Pendle crypto is up 43% in 30 days – Analyzing key entry points

- PENDLE crypto netted 43% recovery gains in the past 30 days of trading.

- Looking into key market re-entry points as whales trimmed their exposure.

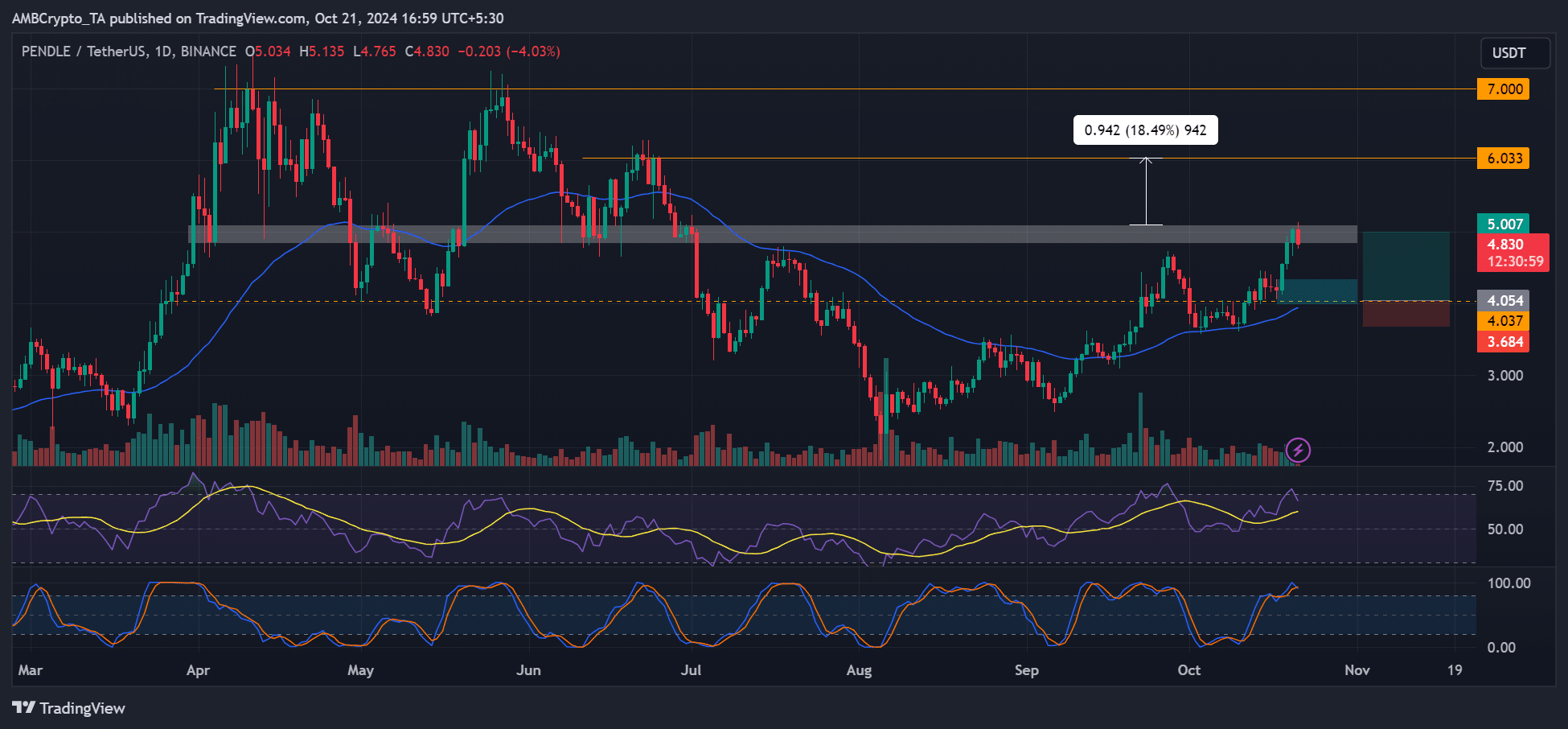

Pendle [PENDLE] extended its October recovery and hit a new monthly high of $5.13, tapping 43% in the past 30 trading days.

However, the $5 psychological level has been a critical resistance in the past, can it decidedly crack it?

