TROY crypto’s wild +70% pump – Key levels to watch for re-entry

- TROY surged by +70% in 24 hours, and nearly 150% in three days

- SuperTrend flashed a buy signal for TROY at press time – Will the uptrend hold up?

TROY crypto, the native token of the global crypto brokerage platform Troy Trade, logged +70% gains in a single day. The bullish start to the week was part of a wild upswing over the weekend. In fact, the altcoin pumped by +150% in just three days, rising from $0.0013 to $0.00335.

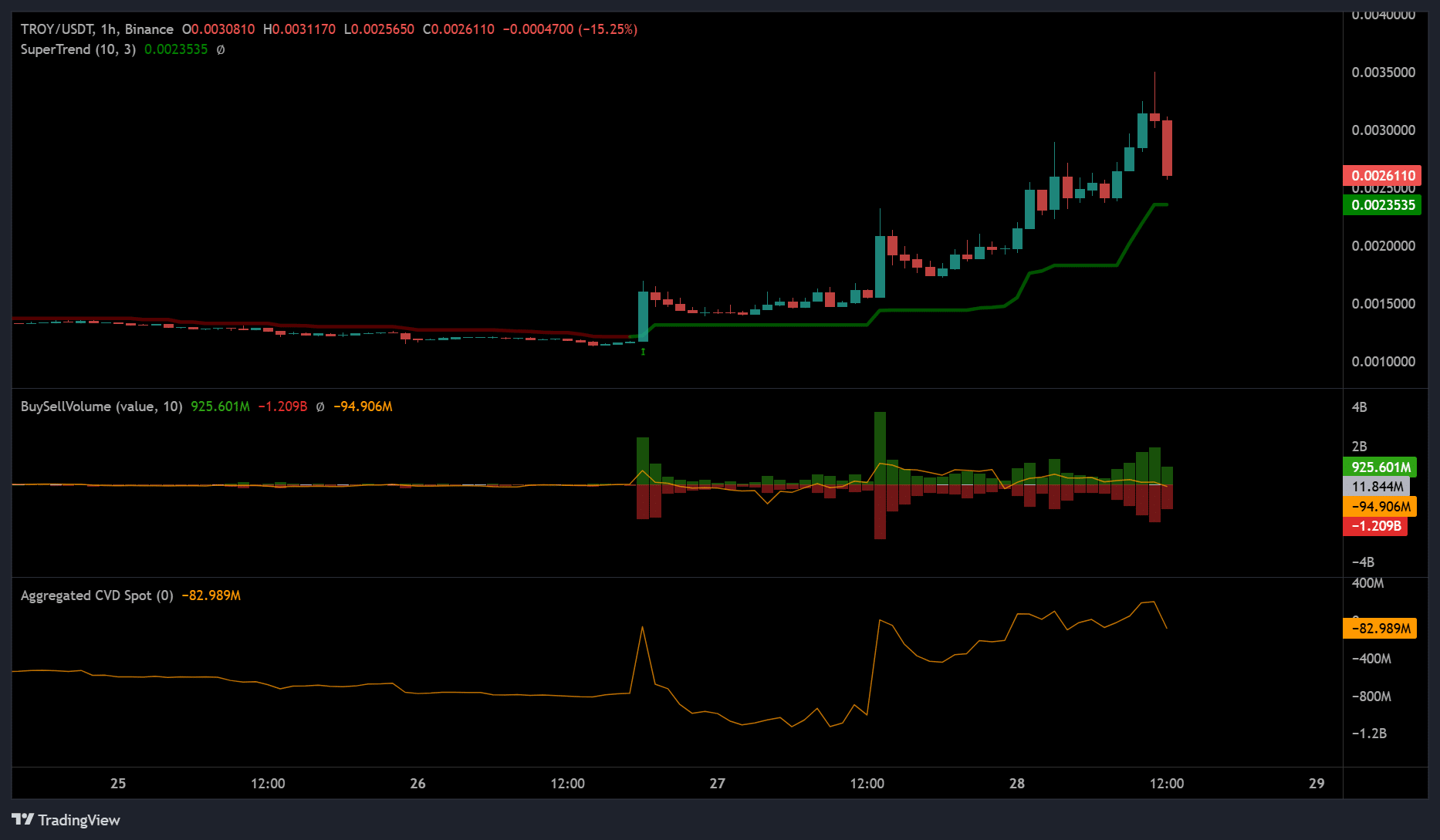

However, at press time, a long candlestick wick was on the upper side, indicating likely buyer exhaustion and a possible retracement. So, if the bullish sentiment persists in the short term, what would be the key levels to consider?

TROY’s potential re-entry levels

On the 3-day price chart, the recent uptrend surge above the range formation chalked in mid-2023 and mid-2024. There was price rejection at $0.0035 and a possible headwind at the previous range-high bear of $0.0030 (red zone).

Should the cool-off continue, TROY could be dragged to the support above $0.002 (white zone). A decisive defense of the level could tip TROY to re-target $0.003. If so, the support could offer re-entry for bulls again, with targets at $0.0030 and $0.0035.

However, a crack below the 50-day EMA (exponential moving average) of $0.0016 would invalidate the bullish thesis. The drop could extend to the $0.0012 demand level – A key H2 2024 support in such a case.

SuperTrend flashed ‘BUY’

The SuperTrend indicator flashed a ‘buy’ signal on 26 October, with TROY remaining there since. This suggested that despite the wild run, some extra rally was still possible.

Additionally, the spot CVD (cumulative volume delta) has been northbound for the past three days, indicating strong spot demand.

This corroborated the bullish thesis and the potential for gains, especially if the pullback doesn’t morph into a downtrend. However, a drop below $0.002 would invalidate the bullish outlook.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

![Ethereum [ETH] targets $1,810 – Will THIS crucial level ignite a breakout?](https://ambcrypto.com/wp-content/uploads/2025/04/Gladys-59-400x240.jpg)