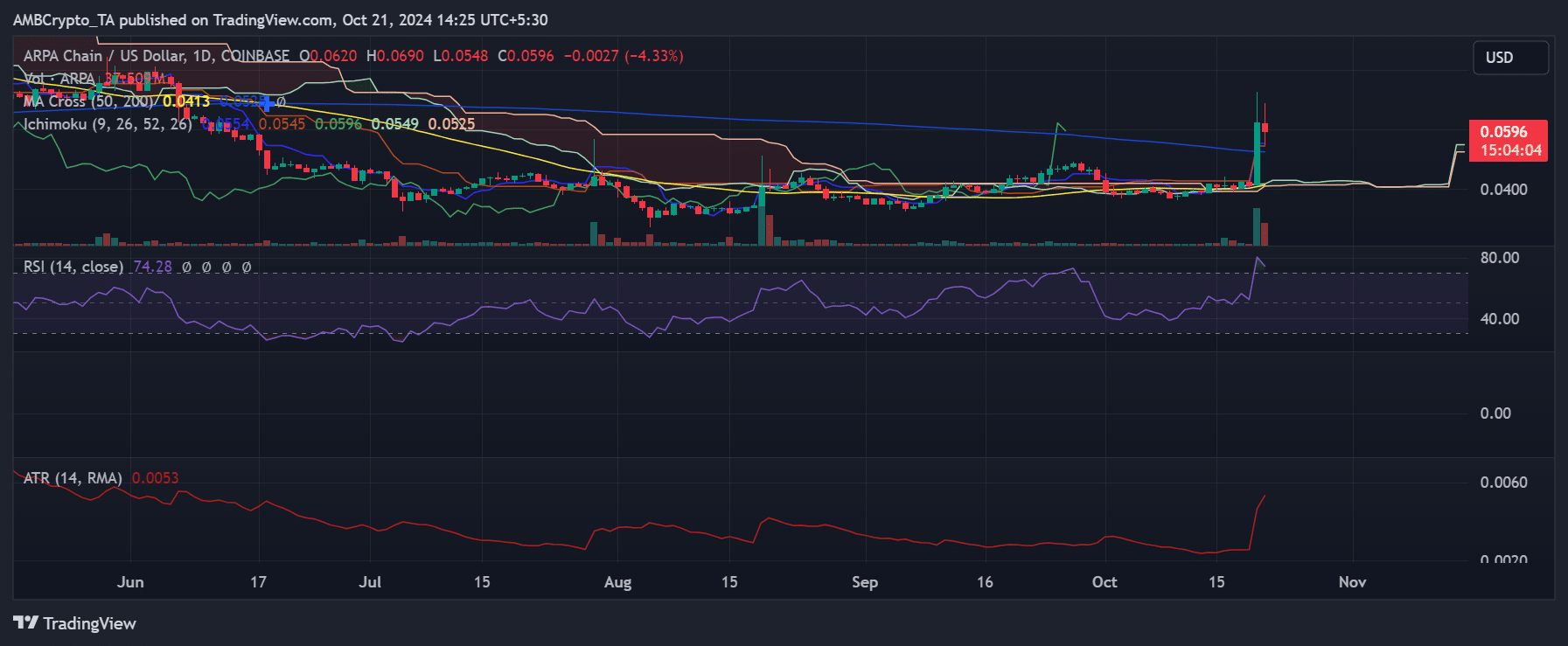

After hitting a recent high of $0.0690, it has pulled back by 4.33%, trading around $0.0596 as it encountered resistance.

This correction may indicate the start of a consolidation phase or a pullback before another potential price surge.

Also, it was trading well above its 50-day moving average, around $0.0413 at press time, signaling that the bullish momentum had driven prices higher.

The spike has also breached the upper bound of the Ichimoku Cloud, signaling a breakout.

However, this swift price movement has raised concerns that the rally may have been overextended, as momentum indicators suggest a pause could be imminent.

RSI and ATR point to overbought and high volatility

The Relative Strength Index (RSI) for ARPA was 74.28, firmly in overbought territory at the time of writing. When the RSI surpasses 70, an asset may face a short-term correction as buying pressure decreases.

This aligns with the price pullback from its daily high, indicating that traders may be taking profits after ARPA’s rapid surge.

Additionally, the Average True Range (ATR), which measures market volatility, has surged to 0.0053, reflecting heightened volatility in recent sessions.

This increased volatility often accompanies sharp price movements, suggesting that ARPA crypto may experience further fluctuations before settling into a more stable trend.

What to expect next for ARPA crypto

Traders should closely monitor ARPA crypto as it tests resistance near $0.0690. A breakout above this level could push the price toward $0.075, confirming the continuation of its uptrend.

On the downside, immediate support can be found near $0.0548, with a stronger support level around the 50-day moving average at $0.0413.

Given the current overbought conditions and heightened volatility, ARPA may enter a consolidation phase before its next significant price movement.

A period of sideways trading could allow technical indicators like the RSI to cool off, potentially paving the way for a medium-term rally.

However, ARPA may face a deeper retracement toward $0.050 or lower if it fails to hold key support levels.