Dogecoin positions for rebound, but here’s what’s holding it back

- DOGE is well-positioned to capitalize on the ongoing volatility for a potential rebound.

- While some factors support this outlook, others may require more time to align.

Despite a 2% weekly dip, Dogecoin [DOGE] is still leading the pack, while its rivals trail with a hefty 10% decline. Thanks to a recent parabolic rally, DOGE has soared above the $0.14 mark, a level it hasn’t reached in two months.

Currently trading at $0.1383, DOGE appears to be mirroring Bitcoin’s moves, prompting analysts to wonder if DOGE is still drawing capital away from BTC in this volatile market.

If that’s the case, an underlying pattern could soon propel Dogecoin past its previous resistance levels, even amid the prevailing bearish sentiment.

DOGE might be squeezing on a rebound

Now, Dogecoin is at a critical juncture. With a strong liquidity pocket at $0.144, breaking through this range could trigger short liquidations, forcing those with short positions to buy back DOGE, potentially driving the price higher.

During the recent bull cycle when BTC nearly touched $70K, DOGE posted daily gains exceeding 7%, while other memecoins struggled to gain traction, with even Ethereum lagging behind.

These factors have certainly fostered growing optimism among traders.

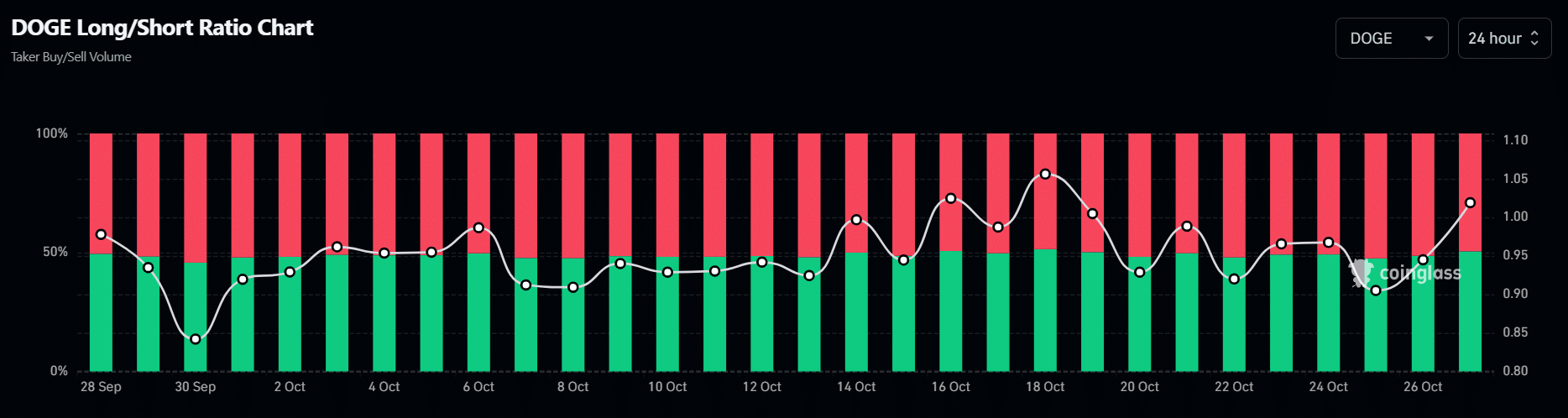

As a result, the futures market has seen long positions dominate over the last 24 hours, with traders betting on a rebound. With DOGE’s market cap rising by 2% to $20.22 billion, traders holding long positions feel incentivized by the potential for a reversal, positioning DOGE to benefit from the current volatility.

In short, if BTC continues to consolidate at these price levels, creating a major steep in weekly gains for top altcoins, history could repeat itself, allowing Dogecoin to capitalize and potentially rally, establishing new resistance levels above $0.143.

This aligns with a common trading strategy where traders view high-cap altcoins as more attractive alternatives during periods of solid market risk. Given DOGE’s current positioning, it’s not overly optimistic to suggest that it might draw capital away from BTC. However,

Something might be sabotaging their efforts

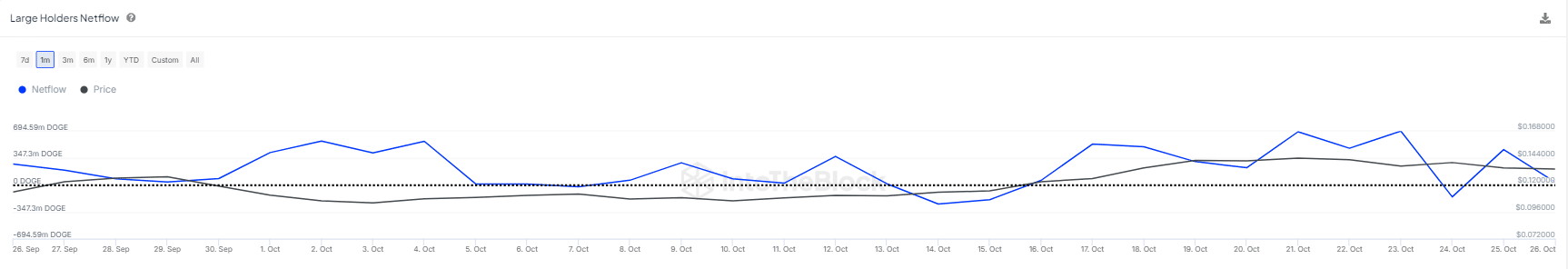

Dogecoin shows promise for a rebound as spot traders eagerly buy the dip, but large holders’ erratic order book could hinder progress.

Over the past few days, large holders – especially whales, who control a remarkable 42% of the supply with over 66 billion DOGE – have entered a distribution phase. This shift has coincided with the recent 7% dip, pushing DOGE down to $0.131.

Read Dogecoin’s [DOGE] Price Prediction: 2024-2025

Although their selling efforts were short-lived, DOGE rebounded with a 4% gain the following day but still hasn’t fully recovered from the significant sell-off.

Therefore, caution is warranted. Despite the optimism for a potential rebound and the overall volatility that gives DOGE an upper hand, if this segment of holders does not cooperate, Dogecoin may struggle to seize this opportunity. Monitoring their activity in the coming days will be essential.