Aerodrome crypto soars 1200% in a year: What’s fueling the surge?

- AERO has surged +1200 in the past year.

- Base growth has been the most significant driver – will the trend continue?

Aerodrome crypto [AERO] has seen massive growth thanks to the wild expansion of Base, an Ethereum [ETH] L2.

Aerodrome is a strategic central liquidity provider in the Base ecosystem, operating as a decentralized exchange (DEX) and automatic market maker (AMM).

The L2’s growth has been a huge catalyst for the protocol. In 2024, Base’s TVL (total value locked) increased 6x (from $500 million to nearly $3 billion).

Over the same period, Aerodrome Finance’s TVL increased from $100 million to over $1.3 billion (13x).

Its native token, AERO, has perhaps been the most notable beneficiary. On a year-on-year basis, AERO rallied +1200%. Given the expected extra growth for Base, should you include it in your watchlist?

AERO’s potential

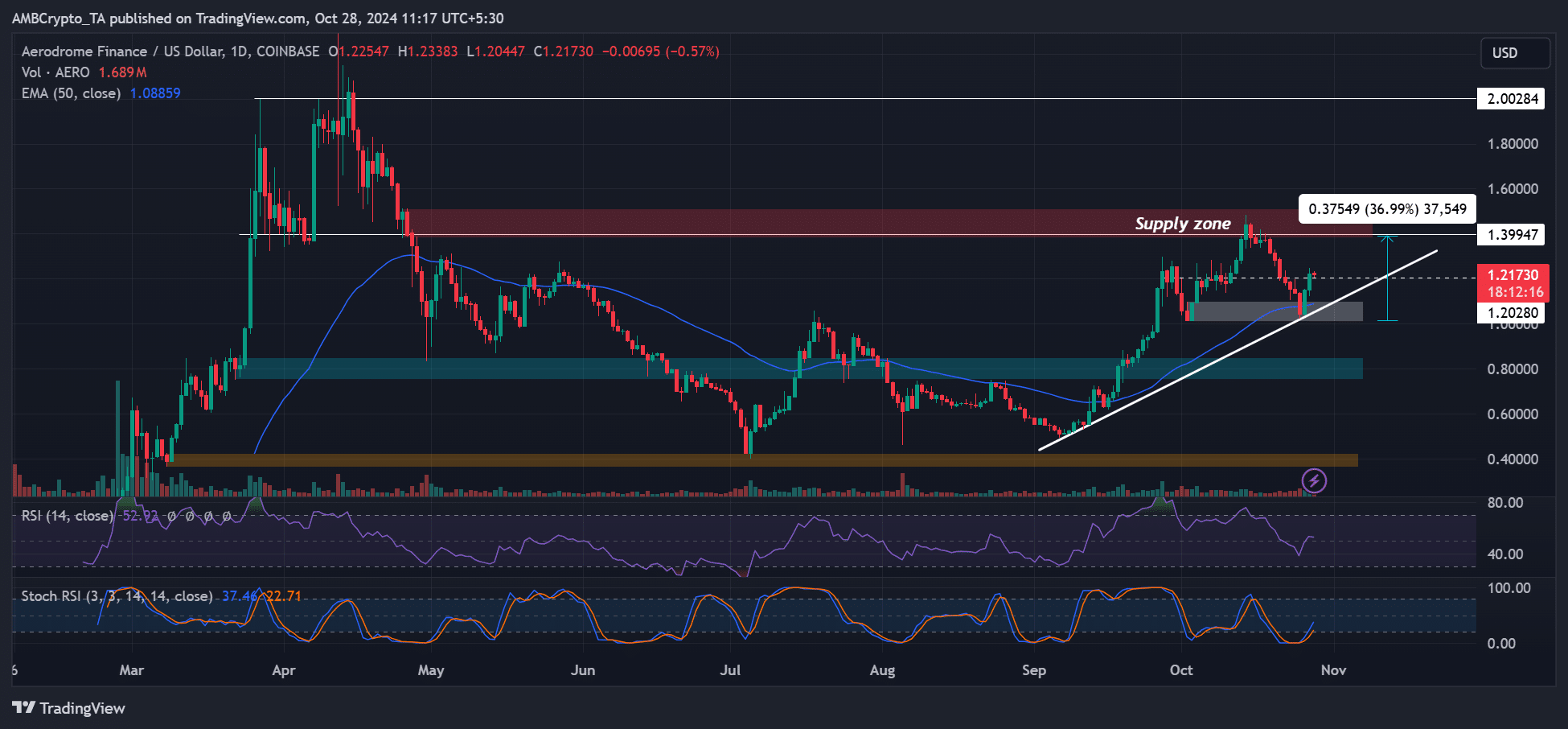

AERO logged over 140% recovery gains during the broader market rebound in September. However, it faced price rejection at $1.3 – $1.5 (red, supply zone).

However, the pullback was stopped at the short-term demand near $1.2, making it a crucial level to watch.

An extended uptrend to $1.5 could trigger a 36% recovery. A more aggressive push to $2 could log nearly 100% potential gains.

Key technical chart indicators showed enough room for growth since they were far from overbought conditions.

However, market uncertainty and volatility could erupt with US elections just a few days away. A breach below $1.2 could still offer a discounted bid at $0.8.

Weekend spot demand

Read Aerodrome Finance [AERO] Price Prediction 2024-2025

The latest 18% upswing over the weekend was primarily driven by spot demand, as seen by a spike in spot CVD (Cumulative Volume Delta).

The metric tracks the difference between buying and selling volume. The spike meant more buying volume, hence bullish sentiment.

However, interest in the Futures market tapered slightly, as shown by a nearly 1 million AERO drop in open interest (OI) rates. Should the decline extend, a move to $1.5 could be delayed.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion