Bitcoin network turns positive: A bullish signal for investors?

- BTC ran up to $70K flipped network fundaments positive.

- Is it a bullish signal despite the short-term correction and likely consolidation?

Bitcoin [BTC] network fundamentals turned positive for the first time in October, on what an analyst deemed a positive signal for the asset in the medium term.

According to CryptoQuant, the positive network metrics were a familiar trend during bullish periods and suggested a likely positive outcome for the asset despite a likely correction or consolidation.

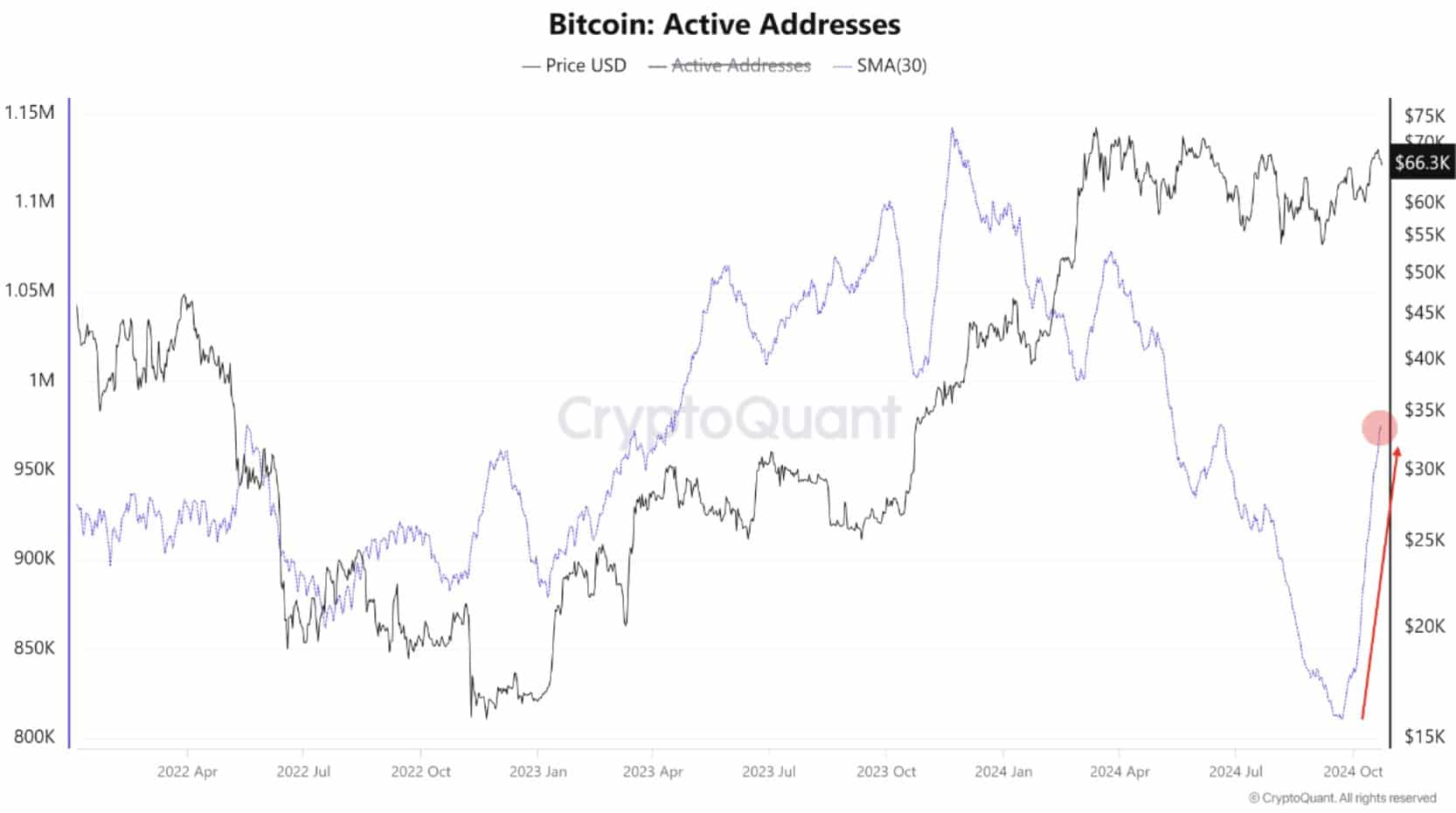

Following a recent run towards $70K, the 30-day average number of active BTC addresses surged towards the 1 million mark. It hit levels last seen in June, indicating massive interest in the asset amid last week’s pump.

A BTC hike next?

A similar positive trend was recorded across the mining segment and network fees. Notably, the mining difficulty hit an all-time high, indicating intense competition for rewards among BTC miners, a positive catalyst for BTC’s intrinsic value.

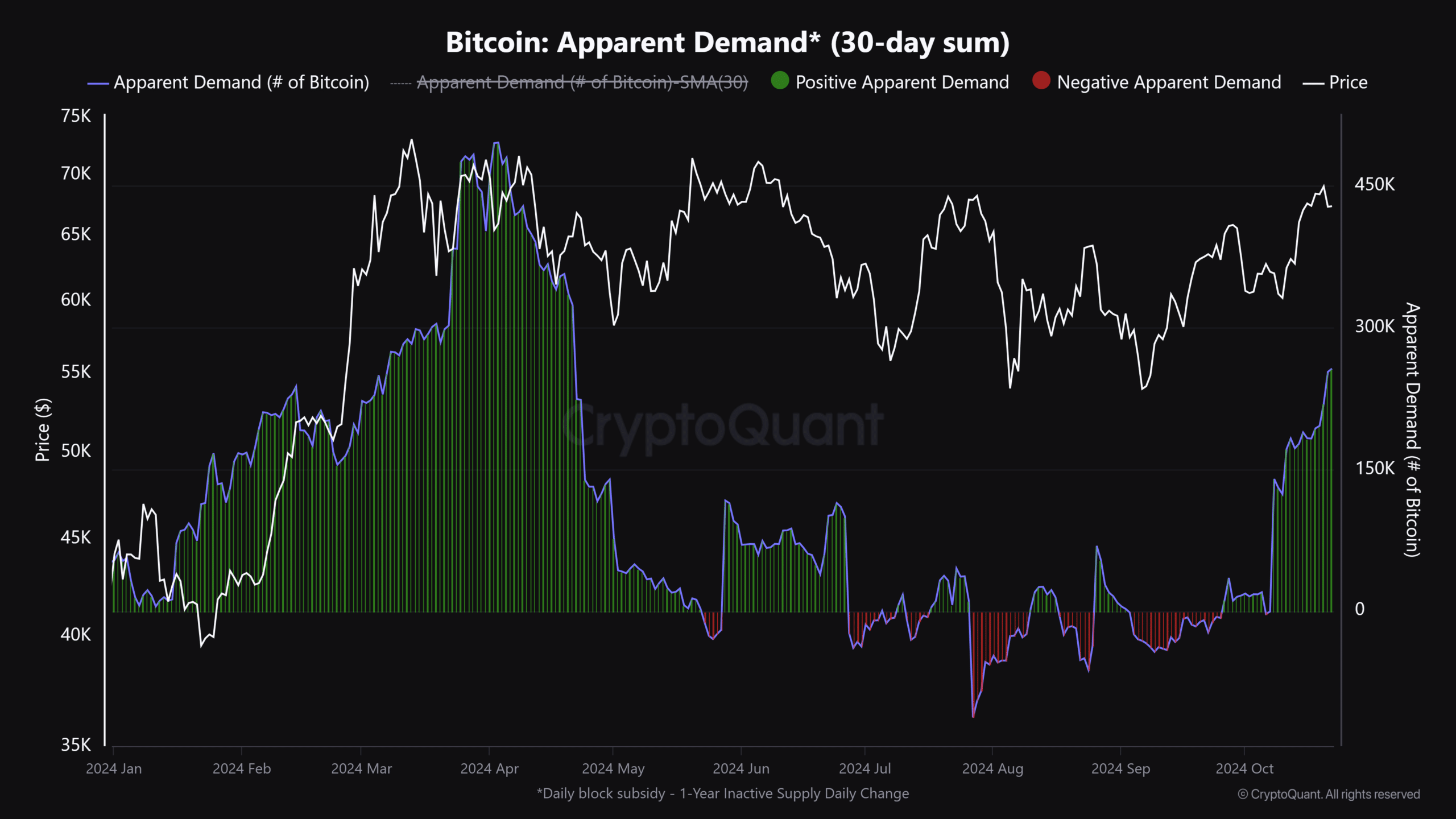

Additionally, BTC’s apparent demand, or difference between production and inventory schedule, surged to a 6-month high of 256K BTC as of press time. In most cases, the spike in demand is always preceded by a BTC price hike.

Despite the above positive catalysts, analysts had mixed BTC price projections as the US elections edged closer.

Blockworks’ analyst Felix Jauvin cautioned that BTC could be range-bound until the election was over.

“Nobody wants to be a marginal buyer of risk here this close to the election. Probably just a whole lotta chop until it’s over….:

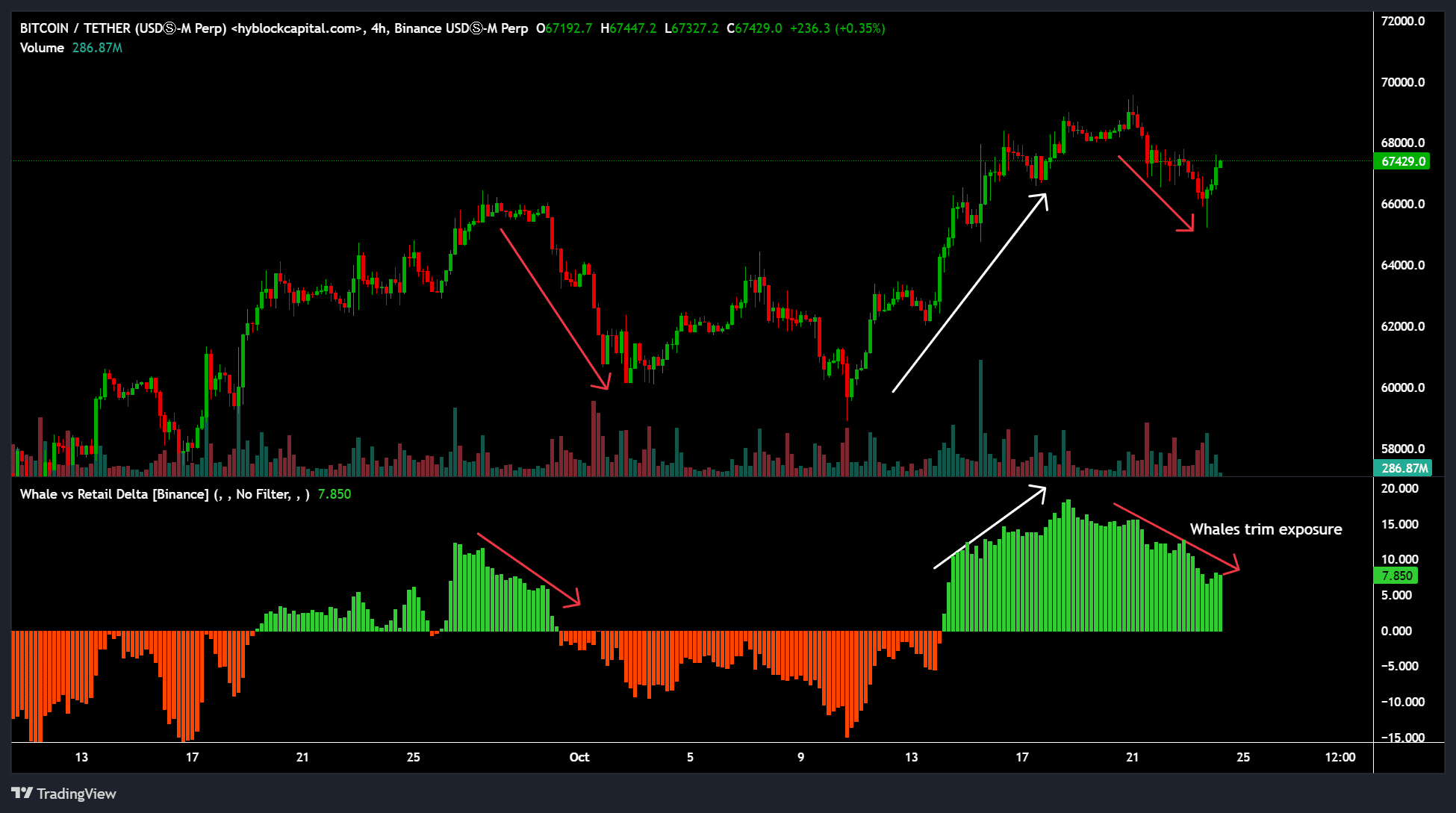

Another pundit, Justin Bennett, echoed his cautious sentiment, citing whales’ lack of interest in grabbing the recent mid-week dip.

Since 17th October, Whale vs. Retail Delta, which tracks whales’ positioning relative to retail traders, has declined, suggesting that whales trimmed exposure on BTC.

Interestingly, options traders remained bullish, as seen by their increased buying of call options (bets that the BTC price will rise) by election day.

On the 22 October daily update, trading firm QCP Capital noted,

“Short-term implied volatility is peaking at election day expiry, with a 10-vol spread over the prior expiry and skews favouring calls over puts, despite BTC being about 8% below its all-time highs”