Ethereum price analysis: Strong outflows, MACD hint at a move to…

- Ethereum’s price resilience and key resistance levels suggest potential for an imminent breakout.

- Strong outflows, positive MACD, and dominant long positions indicate a supportive bullish setup.

Ethereum [ETH] has once again captured attention as it records a substantial daily net outflow exceeding 25 million, leading all other blockchains in capital movement. Such a large-scale shift could signal profit-taking or strategic repositioning by major investors.

With ETH trading at $2,618.54, up by 3.32% at press time, this trend raises the question: could these outflows consolidate liquidity and fuel a new bullish surge? Let’s break down the technicals and market indicators behind Ethereum’s current price dynamics.

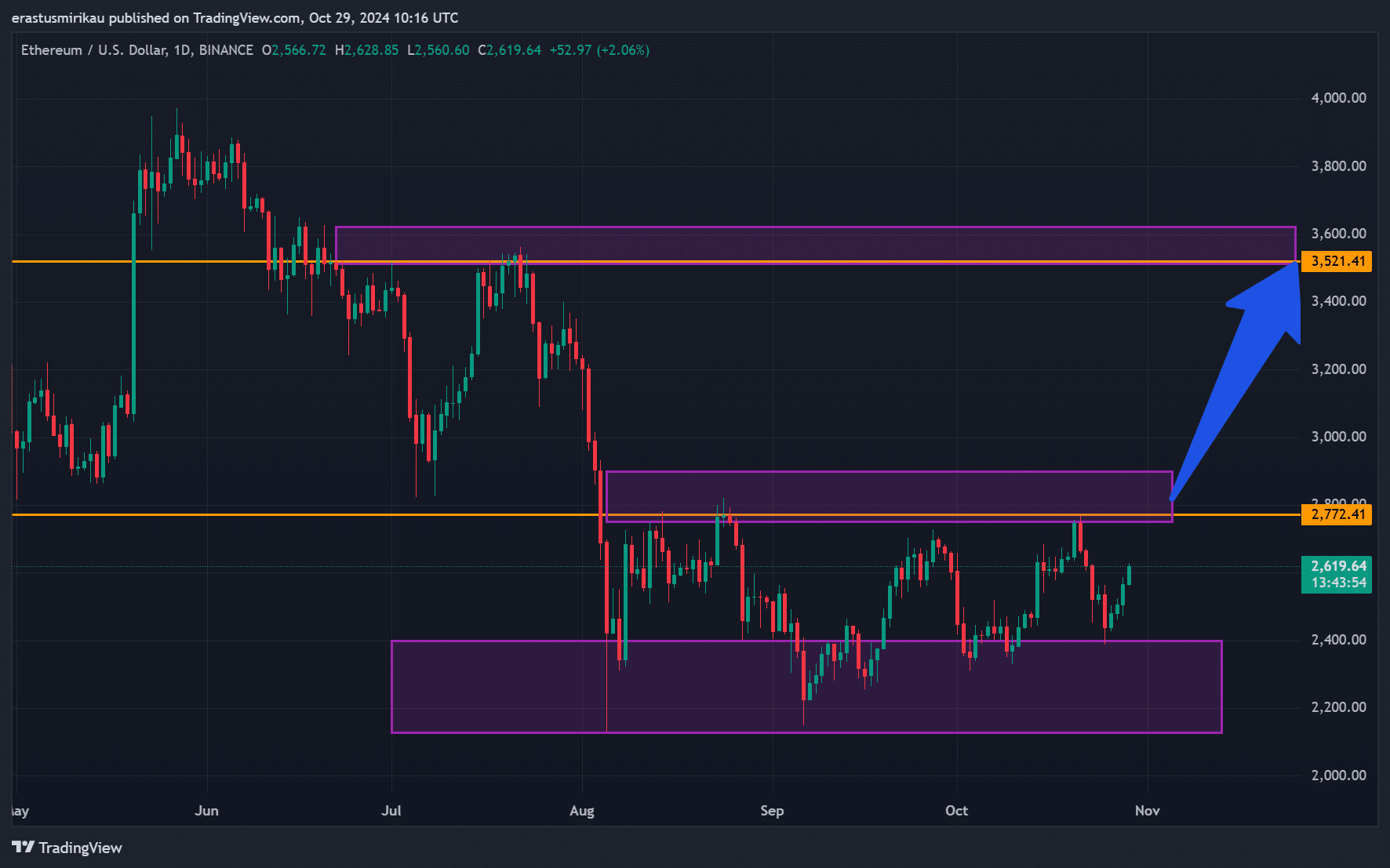

ETH price analysis: Building up to a breakout?