PENDLE crypto hits a hurdle

At press time, the roadblock had already attracted short sellers, as seen by the red daily candlestick. This could accelerate profit-taking from short-term holders.

Additionally, key technical chart indicators flashed overbought conditions, suggesting a potential pullback. But PENDLE has been making higher highs and higher lows, painting a bullish market structure.

As such, it made sense to go long on the asset rather than shorting it. There were two possible long scenarios.

First, a re-entry at the short-term support above $4 and the 50-day EMA (blue line), with a bullish target at $5. This would offer a 23% potential gain, but only if PENDLE retraced to $4.

The second scenario would be a retest and flipping of $5 to support (marked white), allowing bulls to eye the $6 target. Such a move could offer an 18% potential gain.

A crack below $4 would invalidate the long position; hence, a stop loss could be placed just below it.

Pendle whales trim their exposure

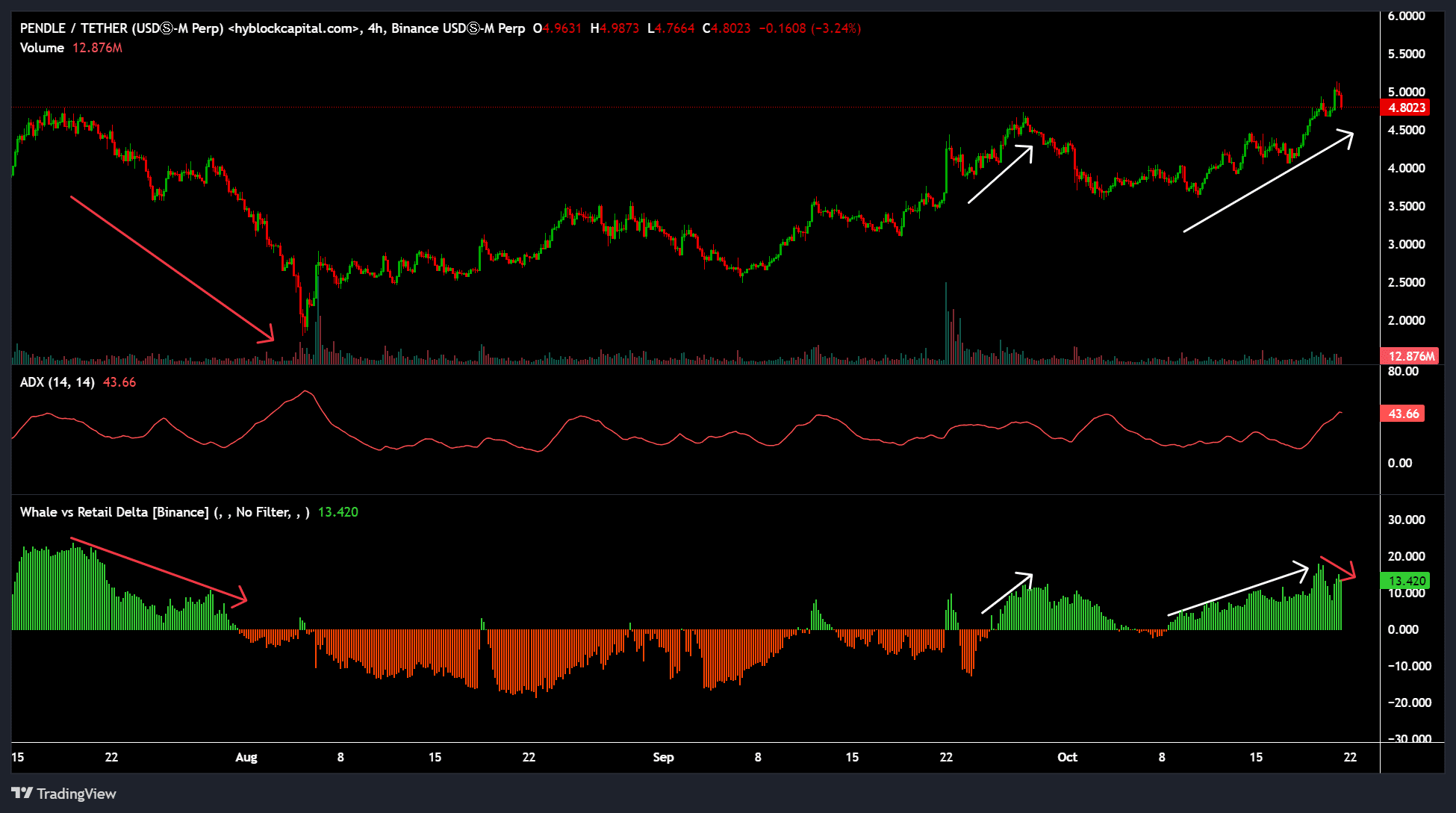

Although the recent uptrend was strong, as denoted by a 43 reading from the ADX (Average Directional Index), whales’ actions called for caution.

