Bitcoin dominance nears 60%: How will it impact altcoins?

- Bitcoin dominance approaches 60% amid rising volatility, suggesting a near-term bullish outlook.

- What does this mean for altcoins?

In just over two weeks, Bitcoin [BTC] dominance has surged from 57% to nearly 60%, extending control over the crypto market despite fierce competition from rival assets.

However, despite this milestone, BTC’s price has remained consolidated below $68K for an entire week. If this trend persists, the high dominance could signal a market top, with the current price serving as a key psychological resistance level.

On the flip side, the prevailing market sentiment is significantly shaped by key macroeconomic factors. The impending election results are expected to bring shifts in monetary policy, potentially setting BTC up for a volatile week ahead. However, this situation underscores a more significant issue.

Investors are increasingly becoming risk-averse

The cryptocurrency market is witnessing a notable transition. While Bitcoin continues to break out to new highs, altcoins are lagging behind.

Currently, only 14 out of the top 50 altcoins have outperformed BTC in the last 90 days, accounting for a mere 29% of their dominance. Meanwhile, Ethereum has seen its market share tumble over 7% in just 30 days, now standing at 13% at the time of writing.

Put simply, there is a perception that Bitcoin serves as a safe haven during heightened volatility. As regulatory uncertainties loom, capital is expected to flow more into BTC, potentially delivering another blow to high-cap altcoins.

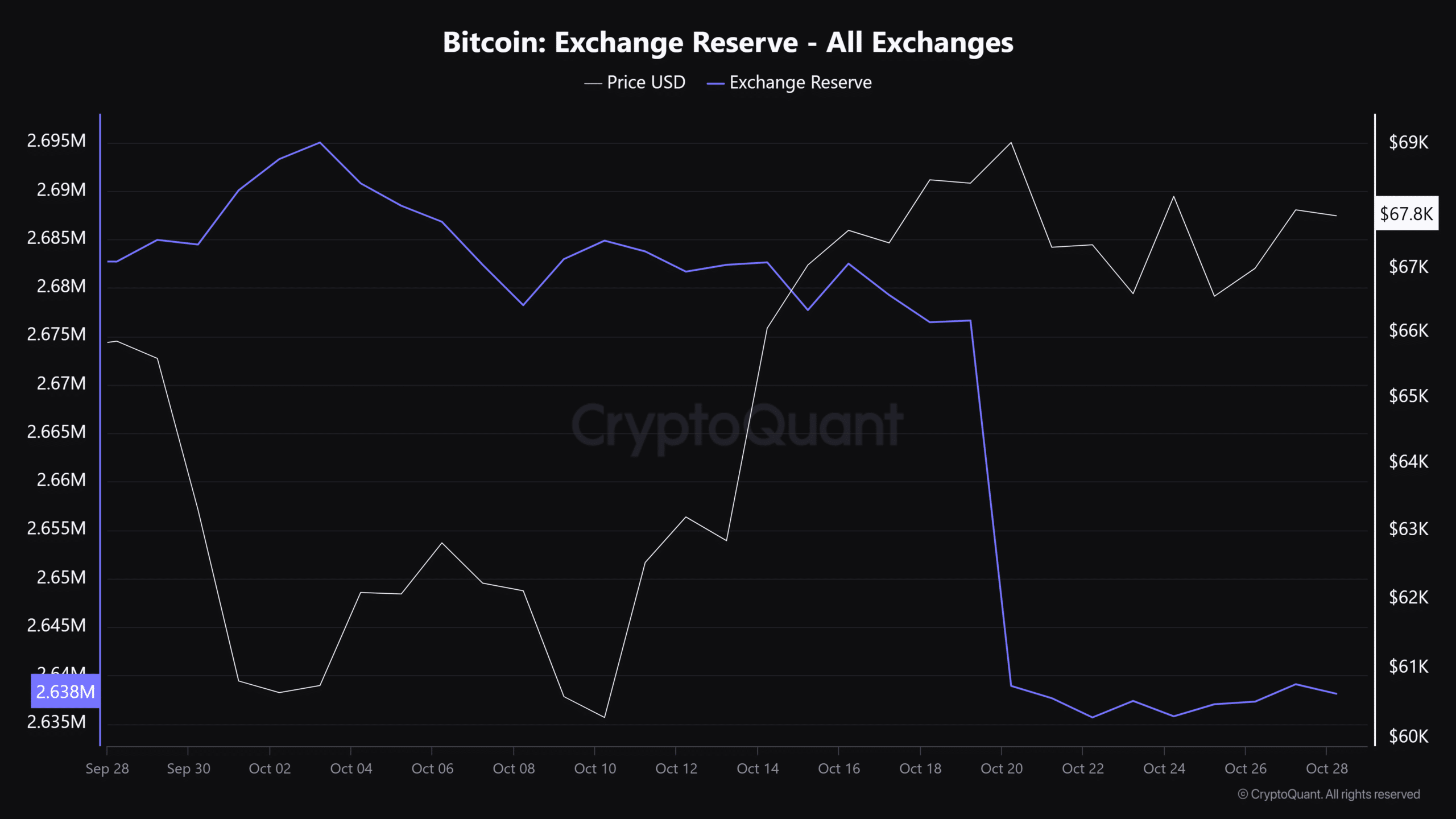

The total Bitcoin held on exchanges has hit a lower low, a pattern that frequently signals market bottoms during bullish trends. This development, alongside various other indicators, hints at a potential sentiment shift among investors.

AMBCrypto suggests that as the election buzz begins to settle, more investors may flock to Bitcoin – at least until a clearer regulatory landscape emerges.

This situation points to a neutral short-term outlook for BTC, as market participants look for stability in the face of uncertainty.

Altcoins poised for short-term gains

As Bitcoin stands to benefit from the current volatility, altcoins may also see some movement. However, an altcoin season remains out of reach.

While altcoins could receive the necessary push for a slight reversal, their momentum is still heavily reliant on Bitcoin’s performance.

Consequently, AMBCrypto dismisses the possibility of a robust altcoin season unless the post-election landscape ushers in a more pro-altcoin sentiment or Bitcoin dominance nears 70%, signaling an overheated market and a potential top.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Currently, on-chain data indicates that $67K is a significant local low for BTC. With expectations of increased volatility next week, Bitcoin appears poised to challenge its previous resistance at $69K and could even reach a new ATH.

As a result, altcoins are also showing a bullish short-term outlook, hoping to benefit from Bitcoin’s positive trajectory. However, the long-awaited altcoin season still remains elusive.

![Assessing if Render [RNDR] can soar 30%, reach $10 soon](https://ambcrypto.com/wp-content/uploads/2024/11/Chandan-RNDR-400x240.webp)