Ethereum’s recent price movements suggest that a breakout might be in the works. ETH has maintained strength above $2,500, a key psychological support, despite market fluctuations.

This level has proven resilient and may act as a launchpad for a stronger upward push.

Looking ahead, $2,772 stands as the immediate resistance level, while $3,521.41 represents a more significant barrier that could either confirm or halt bullish momentum.

If Ethereum successfully clears these levels, we could witness a sharp rally. However, if resistance holds firm, ETH might enter a consolidation phase, awaiting a decisive catalyst.

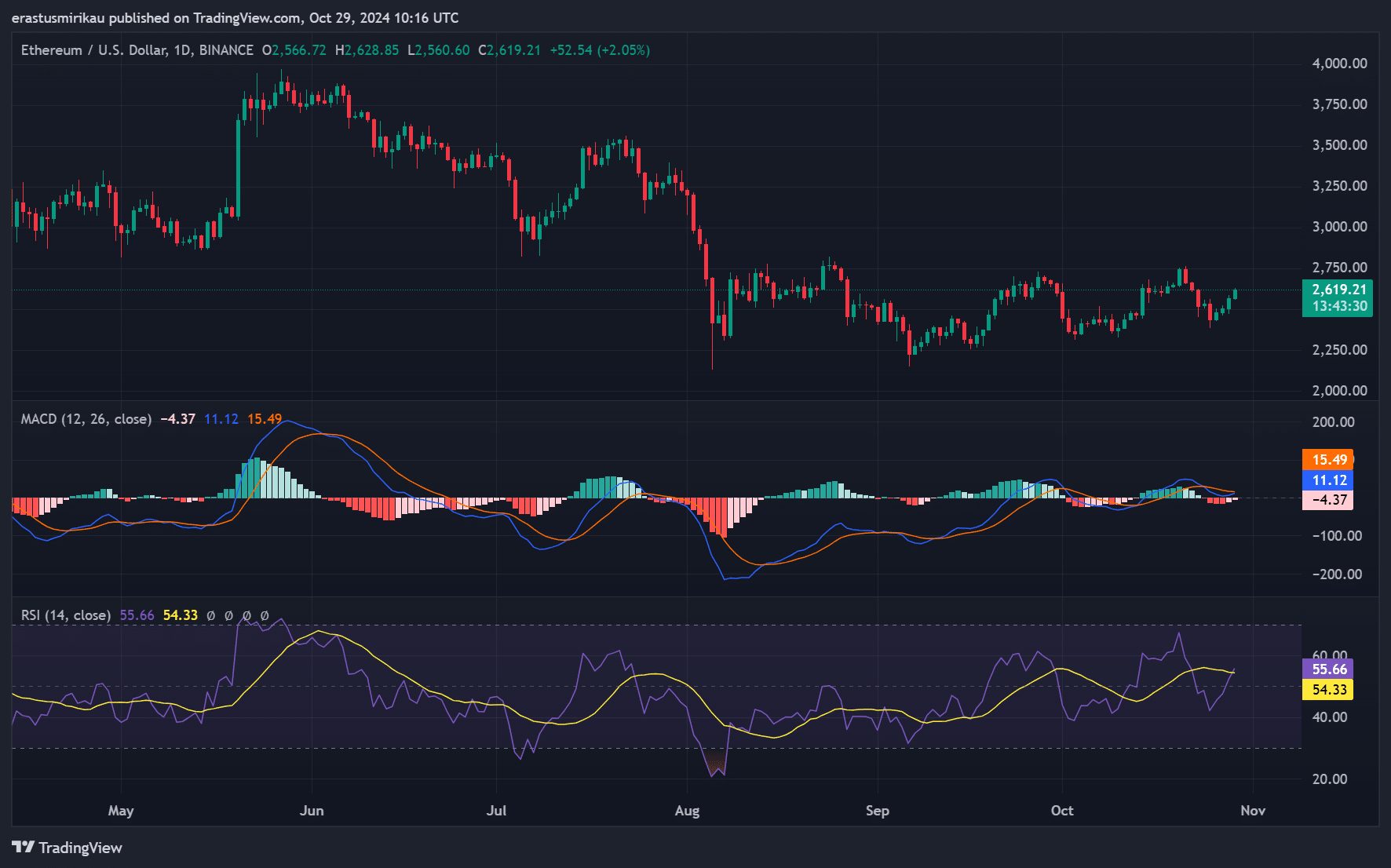

MACD and RSI indicate strengthening momentum

Ethereum’s technical indicators further emphasize its potential for an upward move. The Moving Average Convergence Divergence (MACD) indicator is showing bullish signs, as the MACD line has crossed above the signal line, often seen as a precursor to positive price action.

Additionally, the Relative Strength Index (RSI) is currently around 54.33, a moderately bullish level.

Therefore, Ethereum has considerable room for upward momentum before it approaches overbought conditions, signaling that buyers could still drive prices higher in the near term.

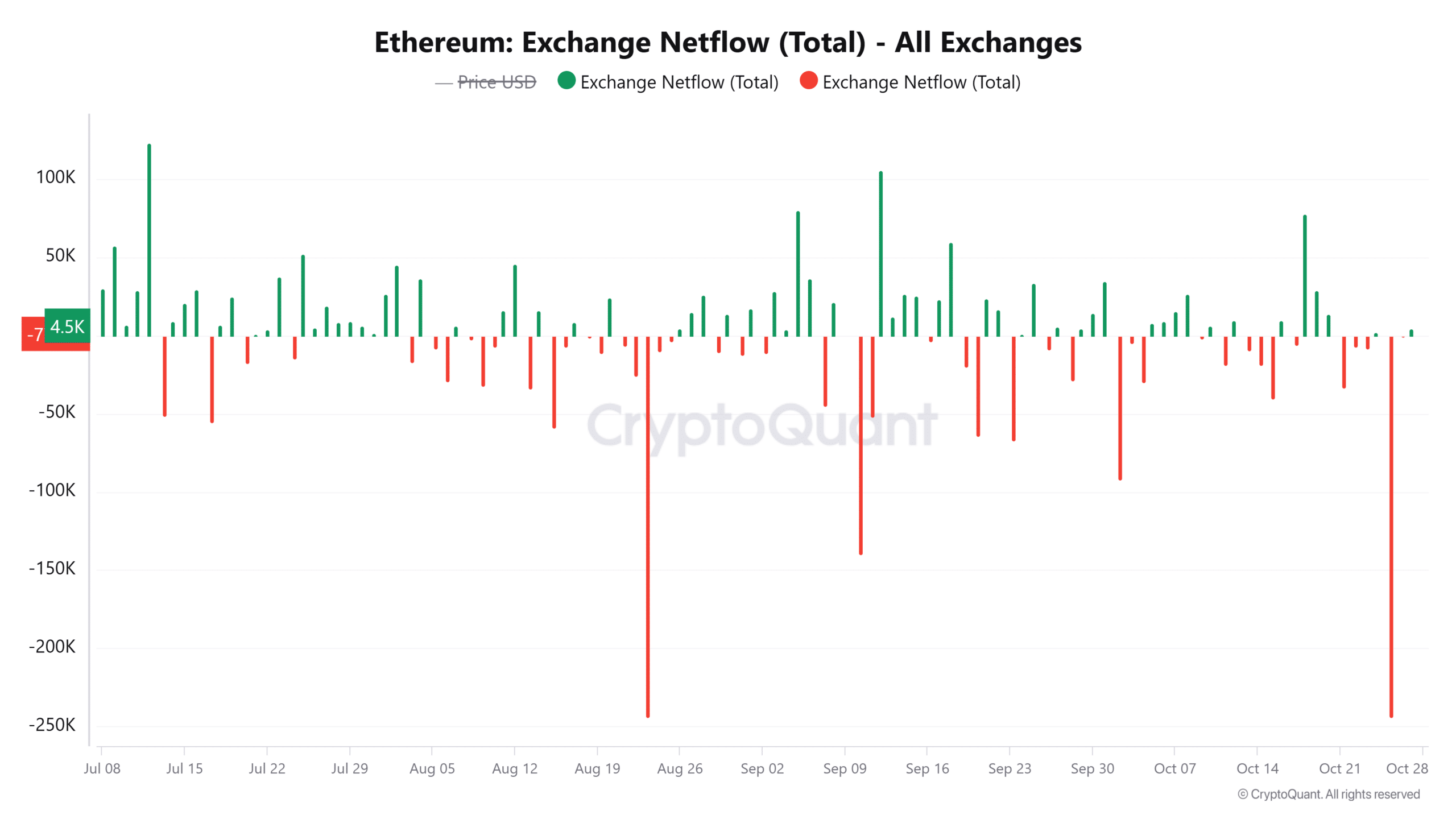

Major outflows from exchanges: A sign of bullish sentiment?

Ethereum’s exchange netflow data reveals a significant outflow of 4.5K ETH over the past 24 hours, marking a 3.03% decline in available exchange liquidity.

Consequently, when large amounts of ETH move off exchanges, it often suggests that investors are choosing to hold their assets long-term or stake them elsewhere, reducing immediate sell pressure.

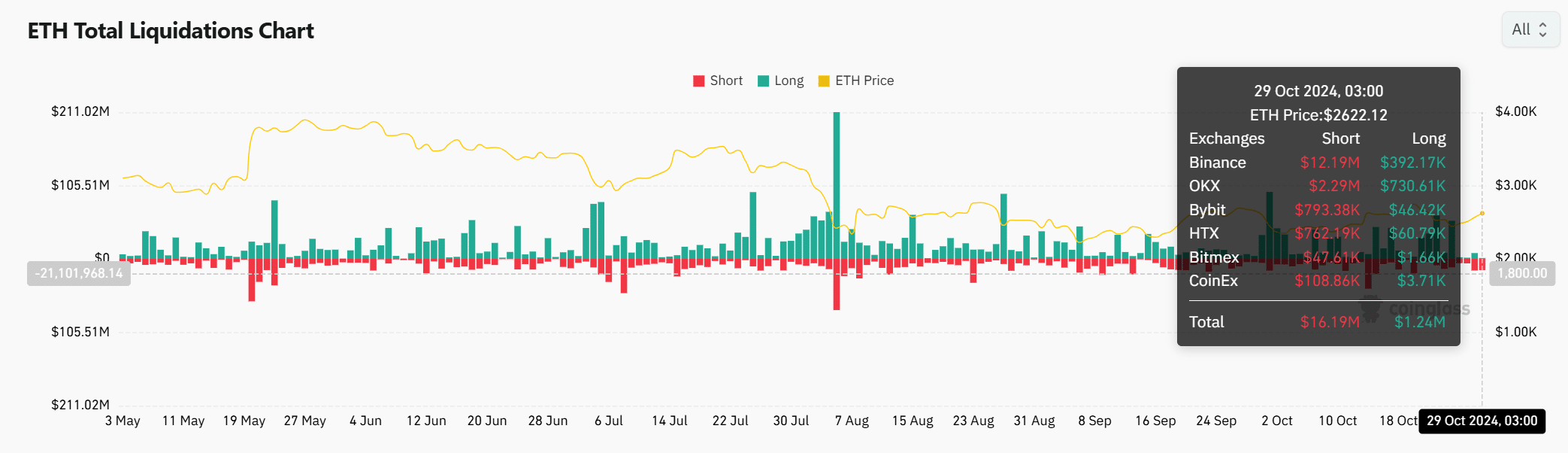

ETH liquidation data highlights dominance of longs

Ethereum’s liquidation data supports a bullish narrative. The majority of liquidations are on short positions, while long positions dominate the scene. This trend indicates confidence among traders in Ethereum’s upward potential, as long holders anticipate continued gains.

Consequently, this confidence among long positions could add further upward pressure, providing the support needed for a sustained rally.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Ethereum’s considerable outflows from exchanges, in conjunction with its supportive technical indicators, hint at a potential bullish continuation.

Breaking key resistance levels could be the final trigger for a strong rally. Ethereum appears well-positioned for a surge as liquidity consolidates, making the coming days critical for ETH’s price action.