Historically, when whales add more positions than retailers (green Whales vs Retail Delta), PENDLE tends to rally. On the contrary, when they reduce exposure, a pullback always follows.

Since early October, whales have added more PENDLE, driving an uptrend in prices. However, whale players have slightly trimmed their exposure at press time. This could partly explain the profit-taking at the $5 roadblock.

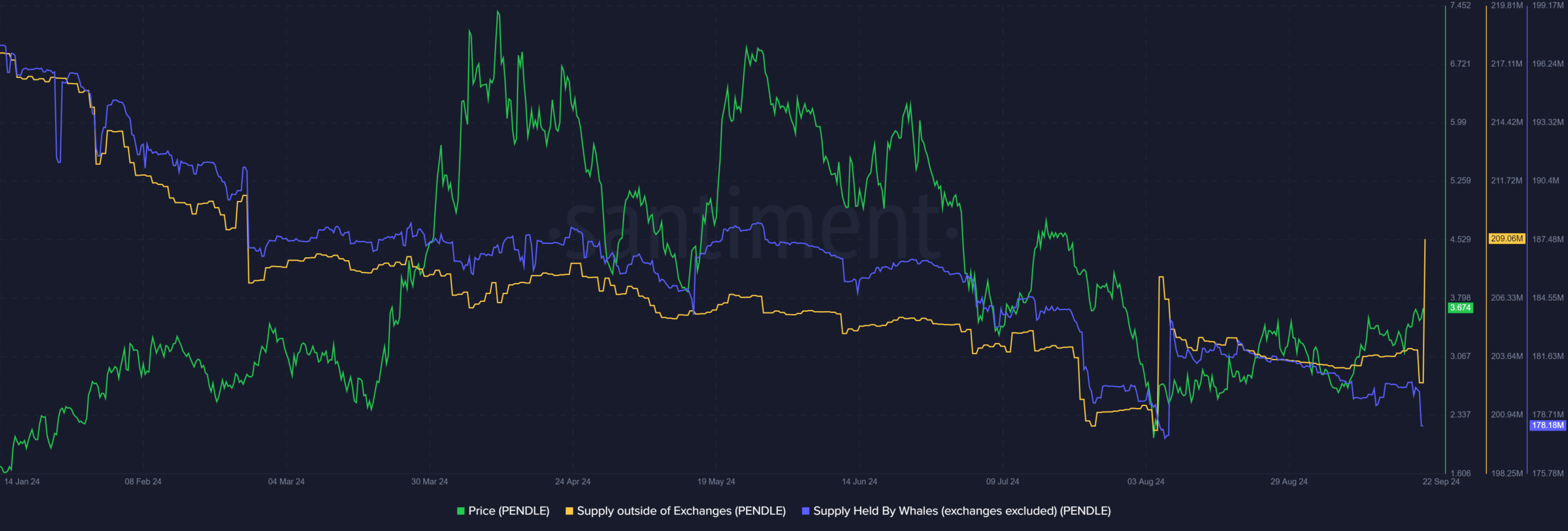

The above observation was supported by Santiment data, which showed a slight drop in Supply Held By Whales (blue).

It was also worth noting that there was a spike in Supply outside Exchanges, reinforcing the accumulation trend, perhaps amongst retailers. This might not necessarily pump PENDLE.

Read Pendle [PENDLE] Price Prediction 2024-2025

In the August sell-off, both accumulation trends spiked, led by whales, and PENDLE rallied afterward. However, a strong PENDLE rally could be challenging, with whales taking the back seat.

So, a pullback from the $5 roadblock could make the first long scenario more feasible. But a crack below the dynamic support of the 50-day EMA would invalidate the bullish outlook.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion