Can BNB break the $608 barrier? Whale accumulation, indicators suggest…

- BNB is nearing the $608 resistance level, with potential upside toward $721 if momentum holds.

- Whale accumulation and rising open interest are fueling confidence in a potential breakout.

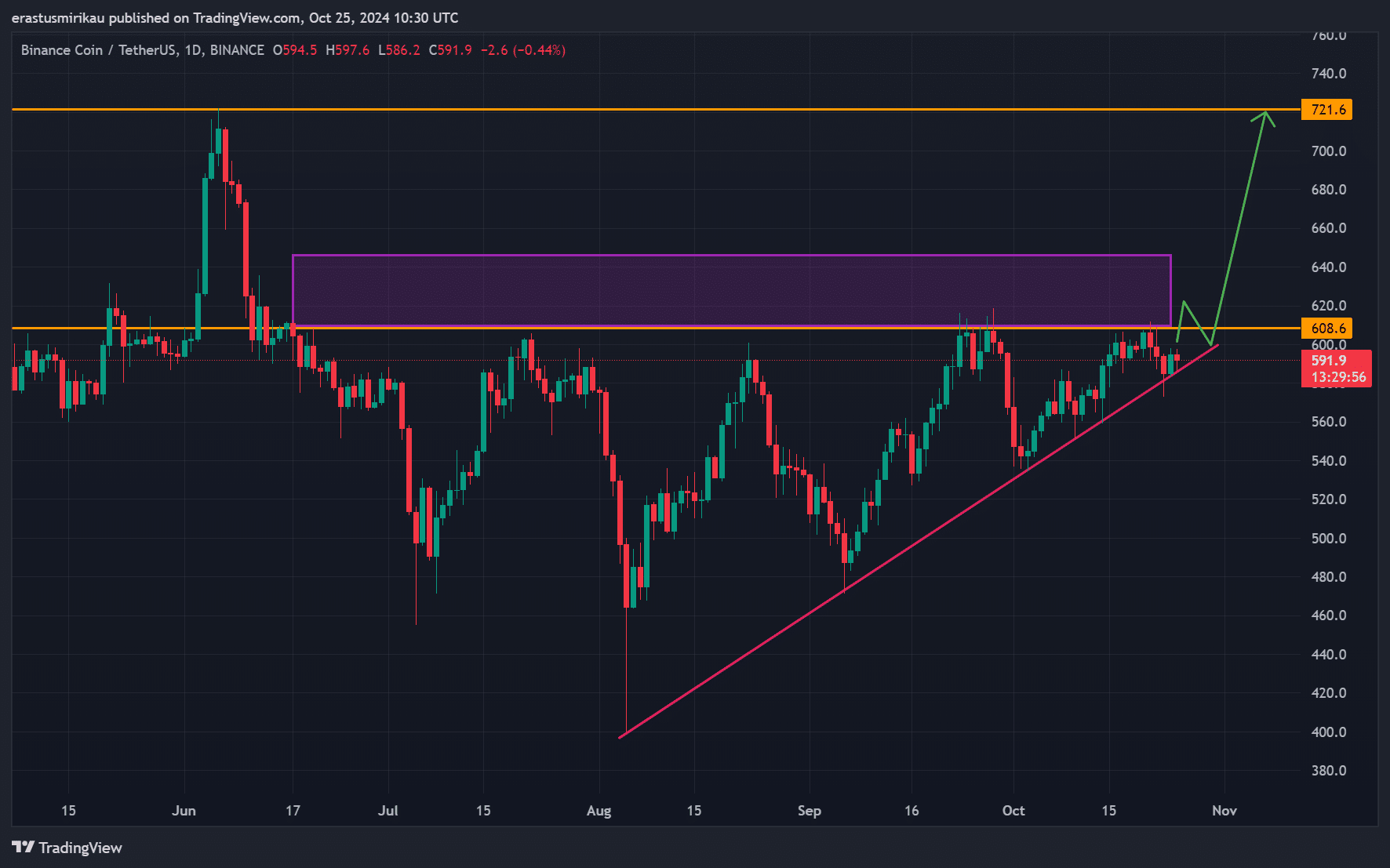

Binance Coin [BNB] is gaining momentum after a prolonged consolidation period, as it eyes a potential breakout from its recent trading range. At press time, BNB was trading at $590.66, having surged 0.27% in the last 24 hours.

The price action is now approaching the significant $608 resistance level, a key barrier that could determine the next major move. If BNB successfully breaks through this zone, the next target would be $721, marking a potential 22% upside.

BNB breaking out of consolidation – Is $608 the key?

BNB has been trading in a tight range for weeks, respecting a rising trendline. Currently, the price is nearing the significant resistance level of $608, which has acted as a barrier in previous attempts to break out.

A clear move above this level could spark a rally toward $721, representing a substantial 22% upside.

Additionally, the trendline and increasing upward pressure suggest that a bullish breakout could be imminent. However, any failure to break above $608 could see BNB pulling back to lower levels.

Technical indicators show mixed signals

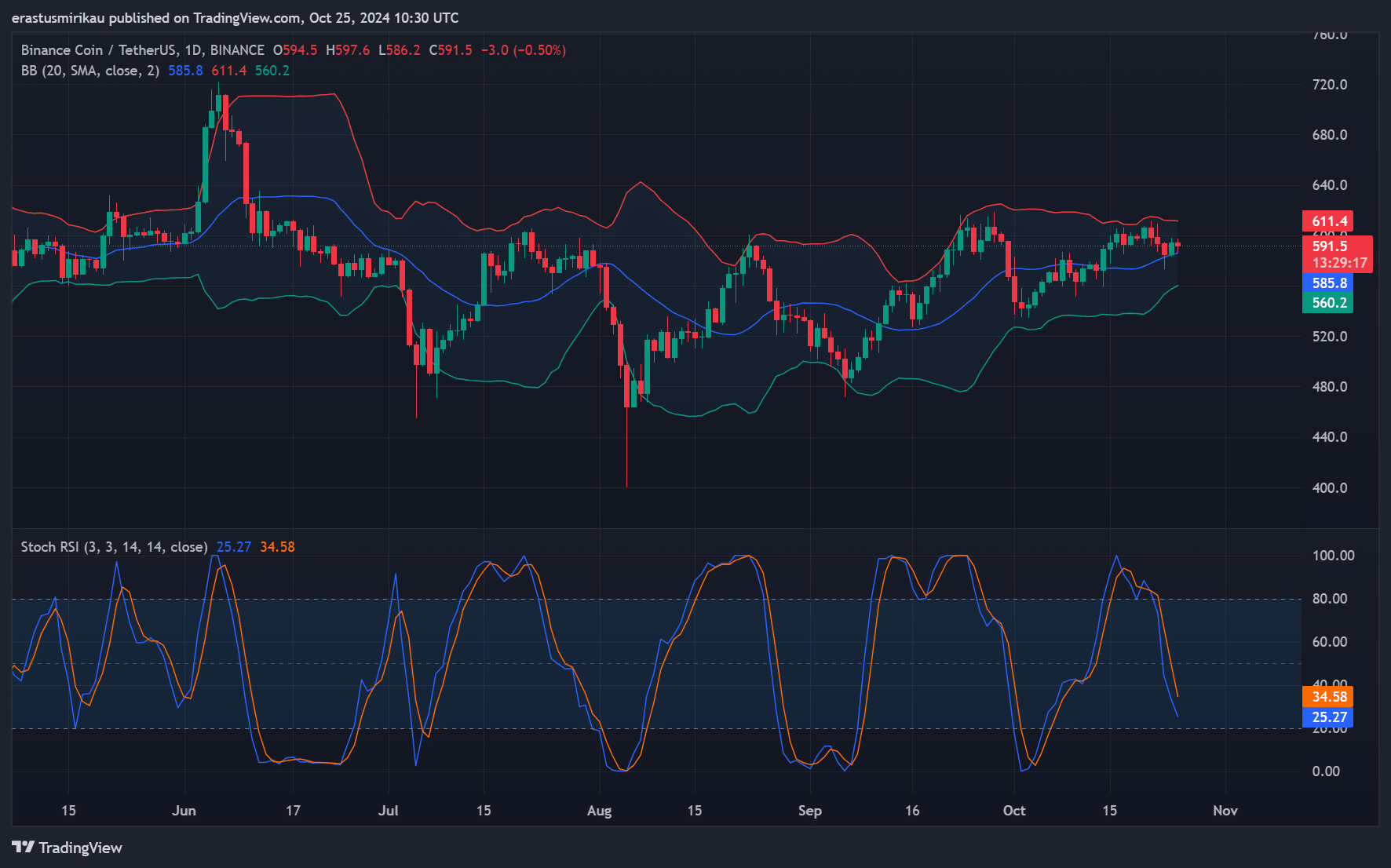

Looking at BNB’s technical indicators, there are signs that volatility could soon increase. The Bollinger Bands (BB) reveal that the price is hovering near the upper band, which typically precedes significant price moves.

Additionally, the Stochastic RSI indicates that BNB is currently in an oversold region, with a reading of 25.27.

Therefore, we could see buying pressure intensifying soon. This combination of indicators points to the possibility of a bullish continuation if momentum picks up. However, traders should remain cautious, as these indicators can be influenced by short-term market fluctuations.

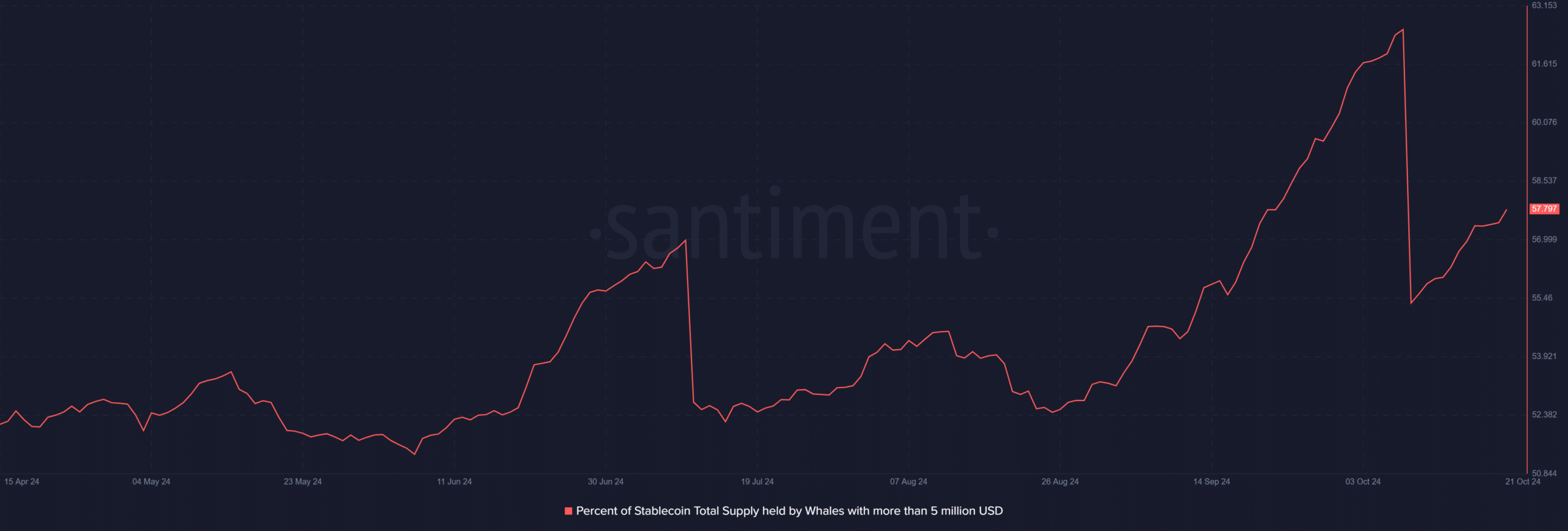

Whale accumulation continues

One important factor supporting BNB’s potential breakout is the increasing whale activity. As of October 21, whales holding over $5 million in stablecoins control 57.80% of the total supply.

This significant accumulation is a bullish sign, as large holders typically position themselves ahead of significant price moves.

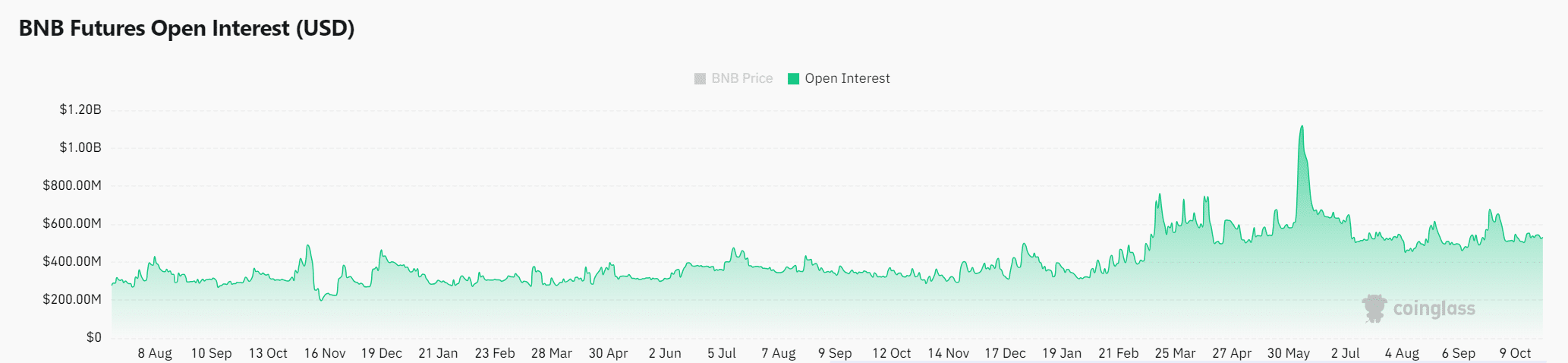

BNB open interest rising: A bullish sign?

Moreover, open interest in BNB futures has increased by 0.70%, reaching $528.23 million. This uptick suggests growing trader interest in BNB, which could drive increased volatility.

Additionally, rising open interest often leads to higher price swings, especially in the event of a breakout.

Read Binance Coin’s [BNB] Price Prediction 2024–2025

Conclusively, BNB appears well-positioned for a breakout if it can clear the $608 resistance. Whale activity, rising open interest, and favorable technical indicators all point to the potential for further upside.

However, sustaining momentum will be crucial to achieving the $721 target. Traders should stay alert for any signs of weakening momentum that could signal a reversal.